Jonathan Kitchen

Intel Corporation (NASDAQ: INTC) recently released an updated corporate structure, reporting segments, profitability and growth roadmap, and mid- to long-term foundry goals.This provides important visibility into the profitability and results of the company’s product and foundry operations It was a bit eye-opening. Based on management’s plan to generate $15 billion in customer foundry services revenue by 2030, Intel will position itself as the second-largest foundry in terms of production capacity. I believe this ambition will be a difficult challenge as the company must first gain the trust of its customers before it can access next-generation fab services. Given the near-term headwinds for equipment, networking, and non-AI servers, I offer a sell recommendation on INTC stock with a price target of $36.76 per share.

operations

As management discussed during its fiscal 2023 earnings call, Intel will separate its Intel Foundry business into its own separate legal entity.new entity Will include operations focused on process engineering, manufacturing and foundry services, including manufacturing, test and assembly for Intel product businesses and third-party customers. The thought process behind this restructuring was to better understand all aspects of the business in order to achieve a more appropriate sum-of-the-parts valuation for each segment. I believe this is also partly related to gaining third-party business, as it may create a firewall between Intel products and Intel foundries, as the company’s plan is to focus on leading in the so-called “post-EUV” era – edge, advanced Wafer manufacturing. With that in mind, I expect it will be an uphill battle to win customers’ trust to manufacture their advanced chipsets, as there’s no guarantee that crosstalk between the two companies will be eliminated without a complete divestment. In view of the confidentiality of the business, ensuring the sanctity of customers’ intellectual property rights will be the top priority when purchasing third-party orders.

I believe another factor that Patrick Gelsinger mentioned on the call was his intention to reduce costs through inter-division sales of chip designs. I believe this will make Intel more disciplined in its production process and less inclined to overproduce and build inventory. This will also tally the differences between internal and external operations so investors can understand the full scope of Intel’s chip manufacturing. Regarding in-house wafer manufacturing, Mr. Gelsinger set a goal of insourcing advanced wafer manufacturing to reach 70% by 2030. He intends to use external manufacturers to produce the remaining 30%, which may focus on more commoditized nodes rather than higher nodes. Top-notch chipsets such as 18A and above.

Intel next-generation chipset roadmap

Mr. Gelsinger laid the groundwork for how he plans to return Intel to dominance in leading chip design. The plan is to produce five nodes over four years, with the first node expected to enter production by the end of 2024. The roadmap for next-generation chipsets is to achieve 18A production ramp-up in 2025 and reach full production in 2026. For internal foundries, the majority of wafers in 2025 will originate from Intel 3, Intel 7, and Intel 10. From an investor’s perspective, I believe Intel needs to prove to the investment community that they can walk the talk. While I have no doubt that the company will be able to scale its 18A chips, I expect investors will want to see Intel prove that margins will improve once it scales.

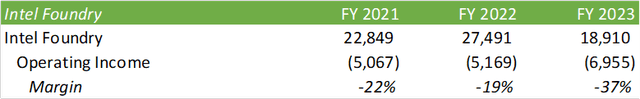

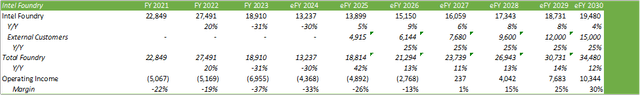

From what I gathered from the webinar portion, Intel will be catching up in the design and production of its accelerators. Management mentioned that significant capital investment will be required in 2024 to drive online IDM 2.0, EUV adoption, and bring 18A to market. Intel isn’t the only company involved in this investment. Through the CHIPS Act, Intel will receive $850 million in grants, $11 billion in loans, and more than $25 billion in tax incentives to help build foundries. The European Union has also committed to build more than $10 billion in wafer fabs. Once completed, Intel will rush to staff its facilities, fill capacity and develop sales pipelines to compete with the likes of NVIDIA (NVDA) and Taiwan Semiconductor Manufacturing Company (TSM). I believe 2026 will be the decisive time for Mr. Gelsinger to prove that Intel can design and produce its own chips as well as third-party chips. If 18A doesn’t scale as expected, and if Intel can’t fill foundry capacity, I believe their four-year, five-node plan will be a failure. With the ambitious goal of achieving second place in foundry by 2030, correct execution and timing will be key. To achieve this goal, management expects to invest $25 billion per fab to expand EUV scale. To further move toward high numerical aperture, management expects to invest $2.5-3 billion per fab. These two advanced next-generation processes are expected to increase foundry profit margins from the current -37% operating profit margin to 40% and 50% respectively.

