Klaus Wadefeldt

The typically outperformance of low-yielding large-cap growth stocks has been paused. While the Magnificent Seven ETF (MAGS) hit a record high last week, high-yield stocks and even foreign stocks are showing signs of falling. Relative longevity compared to the S&P 500 over the past two months. Despite the macro headwinds, the market’s expansion has occurred not in the area most investors are focused on (small caps) but in other areas.

I rate WisdomTree International High Dividend Fund ETF a Buy (NYSE:DTH). The ETF construction process is robust and The current yield is above 5% This comes as a rate cut could be imminent.

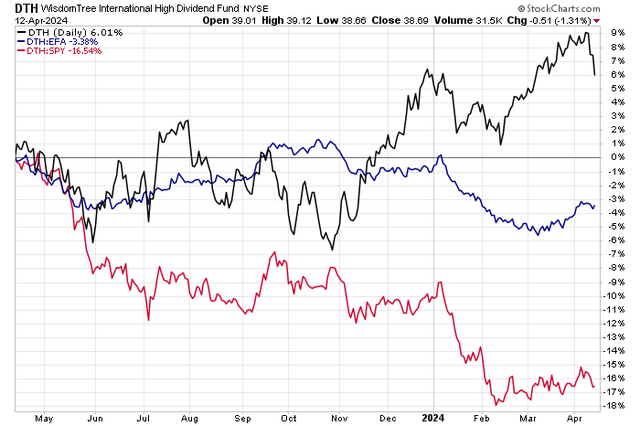

DTH has outperformed EFA since early March and DTH has outperformed SPY since early February

Stockcharts.com

According to the issuerDTH attempts to trace Investment results for high dividend yield companies in developed countries excluding the United States and Canada. Investors use this fund to target high dividend yield companies in developed countries (excluding the United States and Canada) and can complement or replace developed international large-cap value and dividend-oriented active and passive strategies.

The U.S. dollar index hit a multi-month high last week, breaking above the 106 mark amid weakness in the euro, pound and yen. This is usually a problem for foreign stocks, but DTH performed well. If the dollar’s upward momentum is expected to continue, I encourage investors to also consider the WisdomTree International Hedged Quality Dividend Growth Fund ETF (IHDG).

Dollar index jumps to 2024 highs

trading view

DTH is a mid-sized ETF with $2.4 billion in assets under management as of April 12, 2024, and has a mid-sized Annual expense rate 0.58%. Stock price momentum Last year, DTH performed solidly and was rated a B ETF grade by Seeking Alpha. Risk indicators are favorable Consider that portfolio diversification and annual standard deviations are generally low. at last, mobile health DTH’s average daily trading volume is over 300,000 shares, and its 30-day median bid-ask spread is 10 basis points. However, limit orders are encouraged to be used during lower liquidity parts of the trading day.

The WisdomTree International High Dividend Index tracked by DTH includes the top 30% of companies in the WisdomTree International Stock Index dividend yield. The international universe developed exclusively by the publisher is defined through a series of key standards. First, it evaluates companies registered or listed in specific regions, including Japan, 15 European countries, Israel, Australia, Hong Kong and Singapore. Next, it focuses on companies that regularly pay cash dividends of at least $5 million. Third, the index screens companies based on a comprehensive risk filter that considers factors such as profitability, momentum and dividend yield to ensure dividend sustainability.

The company also needs to meet trading volume requirements, trading at least 250,000 shares per month for six months and having a median daily trading volume of at least $100,000 for three months. Finally, the minimum market capitalization required for inclusion in the index is $100 million. After all these screens, eligible international dividend payers are essentially weighted based on regular cash dividend payments, adjusted for a risk screen for dividend sustainability.

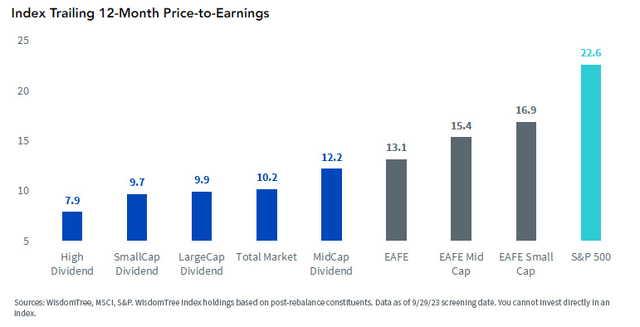

As of the middle of last year, DTH’s trailing 12-month price-to-earnings ratio was as low as 7.9. That compares to the S&P 500’s 22.6x. Today, WisdomTree noted that the forward price-to-earnings ratio is 9.5, still 11 times cheaper than the S&P 500.

