Jacob Wackerhausen/iStock via Getty Images

introduce

I admit that when innovative industrial real estate (NYSE:IIPR) is the new hot spot on the stock market, and I almost bought the company’s stock for its attractive dividends.I saw the stock explode and approach $300 before falling back to Earth. I remember saying to myself, I’m glad I didn’t start workingotherwise I would have been underwater.

Despite the stock price decline, the company’s fundamentals remain strong. REITs recently reported their latest earnings to end the year, and I have to admit I was impressed, prompting me to do another analysis of the stock and consider opening a position in my retirement account. In this article, I will discuss the appeal of IIPR and why I may be opening a position soon.

Previous analysis

I introduced innovation last time An article in Industrial Real Estate last November was titled: Dividends look generous, but growth prospects look bleak. I’ve discussed that while the dividend growth is impressive and broad, their tenant issues and growth prospects make me skeptical.

Cannabis industry sales are expected to grow 66% over the next 6 years, to $58 billion, but despite the impressive growth, IIPR’s financials are expected to decline by the end of 2024, which again makes the REIT a risk, in my opinion invest.

However, there are some metrics that I like, such as its good dividend payments and strong balance sheet. Well, since then, the company has reported fourth-quarter earnings, ending the year with strong revenue and profits. Analyzing the company further, it may be time to consider starting a position.

follow up

IIPR reported fourth-quarter earnings on February 27, impressively beating FFO estimates by $0.05 and revenue estimates by nearly $3 million. FFO was $2.07, while revenue was $79.16 million. While FFO was down slightly from $2.09 in the previous quarter, revenue climbed from $77.8 million in the third quarter. However, FFO and revenue increased approximately 6% and 12% year over year to $1.95 and $70.5 million, respectively.

The REIT also collected 100% of rent, which increased from 97% in the third quarter of 2022 and 94% in the fourth quarter. I’m a little surprised and impressed that they were able to collect 100% of the rent, considering the tenant issues they have with Parallel, Green Peak and Medical Investor.

Particularly given the challenging economic backdrop, portfolio companies face higher interest rates over the longer term. The tense environment has led to businesses not only falling behind on rent, but some even filing for bankruptcy. For its 100% rent collection, $800,000 of that came from the security deposit and $700,000 came from a $1.7 million concurrent judgment that the REIT won.

As for Green Peak, management’s expected move-out date is March 1, and management has taken a strong interest in the asset since Green Peak announced its exit. Additionally, IIPR was awarded $1.7 million in possession and damages judgments after Parallel ceased operations in October. IIPR is currently exploring leasing options for the property.

new investment activities

Regarding the REIT’s new business, IIPR seizes new opportunities with existing tenant partners. They modified their new lease with Goodness Growth this season to provide additional funding to complete development, cultivation and processing facilities.

They also executed a lease modification with PharmaCann, the largest tenant in terms of annualized base rent. The company expects to provide the company with $16 million in additional funding as they develop a strategy to expand production capacity upon receiving an adult-use manufacturing license in late 2023.

Other than the lease amendments, the REIT did not make any additional acquisitions outside of its existing portfolio companies. As of the end of the fourth quarter, their portfolio company count remained at 108 properties in 19 states, the same as at the beginning of 2023.

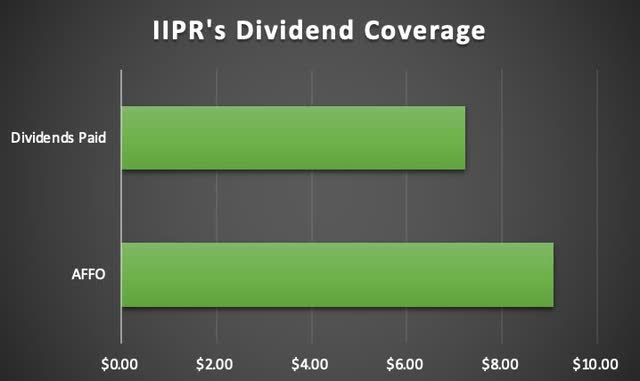

Dividend safety

Due to the uncertainty surrounding the cannabis industry, IIPR significantly increased its dividend and maintained a conservative payout ratio in the 75% – 85% range. The current dividend of $1.82 is fully covered by AFFO of $2.28. As an avid REIT investor, adjusted funds from operations is the preferred method when measuring dividend safety.

AFFO was down slightly by 1 cent from the third quarter, but was up from $2.25 in the first quarter. Still, IIPR’s payout ratio fell from 85% in 4Q22, which is what I’d like to see. Although REITs are required to pay out a majority of their distributable earnings, I would prefer to see a payout ratio below 80%.

