Editor’s Note: Seeking Alpha is proud to welcome First Principles Fellows as new contributors. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also have free access to SA Premium. Please click here to learn more”

Eloy O’Meara

What kind of play is this?Summary of our paper

In a volatile market, everyone is looking for investment theme Given that the Taiwan election has passed and the U.S. presidential election is around the corner, this is resilient and is not affected by geopolitical factors or has little impact. Artificial intelligence is a big theme and it’s everywhere, but at the same time, sanctions are everywhere. Interest rate issues have been plaguing the market, and growth companies are currently unsuitable for investment.

Morgan Stanley Capital International

So what’s better than investing in the fight against the pandemic? The world’s biggest common enemy—climate change? Based on this long-term trend along with fundamental and technical analysis, Hannon Armstrong Sustainable Infrastructure Capital (NYSE: Negative) is our first choice.

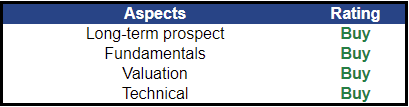

HASI is a Strong Buy considering the company’s fundamentals, such as profit and capital efficiency performance, current market valuation compared to peers, and the fact that stock action has been showing a promising bullish direction and strong resistance.

First Principles Partner

We believe HASI is a long-term value pick

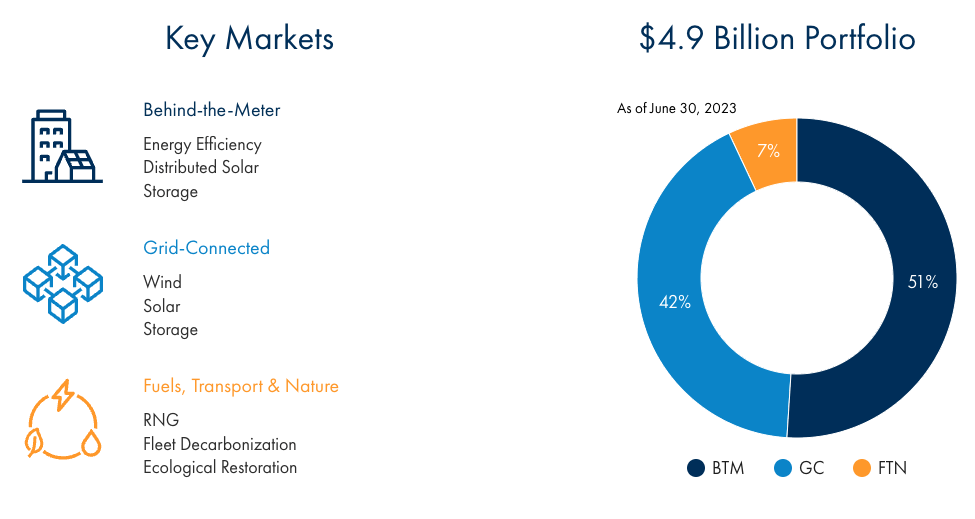

HASI is a US real estate investment trust (REIT) focused on investing in real assets that promote the energy transition, from typical renewable energy projects to climate technologies. It manages assets worth more than $11 billion across multiple sectors and technologies in the energy transition. 4.3 GW of grid-connected wind power, 2.3 GW of grid-connected solar power, 3.8 GW of behind-the-meter solar power and 5.8 million BTU annual renewable natural gas production capacity, etc.

start

The company maintains proprietary partnerships with leading supplier and financial partners such as Johnson Controls, Ameresco, Clearway, Sunpower, AES, Engie and Sunrun, focusing on standardized, repeatable transactions with the goal of investing in renewable Profitable niche opportunities in energy and energy efficiency assets.

HASI offers a variety of financial options, including debt and equity investments, as well as customized structured finance products designed to meet clients’ specific requirements. HASI leverages its expertise in sustainable investing and its extensive network of collaborators to promote the creation and implementation of creative solutions that address critical environmental issues.

How is the company doing?Different records under uncertain market environment

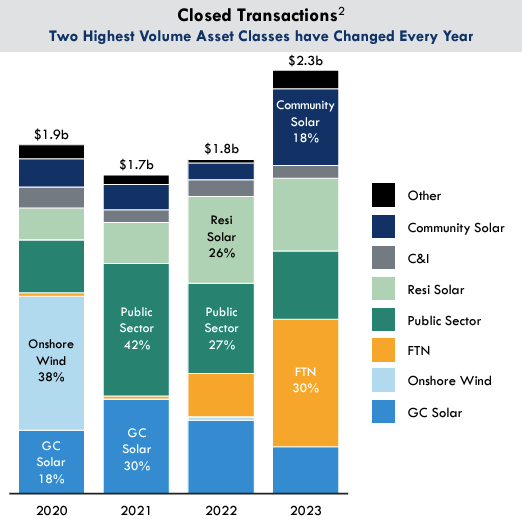

Numbers expected to be delivered. In the current market environment where transaction volume has dropped sharply, HASI has demonstrated extraordinary resilience. Record USD 2.3 billion in transactions have been completed, with a return on investment exceeding 9%. This not only highlights HASI’s financial strength, but also reflects its strategic foresight to actively invest in real assets when valuations are low, especially in the field of renewable energy projects. The growth in return on these assets further reflects HASI’s management’s ability to source and invest in quality assets at reasonable prices.