High-yield stocks are cheap compared to the S&P 500

wisdom Tree

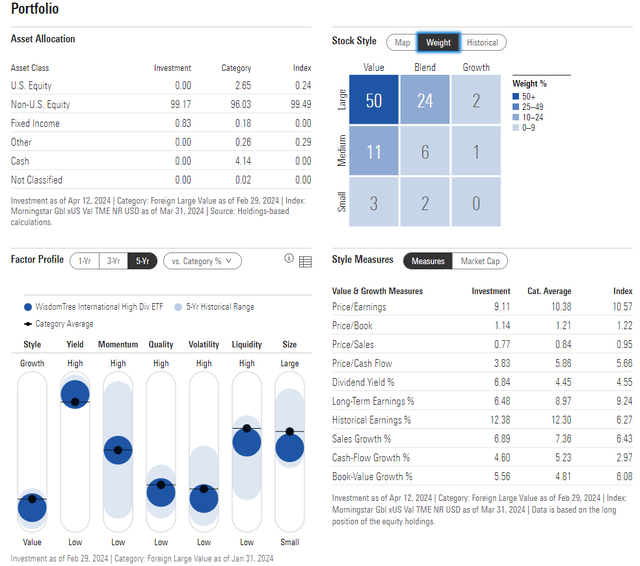

Given its high-market value orientation, Morningstar’s two-star Bronze-rated fund is in the upper left corner of the style framework. Its yield factor is about the highest in the equity ETF space, while its momentum was middling as of mid-April. However, earnings quality is weaker due to the lower risk exposure of long-term growth companies. DTH also offers investors some exposure to small and mid-cap stocks.

DTH: Portfolio and Factor Profile

morningstar

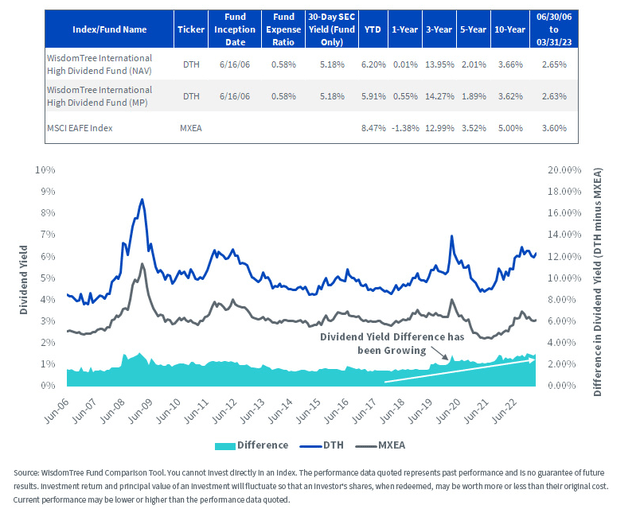

DTH is an interesting idea today because the yield differential between the ETF and the EAFE index is at an all-time high, according to WisdomTree. While dividends aren’t everything, this could be a sign that high-yield stocks are relatively cheap compared to the broader non-U.S. market.

Relative to the MSCI EAFE Index, DTH’s dividend yield has been increasing over the past 12 months

wisdom Tree

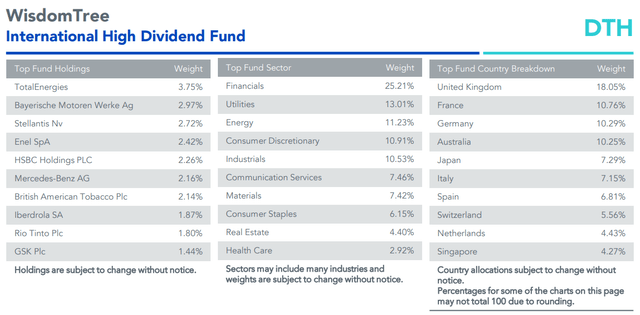

As it stands, DTH is very heavily weighted in the cyclical financials sector. With more domestic and foreign bank earnings due in late April, some of the fund’s largest positions could see some volatility — recall that JPMorgan Chase & Co. (JPM) on Friday experienced its worst performance since June 2020 trading day.

DTH is also significantly overweight two sectors that have been outperforming of late: utilities and energy. With a weighting of only 0.8% in information technology stocks, the ETF’s returns are expected to deviate significantly from the S&P 500’s returns.

