Justin Sullivan

Overview

My recommendation for Hasbro (Nasdaq: YesI maintain a Hold rating as the demand environment remains weak, and I don’t believe this situation will be resolved in the near term.even if i have Confidence, I will only take action if HAS reports strong positive results. That said, I look forward to seeing gross margin expansion going forward, which is one of two things I expect must happen for an upgrade on this stock.please note that i Previously rated as Hold For HAS, as there is no improvement in Season 3 of 2023. In contrast, revenue fell further, prompting management to lower its fiscal 2023 guidance.

Recent results and updates

Nearly a month ago, HAS announced its 4Q23 results, and it took me a while to fully grasp HAS’s current situation and future expectations. As expected from the revised fiscal 2023 guidance, performance in Q4 2023 was not strong. Revenue was $1.29 billion, down 23% from the fourth quarter of 2022, missing the consensus estimate of $1.32 billion. HAS also missed adj. EBITDA, reported was $11 million, compared with consensus estimate of $219 million. As a result, earnings per share were also lower than expected, coming in at $0.38 versus expectations of $0.62. Overall, performance was very lackluster.

Clearly, the top line shows no signs of regaining strength at all. In fact, the POS (point of sale) performance in Q4 2023 was weaker than the performance in Q3 2023 (-8% revenue growth), as POS fell by 12-13% in the quarter. This is a poor performance because the fourth quarter of 2023 should be a strong year for HAS due to the holidays. In addition, 4Q22 results were relatively easy due to retailers’ efforts to reduce inventory. This is enough to illustrate how weak the consumer demand environment is. With inflation remaining sticky and the entertainment industry looking relatively calm in 2024, I think the toy industry will continue to face pressure in the near term. This is very consistent with management’s expectation that the toy industry will remain weak in 2024. Another reason that makes me think growth pressure will persist is that inventory levels in retail remain high, with old inventory and heavily discounted inventory (which means promotions are more likely and may force HAS to do so). Therefore, I remain pessimistic about the growth prospects in fiscal 2024. Given that management guided for a 7-12% decline in Consumer Products segment (CP) revenue, with an even steeper decline in the first half of FY24 (vs. 20-25% decline in 2H23 results). While management expects stabilization in the third quarter and a return to growth in the fourth quarter, I don’t think any investor has a firm belief that growth will return given the state of the consumer demand environment.

Retailers ended the year with inventory down in the high single digits, measured in dollars and weeks of supply. Although retailers have made significant progress in 2023, inventories are still slightly higher than historical normal levels. MAT 2023 Q4 Earnings Conference Call

By 2023, our retail inventory will decline by approximately 20%. While we think Hasbro’s retail inventory is in good shape, the industry as a whole still has a lot of old discount inventory left on the market.The 4Q23 earnings conference call has been held

If I look at the medium term, the area I’m monitoring is margin expansion (assuming consumer demand eventually returns). Although gross margin declined approximately 820 basis points in Q4 2023, HAS should see improved inventory due to a 50% reduction in SKU count (which reduces inventory management costs) and reduced discount pressure as the industry moves away from excess ( work overtime). In terms of inventory conditions, although industry inventory levels have increased, it is encouraging that HAS’s own inventory levels have dropped by more than 50% compared with last year, and retail inventory has dropped by 20%. The important thing to remember is that management noted that all of their inventory comes with purchase orders, meaning there is no need to offer discounts that would eat into growth and profits (it’s important to note that this is for current inventory and not incremental quantity inventory). Therefore, my view is that HAS is “ahead” of the industry in this regard, but the positive impact will only be seen after industry inventory levels ease.

Management is also accelerating savings plans. Specifically, the total savings target is increased from $35-400 million to $750 million. Management expects to save $250 million by 2024, half of which will be charged to the income statement. I think this goal is reasonable, as management will implement many measures (besides reducing SKUs). These include improving supply chain forecasting to keep own and retail inventory within required thresholds, implementing zero-based budgeting to stem overhead deleveraging, and working with retailers to improve pricing accuracy and execution.

Valuation and risk

Author’s valuation model

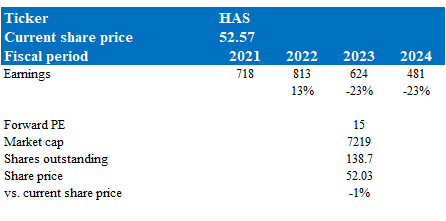

Honestly, at this point, the best guess at HAS’s near-term value is to rely on management’s guidance. Based on fiscal 2024 guidance, I’m given a price target of $52. I use management’s fiscal 2024 adjusted EBITDA guidance and a 50% EBITDA to earnings conversion ratio assumption (consistent with the past two years) to arrive at fiscal 2024 earnings of $481 million. The market currently values the stock at 15x forward P/E, which is a 2x increase from my last valuation. While the outlook is uncertain, I think HAS deserves credit for managing its inventory position extremely well, suggesting it doesn’t need to resort to further discounts to clear stock.

Overall, I think the stock will be range-bound until we see two things: (1) a recovery in industry demand that drives revenue growth back up; and (2) significant margin expansion, signaling that HAS is officially free from excess inventory pressure.

generalize

I currently stick with a Hold rating on HAS. The near-term outlook remains uncertain due to weak consumer demand and rising industrial inventories. On the positive side, HAS has significantly reduced its own inventory, which means it doesn’t need to implement deep discounts, which would impact profit margins. Management is also aggressive in implementing profit improvement initiatives (to cut costs or increase productivity). All in all, there are two key metrics I’ll be watching closely: a rebound in top-line growth and clear margin expansion. These will indicate potential buying opportunities for HAS in the future.