Seizing opportunities in the climate technology market. HASI has the foresight to start from emerging markets benefiting from the Inflation Reduction Act and decentralized renewable energy projects (i.e. not project-level renewables but individual installations), as well as the importance of transportation and fuel industry investment in decarbonisation. Typical renewable energy projects move to the forefront, which further strengthens our confidence.

start

Maintain fiscal year 2024 target. Reaffirmed distributable EPS CAGR of 10-13% for FY21-24, implying a midpoint of $2.40 for FY24. The dividend payment growth target remains below earnings per share growth as the company looks to partially fund its growing pipeline. HASI believes the FY2024 target can be achieved without incremental financing (either equity or debt), new balance sheet investments, and sales proceeds charges consistent with 2021-23 levels, which we believe will ease investor concerns about the near-term Worry about dependence on capital markets for growth. To be clear, the company said it doesn’t need to raise incremental financing to achieve its goals, but it did say it will evaluate whether the incremental financing can add value.

Fundamental Perspective: Undervalued in Many Aspects

From a valuation perspective, we believe the company’s diversified asset portfolio, demonstrated securitization capabilities, and large addressable market should position the company well, and we believe the company is currently undervalued.

dividend growth model

“Our long-term business model is to continue to deliver 10% earnings per share growth, consistent with our first 10 years as a public company – CEO Jeffrey Lipson

As an investment trust with stable cash flows, a key valuation method is to derive the fair value of its share price from dividends and their growth. In the latest earnings call, management once again committed to a 50% payout ratio, with the remainder reinvested in growth.

Whereas total dividends At $1.60 per share, with a target dividend growth rate of 10% over the next 10 years and 5% thereafter, it gives a valuation range of $30.60 to $37.50, depending on short-term market performance, which will affect the requirements used by the company. response rate. Dividend growth model.

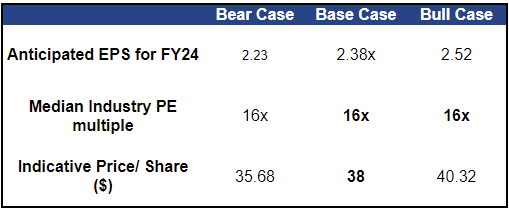

multiple valuation

Based on a specified P/E ratio of 16 times and the company’s fiscal 2024 earnings per share, our December 2024 target price remains at $35-$38. The stated P/E is slightly higher than its peers’ five-year average P/E, but we believe HASI’s solid execution, recurring cash flow, end-market diversification and competitive positioning justify it.

First Principles Partner

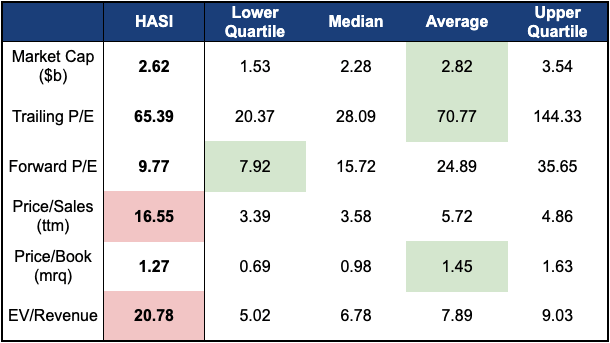

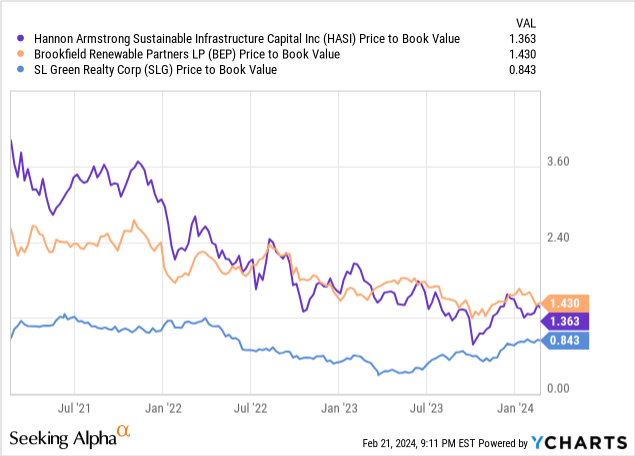

Compare its valuation to its closest peers (Brookfield Renewable Partners and SL Green Realty Corp):

