JHVE photos

Google’s (NASDAQ: GoogleAs other rivals falter in the industry, its slow-and-steady approach to self-driving car projects is finally showing results. Google’s Waymo is launch service Los Angeles and other cities are in full swing radar. Waymo’s operations in San Francisco have been largely successful over the past few months. There have been few major incidents and customer trust has steadily increased. On the other hand, General Motors (General Motors) Cruise ship stumbled Its operation follows numerous complaints and several major accidents. GM is reducing headcount in the unit and replacing some key executives. apple(AAPL) Also closed Its self-driving cars are dubbed “Project Titan” after more than a decade of heavy investment.as mentioned above exist Previous articleDespite some issues, Google has made steady progress in artificial intelligence, and the threat from new artificial intelligence tools to its core advertising business is fairly low.

Although self-driving services are quite old and seem simple, the risks involved in launching this service are very high. Any new competitor would need to spend billions of dollars upfront to build an acceptable self-driving service, and even a few accidents could wipe out the entire investment. Few companies and executives are willing to take such risks. In addition to several other services launched in China, the three major technology giants including Google, Tesla (TSLA) and Amazon (AMZN) are likely to corner most of the market.

Google’s Waymo is nearing a turning point as other major cities and states begin allowing the service. As Waymo puts more cars on the road, the service’s scalability will likely be high. While Google is tight-lipped about the segment’s revenue and losses, we’re seeing strong progress in Google’s “Other Bets” segment, demonstrating its focus on profitability. Losses in the “Other Bets” segment fell from 6 times revenue in the year-earlier period to nearly 1.2 times revenue in the latest quarter, even as the overall revenue base tripled over the same period. Better revenue growth and margins in the segment could improve the company’s earnings per share trajectory and boost valuation multiples, which are currently the lowest among the seven major groups.

Competitors fall behind

Many companies have jumped at the opportunity to build their own self-driving services. The list is long, including Uber (UBER), Ford (F), Volkswagen, General Motors, Apple and other well-known companies. Many of them abandoned the field after considering the investment and operational risks. To build a successful self-driving service, new companies should be prepared to invest billions before making a single dollar. On the other hand, even an accident may bring all efforts to naught. This is the main reason why Uber and Ford gave up on self-driving attempts.

General Motors’ Cruise is a good example of the obstacles any service faces. General Motors launched the service to widespread media attention after reporting billions of dollars in losses from Cruise. However, several incidents led the company to reduce its investment in Cruise and replace some key executives.

Apple also shut down Project Titan, which the company had invested in for nearly a decade. If Apple cannot absorb the investment required for autonomous driving, it is unlikely that many new competitors will enter the field. This gives Waymo a huge lead as it increases monetization of its services.

Google’s advantage among the Big Three

Given the large initial investment and overall risk involved in operations, we may see consolidation in the industry among a handful of competitors. Currently, the three most likely options are Google’s Waymo, Tesla and Amazon’s Zoox. Tesla poses a direct threat to other automakers, and car companies may prefer other options when choosing self-driving services for their vehicles. Amazon is the leading e-commerce company, and many retail giants prefer Amazon alternatives when meeting their own self-driving packaging needs.

Not only does Google-owned Waymo have a huge lead, it also has no competition in its core business with some of the service’s major customers. Robotaxi services may expand to other parts of the logistics supply chain, including trucks and last-mile package delivery. 2023, Waymo Apply the brakes Self-driving truck project. However, it may restart the program once the robo-taxi service is launched in more cities. Robotaxis are more complex because they need to be used in highly dense urban environments. Trucks, on the other hand, may use a hub approach and have less complexity than robotic axles. We expect Waymo to launch self-driving trucks in 2025, which should significantly increase the revenue potential of the service.

Improvements to other betting numbers

The road to autonomous driving is long and arduous. Wall Street will likely wait for actual data before passing judgment on the service. Waymo hasn’t revealed the exact numbers by which we can measure unit profit. However, the “other bets” segment has improved significantly over the past few quarters.

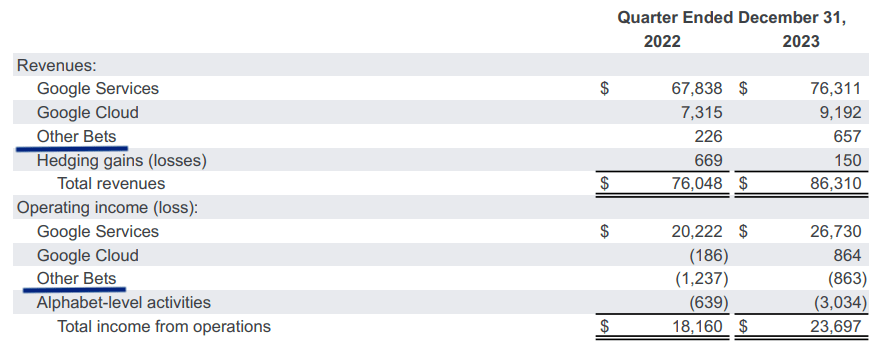

Company filing

Pictured: Recent improvements to the other betting sections. source: Company filing

In the same period last year, Google reported revenue of $226 million from other betting businesses and a loss of $1.2 billion. Revenue in the latest quarter has increased to $657 million, with losses of $863 million. As a result, losses fell from 6 times revenue base to 1.2 times revenue in one year. At the same time, the revenue base tripled in one year. There are many other companies contributing to “Other Bets,” but it’s encouraging that Google was able to make huge strides in this space within a year. On the current trajectory, we could see positive margins in this space by 2025.

