NoDerog/iStock Not published via Getty Images

investment thesis

The prospect of receiving regular dividend income along with capital appreciation is one of the key benefits of investing in companies with high dividend yields.

However, identifying companies with high dividend yields Providing a sustainable dividend can be a challenging task. Companies that pay sustainable dividends not only provide you with the opportunity to receive their dividends immediately, but also provide you with a growing source of income. When it comes to retirement planning, it’s especially important to identify companies that pay sustainable dividends.

Additionally, choosing companies with sustainable dividends reduces the likelihood of dividend cuts, which could have a significant negative impact on the chosen company’s share price. As a result, this may adversely affect your portfolio’s total return, particularly if the corresponding stock represents a relatively large percentage of the overall portfolio.

In this article, I’ve screened out two high-dividend-yielding companies that I currently believe are attractive to dividend income investors. This takes into account their current valuation, solid financials, income generation capabilities, and track record of dividend growth.

However, it’s worth noting that I believe one of these options carries a higher risk of dividend reduction, which is why I recommend underweighting the company in your portfolio.

Companies participating in the pre-selection need to meet the following requirements:

- Dividend yield (FWD) > 3%

- Price to earnings ratio (FWD) < 30

- Return on equity > 10%

I have selected the following two companies for March 2024:

- CVS Health, Inc. (NYSE: CVS)

- Bank of Nova Scotia (NYSE: BNS)

CVS Health

CVS Health Corporation is a health solutions provider with a current market capitalization of $93.55B.

CVS Health Corporation has a dividend yield (FWD) of 3.59% and a 10-year dividend growth rate (CAGR) of 10.07%, providing investors with an attractive combination of dividend income and dividend growth. These metrics suggest that the company should be an attractive candidate for investors who plan to benefit from steadily growing dividend enhancements while investing for the long term.

CVS Health Corporation’s competitive advantages include its extensive network within the healthcare industry, strong brand recognition, diversified business model that helps reduce risk, and economies of scale that help reduce costs.

Valuation of CVS Health Corporation

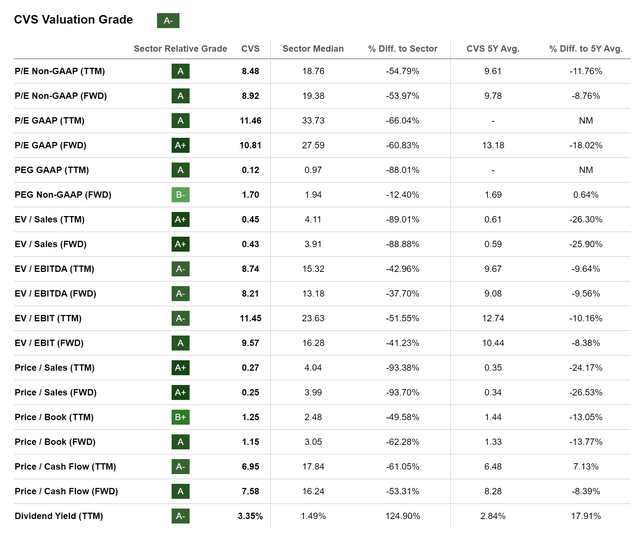

I think CVS Health Corporation is currently undervalued. First of all, the company’s current price-to-earnings ratio is 10.81, which is not only 18.01% lower than the 5-year average, but also 60.83% lower than the industry median, clearly showing that the company is currently undervalued.

Secondly, its price-to-sales ratio (FWD) of 10.25 is not only 26.53% lower than the company’s 5-year average, but also 93.70% lower than the industry median.

Third, CVS Health Corporation’s dividend yield (TTM) is 3.35%, which is 17.91% higher than the 5-year average and 124.90% higher than the industry median, which further strengthens my belief that the company is undervalued.

This undervaluation is further reflected in the company’s Seeking Alpha valuation grade, which you can find below.

Source: Seeking Alpha

CVS Health Corporation Attractive Dividend

Different metrics highlight the attractiveness of CVS Health Corporation’s dividend: The company’s current dividend yield (FWD) of 3.59% is not only higher than the average over the past five years (2.90%), but also well above the industry median (1.62% ).

Beyond that, it’s worth highlighting that the company’s free cash flow yield (TTM) of 10.91% reflects its attractive risk-reward profile, showing that its share price is not the result of high growth expectations. This reinforces my belief that you can safely invest in CVS Health Corporation right now.

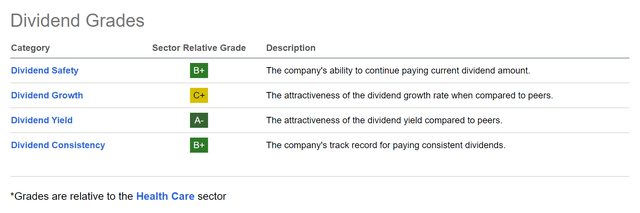

CVS Health Corporation Under Seeking Alpha Dividend Rating

The attractiveness of the company’s dividends is further highlighted when looking at the results for Seeking Alpha’s dividend grades: CVS Health Corporation gets an A- rating for dividend yield and a B+ rating for dividend safety and dividend consistency. For dividend growth, the company gets a C+.

Source: Seeking Alpha

bank of nova scotia

Nova Scotiabank was founded in 1832 and is headquartered in Toronto. This Canadian bank operates through the following divisions:

- canadian banking

- international banking

- Global Wealth Management

- Global Banking and Markets

Valuation of Bank of Nova Scotia

I think Bank of Nova Scotia is currently undervalued. This occurs because the bank’s price-to-earnings ratio (FWD) of 10.33 is just below the industry median of 10.47. Beyond that, it’s worth highlighting that its price-to-book ratio (FWD) of 1.13 is 11.04% lower than the 5-year average (1.27), further suggesting that the Canadian bank is undervalued at the time of writing.

