Natalia SO/iStock Editorial via Getty Images

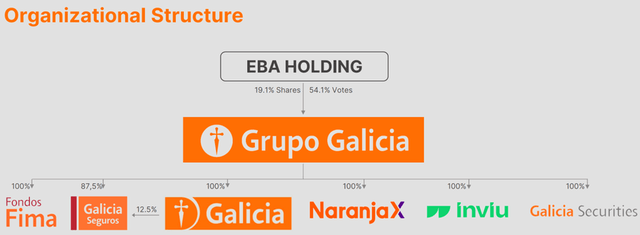

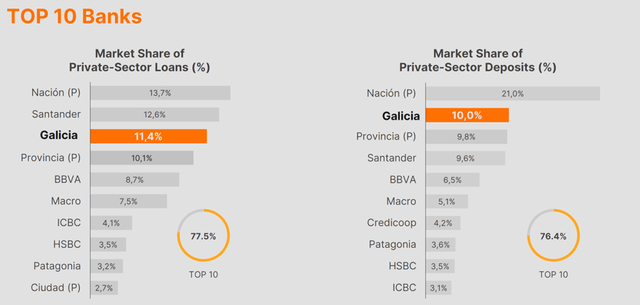

Argentina’s banking system has long been a fragmented one, with no single large bank, not even the state-owned Banco Nacion, holding a dominant share of system assets.But continued economic turmoil and the rise of a new economic regime under President Javier Milley marked the Potential step changes in future industry dynamics. Quit last week By HSBC Holdings plc (HSBC) from Argentina, followed by similar moves By Itaú Unibanco (ITU) last year, reinforcing the case for greater consolidation among the country’s major banks. The beneficiary this time is not only a strategic beneficiary, but also a financial beneficiary (the transaction price is significantly discounted from the predetermined price) is Grupo Financiero Galicia (NASDAQ: GGAL), the holding company of banking unit Banco Galicia and insurance unit Galicia Seguros.

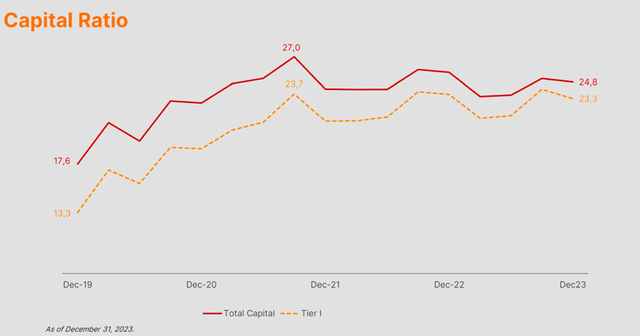

Galicia Financial Group

From here, GGAL’s excess capital position will only increase as the country grows The move toward a looser regulatory regime puts the group in a good position to take advantage of industry consolidation. Even though the consolidation theme will take time to materialize, the P&L benefited from a more benign competitive environment, as well as increased capital flexibility (taking into account dividends and buybacks) under the new BCRA, suggesting higher structural profitability for the bank. At the same time, the base of system credit is also very low (as a percentage of GDP), which will only increase the upside potential if Milei succeeds in containing inflation over time.

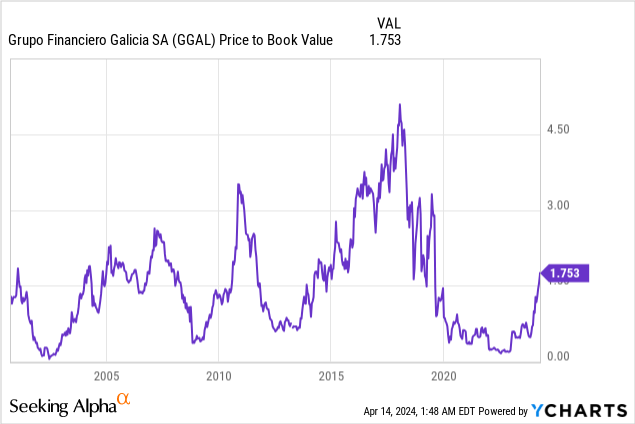

The issue is valuation, as GGAL shares have been re-rated (currently around 1.8x book value), meaning some possibility of an economic/credit recovery is already priced into the price. But given the relative quality here, and the fact that sustained high ROE now looks more and more likely, aided by increasing M&A, I wouldn’t be surprised at all if GGAL stock continues to move higher.

