peterschreiber.media/iStock via Getty Images

By Nitesh Shah and Jeremy Schwartz, CFA

Gold is a special asset. Both commodities and forex instruments. It’s cyclical and defensive at the same time.Used as a store of value and medium of exchange millennium. This metal is mentioned in the Torah, Bible, Quran and Bhagavad Gita, and its historical appeal to humanity is near-parallel.

Different and flexible

In the financial world, its unique behavioral characteristics1 Making it a perfect diversifier for your portfolio:

- It behaves differently than stocks, bonds, commodities and cryptocurrencies

- This is a great inflation hedging tool

- It’s a great hedge against geopolitical shocks

- It’s a good hedge against financial shocks

- It performs well in both recessions and strong expansions

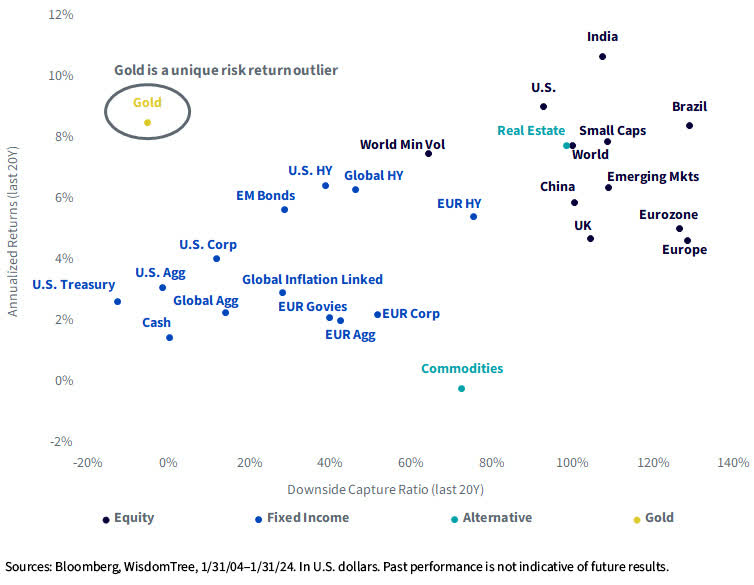

A balance between downside protection and the ability to generate positive returns over the long term This term is unique to gold. As shown in Figure 1, returns for most assets are roughly proportional to risk. Over the past 20 years, the downside capture rate (relative to the stock market) for high-return assets similar to stocks has been approximately 100%. Assets with lower downside risk capture, such as fixed income, tend to have lower returns.

Gold bucks these trends: Over the past 20 years, it has returned 8.5% annually, comparable to stocks, and has suffered very little downside. Gold is therefore a unique asset that can add diversification to a portfolio and reduce risk without compromising long-term performance.

Figure 1: Long-term performance and downside risks of different assets over the past 20 years

The perfect diversification tool…..

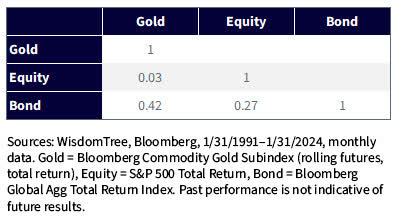

As the late Markowitz said, the only free lunch in the investing world is diversification. Low correlations enhance this diversification. As shown in Figure 2, gold has a low correlation with stocks and bonds.

Figure 2: Asset correlation matrix

…But now it is shunned by many investors

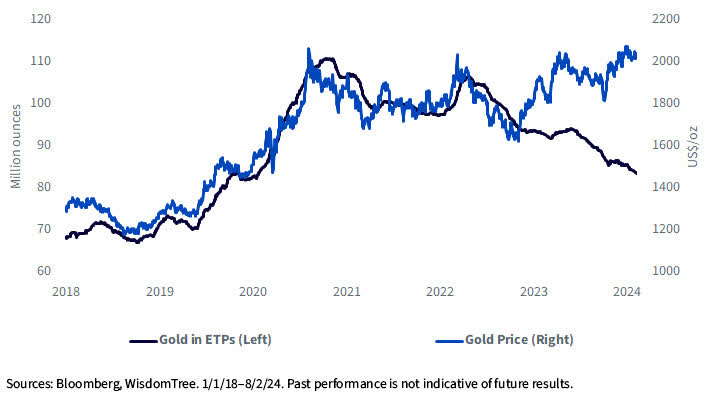

Judging by outflows from physical gold exchange-traded funds (ETFs) over the past three years, it appears professional gold investors are no longer in favor of the metal (Figure 3). Despite multiple attempts to break the $2,050 per ounce mark, the ETF market has failed to provide any momentum. If gold manages to break above this level, we may see ETF investors return, which could fuel a stronger rally.

