Moussa 81

introduce

It’s time to talk about gold, the precious metal that has been an increasingly hot topic since the pandemic.

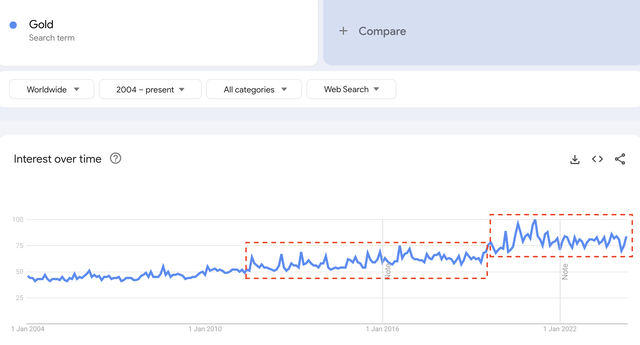

Looking at global Google searches for “gold”, we found that search volume has continued to rise since the beginning of 2020, with the first There are signs of upward momentum in the second half of 2019.

Google Trends

We’ve seen this translate into strong performance for gold as well.

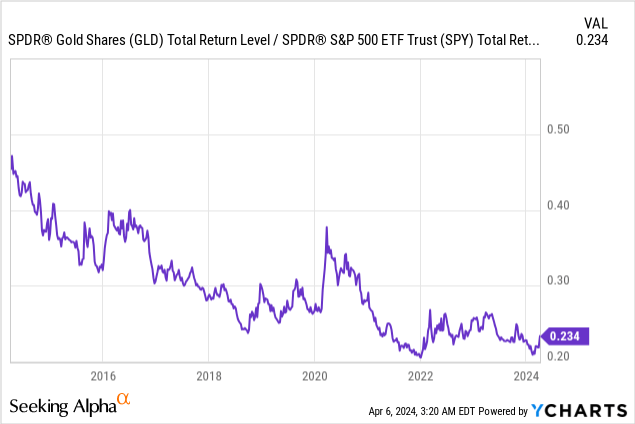

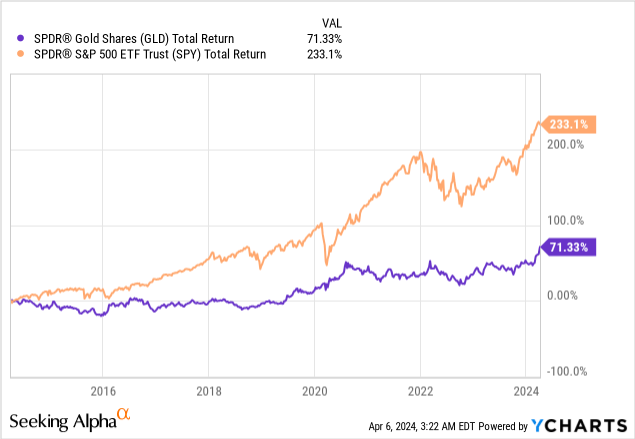

Using the SPDR Gold Stock ETF (GLD) as a proxy for gold, we see that relative performance relative to the S&P 500 (including dividends) will bottom in 2022.

Note that the chart above shows the ratio of GLD to the S&P 500. The shiny metal has lagged the market until 2022.

In fact, over the past decade, gold has returned just 71%, lagging far behind the S&P 500’s 233% return. profit.

Now, that appears to be changing, and gold is hot again.

COMEX gold futures are up more than 13% year to date, trading above $2,300 per troy ounce.

TradingView – COMEX Gold

As you can imagine, this is very beneficial to the miners who produce this metal.

One of my most recent articles was about VanEck Gold Miners ETF (NYSE:GDX) Written on October 13, 2023, my title at that time was “Buy GDX before it’s too late.”

Since then, GDX has returned 19%. Even though the S&P 500 has returned 20%, there’s reason to believe that undervalued miners have more room to run and could potentially outperform the market.

So, in this article, I’ll explain why I believe this is the case.

So, let’s get started!

Gold has become an attractive commodity

Gold is a tricky asset – very tricky.

One of the things that makes it difficult to analyze is that its primary use is not key to the economy.Unlike metals such as copper, which are used in construction and many other uses, gold Mainly used Applies to jewellery, investments (gold bars, coins and ETFs) and assets held by central banks.

research gate

Only 8% is dedicated to the technical/industrial market, which has an impact on gold.

After all, this essentially means it is a zero-yielding competitor to the U.S. dollar—an investment that cannot be “printed” and stored permanently.