company report

When developing a roadmap to reach $15 billion in external foundry services revenue, we must first find a starting point. Reading Intel’s FY23 10-k, the company is in talks with Tower Semiconductor to provide foundry services for 300mm advanced analog processing at its advanced manufacturing facility in New Mexico. The company has also reached a final agreement with Synopsys to develop IP on Intel 3 and Intel 18A, and an agreement with ARM to enable chip designers to build optimized computing SoCs on the Intel 18A process. Outside of these strategic partnerships, I can’t find any indication that Intel is producing third-party chip designs in its foundries. With this assumption, I believe the company will start from scratch for external customers (if you do know external 3RD Party customers please leave a message and I will update the model).

company report

Coupled with the numbers behind its growth, I expect fiscal 2027 to be the break-even year for Intel’s foundries, as that should coincide with the timing of their more advanced chipset expansion as well as scaling external customers. I believe the company’s partnership with Tower will be a solid stepping stone to new business. The only pushback I see in this partnership is that the partnership is to make lower-margin analog chips and won’t leverage the full advanced process capabilities Intel is seeking. I think a major factor is whether Intel can build new foundries domestically before then. TSMC goes into production Domestic business.I think Intel either needs to get ahead of TSMC in deploying domestic capacity or some Geopolitical events require Insource wafer manufacturing immediately. I believe the latter will likely lead to Intel increasing production capacity as chip designers step up to nearshoring production.

financial report

company report

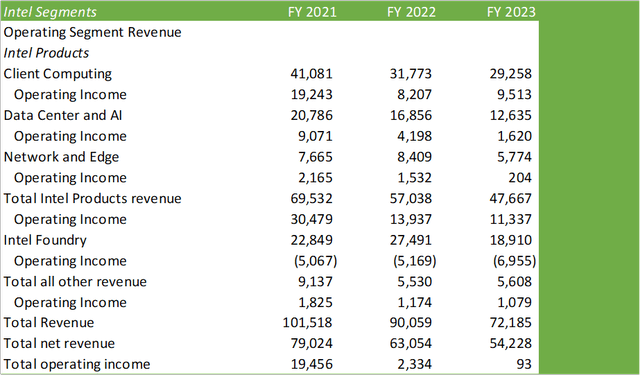

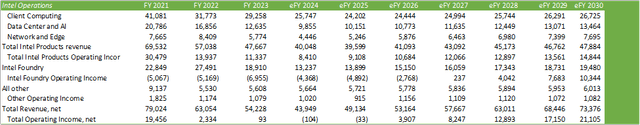

As previously reported, Intel’s business units face significant headwinds in returning to growth.

company report

Looking to other operating segments, I expect continued decline in FY24-FY25, with FY26 being the paradigm shift back to growth. Despite the release of AI-enabled workstations and laptops, I expect client computing to continue declining. As I stated in my coverage of Dell (DELL) and Hewlett Packard Enterprise (HPE), I expect device sales to continue to decline as business spending is tight and consumers face tighter budget constraints in the face of ongoing inflationary pressures. I also expect Network Equipment to continue its bearish trend through 2024 before returning to growth. Both Dell and HPE say non-AI servers are recovering; however, I expect it will be a slow process as enterprises turn their attention to GenAI support and cost-saving initiatives.

I expect turning around Intel will be an uphill battle in the face of challenging macroeconomic conditions. However, I do believe it is possible. Whether Intel can achieve its stated revenue and profit targets is another question. However, given geopolitical risks and limited accelerator capacity in the market, Intel does have a chance to achieve its goal of becoming the second-largest foundry in terms of capacity.

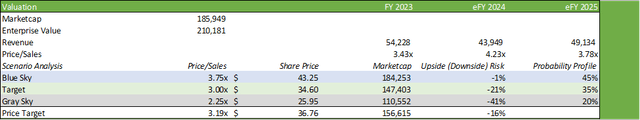

Valuation and shareholder value

company report

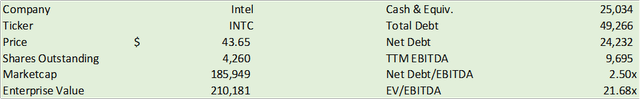

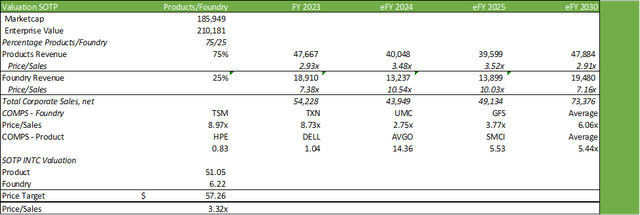

Using Intel’s new segmentation between foundries and products, we can now compare companies on a sum-of-the-parts basis. With management’s expectations of achieving Intel’s growth goals, I believe INTC stock could be worth $57.26 per share. This is a very long-term valuation target and assumes everything goes according to plan.

company report

For near-term targets, I value INTC stock at $36.75 per share. I believe INTC will be a “show me” story and companies need to prove they are capable of regaining industry leadership. Regarding its near-term trend, I offer a sell recommendation to INTC stock with a price target of $36.76 per share and a P/E ratio of 3.19x.

company report