Bank of Nova Scotia’s valuation is slightly lower compared to U.S. banks like JPMorgan Chase (NYSE:JPM) and Bank of America (NYSE:BAC): while the Canadian bank has a price-to-earnings ratio (FWD) of 10.33, JPMorgan’s 11.76 and Bank of America at 11.21.

It’s further worth highlighting that Bank of Nova Scotia pays a significantly higher dividend yield than its U.S. rivals (6.39%, compared to 2.71% for Bank of America and 2.23% for J.P. Morgan).

Bank of Nova Scotia Profitability

Bank of Nova Scotia’s net profit margin was 26.75% (14.11% higher than the industry median) and return on equity was 10.34%, reflecting the bank’s strong profitability and financial position. Moody’s Aa2 credit rating further highlights its financial health.

The appeal of Bank of Nova Scotia dividends

I believe this Canadian bank is particularly attractive to dividend income investors because of its dividend yield (FWD) of 6.39% and its 5-year dividend growth rate (CAGR) of 4.28%.

The attractiveness of Bank of Nova Scotia’s dividend yield and its dividend growth potential reinforce my confidence that this Canadian bank is a potential candidate for inclusion in the Dividend Income Accelerator portfolio.

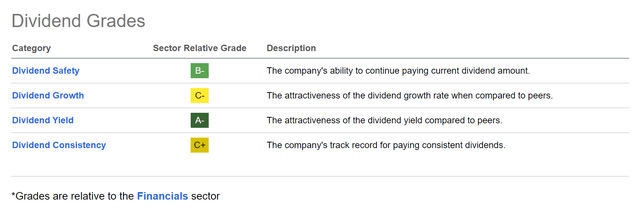

Bank of Nova Scotia under Seeking Alpha dividend grade

The Seeking Alpha Dividend Rating further emphasizes my theory that Bank of Nova Scotia is an attractive option for dividend income investors. Dividend yield is rated A-, dividend safety is rated B-, dividend consistency is rated C+, and dividend growth is rated C-.

Source: Seeking Alpha

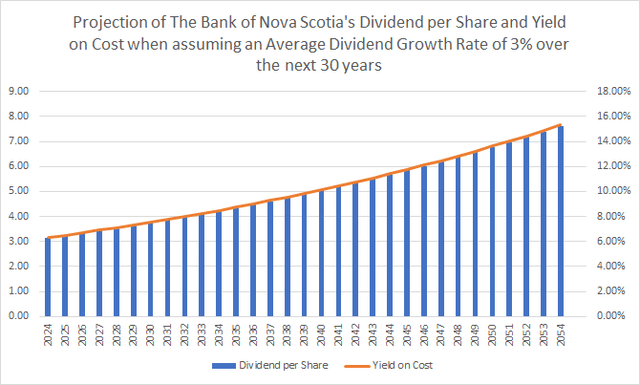

Bank of Nova Scotia Dividend and Yield to Cost Forecast

The chart below shows Bank of Nova Scotia’s dividend and cost yield forecasts assuming an average dividend growth rate of 3% over the next 30 years, further demonstrating the Canadian bank’s appeal to dividend income investors.

Source: Author

risk factors

Given the risks associated with CVS Health Corporation and Bank of Nova Scotia, I think the level of risk is slightly higher for Canadian bank investors.

Reflecting this higher level of risk, the company’s 24M Beta factor increased to 1.00, compared to CVS Health Corporation’s 24M Beta factor of 0.48.

CVS Health Corporation’s relatively low 24M beta suggests that by including it in your portfolio, you can significantly reduce your portfolio’s volatility. Bank of Nova Scotia’s 24M beta of 1.00 reflects the beta of the broader stock market, which shows the same level of volatility.

Beyond that, it’s worth highlighting that Bank of Nova Scotia’s payout ratio of 66.59% is much higher than CVS Health Corporation’s 27.69% payout ratio. This shows that investors in Bank of Nova Scotia are significantly more likely to cut their dividends.

Further supporting this theory, Bank of Nova Scotia’s negative diluted EPS growth (FWD) of -5.93%, while CVS Health Corporation’s positive diluted EPS growth (FWD) of 2.02%. These indicators provide further evidence that Bank of Nova Scotia is more likely to cut its dividend than CVS Health Corporation.

Due to the higher likelihood of dividend cuts, I recommend underweight Bank of Nova Scotia in a balanced dividend portfolio with lower risk levels, providing the company with no more than 2.5% relative to the overall portfolio. This approach reduces the risk level of your portfolio and increases your chances of achieving positive investment results when investing over the long term.

in conclusion

I believe both CVS Health Corporation and Bank of Nova Scotia would be good additions to your investment portfolio and contribute significantly to generating additional income through dividend payments.

CVS Health Corporation and Bank of Nova Scotia have dividend yields (FWD) of 3.59% and 6.39%, respectively, and have continued to grow their dividends in recent years (5-year dividend growth rates (CAGR) of 4.40% and 4.28%, respectively), demonstrating Attractive valuation (its current price-to-earnings (FWD) ratio is below the industry median) and strong financial position (Moody’s Baa2 and Aa2 credit ratings).

Adding CVS Health Corporation and Bank of Nova Scotia to a broadly diversified dividend portfolio combines high dividend yields with dividend growth companies to provide investors with numerous benefits.

You can use this extra income through dividends to further strengthen your portfolio by reinvesting it or managing your daily expenses.

Wouldn’t it be great to explore the possibility of using dividend payments from CVS Health Corporation and the Bank of Nova Scotia to fund your next family vacation?

Author’s Note: I’d love to hear your thoughts on this article!If you can only choose two high dividend yields Which company will you choose in March?