The decline was mainly due to the repossession of four properties occupied by King’s Gardens until late September. The current dividend is $1.82, which puts the current payout ratio of 80% in the middle of management’s target range.

Author’s creation

This also provides the REIT with financial flexibility if other tenants run into trouble in the future. Additionally, it provides them with additional liquidity to fund existing portfolio companies or make ongoing investments/acquisitions to continue growing and expanding their portfolios. For the full year, IIPR’s AFFO grew well, reaching $9.08, a growth rate of 7% compared with 2022. Net profit also grew by 7.3% during the same period, showing IIPR’s strong growth indicators during challenging times.

low leverage

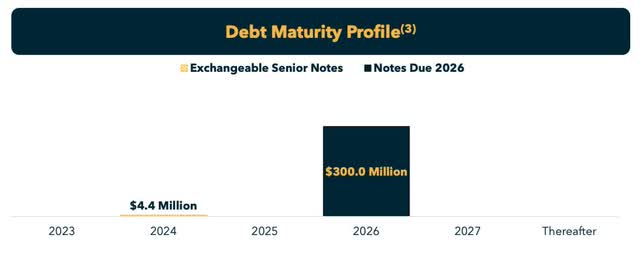

One of the best indicators that stands out to me is that Innovative Industrial Properties is one of the least leveraged public REITs among its peers, with no debt maturities until 2026. Additionally, they successfully increased their liquidity position by $15 million, bringing the total revolving credit facility to $45 million. As of the end of the quarter, IIPR’s debt-to-total assets ratio was below 12% and its debt service ratio exceeded 16 times.

IIPR Investor Introduction

By comparison, cannabis peer NewLake Capital Partners (OTCQX:NLCP) has almost no debt on its balance sheet, with a balance of just $2 million at the end of its latest quarter and a net debt-to-EBITDA ratio of just 0.2x. Still, IIPR’s balance sheet remains strong, and the REIT is in a good financial position with no debt maturities to worry about in two years. And the latter is also much larger compared to NLCP. Their debt is also fixed-rate, so they are not threatened by higher long-term interest rates.

underestimated

At just under $99 per share, IIPR’s current P/AFFO ratio of less than 11x and its dividend make the stock very attractive right now. While peer NewLake Capital Partners’ 8.5x is more attractive, IIPR’s superior dividend growth, payout ratio, and upside potential give them a higher valuation in my opinion. Compare them to Terreno Realty’s (TRNO) P/AFFO ratio of 29.5x. IIPR is a compelling buy right now, especially compared to the 5-year average.

However, both valuations have a lot to do with uncertainty about the overall cannabis industry and the legalization process. But investors who hold on to the stock during the volatility, especially when it dips into the low $70s, could see some decent upside.

You can also earn generous dividends while you wait. IIPR’s P/AFFO ratio is also below the industry median, which may be why Quant gives the REIT a valuation grade of A-, further indicating that it may be undervalued.

In the past, the stock has traded as high as $280, with a 5-year P/AFFO average of nearly 18x. While it may never see a share price like this again, given the stock’s strong fundamentals, I do think a P/AFFO ratio of 13x to 14x is reasonable once interest rates start to fall. This would give them a fair value of approximately $125 per share, an increase of approximately 27% from the current price of approximately $98 at the time of writing.

That’s above analysts’ current price target of $112, but significantly below the high of $179 they assigned the REIT. But as long as their fundamentals and balance sheet remain solid, I think IIPR is worth an upgrade from my previous Hold rating.

Seeking Alpha

Risk factors to consider

Aside from interest rates, which impact REIT and industry-wide prices, IIPR’s biggest risk remains its tenants. This may have affected their share price to some extent. Coupled with industry uncertainty, IIPR’s tenants are somewhat unknown and their portfolios are smaller compared to peers in other industries.

Their top ten tenants account for 78% of annualized base rent, so further defaults rather than an unexpected downturn will significantly impact their financial position. They are also affected by political issues, and since 2024 is an election year, any further issues could negatively impact the industry in the coming months.

bottom line

While I view Innovative Industrial Properties as a high-risk REIT due to the uncertainty surrounding the cannabis industry, the stock offers significant upside to its fair value. Additionally, the high dividend yield is well covered by growing AFFO, and its balance sheet remains well-positioned to weather the current macro environment, with only $300 million of fixed-rate debt maturing over the next two years.

They also managed to collect 100% of rent in the most recent quarter and made new investments in existing portfolio companies, demonstrating to investors their resilience in a difficult environment. I upgrade Innovative Industrial Properties from Hold to Buy due to the cannabis industry’s expected growth, good dividends, potential upside, and strong financials.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.