Vladimirovich

notes:

I’ve got it covered Helix Energy Solutions Group, Inc. (NYSE: HLX) previously, so investors should consider this an update from me older reports of the company.

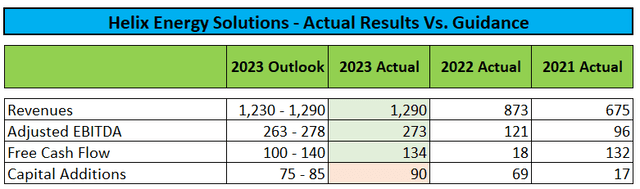

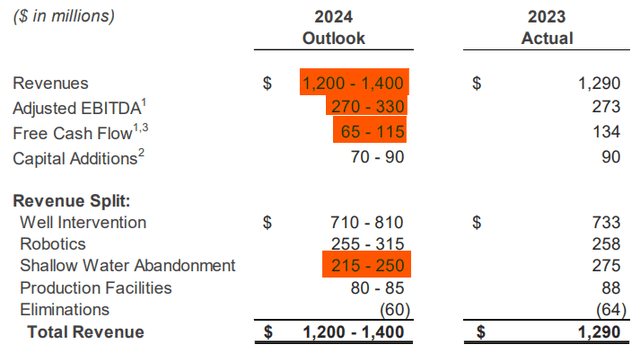

After the close on Tuesday, leading offshore energy professional services provider Helix Energy Solutions Group, Inc. (or “Helix”) reported fourth quarter and full-year 2023 results that were largely within the range provided by management in its third-quarter briefing:

Company Profile

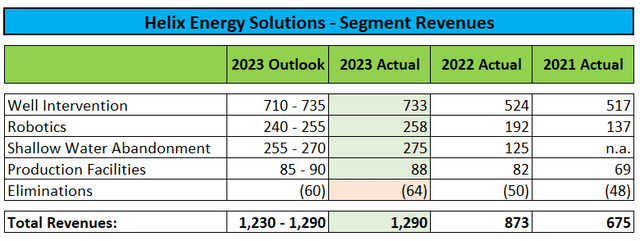

In fact, the company’s three main service segments (well intervention, robotics and shallow water abandonment) all performed at or above the high end of guidance:

Company Profile

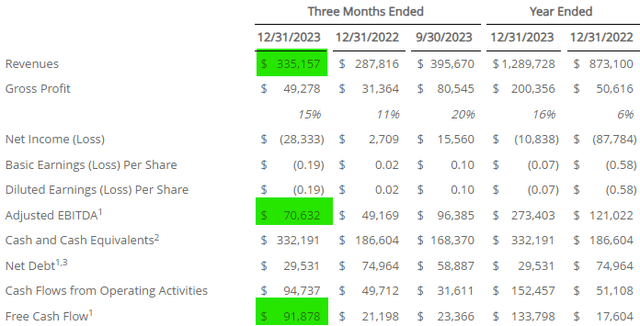

Adjusted for one-time charges, fourth-quarter revenue and profitability exceeded analysts’ expectations. Additionally, the company generated nearly $92 million in free cash flow, its highest level in more than a decade.

company press release

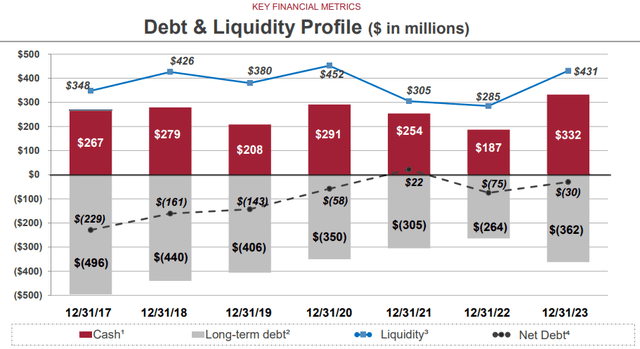

Helix ended the year with liquidity of $431 million, cash and cash equivalents of $332 million, and net debt of only $30 million:

Company Profile

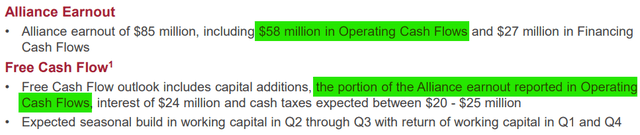

However, the company’s cash position is expected to take a temporary hit in the first half due to an $85 million profit payment related to the project. get 2022 Helix Alliance Shallow Water Abandonment Operations.