HSBC exits Argentina

Speculation has been rampant in recent months that HSBC is about to exit Argentina, so it is no surprise that the group has announced that it will sell its local business to GGAL for $550 million. Specifically, the payment terms of the transaction are as follows: Banco Galicia will pay US$275 million in cash and the remainder in shares of Grupo Galicia Holding Company. While HSBC’s exit is significant, it is significant given that its banking presence in Argentina has been established over three decades and has made it into the top 10, with a share of more than 3% of system loans and deposits. It is also worth noting that HSBC is not the first foreign bank to exit Argentina. Recall that Itau sold its (much smaller) Argentina unit to BMA last year for $50 million.

Galicia Financial Group

Gain strategic benefits from integration

Strategically, this is a clear win for GGAL and the wider national banking industry. From a historically fragmented system, the withdrawal of foreign capital is a clear signal of consolidation and a good sign of future economic improvement. This also puts GGAL in a good position to take advantage of potential macro normalization in the country. Yes, inflation remains high, but the Milley government’s fiscal consolidation efforts are making progress. bear early fruitsand with credit demand coming from a very low base, there’s a lot of upside potential here.

Keep an eye out for more exits on the horizon as other foreign banks may also look to reduce risk; domestic banks like GGAL with excess capital positions are well positioned to acquire cheap assets and gain more share.Similarly, in the insurance sector, GGAL also operated through Galicia Seguros, and more foreign divestments followed Saurer Group (OTCPK:GIVSY) and BNP Paribas (OTCQX:BNPQY)’s exit bodes well for its future profitability.

Galicia Financial Group

Discounted valuations are a big advantage

As positive as acquiring a top-10 bank is to the industry’s economics, its near-term impact is even more compelling given the discounted price, in my opinion.For context, the $550 million deal price spread across Equity base of $1.4 billion That’s equivalent to a price-to-book ratio of 0.4 times – well below the premium price-to-book ratio at which GGAL shares are currently trading. Now, this does not include additional adjustments prior to actual completion of the transaction (which may be within the next twelve months, subject to regulatory approvals), including business profits and fair value gains and losses on HSBC’s Argentina securities portfolio.In addition, HSBC also Preemptively booked $1 billion in losses For now, I wouldn’t be surprised if we see a lower P/E ratio when the acquisition actually closes.

Buying assets cheaply may become a trend among the country’s big banks – recall that major peer BMA also acquired Itau’s Argentinian operations in August 2023 for about $50 million, which means the same 60-70% Deep discounts. More deals like this, especially if financed by quality P/E/book value, would be hugely accretive. Despite the uneven trading economics, I suspect more forced selling may be on the horizon. Like HSBC and Itau, not many parent companies are willing to accept the volatility or complexity associated with hyperinflation accounting. With many banking groups now also focusing on simplification and ROE rather than growth, the cost/benefit will justify exiting at low valuations. Regardless, this is likely to be an effort to factor more accretive acquisitions into these numbers, although I’ll be keeping an eye on how Galicia realizes this one-time gain next season.

HSBC acquisition adds fresh impetus to upside outlook

If recent acquisitions (notably GGAL’s acquisition of HSBC Argentina) are any example, Argentina’s banking system may be consolidating. Playing on this theme through domestic banking groups with excess capital positions, such as GGAL, makes sense. Not only will GGAL benefit from improved system economics in the long term, but there is also significant near-term value-add potential upon completion of the transaction. More fundamentally, banks are also likely to enter a period of strong credit demand and, perhaps most importantly, the most market-friendly regulatory backdrop in decades under Argentina’s new government. GGAL stock could rebound post-election, but given the tailwinds, there may still be more upside ahead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.