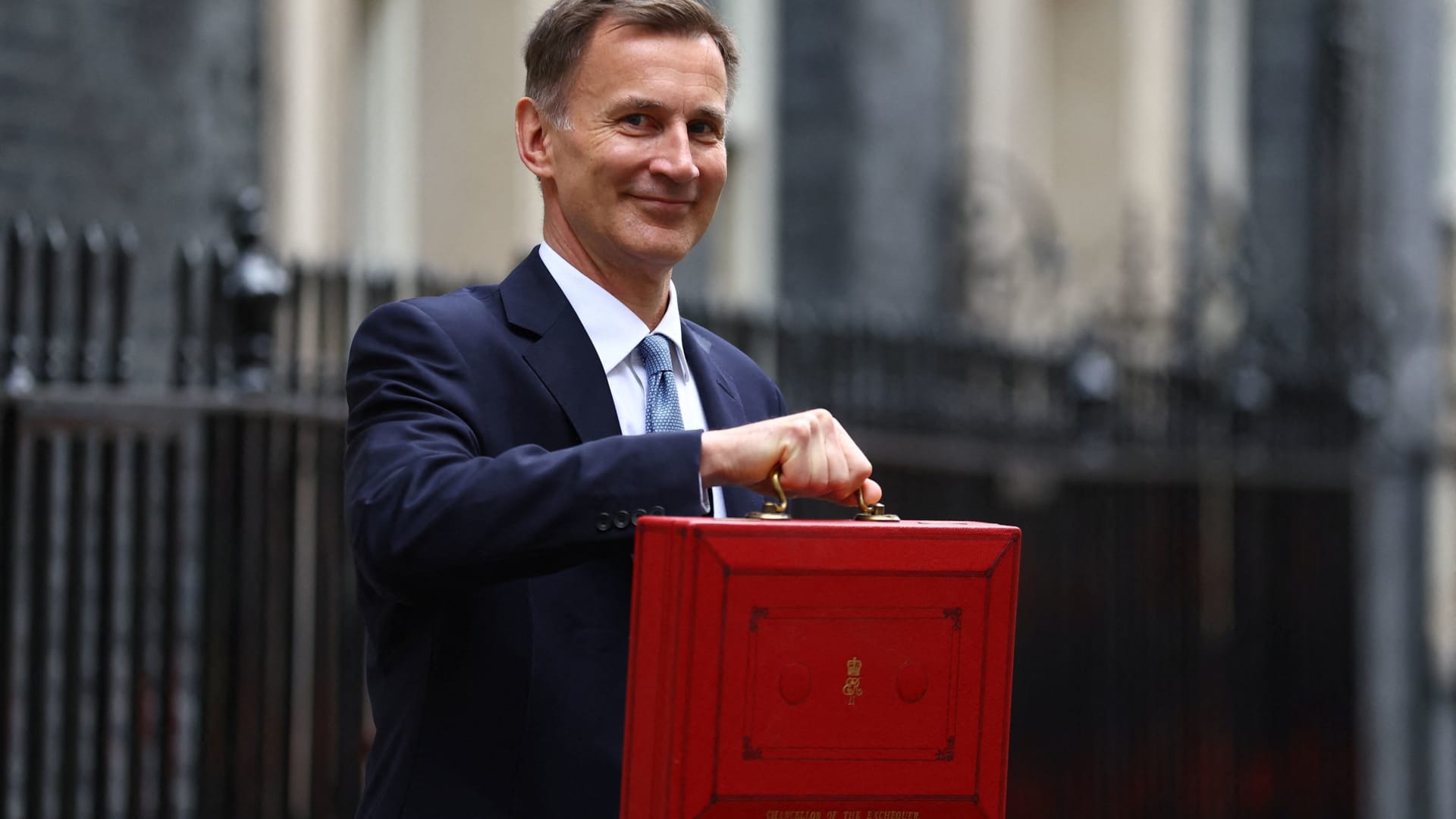

UK Finance Minister Jeremy Hunt said earlier this month that the UK would not fall into recession this year.

Hannah McKay | Reuters

LONDON – The International Monetary Fund (IMF) said on Tuesday that the British government should not cut taxes further this year as the organization’s chief economist believes the national budget needs money for public services and pro-growth investment.

“What we are seeing in the UK and some other countries is the need for medium-term fiscal planning to accommodate a significant increase in spending pressures,” Pierre-Olivier Gourinchas said. said at a press conference.

In the UK, he said, this included spending on the NHS, social care, education and climate transition, as well as measures to boost growth while preventing debt levels from rising.

“In this case, we recommend against further discretionary tax cuts as are now envisaged or discussed,” he said.

A spokesman for the International Monetary Fund also said that Britain’s spending needs on public services and investment are higher than the levels reflected in the current government budget plan. The International Monetary Fund recommends that Britain strengthen taxes on carbon emissions and wealth, close loopholes in wealth and income taxes, and reform the rules that set pension levels.

UK Finance Minister Jeremy Hunt will announce the latest budget in early March, which may be the last major financial announcement before the election. The timing of the vote is uncertain, but the Conservative government must be called at some point this year.

The Conservatives face an uphill battle, with the opposition Labor Party leading in most opinion polls.

Hunt announced a number of tax cuts in the autumn budget and made some proposals that he hopes will enact more tax cuts in the spring.

UK public sector net borrowing The December 2023 figure is about half of the previous year due to higher VAT (sales tax) and income tax revenue and lower spending.

The International Monetary Fund forecast on Tuesday that the British economy will grow by 0.6% this year, slightly higher than the 0.5% forecast for 2023. The group cut its 2025 forecast by 0.4 percentage points to 1.6%, saying deflation would ease financial conditions and allow real incomes to recover.

The report said the downgrade “reflects reduced room for growth catch-up given recent statistical upward revisions to output levels during the pandemic.”

Gurinchas told CNBC on Tuesday that despite the weak growth prospects this year, there is positive news about UK inflation, with the average inflation rate expected to be 2.8%.

“We believe that at this point, the Bank of England will join the Federal Reserve and the European Central Bank in easing policy rates as inflation finally reaches its target,” he said.