filo/iStock via Getty Images

Anktiva FDA Countdown, ImmunityBio’s Strategic Moves

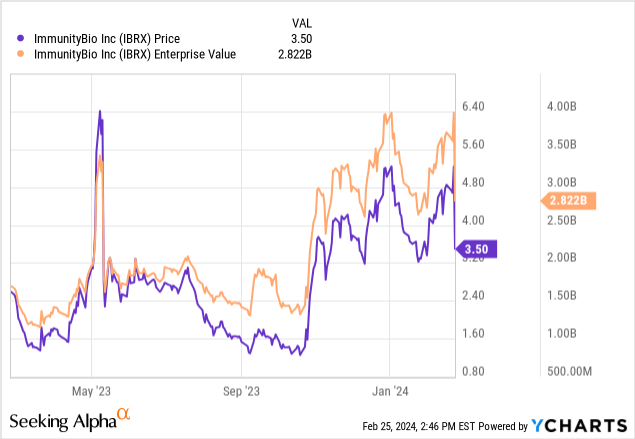

Since I last watched in August, immune organisms (NASDAQ: IBRX) remains a volatile stock.The stock is up 100% since my “sell” recommendation, and we’ve There has been some progress. So, it’s time to reevaluate.

The company is one step closer to PDUFA data (April 23) for Anktiva in non-muscle invasive bladder cancer. Recall that the original CRL was due to manufacturing problems (manufacturing problems are usually easier to fix than data problems). Anktiva plans to enter a highly competitive market where Merck’s (MRK) Keytruda is the leader. However, Anktiva’s robust activity in combination with BCG may make it a key player in the treatment of patients with high-risk non-muscle-invasive bladder cancer (NMIBC), particularly after failure of BCG monotherapy. This could be a huge opportunity for Anktiva (more than $1 billion in annual revenue), which is a biologic and therefore offers 12 years of market exclusivity.

A major concern for ImmunityBio is its financial health, which has improved since August, but there are some issues worth noting. For one, the stock is more dilutive. January, ImmunityBio declare A Income Interest Purchase Agreement (RIPA) with infinity. The deal provides ImmunityBio with $200 million in upfront funding and an additional $100 million upon FDA approval of Anktiva. However, the company will give up a percentage of sales for up to 12 years until Infinity achieves a 195% return on investment. If Anktiva’s royalties don’t meet this requirement, based on my understanding of the agreement, ImmunityBio will have to make up for it in some way.

If the Purchaser has not received a gross income interest payment equal to 195% of the then-accrued Purchaser Payments on or before the twelfth anniversary of RIPA, the Company shall be obligated to pay the Purchaser an amount equal to 195% of the then-accrued Purchaser Payments. Cumulative buyer payments minus interest on total income paid up to that date.

ImmunityBio may elect to increase the royalty percentage at any time to satisfy its obligations, or it may simply be paid in cash. Additionally, they can terminate the RIPA and buy back the royalties. The deal also limits ImmunityBio’s ability to take on additional debt and asset sales (Page 3). Although I have tried to highlight the main issues, the agreement is much more complex than I have described, and is generally quite complex.

Also included in connection with RIPA is a $10 million stock purchase and option agreement, which may include an additional $10 million.

Overall, I think ImmunityBio took a risk on this deal. While this provides a much-needed boost to ImmunityBio’s short-term liquidity, it complicates the company’s already complex financial position and may ultimately reduce its strategic options.

financial health

According to ImmunityBio balance sheet As of September 30, consolidated total current assets were approximately $190.6 million, including $177.96 million in cash and cash equivalents and $11.83 million in marketable securities. Compared to its debt, such as accounts payable of $19.82 million, accrued expenses of $64.87 million, and significant long-term liabilities, including related party promissory notes of $480.02 million and related party convertible notes of $165.29 million, its Financial health needs careful review. .

The current ratio calculated by dividing total current assets by total current liabilities is approximately 2.38, indicating that short-term liquidity conditions are relatively loose. This was further reinforced after RIPA.

Over the last nine months, ImmunityBio reported net cash used in operating activities of $251.49 million, which equates to a monthly cash burn rate of approximately $27.94 million. Taking into account current assets, the cash runway extends to approximately 6.8 months before considering the January update. Keep in mind that this is an estimate based on historical data, and RIPA’s $300 million capital injection greatly expands this runway.

Based on cash burn and recent financings, the immediate need for additional financing appears to have lessened, reducing the likelihood that additional funding will be required over the next twelve months to moderate.

market sentiment

Seeking Alpha data shows that the market capitalization is US$2.35 billion, and the revenue forecast will increase from US$508,000 in 2023 to US$134.3 million in 2025. The growth prospects appear very promising. The stock’s momentum compared to SPY has been mixed, with performance over the past 3 months at -16.47%, but performance over the last year at a notable +27.74%, showing volatility and underlying resilience.

Every Fentelthe number of short interests is huge, reaching 43,933,702 shares, accounting for 31.55% of the circulating supply, indicating that some market participants are skeptical of shorts or that a short squeeze may occur. institutional ownership Moderately at 8.63%, the movement was significant, including 28 new positions and 15 short positions, highlighting active institutional interest. Well-known institutions such as State Street Bank and Geode Capital Management have significantly increased their holdings, showing that institutional confidence continues to grow. insider trading Revealing significant net activity in the last twelve months, which has seen a significant increase in holdings, suggesting insiders are confident in the company’s future.

Given the conflicting messages above, market sentiment surrounding the company can be classified as “mixed.”

Is IBRX stock a buy, a sell, or a hold?

In summary, while recent events have eased immediate liquidity concerns, they have also added to the complexity of ImmunityBio’s financial situation. Also, dilution is still very important. After all, it’s unusual for a stock to be valued at more than $2 billion at $3.50 a share. This usually indicates significant dilution in the past. So while Anktiva is a promising asset with a long life cycle, ongoing financial concerns and regulatory/market risks are largely negative in my view. Importantly, ImmunityBio’s valuation is not “cheap” by any means. Its enterprise value of nearly $3 billion suggests that the market has priced in a strong likelihood of regulatory and market success.

Given these concerns, my recommendation remains to sell ImmunityBio. Despite improvements in the short term (less than 12 months), the company’s financial position remains precarious. Uncertainty about Anktiva’s approval process increases risks.

However, my sell recommendation comes with risks. If Anktiva successfully obtains FDA approval and ImmunityBio is able to effectively meet its financial obligations, the stock could rise significantly. Additionally, the current high short interest suggests the potential for a short squeeze, which could temporarily push the stock price higher. Finally, unforeseen strategic partnerships or licensing transactions could improve ImmunityBio’s prospects by providing additional capital inflows or easing financial burdens.