JHVE photos

introduce

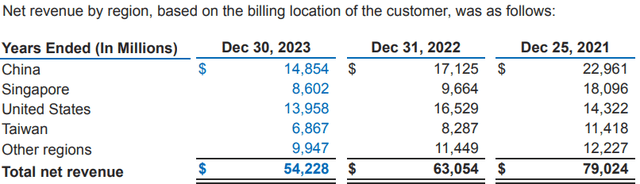

Owns 27% of Intel Corporation (NASDAQ: INTC) revenue comes from China, and news of a ban on the use of its chips in Chinese government computers is a negative development that could put significant pressure on China Semiconductor giant stocks.

Intel releases fourth quarter 2023 financial report

However, after initially falling 4% earlier this week, INTC stock has rebounded and is currently trading at a higher price than before the news broke. Now you’ll find multiple explanations for this resilience in the news media, including but not limited to China’s overall PC end market consumption accounting for around 15% of total global consumption (government consumption is only a small fraction of that number) . According to Bernstein analyst Stacy Rasgon, the revenue impact of the ban will be in the low single digits, with the top-line hit being less than $1.5B Intel.

Intel’s goal through Pat Gelsinger’s “IDM 2.0 strategy” is to become the “Foundry of the West” (as discussed here), and given that ambition, I don’t think China is necessarily a good fit for Intel long-term story. Don’t get me wrong, losing these sales (and the profits that go with them) will hurt Intel’s near-term financial performance; however, this ban is not critical to Intel’s long-term future.

An update on my investment thesis on Intel

If you follow my coverage of Intel, you know that I had a Buy rating on the semiconductor giant starting in late 2021, before downgrading Intel to a Hold rating in June 2023. Competition gradually narrowed in 2007, leaving Intel as the only “scale” semiconductor manufacturer in the Western Hemisphere.

As the global semiconductor supply chain is being reconfigured in light of the COVID-19 pandemic, Intel is well-positioned to benefit from this reshoring activity. Intel is a company of national importance and the US Government’s $20B vote of confidence proves my point!

- Intel provides nearly $2B in grants, loans to U.S. to boost chip production

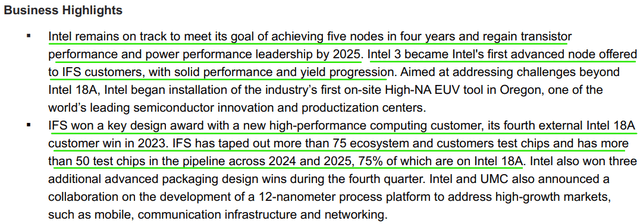

While Intel still lags behind Taiwan Semiconductor Manufacturing Co. (TSM) in process node technology, they appear to be on track to meet CEO Pat Gelsinger’s ambitious goal of 5 process nodes in 4 years (5N4Y) by 2025-26. Reclaiming process leadership.

Intel releases fourth quarter 2023 financial report

Now, TSMC can conjure up a rabbit or two to stay ahead, while Intel is also likely to delay upcoming nodes (such as 18A and 14A) as it has done in the past. To me, Intel continues to be of national importance over the years, and I’m pleased with the progress Intel has made on the foundry (manufacturing) side.

Below is my research paper (investment paper) for your perusal:

As I’ve said in the past, Nvidia (NVDA) and AMD (AMD) have beaten Intel; however, the generative AI craze can still bring huge success to the “Western foundries”!

Intel’s recovery is already underway

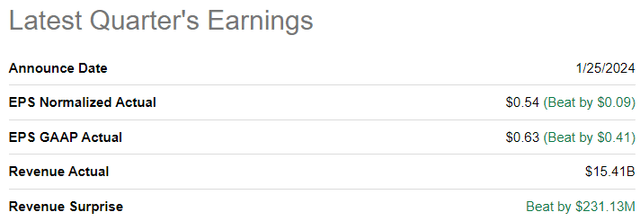

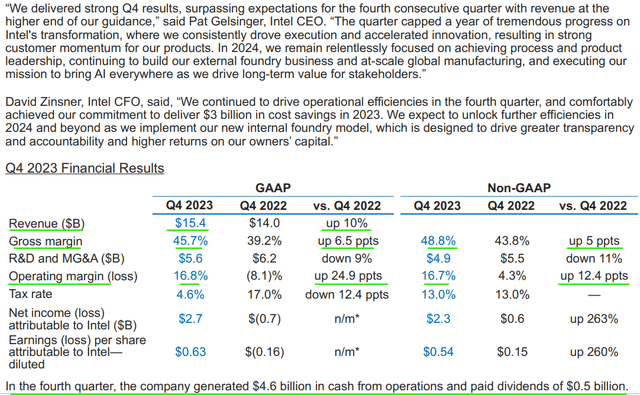

In the fourth quarter, Intel’s revenue and earnings far exceeded management’s guidance and consensus estimates, with operating cash flow jumping to $4.6B.

