tiero/iStock via Getty Images

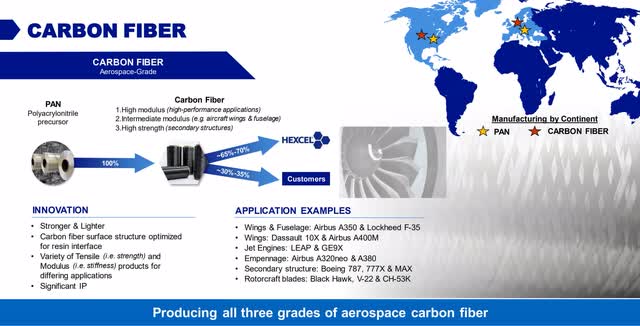

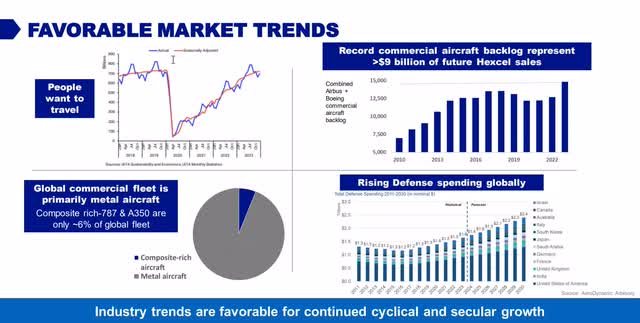

Hexcel Corporation (NYSE: HXL) is a manufacturer of carbon fiber and other products used in making aircraft and other applications.The company recently appointed a new CEO, sending its stock price tumbling information. I wanted to take a closer look to see if this sharp drop was a potential buying opportunity. The company has a fairly unique role in supplying carbon fiber composite materials and numerous patents. It also benefits from aircraft demand, as follows:

Hearst Network

Hearst Network

chart

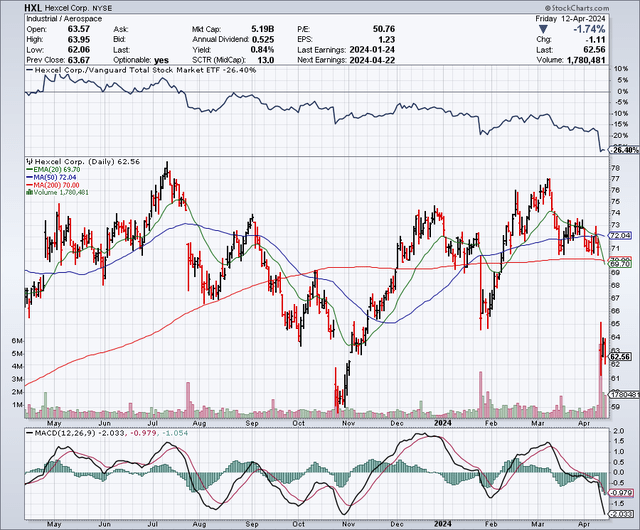

As shown in the chart below, Hexcel’s stock price recently traded around $77, but soon after the company named its new CEO, the stock price plummeted to around $62.The stock is now oversold and could see a near-term technical rebound from the recent sell-off, but I’m still not bullish on the stock It’s an attractive buying opportunity for a number of reasons. The 50-day moving average is $72.04 and the 200-day moving average is $70. With the stock currently trading around $62 and the 50-day moving average currently below the 200-day moving average, a bearish “death cross” could be in sight on the chart. This is usually a sign of a serious, potentially long-term downward trend.

Hearst Network

CEO news and downgrades

Hexcel recently announced the appointment of Tom Gentile as president and chief executive officer. Mr. Gentile is the former CEO of Spirit AeroSystems (SPR), which, as many investors in the industry know, encountered some serious quality control issues during his time in charge. Because of this, many investors seemed caught off guard and expressed concerns about quality control issues under the CEO. The stock tumbled following the announcement, with Bank of America (BAC) analysts quickly downgrading the stock to underperform. Bank of America called the CEO change an “unexpected shake-up,” but took the downgrade very politely and diplomatically, saying:

“We note the surprising nature of this announcement as the company has not communicated to the market that it has been “So we think it may not be well received by the market. “

On February 22, 2024 (before the new CEO was announced), Morgan Stanley (MS) analysts also downgraded Hexcel stock based on valuation, as the company may continue to face ongoing supply chain issues.

Boeing’s recent issues could affect Hexcel

The skies seemed to be clearing for Boeing, but an incident in January 2024 (a door jam blew off during a flight) once again called into question the safety of Boeing aircraft. Since the January incident, there have been more incidents involving issues that could put passengers at risk. While some of these issues may be due to a lack of proper maintenance, Boeing remains in the spotlight as it appears to have potential credibility issues with airlines, the FAA, and even the flying public. I detailed some of these safety incidents in this article about Boeing, in which I stated that I thought the stock was likely to fall as I expected more negative headlines. Sure enough, there was more and more negative news and the stock price went lower. On April 9, 2024, Seeking Alpha News Editor Rob Williams wrote this press release, which states that a whistleblower reported a possible serious safety vulnerability in the manufacturing process of Boeing 787 aircraft. This has triggered additional investigations into Boeing, in addition to an investigation that began earlier this year.

All of this has led to a significant slowdown in Boeing’s production of new aircraft. The production slowdown is starting to affect some Boeing suppliers and also some airlines. Spirit AeroSystems recently announced it would limit hiring and overtime due to reduced Boeing 737 MAX production. Boeing’s production decline is also starting to affect United Airlines (UAL), which recently announced it would suspend hiring new pilots as fewer new planes are delivered. Hexcel also appears likely to have suffered some impact from Boeing’s production delays, which could be reflected in future quarterly results.

according to Hexcel is expected to report first-quarter 2024 earnings on April 22, with consensus earnings per share expected to be $0.44 and revenue expected to be $476.89 million. Updates to 2024 guidance may be a key factor in this earnings report.

Profit Forecasts and Balance Sheets

Analysts expected Hexcel to earn $2.24 per share on revenue of $1.98 billion. By 2025, earnings per share are expected to reach $3, with revenue reaching $2.23 billion. In 2026, earnings per share are expected to increase to $3.59 on revenue of $2.42 billion. Based on these estimates, Hexcel stock trades at nearly 28 times 2024 earnings and nearly 21 times 2025 earnings. Especially given potential production delays at Boeing, which could put those estimates at risk.

Hexcel has a strong balance sheet, with $227 million in cash and approximately $728.8 million in debt.

Potential downside risks

I think there are a lot of potential downside risks for Hexcel. The recent CEO appointment may remain an overhang for the stock for a number of reasons, including possible uncertainty over the transition and the changes the new CEO may implement. Emerging safety concerns at Boeing, which has slowed production of some planes, may also have an impact on Hexcel.

In short

Hexcel is obviously an interesting company and a major supplier of carbon fiber composites. However, even after the share price plunge, the valuation doesn’t appear to be that interesting. Based on my observations, the recent analyst downgrades make sense and I rate this stock a Sell. I think earnings and guidance are at risk for downward revisions due to the possibility of extended production delays for Boeing. I also think better buying opportunities may arise as a result, but I’m still concerned about the uncertainty of the (new CEO’s) leadership transition.

No warranties or representations are made. Hawkinvest is not a registered investment adviser and does not provide specific investment advice. This information is for reference only. You should always consult a financial advisor.