Trada Santivet

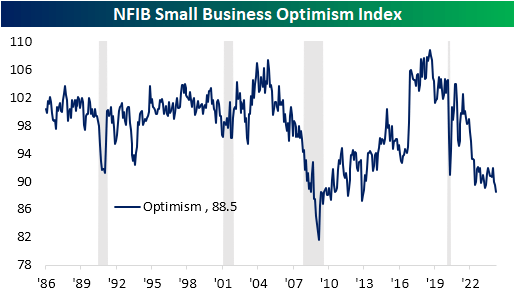

U.S. data started the week on a light note. The only news worth watching today is the NFIB’s interpretation of small business confidence.Although the index is expected to rise to 89.9 from February’s 89.4, in fact dropped to 88.5. This is the weakest reading since December 2012.

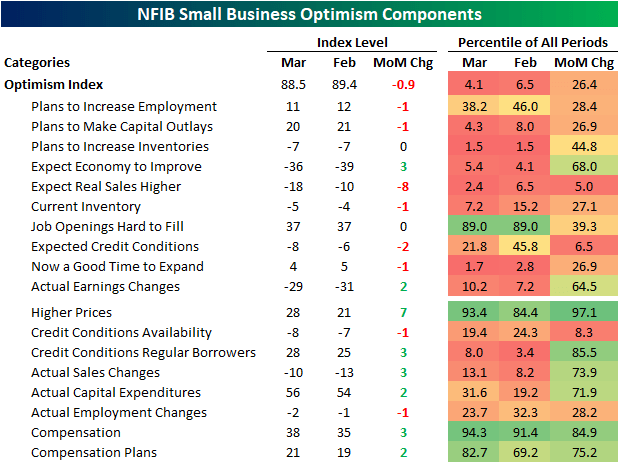

The breadth of this month’s report is very poor given the soft overall data. Among optimism index entries, only two were up quarter-on-quarter. Among these declining categories, one of the most significant declines is an 8-point drop in actual sales expectations.

The monthly decline ranks in the bottom 5% of all months on record, although readings in past years have been even weaker.

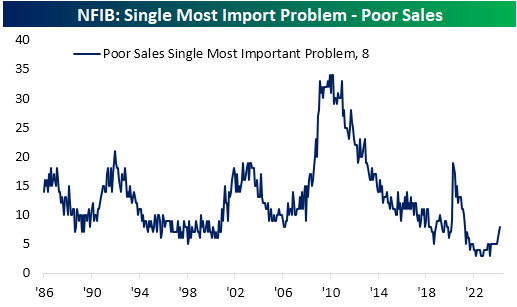

The survey also asked small businesses what they considered their biggest issues.These results echo Expectations for higher actual sales worsened.

As shown below, the share of respondents citing poor sales as their biggest problem has been rising. While 8% is far from an all-time high, it is a significant increase compared to the past two years.

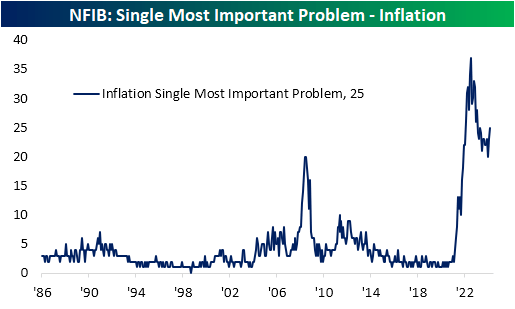

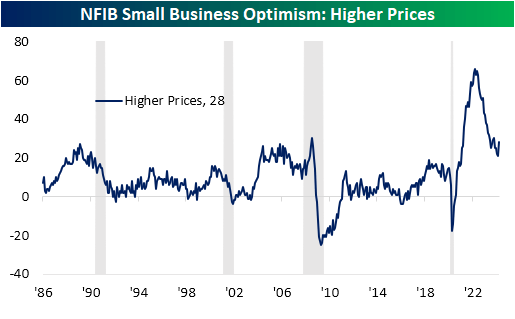

Poor sales aren’t the only concern for the stock market’s rise. CPI data for the first three months of 2024 beat expectations, with small businesses increasingly worried about rising prices.

