Gutierrez

William J. Luther

When inflation picked up in January 2024, many commentators described it as more noise than signal.this Latest data from the Bureau of Economic Analysis (BEA) expressed doubts about this view.

personal The Consumer Expenditures Price Index (PCEPI), the Federal Reserve’s preferred inflation gauge, registered a sequential compound annual growth rate of 4.0% in February.

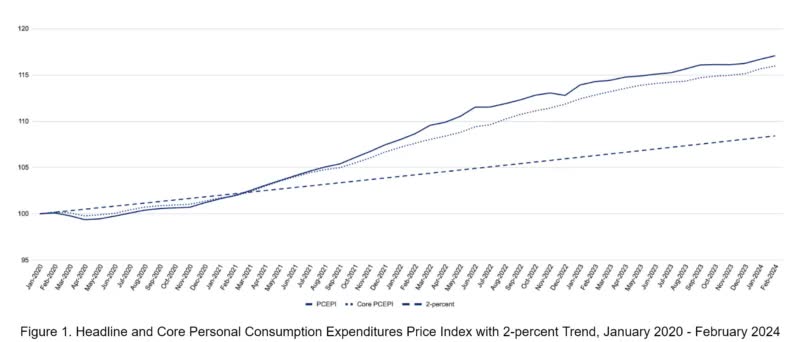

PCEPI has grown at an annualized rate of 3.3% over the past three months and at an annualized rate of 2.5% over the past six months. Today’s prices are 8.7 percentage points higher than the 2.0% annualized growth rate since January 2020.

Core inflation, which excludes volatile food and energy prices, also remained elevated. The core PCEPI sequential compound annual growth rate in February was 3.1%.it has grown up The annualized growth rate over the past three months was 3.5%, and the annualized growth rate over the past six months was 2.9%.

At a press conference after the March Federal Open Market Committee (FOMC) meeting, Fed Chairman Jerome Powell told reporters that the FOMC was proceeding with caution:

We are not overly celebrating the good inflation data for the last seven months of last year. We didn’t get much of a signal from it. What you heard us say is we need to see more. We can, and we want to be careful with this decision. We will not overreact to these two months of data, nor will we ignore them.

This seems to mean that the FOMC does not plan to lower the federal funds rate target anytime soon.

Gov. Christopher Waller echoed Powell’s sentiments in a speech to the Economic Club of New York earlier this week:

It should be noted that one or two months of data does not necessarily indicate a trend, and there are good reasons to think that inflation will progress unevenly but may continue to fall towards 2%. At the same time, monetary policy is data-driven, and I do want to take that into account when setting the economic outlook. While I don’t want to overreact to two months of data, I do think it’s appropriate to react to it.

Waller said there was “no rush to lower the policy rate.” Given the latest data, he said it would be “prudent to keep the rate at its current restrictive stance, possibly longer than previously anticipated, to help keep inflation at bay.” On a sustainable trajectory close to 2%.”

The median Federal Open Market Committee (FOMC) member continues to expect three 25 basis point interest rate cuts at the March meeting. But many FOMC members raised their forecasts. In December 2023, five forecasts for the federal funds rate this year were below the median. Now, there is only one.

Market participants continue to expect three rate cuts this year, with those cuts to begin in the first half of the year. But they have adjusted their odds. The federal funds futures market shows that as of June, the probability that the Fed will maintain the target interest rate at 5.25% to 5.5% is only 36.4%, up from 24.4% a week ago.

Fed officials seem prescient so far. When low inflation data led others (myself included) to call for rate cuts, they kept the federal funds rate target high. The next few months will determine whether this assessment holds true.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.