Seeking Alpha Intel releases fourth quarter 2023 financial report

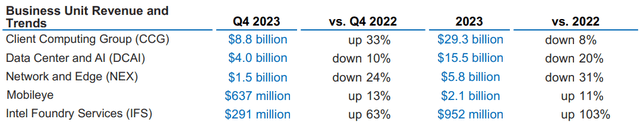

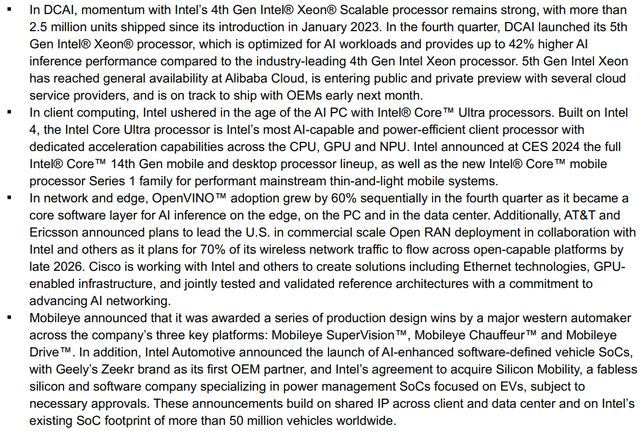

As the PC recession draws to a close, Intel Client Computing Group (CCG) revenue jumped 33% year over year to $8.8B, offsetting continued weakness in Data Center and Artificial Intelligence (DCAI) (-10% year over year) and Networking and Edge (NEX ) segment (-24% y/y). Given its stronger-than-expected financial results, Intel is now firmly in recovery mode.

Intel releases fourth quarter 2023 financial report Intel releases fourth quarter 2023 financial report

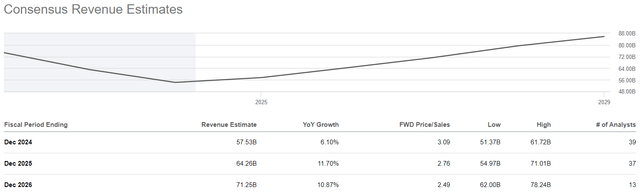

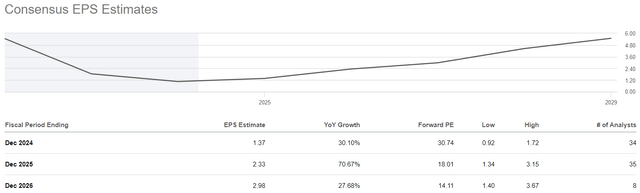

By 2024, Intel expects revenue to grow by mid-single digits and earnings per share to increase by about 30% annually to $1.37. While Intel’s growth pales in comparison to global Nvidia and AMD, the reacceleration of sales and earnings is a huge positive.

Seeking Alpha Seeking Alpha

Is Intel stock a buy, a sell, or a hold?

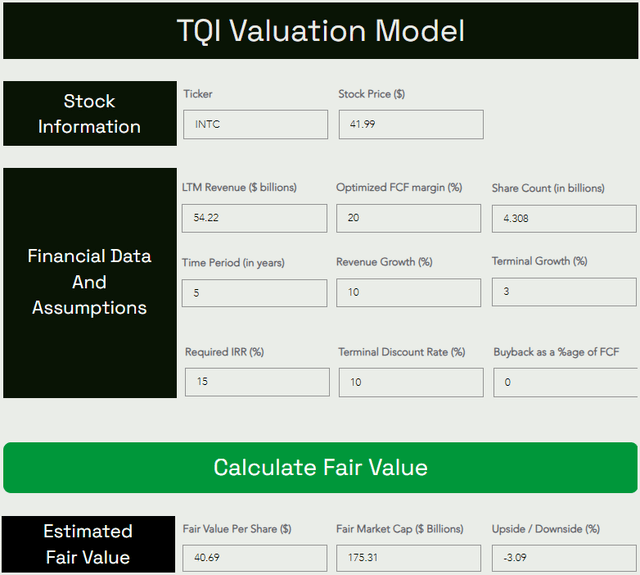

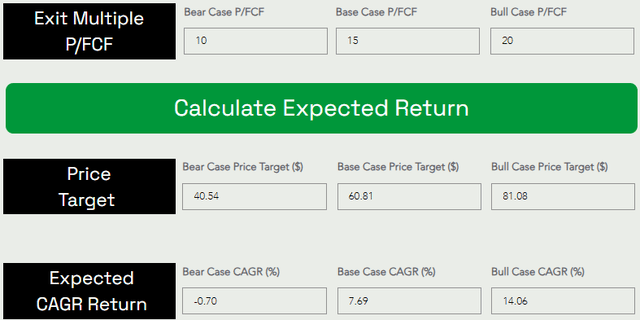

In my opinion, the reset of Intel’s business is now complete, so instead of using the $50B revenue base, I will use TTM revenue to build the company’s valuation model. The rest of the assumptions are simple; however, if you have any questions, please share them with me in the comments section below.

TQI assessment model (TQIG.org) TQI assessment model (TQIG.org)

Based on these results, Intel is fairly valued at current levels; however, if one purchased Intel at today’s price of around $42 and held the stock for five years, they would expect a CAGR of approximately 7.7% (similar to the market’s returns ). That said, since these returns are below the minimum return on our dividend buyback portfolio (10%), I continue to maintain my “Hold” rating on Intel at current levels.

Key takeaway: I rate Intel a Hold at $42 a share

Thank you for reading and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.