Alexander Zhilenkova

It’s been about four months since I last reported on Grayscale Bitcoin Trust (NYSE: GBTC) Seeking Alpha. At the time, I was bullish, although I did mention that I was reducing my position in the fund:

I have minimized my exposure to GBTC, partly because the NAV window has closed significantly and I think BTC will go through some consolidation before moving higher.

No such consolidation has occurred, and we essentially see GBTC stock continuing higher as the market cap of Bitcoin (BTC-USD), the fund’s underlying stock, has risen each of the past four months. That said, a lot has happened in the Bitcoin investment market in the months since my last article.In addition to GBTC’s successful conversion from a closed-end fund to a spot ETF, the U.S. Securities and Exchange Commission The committee approved nearly a dozen spot Bitcoin ETFs in the United States.

In this update, I will detail why I gave up trading GBTC entirely, and why I now believe this fund is one of the worst spot BTC products investors can buy in the US market.

cost flights

Before the fund converts to a spot ETF, GBTC’s management fee is 2%. For a fund that is not actively managed in any meaningful way, holding 2% of BTC per year in a traditional investment account has always been considered high by market participants. Even the ProShares Bitcoin Strategy ETF (BITO), which relies on recurring monthly futures contracts, charges less than 1%.

However, given the lack of competing products that actually custody Bitcoin in the U.S., investors don’t have much choice but to endure Grayscale’s high costs or focus on volatile mining stocks. The era of minimal competition for investment capital is over:

Source: IntoTheBlock

With so many other spot BTC ETFs emerging in the US, AUM now faces real competition, and GBTC is clearly the outlier in the table above. Even after lowering fees by 50 basis points, Grayscale’s 1.5% annual return on the fund is still very uncompetitive, as evidenced by BTC outflows from the GBTC product.

Grayscale’s USD-denominated AUM numbers remain healthy at $28.6 billion, but BTC-adjusted AUM is in free fall:

| fund | stock ticker | Bitcoin balance | AUM |

|---|---|---|---|

| Grayscale Bitcoin Trust | GBTC | 400,165 | $28,675,423,735 USD |

| iShares Bitcoin Trust | it will go | 195,985 | $14,044,089,115 USD |

| Fidelity Wise Origin Bitcoin ETF | Forbitt | 124,832 | $8,945,336,288 |

| Ark 21 Equity Bitcoin ETF | ARKB | 37,649 | $2,697,889,691 USD |

| Bitwise Bitcoin ETF | BITB | 27,866 | $1,996,849,694 USD |

| Invesco Galaxy Bitcoin ETF | BTCO | 5,679 | $406,951,461 USD |

| VanEck Bitcoin Trust | long term holding | 4,299 | $308,062,041 USD |

| Valkyrie Bitcoin Fund | BRRR | 4,981 | $356,933,479 USD |

| Franklin Bitcoin ETF | BC | 2,958 | $211,967,322 USD |

| Wisdom Tree Bitcoin Fund | BTCW | 924 | $66,212,916 |

| Total current spot ETF BTC holdings | 805,338 | $57,709,715,742 USD | |

Source: Bitcoin Treasury, as of March 11, 2024

Total BTC holdings backing GBTC stock are currently just over 400,000 BTC. This is down more than 35% from the 619,000 BTC in the fund before the spot ETF conversion was approved.

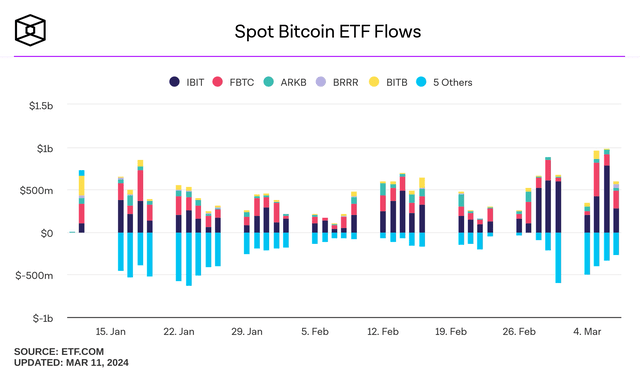

Spot ETF flow (TheBlock)

Not every spot BTC ETF sees the same inflows as funds like IBIT or FBTC, but none of them have experienced the level of outflows that GBTC has experienced. Since mid-January, Grayscale’s flagship fund has experienced single-day outflows approaching or exceeding $500 million nine times. In addition, GBTC has jumped from the fund with the largest trading volume share to the third largest market share by trading volume:

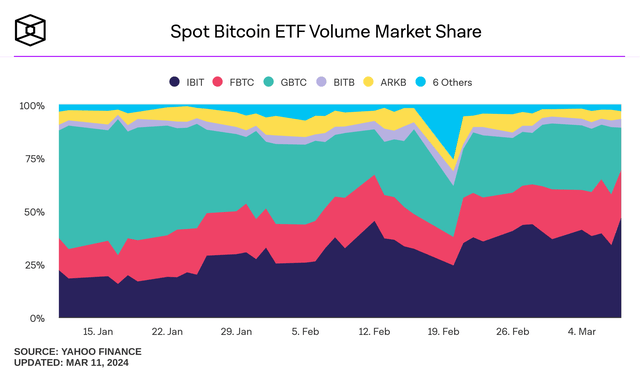

ETF Volume Share (TheBlock)

For most of January, GBTC trading volume share accounted for 50-60% of all funds. On March 8, this number fell below 20%, lagging behind IBIT and FBTC, although the fund is still larger than the other two funds combined.