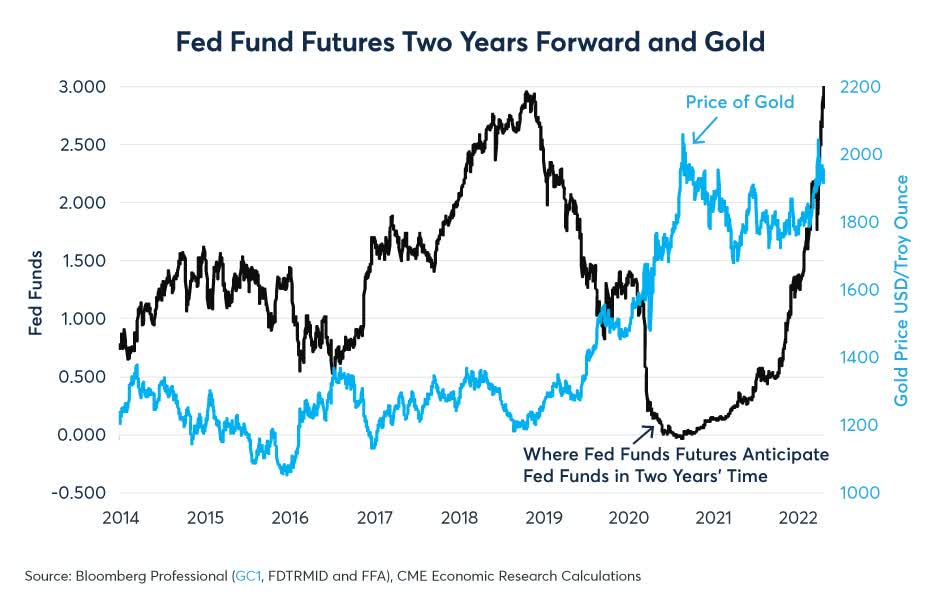

In my previous article on GDX, I used the chart below, which shows the highly correlated (inverse) relationship between gold and future interest rate expectations.

As we have seen, gold prices start to rise once markets anticipate lower interest rates in the future. After all, it is a zero-yielding “alternative” to the U.S. dollar. Once U.S. dollar yields fall, gold becomes relatively more attractive.

CME Group (not updated)

So this is what I wrote in the gist of my last post:

The dynamics of the gold market have changed, and the previously expected Fed turnaround has not materialized.

This has impacted gold miners, which are currently trading well below their highs.

The key factor influencing its trajectory is interest rate expectations. Gold faces challenges as interest rates are expected to rise, but potential future interest rate cuts from the Federal Reserve could boost gold and mining stocks.

It turns out that the bull market situation is stronger than that because we are dealing with two factors:

- Inflation is higher than expected.

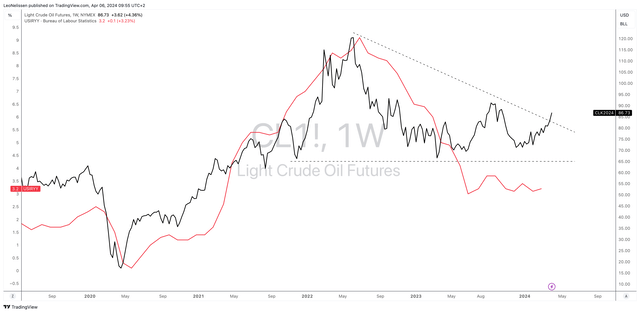

As shown in the chart below, the U.S. all-item inflation rate (red line) ended its downward trend in June 2023. Since then, inflation has moved sideways. To make matters worse, inflation has been higher than expected for three consecutive months. Additionally, oil prices are breaking out, which is why I added NYMEX WTI prices to the chart below.

TradingView (US Inflation, NYMEX WTI)

Typically, rising inflation is not necessarily good for gold as it should lead to higher interest rates in the future.

While I’m in the “longer higher” camp when it comes to inflation and interest rates, gold may do well because the Fed isn’t willing to become more hawkish just yet. This is reason two.

- The Fed is not as hawkish as some expected.

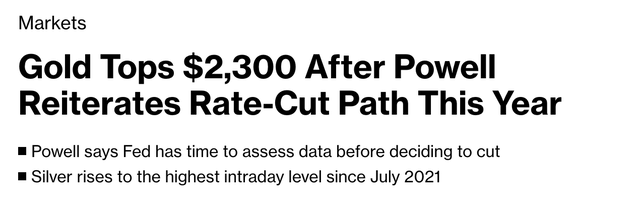

Bloomberg

It is reported Bloomberg (emphasize):

powell says Recent inflation data – although higher than expected – does not “materially change” the overall pictureThat’s according to a speech he gave Wednesday at Stanford University in California. He said policymakers would wait for clearer signs of falling inflation before cutting interest rates. Lower interest rates are generally good for gold because it pays no interest.