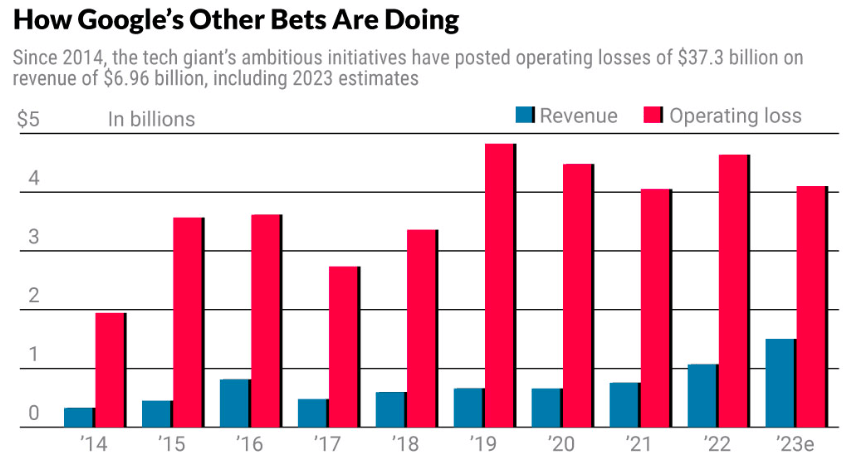

Company filing

Figure: Losses and gains from other bets. source: Company filing

Over the past 10 years, Google has reported losses of $37 billion in its “other bets” business. This doesn’t match the scale of Meta’s (META) real-life lab losses, but it’s still pretty close. A large part of the damage was caused by Waymo. Google has more than 1,000 employees and the costs are huge.

Positive margins on “Other Bets” would go a long way toward improving the company’s overall margins and increase trust within Wall Street that management is using resources prudently.

Waymo’s impact on Google stock

Morgan Stanley published a research report estimating Waymo’s valuation $175 billion. Those days are gone, and the current valuation is down to $30 billion, which won’t have any impact on Google stock. However, if Google can successfully expand its presence in other cities in 2024, it will improve the service’s long-term forecasts. Waymo can also expand into logistics, which will be its largest revenue driver and could be hugely profitable.

Waymo’s success could change the outlook for Google stock, especially if giants like General Motors, Ford, Apple, Uber, etc. all fail. Currently, Google stock’s price-to-earnings ratio is the lowest among the seven major corporate groups. Other business units are also performing quite well, and the cloud, subscription and hardware businesses all have good growth momentum.

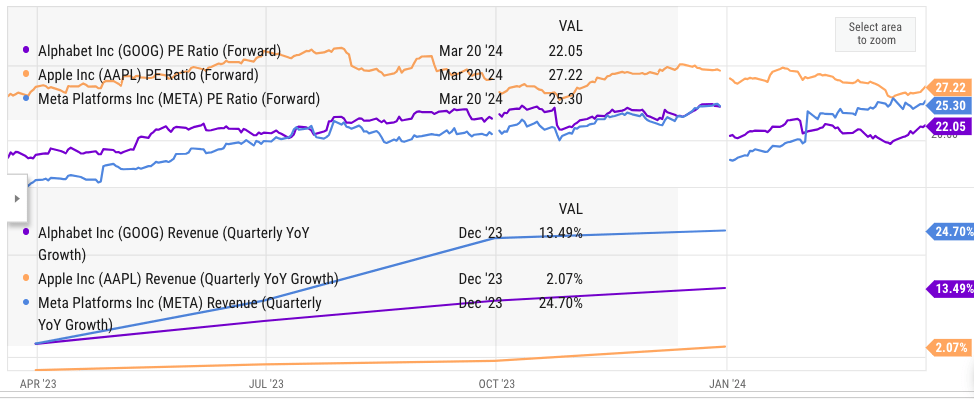

Y chart

Figure: Comparison of forward price-to-earnings ratio multiples of Google and other companies. source: Y chart

Waymo’s recent satisfactory performance increases the likelihood of its successful expansion into other cities and other logistics areas. We should see Waymo’s impact on Other Bets’ revenue and margins over the next few quarters, which is a huge positive for the company and the stock. Waymo provides a good revenue stream for the future and may also improve overall sentiment towards Google stock.

Important points for investors

The recent collapse of General Motors’ Cruise and Apple’s closure of Project Titan have shown that the barriers to entry for autonomous driving are very high. Google, Tesla and Amazon are likely to be the three major players in this space. Waymo is finally expanding into other cities and monetizing its services. This puts the company ahead of others.

As the Waymo business starts reporting better numbers, we should start to see significant improvement in revenue and margins from “other bets.” This would add another important future revenue driver for Google and should improve its current price-to-earnings ratio, which is among the lowest among the seven largest company groups.