Fund performance

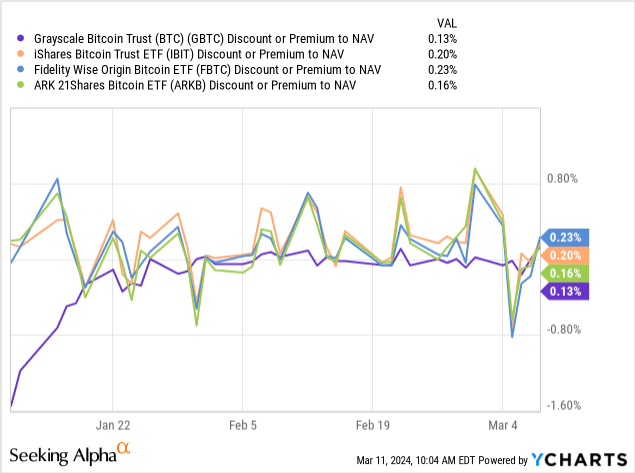

GBTC stock has notoriously traded at a deep discount for much of the past two years. Even when the fund made the ETF conversion, the shares still traded at a discount to their pre-conversion discount. The discount window has since closed and fund shares occasionally trade at a slight premium to NAV:

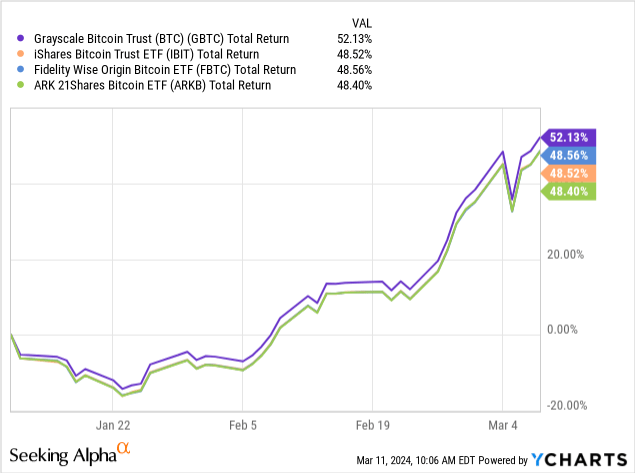

Given that GBTC stock still trades at a discount after the fund switch, despite the higher expense ratio, the total return of GBTC stock actually favors GBTC when compared to the next three largest funds ranked after launch:

But in my opinion, this outperformance is more a product of the fund’s discount normalization in mid-January rather than the Bitcoin underlying GBTC stock somehow outperforming Bitcoin in other funds. I suspect GBTC’s outperformance over the past two months will be relatively short-lived, and if Grayscale doesn’t lower fees in line with the rest of the market, fund shares will lag behind peers in the long term.

investment risk

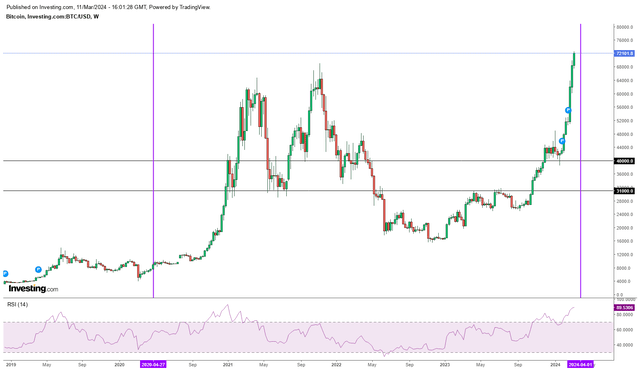

For those who want simple exposure to Bitcoin at a traditional brokerage, GBTC will be great. If investors believe that Bitcoin is about to reach six-figure prices, the 1.5% fee is unlikely to affect it to a large extent. That said, there are many risks associated with coveting Bitcoin and Bitcoin brokers like GBTC. Bitcoin is designed to be stored directly on-chain. If you don’t have a mnemonic phrase, you don’t actually own the Bitcoin. In addition to Grayscale, GBTC also exposes investors to third-party risks through Coinbase (COIN), which hosts AUM. Not all spot ETFs are structured this way. There are also market cycle risks. The 2024 halving cycle is an immediate reminder that past performance is no indicator of future rewards:

Halving (Investing.com)

In this halving cycle, Bitcoin has reached a record high, but the halving has not actually happened yet. This is the first time in the history of Bitcoin that this has happened. Even if it’s unlikely, the remainder of this cycle has the potential to bring surprises, and some of the lofty price targets we’ve seen in recent forecasts may not actually materialize.

generalize

While I think GBTC is arguably the worst Bitcoin ETF on the market right now, I wouldn’t call it a sell because I believe investors who hold the fund long-term will see gains consistent with Bitcoin. Since the fund’s shares are now redeemable, I think the likelihood of the deep discounts we saw throughout much of 2022 and 2023 is unlikely to happen again. But strictly speaking, GBTC is viable as a way to buy Bitcoin in a traditional investment account. To me, there are better options that offer lower fees while minimizing third-party risk. Because of these charges, I now rate GBTC a Hold.