I think the Fed may be forced into a position where if debt quality deteriorates too much, the Fed needs to choose between protecting the economy even if inflation remains above target.

This is very bullish for gold.

In addition, central banks are accelerating their gold purchases, which is also seen as a bullish sign, although I disagree with the argument that the dollar may lose its reserve currency status.

(…) UBS pointed to rising gold purchases by central banks around the world, saying gold purchases in the past two years have reached their highest levels since the 1960s, exceeding 1,000 tons each year. These bets by central banks can be seen as a hedge against the dollar as a reserve currency. Especially from countries like China, they may also represent a precaution against future sanctions in response to more geopolitical chaos. – wall street journal

This reminds me of gold miners.

It’s time for miners to shine

There are many ways to invest in gold. One of them is to buy the miners who produce it.

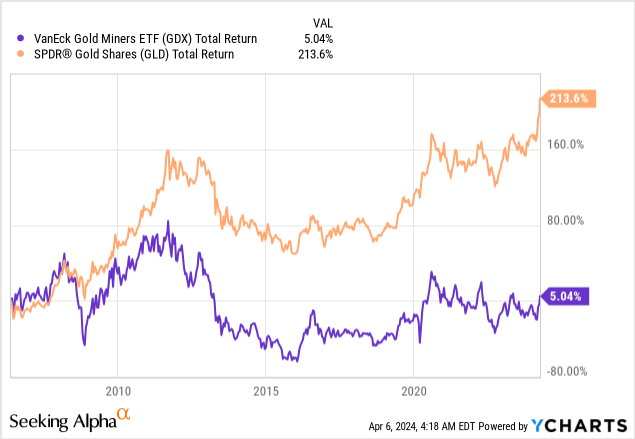

However, these mining rigs are a poor long-term investment.

Since 2006, the gold mining ETF GDX has returned 5% – including dividends. During this period, gold prices more than tripled.

According to Bloomberg article From April 5th (emphasis added):

The faltering stock market has upended the industry orthodoxy that producers outperformed underlying commodities, confusing observers.

“I’ve never seen it dislocated like this” said Peter Grosskopf, Chairman and former CEO of SCP Resources Finance LP. Sprott Corporation

In addition to geopolitical risks, mining companies must also contend with the risk of rising costs. Additionally, sometimes rising debt levels and equity issuance to fund operations are why metals outperform miners.

In addition, some miners also have The history of improper hedgerowscosting them billions of dollars in profits.

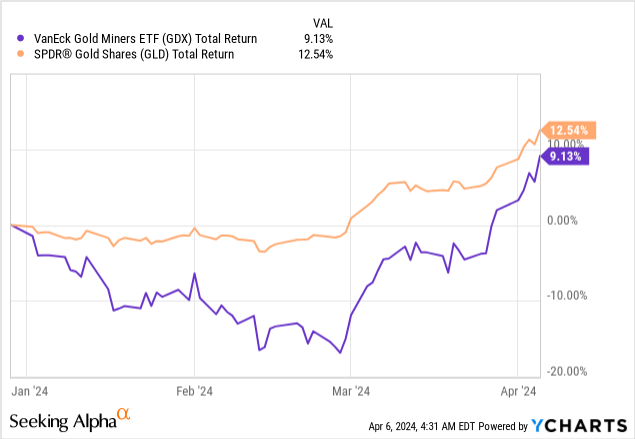

That underperformance has continued this year. Year to date, GDX is up 9%, underperforming the GLD ETF by about 3.4 points.

The good news is that the gap is closing. As we saw above, GDX performed much worse until it started gaining momentum in March.

I expect this to continue.

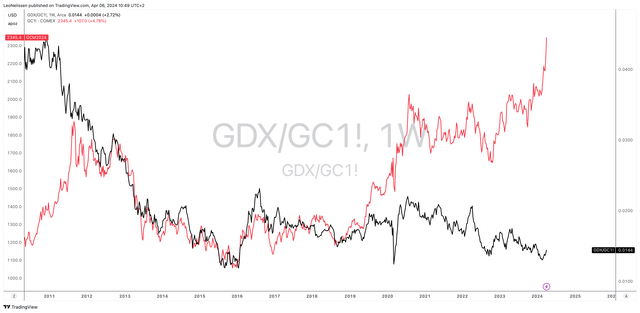

To show you why, we can use the chart below.

The red line shows the COMEX gold price. The black line shows the ratio between GDX ETF and COMEX Gold. As we’ve seen, gold mining stocks underperformed gold when gold prices weakened from mid-2020 to late 2022. However, they underperformed gold when it started rising.

TradingView (GDX/Gold Ratio, Gold)

The good news is that relative performance may have bottomed, making it possible for the market to see value in gold mining stocks following the recent divergence.

