The Fed appears to be achieving its goal of a soft landing. Inflation is moving in the right direction, especially in the commodities sector, and the economy now seems likely to avoid recession.Released by the Federal Reserve Bank of Philadelphia 2024 First Quarter Professional Forecaster Survey On February 9, 2024, real GDP growth in 2024 was estimated to be 2.4%, an increase of 0.7 percentage points from the forecast in the previous survey. The forecast does not include a single quarter of negative economic growth, let alone a recession, just a soft landing. The chart below shows the survey’s average odds of real GDP growth in 2024. It highlights the importance of thinking about forecasts not in terms of point estimates but in terms of probabilities over a wide spread of possible outcomes (there is no clear crystal ball). With this in mind, forecasters predict the likelihood of a recession in 2024 as follows:

- First quarter: 17.3%

- Second quarter: 23.9%

- Q3: 25.6%

- Fourth quarter: 25.2%

As good economic news emerges, investors’ level of fear or stress (in terms of VIX (an index that represents market expectations for volatility over the next 30 days), well below historical averages 20.However, this number has been rising slightly since the end of 2023 12.45. When I write this article on February 28, 2024, its price is 13.64 (although it reached 15.07 on February 20). The rise suggests investors have become more concerned about the market outlook.Historically, the VIX has been negative correlation Related to the performance of the S&P 500 – when the price of the VIX rises, the price of the S&P 500 tends to fall.

There’s good reason for investor concerns to grow. Geopolitical risks are high and rising, and other economic risks can lead to “financial mishaps” that negatively impact stock and bond markets. Below is a list of concerns, any one of which could cause problems for the market. Before reading them, please remember that if I know these things, “the market” knows them too. Therefore, this information should already be included in the price. Or maybe investors are overly optimistic and FOMO drives prices higher. Please note that this list is not meant to be a prediction (my crystal ball is as gloomy as ever). This is only a list of potential events and their risks to the markets.

- Given the strength of the real estate market (in terms of prices), it will be difficult for the Fed to control inflation since real estate accounts for 40% of the inflation basket.In fact, house prices rebound. As a result, the risk of a sustained increase in the housing security component of inflation is rising and complicating the Fed’s path back to its 2% target. Additionally, prices for services, such as homeowners and auto insurance and auto and home repairs, are rising much faster, complicating the Fed’s task and increasing the likelihood that rates will have to stay in place for longer than the market currently anticipates. maintain a high level of risk over time.

- Geopolitical tensions are high in Ukraine, the Middle East and China. China is particularly worrisome. In addition to these problems, rising nationalism could lead to trade wars and rising inflation, negatively impacting global economic growth.

- With Congress unable to agree on a spending bill, the U.S. government faces the threat of at least a partial shutdown (not to mention the risk of a default).

- The ratio of U.S. debt to GDP currently exceeds 100%. Empirical research, including the 2011 study”The real impact of debt, 2013 study”Has high public debt been holding back economic growth? “, 2020 Research”Debt and Growth: A Decade of Research” and 2021 research”The impact of public debt on economic growth“ and”Public debt and economic growth: panel data evidence from Asian countries,” has found that debt at moderate levels can improve growth, but at high levels (thresholds somewhere between 75% and 100%) it can become damaging—if the high ratio isn’t addressed and becomes persistent, the debt becomes a drag on Economic Growth.

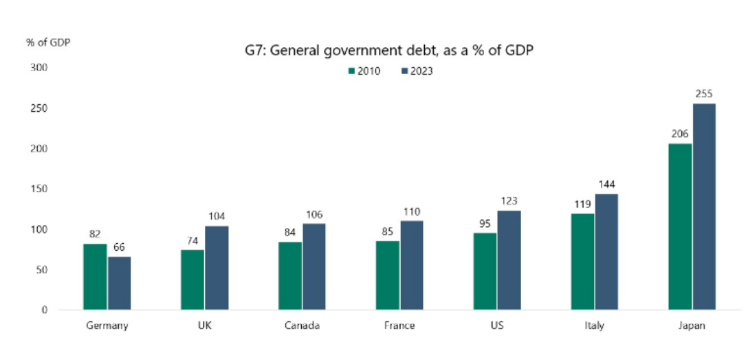

- Sovereign debt continues to rise in most developed countries and China. The United States is not the only country facing problems related to rising debt-to-gross domestic product ratios. “The share has increased in all G7 countries except Germany since 2010”. Note in the chart below that all G7 countries except Germany currently have ratios above 100%, a figure that not only hinders governments’ ability to respond to future financial crises, but also limits future growth. The rising debt problem is compounded by the need for Europe to significantly increase defense spending as a result of the ongoing war in Ukraine, with no end in sight. Rising ratios increase the risk of an eventual downgrade of sovereign debt, with attendant problems for financial markets. Defense spending also tends to cause inflation because it does not increase the supply of products for consumers to buy, but it does inject money into the economy.