First Principles Partner

Let’s look at the key ratios for REITs and ETFs:

Enterprise value to revenue (EV/R) ratio:

Similar to its price-to-sales ratio, HASI’s EV/R ratio is much higher than its peers. This further highlights the market’s premium valuation of the company. Factors driving the price-to-sales ratio higher, such as expected growth or unique market advantages, may similarly affect the metric.

Trailing price-to-earnings ratio (P/E):

Compared to its peers, HASI’s P/E ratio is close to average but above the median. This suggests that the company’s stock price is slightly higher relative to current earnings.

Although the renewable energy industry has a high P/E ratio, we chose a more conservative P/E ratio of 16.0 times for HASI’s valuation, which is close to the broader market (the average P/E ratio of the S&P 500 is about 20). Also consider:

-

Industry Norm: While renewable energy companies typically command higher P/E ratios due to strong growth expectations, adjusting HASI’s P/E ratio to be closer to the broader market average (S&P 500 Index) reflects a balanced approach.

-

Long-term Outlook: We prioritize HASI’s long-term growth potential in rapidly developing markets such as climate technology and decentralized energy. This focus justifies valuations that forecast future earnings rather than rely solely on current data.

Price to Book Ratio (P/B) Ratio:

HASI’s price-to-book ratio shows that the company’s market capitalization modestly exceeds its book value (net assets). That’s in line with typical valuations for growth companies, where investors focus on potential future earnings, not just current assets.

Technical Perspective: Bullish Pattern Revealed

Since October 6, 2023, HASI stock has risen from $13.22 to $29.88 and is currently priced at $25.19. We can see that the price of this stock has recovered significantly in a short period of time, and according to the rules of technical analysis, this stock still has room to rise, especially if the price breaks above $27.50 again.

In the chart below, we can see that the price has formed a bullish pattern, which is a continuation pattern that usually resolves after the price breaks out of its range and follows the direction of the previous trend. On the chart we can also note that the price has risen above the 10-day moving average, indicating that HASI stock may rise further in the coming days.

trading view

Important support levels are $22.50 and $20; while $30 represents strong resistance. If the price breaks through $27.50, this would be a signal to trade HASI stock, with the next target likely to be the important resistance level of $30. On the contrary, if the price falls below $22.50, this will be a “sell” signal and the next target may be $20.

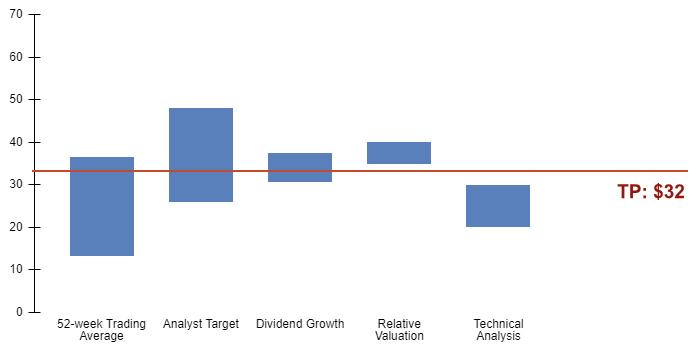

overall valuation

First Principles Partner

Taking into account all previous valuations and analyst price targets, our final price target for Hannon Armstrong Sustainable Infrastructure Capital is approximately $32, representing more than 30% upside from the current share price.Therefore, this proves Strong Buy Our ratings.

investment risk

-

As a renewable asset REIT, the company and its stock price are sensitive to the yield curve, and it is generally expected that the yield curve will reverse in the next six months (that is, the Federal Reserve will cut interest rates). However, if this does not happen, the stock price will be negatively affected. In addition, a company’s balance sheet mix is also affected by interest rates.

-

Renewable energy projects are subject to development risk (i.e. whether the project can be successfully constructed and produce the expected electricity) and counterparty risk to the power purchase agreement

-

Some invested companies are involved in deep technologies and have long R&D cycles, which may be affected by the current high interest rate environment.

in conclusion

Overall, given that most corporate carbon emissions targets are set to expire between 2040 and 2050, requiring significant clean energy investment, we believe HASI is well-positioned to ride on the clean energy trend over the next decade and beyond and climate tech trends. From a quantitative valuation perspective, the company is currently over 20% below our calculated fair value, making it an attractive investment opportunity.