Particularly if we see a larger deterioration in credit quality or economic stability, I would expect investors to start allocating (more) capital to gold miners.

Gold miners have underperformed for nearly four years amid an increasingly bullish environment for gold.

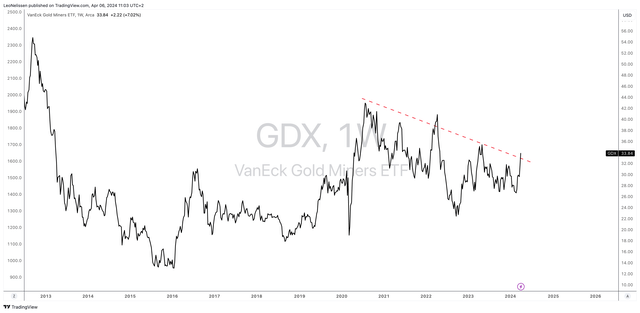

Beyond that, while I’m not too keen on technical analysis, we see the GDX ETF breaking out, which could be very supportive for upside momentum given its (relative) underperformance since 2020.

Transaction View (GDX)

All things considered, I currently own Kinross Gold Corp. (KGC), Newmont Mining (NEM), and Agnico Eagle Mines (AEM). I don’t go long GDX because I prefer buying individual stocks.

I have these positions in my trading account. However, I am considering ending these investments and moving the cash into my dividend growth portfolio, with the goal of buying Franco Nevada Corp. (FNV), which I discuss in this article.

That said, GDX is not only a great benchmark for miners, but also a great ETF to buy Diversified mining investment.

The ETF has an expense ratio of 0.51%, replicating the performance of the NYSE Arca Gold Miners Index.

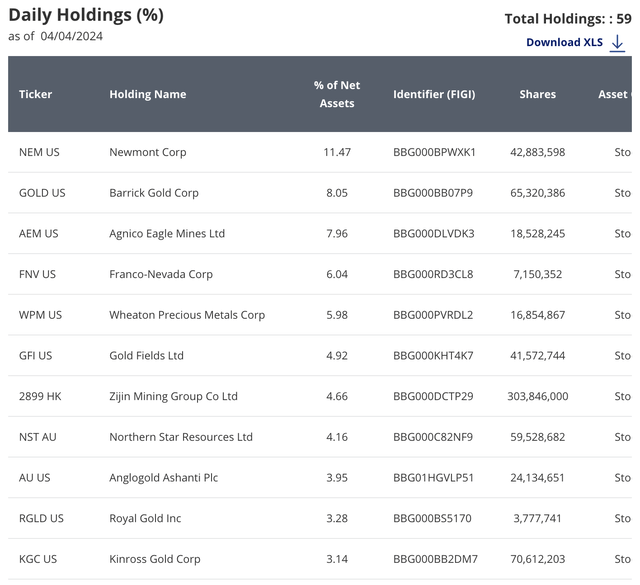

Founded in 2006, GDX has overweight positions in some of the world’s largest mines, including Newmont (11.5% weight), Barrick Gold (GOLD), Agnico Eagle Mines, Franco-Nevada and Wheaton Precious Metals (WPM).

Van Eyck

This also means it owns both miners and streaming companies like FNV and MPW, which have attractive profit margins.

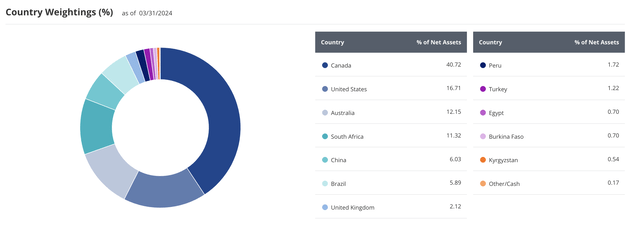

Meanwhile, 41% of the ETF’s assets are located in Canadian mining companies. The United States follows closely behind, accounting for 17%. Australia’s exposure is 12%.

Van Eyck

All things considered, I insist Strong Buy Rating and believing that the risk/reward of GDX remains extremely attractive.

If gold prices continue to rise, I wouldn’t rule out more mergers and acquisitions in the sector.

take away

Gold’s recovery presents an attractive opportunity for investors.

As global interest grows and market dynamics change, investing in gold miners like the VanEck Gold Miners ETF could yield substantial returns.

As central banks ramp up gold purchases and inflationary pressures rise again, the potential for gold miners to outperform looks very promising.

Despite past challenges, recent trends point to a promising future for the industry, making GDX a compelling (albeit volatile) investment option.

The biggest risk to this thesis is a prolonged decline in gold prices, which could be triggered by rising long-term interest rates. This would make the dollar relatively more attractive compared to gold and its minerals.