- Congressional Budget Office forecast $1.66 trillion deficit And with a record $8.9 trillion in government debt coming due next year, the Treasury will have to find more than $10 trillion By 2024, U.S. government debt will account for more than one-third of outstanding U.S. government debt and more than one-third of U.S. GDP.Additionally, the Fed has been reducing its balance sheet holdings since September 2022 $95 billion per month (Quantitative Tightening or QT). The market’s ability to absorb all the debt may be challenging, especially when the largest holder of U.S. Treasuries (foreigner) continues to reduce its holdings of U.S. government debt. The risk is that interest rates may remain higher than the market currently expects. How will the market react if demand for Treasury bonds weakens in future auctions?

- The work-from-home movement has led to a sharp fall in office valuations, which has restricted bank lending and could lead to more bank failures.

- Municipal finances in large cities such as New York, Chicago, and Los Angeles are under pressure as office property values decline (resulting in lower tax revenues) and as illegal office towers proliferate, leading to increased expenses. migrant. If action is not taken to counter this trend, debt ratings could be downgraded. These issues could lead to reduced spending by municipalities, negatively impacting the economy.

- For technology stocks, especially the Magnificent 7 stocks, there appears to be a growing risk that antitrust legislation could have a negative impact on the industry, which has the highest valuations.

What, if anything, should investors do with this information?

focus

Investing in stocks is always risky due to the uncertainty of future returns and countless other reasons not to invest. This is why stocks have historically provided high returns – investors require a huge risk premium to accept these risks. Therefore, the first point is that it is crucial to consider the possibility of a left-tail event occurring in the form of a black swan (an unforeseen event, such as what happened on 9/11) or a “white swan” (a foreseeable risk) . like the ones mentioned above) – and they are built into your investment plan to ensure you don’t take on more risk than you are able, willing or need to take.

The second takeaway is that there are steps you can take if you’re concerned about the risks listed above. However, this should not include trying to time the market, and the evidence that active managers are failing suggests that this is a loser’s game. Instead, you can reduce left-tail risk by reducing exposure to business cycle risk in traditional stocks and bonds and increasing exposure to risks that are not highly correlated with the same business cycle risk.

A good example of an asset with unique risks is reinsurance, since hurricanes and earthquakes (generally) don’t cause bear markets, and bear markets don’t cause hurricanes or earthquakes. Now is a particularly good time to consider reinsurance because the market has “hardened” due to several years of poor returns (2017-19 and 2021). The result has been significant increases in premiums, along with tightening of underwriting standards and rising deductibles (reducing risk).Funds that investors might consider investing in this asset class include SRIX, Schrex and Xilin SX.

Another good example of assets with low correlation to traditional stocks and bonds are long-short (market neutral) factor funds, e.g. QSPRX and QRPRX.

Investors may also consider private, high-quality, senior secured, floating rate (protected from inflation risk) credit, including the following funds: CCLFX (Net yield is about 12%).

It should be noted that these funds (except SHRIX) are range funds that offer limited quarterly liquidity (investors receive higher expected returns by accepting the risk of illiquidity).

Finally, investors can also consider trend following strategies (e.g. QMHRX), historically perform well in secular bear markets.

The benefits of diversity are well known. In fact, it’s been called the only free lunch in investing. Increasing unique risk is the most effective and prudent way to reduce left-tail risk. Investors seeking to benefit from diversifying their portfolio’s sources of risk and returns must accept the fact that adding unique sources of risk means their portfolios will inevitably experience what is known as tracking error—a measure of how much a portfolio’s relative indicators of portfolio performance. The performance of a benchmark, such as the S&P 500 Index.

“Tracking regret” (which occurs when your diversified portfolio underperforms the broader market benchmark) rears its ugly head from time to time and can even lead to abandoning well-thought-out plans. But diversification is like “insurance” for a portfolio, preventing all your risky eggs from being placed in the wrong risk basket. It doesn’t eliminate the risk of losses or relatively poor returns, but it does reduce them. Diversification requires accepting the fact that some parts of your portfolio will perform completely differently than the portfolio itself, and may underperform broad market indexes (such as the S&P 500) over long periods of time. At least between these two options (avoiding or accepting tracking error), there is no free lunch – you either have to accept the tail risk, or increase your exposure to a risk-free asset, such as the one-month Treasury bill (and accept its very low Real interest rates) historical returns, even before taxes are taken into account).

Larry Swedroe is director of financial and economic research at Buckingham Strategy Wealth, LLC and Buckingham Strategy Partners, LLC.

Provided for informational and educational purposes only and should not be construed as specific investment, accounting, legal or tax advice. Some information is based on third-party data and may be outdated or superseded without prior notice. Third-party information is deemed reliable, but its accuracy and completeness cannot be guaranteed. The views expressed here are his own and may not accurately reflect the views of Buckingham Strategic Wealth LLC or Buckingham Strategic Partners LLC (collectively, Buckingham Wealth Partners). Neither the U.S. Securities and Exchange Commission (SEC) nor any other federal or state agency approved, determined the accuracy, or confirmed the adequacy of this article. LSR-23-617