In addition, the company expects to use an additional $40 million to redeem the remaining 6.75% convertible notes.

In addition, Helix expects to use $20 million to $30 million for stock repurchases this year.

Total financing debt is expected to decrease to approximately $324 million by the end of the year.

Although the company beat expectations for its fourth-quarter and full-year 2023 results, Helix Energy Solutions’ 2024 outlook is nothing to write home about:

Company Profile

At the midpoint of the top-line range provided, revenue will be essentially flat and adjusted EBITDA will grow approximately 10%.

Free cash flow guidance of $65 million to $115 million looks even worse, but note that this number includes an estimated $58 million related to the earnings payment discussed above:

Company Profile

But even adjusting for earnings payments, free cash flow is unlikely to improve significantly from the $134 million reported in 2023.

With analysts expecting revenue to hit the high end of the range provided and profitability to improve significantly, I expect the 2024 forecast to be revised downwards.

Perhaps the most disappointing part of the company’s 2024 outlook is that the recently acquired shallow water waste segment is expected to post a significant year-over-year decline shortly after the end of the earnings period.

On the conference call, management acknowledged a temporary drop in demand in the Gulf of Mexico, but expected the pullback to be short-lived:

We forecast that the shallow water market will generate similar levels to our guided 2023 EBITDA levels, implying a significant reduction in EBITDA contribution year-over-year. However, we do expect meaningful growth in 2025 and believe the shallow water market in the Gulf of Mexico will be strong in the coming years.

In addition to the expected recovery in the Gulf of Mexico, the company’s performance in 2025 will also benefit from multiple high-spec workover assets (Siam Helix 1, Siam spiral 2 and Q7000) Shifting from low-margin traditional contracts to current charter rates, EBITDA earnings are expected to exceed $75 million compared to the same period last year.

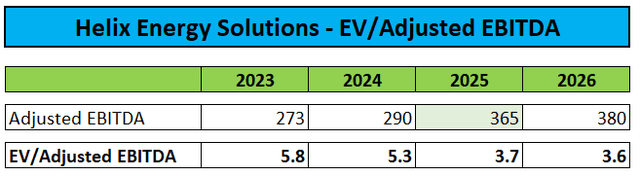

However, based on this year’s rather disappointing guidance, I am lowering my 2025 adjusted EBITDA outlook slightly from $375 million to $365 million:

Company Profile/Author’s Estimate

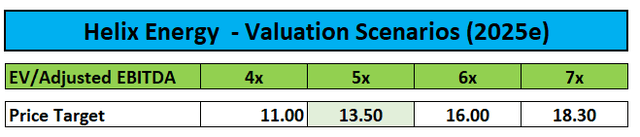

Assigning 5x my 2025 EV/adjusted EBITDA estimate to a price target of $13.50 on the stock (down from $14.20 previously) provides ~50% upside after Tuesday’s selloff.

Author’s estimate

Therefore, I reiterate my “purchase” rating for the stock.

Main risk factors

Note that offshore drilling and professional services stocks remain closely tied to oil prices (CL1:COM), so any sustained decline in the commodity will almost certainly result in another hit to Helix Energy Solutions’ share price.

bottom line

While Helix Energy Solutions reported solid fourth-quarter results, the company’s 2024 outlook missed expectations, sending the stock down more than 10% on Tuesday.

However, with 2025 still likely to be a major earnings inflection year, I reiterate my Buy rating on the stock while lowering my price target slightly to $13.50.