DTH Holdings, Industry, Country Segmentation

wisdom Tree

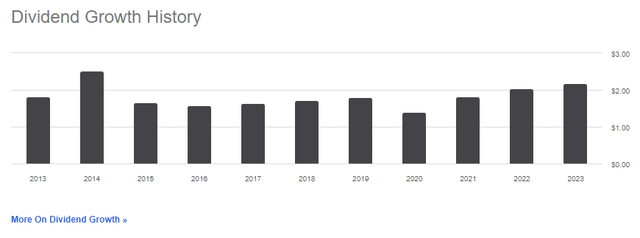

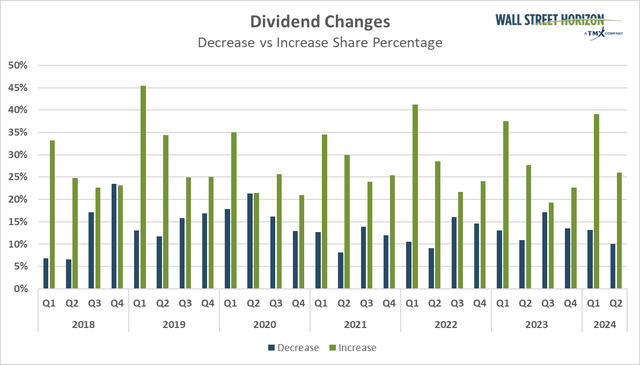

DTH has increased its dividend amount in each of the past three years. Based on the growing number of dividend increase announcements, I expect totals in 2024 to rival the 2014 highs, according to Wall Street Horizon.

DTH Annual Dividend Trends

Seeking Alpha

Global dividends set to increase so far in 2024

wall street skyline

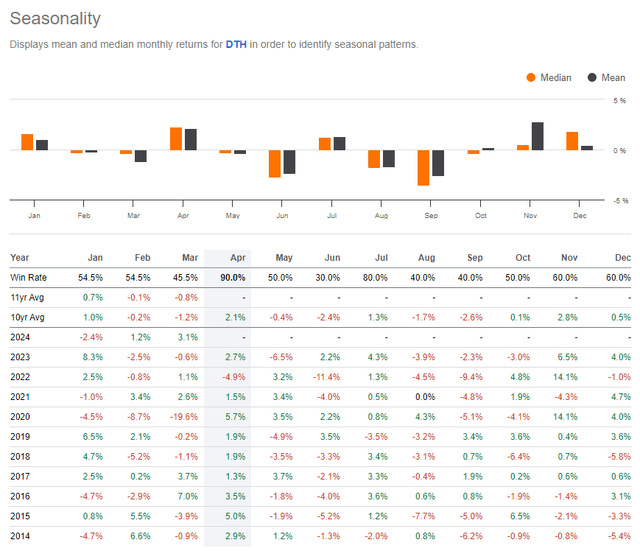

Seasonally, DTH tends to rebound well in April – historically the best month of the year. DTH typically struggles in May and June before a rebound that begins in the second half of the year.

DTH: Bullish April Trend

Seeking Alpha

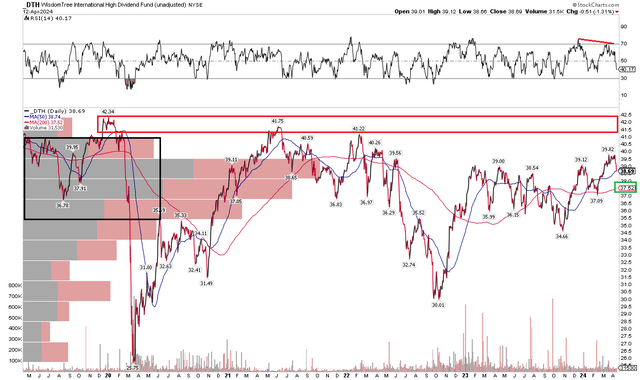

Technical points

With low valuations, high yields, and value exposure, the technical view of DTH leaves something to be desired. Note that in the chart below, the ETF remains at key resistance in the $41 to $42.50 area. This range is key for bulls to regain lost ground. Ahead of this, DTH is in a precarious position with prices between $35 and $41, which could be an ongoing battle zone between bulls and bears.

Also take a look at the RSI Momentum Oscillator at the top of the chart – it confirmed bearish divergence in price at the recent rally high just below the $40 mark. This suggests a pullback to the rising long-term 200-day moving average may be brewing. I see support near $36, with the Q4 2023 low of $34.66 providing another potential layer of support.

Overall, I would like to see DTH get past its early 2020 peak to assert that the bull market has resumed.

DTH: Above resistance, bearish RSI divergence

Stockcharts.com

bottom line

I have a buy rating on DTH. Although its absolute momentum is not particularly large, since mid-February, there have been signs that relative strength is emerging. Its high exposure to energy, utilities and even certain materials stocks could bode well for performance in 2024 as macro risks emerge.