As the chart below shows, a quarter of companies believe inflation is their biggest problem. That erased any improvement in readings since last May.

In addition, the higher price index also increased, although the increase was less significant. This puts the index back into the top tenth of its historical range.

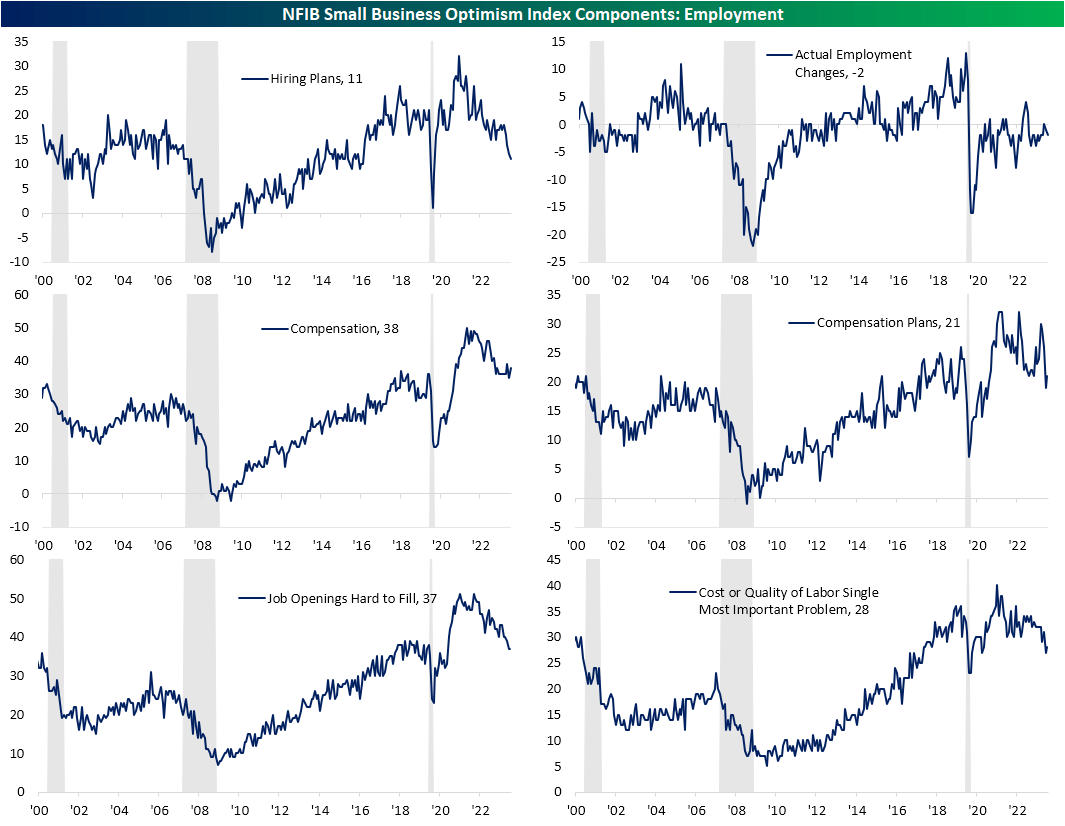

In today’s morning lineup, we discuss weakness in labor market indicators as well as weakness in capital spending plans based on data from this report. As shown below, all categories except compensation (actual and planned) worsened in March.

The most significant drop is in hiring plans, which are now at their lowest level since spring 2020. Prior to 2020, the last time the index was this low was in late 2016.

While small businesses have cut back on hiring plans, they also report that job openings are struggling to be filled at levels similar to pre-pandemic levels.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.