Figure 3: Gold price and ETP holdings

Gold on track to hit new highs

While soft landings have historically not provided the best environment for gold to shine, during this interest rate cycle we saw gold prices reach new highs in December 2023 when markets expected the Federal Reserve (FED) to Make a decisive turn.Some of those gains have been clawed back as markets reassess the Fed’s urgency, but our gold model suggests Gold prices reach higher highs by end of yearas bond yields fell and the dollar depreciated.

Gold prices could reach $2,210 per ounce, up nearly 10% at the time of writing (February 6, 2024). Achieving the much-lauded soft landing is easier said than done (which is why we have so few observations). We may be facing a bumpy road in 2024, and the Fed and the market clearly have different views on the path of interest rates ahead of us. Gold’s hedging capabilities may once again prove to be an antidote to volatility elsewhere.

solution

While there are growing strategic and tactical benefits to including gold in investment portfolios, finding space for gold has always been a challenge. As bond prices fell sharply in October 2023, many investors opportunistically filled the defensive portion of their portfolios with U.S. Treasuries, leaving less room for gold. In a year when interest rate cuts are widely expected, investors are keen to maintain large investments in stocks.

WisdomTree has developed capital efficient solutions to solve this problem. Wisdom Tree High Performance Gold + Stock Strategy Fund (GDE) tracks a broad range of stock indexes and provides gold exposure through gold futures contracts. The leverage inherent in gold futures provides capital efficiency. For example, an investment of $100 would be divided into $90 of equity and $90 of exposure to gold futures ($10 of cash collateral). This solution enables investors to find prime space without significantly reducing their equity positions.this WisdomTree High Performance Gold Plus Gold Mining Strategy Fund (GDMN) offers a similar solution, replacing the broad stock component with gold miners. Gold miners and gold futures perform differently at different stages of the economic cycle, and this solution allows investors to invest in both products in a capital-efficient manner.

1 look: Wisdom Tree High Performance Gold Plus Gold Mine Strategy Fund Investment Case

Important risks associated with this article

Investing involves risks, including possible loss of principal. The fund is actively managed and invests in U.S.-listed gold futures and global equity securities issued by companies that derive at least 50% of their revenue from gold mining operations (“gold mining companies”). The Fund’s use of U.S.-listed gold futures contracts creates leverage, magnifying gains and losses and causing the Fund to be more volatile than it would be without leverage. Additionally, price movements in gold and gold futures contracts can fluctuate rapidly and wildly, with correlations with stock and bond market returns at historically low levels. By investing in equity securities of gold mining companies, the Fund may be susceptible to financial, economic, political or market events affecting the gold mining sub-sector, including commodity prices and the success of exploration projects. The Fund may invest a substantial portion of its assets in securities of companies in a single country or region, including emerging markets, and therefore the Fund is more likely to be affected by events and political, economic or regulatory conditions affecting that country or region. region, or emerging markets in general. The Fund’s investment strategy will also require it to redeem its shares for cash or otherwise receive cash as part of its redemption proceeds, which may cause the Fund to recognize capital gains. Please read the fund prospectus for specific details regarding the fund’s risk profile.

Nitesh Shah, Research Director, WisdomTree Europe

Jeremy Schwartz, CFA, Global Chief Investment Officer

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021, leading WisdomTree’s investment strategy team in building WisdomTree’s equity index, quantitative active strategies and multi-asset model portfolios. Jeremy joined WisdomTree in May 2005 as a senior analyst and was added as associate director of research in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. WisdomTree, who is a principal research assistant to Professor Jeremy Siegel and co-author of the sixth edition of the book in 2022 long term stocks.Jeremy is also the co-author of the book financial analysts magazine The paper “What happened to the original stocks in the S&P 500?” 》 He received a bachelor’s degree in economics from the Wharton School of the University of Pennsylvania and hosted the Wharton Business Radio Show Behind the market SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.