BT Series/iStock via Getty Images

I’ve been writing for Seeking Alpha since 2019. Believe it or not, this is my 300th article on the site.Of all the articles I’ve ever written, I didn’t know I’d ever had so many Just as confident as I am on this call. I’m extremely bearish on Grayscale Solana Trust (OTC market: GSOL), I expect trading volumes to be significantly lower than current levels twelve months from now.

Fund objectives

GSOL is a very easy to understand product. This fund is one of Grayscale’s many single-asset, cryptocurrency closed-end funds. The sole purpose of this particular fund is to provide investors with investment opportunities in Solana (SOL-USD), a blockchain-native asset called SOL. That’s it. Apart from SOL, GSOL has no other assets or businesses on which it is based.Therefore, GSOL stock relative to The SOL represented by each share is arguably the most important factor in determining whether GSOL stock is a buy or a sell. More on this later.

Opportunity cost issue of GSOL

As a simple tool for reaching Solana, GSOL is theoretically effective. That said, there are several factors that make this fund a questionable choice for long-term investment, in my opinion. The most obvious problem is the 2.5% management fee. Solana behind GSOL shares are not traded or leveraged in any way and SOL is in custody. In my opinion, a 2.5% discount is a high price to pay if the assets invested are not truly managed in a meaningful way. Then there is a less obvious problem with non-custodial crypto assets:

90 Day Solana Price (Staking rewards)

Solana is a proof-of-stake blockchain. Unlike other grayscale funds that track proof-of-work tokens (where transaction verification is handled by miners), proof-of-stake tokens can provide benefits to the token holders themselves. Unlike deflationary Ethereum (ETH-USD), Solana experiences high inflation due to new token issuance. If the token price drops with inflation, staking allows holders to receive that issuance in an attempt to maintain the purchasing power of the asset.

Recently, the unadjusted token price, “real yield” on staking has turned positive – and regardless, token prices have risen a lot over the past 12 months. The broader point is that when the reward rate for staking SOL is 7.4%, the opportunity cost of paying 2.5% for fixed SOL is close to 10% per year. On its own, this makes GSOL virtually uninvestable for long-term holders. But the bigger issue today is the NAV premium.

NAV Rate and GSOL Premium

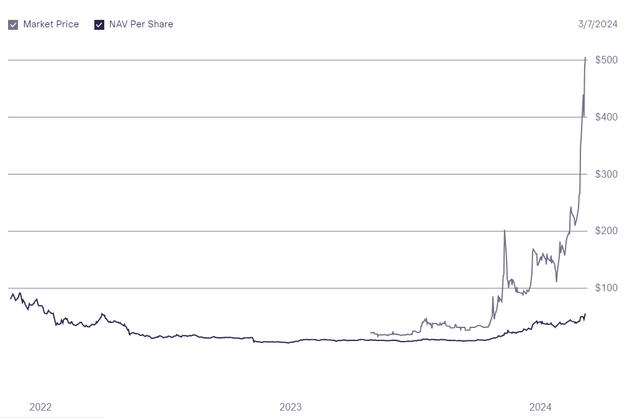

Since the only asset managed by the fund is SOL, it’s easy to track the real-time NAV rate, or the price of the fund’s NAV. With a negative net worth ratio, stocks are theoretically cheap. With a positive NAV, a stock is trading above its underlying value. Unlike ETF wrappers, shareholders cannot redeem shares in closed-end funds such as GSOL. This resulted in many of Grayscale’s funds trading at significant discounts to NAV throughout much of 2022 and 2023.

With ETFs, if the discount becomes large, arbitrageurs can purchase the shares and redeem the underlying assets to pocket the price difference. To put it bluntly, GSOL’s premium is completely off the rails:

GSOL premium to net asset value (grayscale)

As of the close on March 7, 2024, GSOL stock had a premium of 810% relative to the fund’s underlying Solana:

| General Petroleum Company | Osor | |

|---|---|---|

| SOL per share | 0.37764114 | 0.480471 |

| SOL price | $146.83 | $146.79 |

| GSOL value | $55.45 | $70.53 |

| GSOL price | $505.00 | $149.99 |

| High quality | 810.7% | 112.7% |

Source: Grayscale, Osprey

What makes GSOL expensive is not just the value of the SOL underlying GSOL, but also the premium compared to nearly identical products offered by different asset managers. Osprey Solana Trust (OTC:OSOL) closed at only A premium of 113% to net asset value. So if you’re looking to go higher in the FOMO cycle but still have a little incentive to hunt for “bargains,” OSOL may be a better choice. That said, both funds are currently available for private placement, so I can’t even recommend OSOL as a legitimate alternative to GSOL.

| General Petroleum Company | outstanding shares |

|---|---|

| March 7 | 892,227 |

| January 31 | 633,627 |

| Change | +40.81% |

In fact, GSOL shares outstanding have moved higher quickly. Since the end of January alone, outstanding shares have increased by more than 40%. When the shares are lifted from the lock-up, accredited investors conducting the private placement will be able to sell the shares on the secondary market. In this case, it is a reverse discount arbitrage. Since the private placement is done at NAV, if GSOL is still trading at the huge premium levels we are currently seeing, then these new private placement shares could be sold at a premium in the secondary market after the lock-up – giving holders the patience to sell Huge price differences are pocketed.

Private Placement Risks

I would also like to caution accredited investors who may be reading this and considering a private placement strategy. These discount/premium arbitrage risks are high and the market may turn against arbitrage traders before the lock-in window expires.Take the following story as an example Three Arrows Capital (Also known as 3AC). In addition to this, the company also borrowed heavily to conduct large-scale GBTC premium arbitrage. Before Sanjian was eliminated, GBTC fell from premium to discount, and the duration risk brought by lock-up destroyed the transaction.

Granted, 3AC’s demise may be more of a story about leverage. But as I stated in the previous section, GSOL is fundamentally a bad product because of the opportunity cost and the inability of shareholders to redeem their shares while they trade at a discount. There’s nothing stopping GSOL from trading at a discount like many of Grayscale’s other funds did during the crypto winter.

generalize

GSOL is a disaster waiting to happen. If there was no other way to get exposure to Solana, I would understand the desire to have the stock in an account like a Roth IRA. But there are too many other options for Solana investing to justify buying GSOL as a long-term hold – especially at an 800% premium. You can certainly try to trade this thing if you want. But keep in mind the risks that come with trading volatile, illiquid stocks over the counter. If you believe the underlying asset will catch up with the premium, then you are better off purchasing SOL directly through an exchange or crypto IRA.

On the other hand, you could indeed convince me to do a private placement. But even then, you still face duration risk, as the NAV ratio could collapse before the lockup expires, and you’d then need to pay Grayscale’s 2.5% fee to not stake your tokens. If I haven’t made it clear by now, I’m staying away from this.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.