Devrimb/iStock via Getty Images

March CPI inflation data

March CPI data has just been released, and the data shows that,

The consumer price index rose 0.4% in March, the same increase as in February and exceeding economists’ expectations for a 0.3% increase.This indicates The hot data in January and February may be more than just a “bump” in inflation’s march toward the Fed’s 2% target.

Digging a little deeper, it’s not hard to see that the increase is largely due to increases in housing and gas costs. These two items combined contributed more than half of the monthly CPI increase. Among them, the energy index rose 1.1%.

In this context, I think Enterprise Product Partner LP General Unit (NYSE:EPD) is an attractive idea.In the remainder of this article, I Three key aspects will be detailed: A) its dividend that can help you hedge against inflation; B) its fair (even discounted) valuation; and C) the catalysts that help it grow at the same time.

EPA Dividends

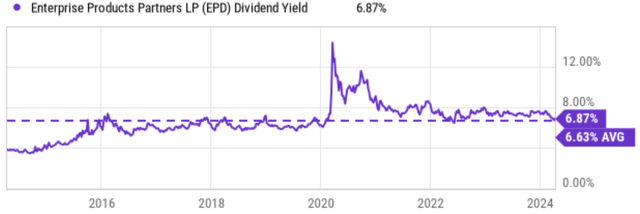

As a master limited partnership (MLP), a significant portion of Enterprise Product Partners’ profits are distributed as dividends. As shown in the chart below, EPD currently has a yield of 6.87%. Yields are significantly higher than current inflation (even the highest forecasts). Note that it is also above the historical average of 6.63%, indicating some degree of undervaluation (more on this later).

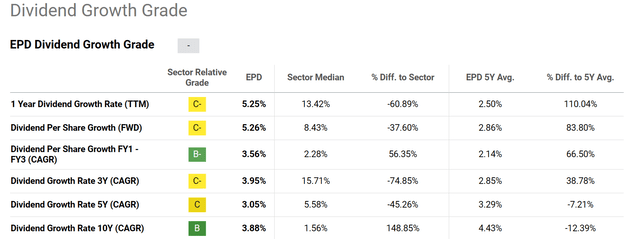

Enterprise Products Partners has an impressive track record of consistent dividend growth. In January 2024, it increased its quarterly unit payout to $0.515. The year-on-year and quarter-to-quarter growth rates were 5.1% and 3% respectively. Some investors may find the growth rate unimpressive. But over the long term, they far outpace inflation. Its dividend growth rate in the past three years and the past 10 years has been approximately 4.0%, as shown in Figure 2 below.

What’s more important is consistency. A Dividend Champion, EPA has consistently increased its dividend over the past 25 years. In my opinion, Enterprise is one of the best-run and most resilient businesses in the midstream industry. One notable example is that most companies in the group have been forced to significantly reduce allocations during COVID-19. Additionally, annual spending by many of these entities has still not returned to pre-pandemic levels. Not only did Enterprise not reduce its circulation, it actually increased it year by year.

Seeking Alpha Seeking Alpha

Valuation

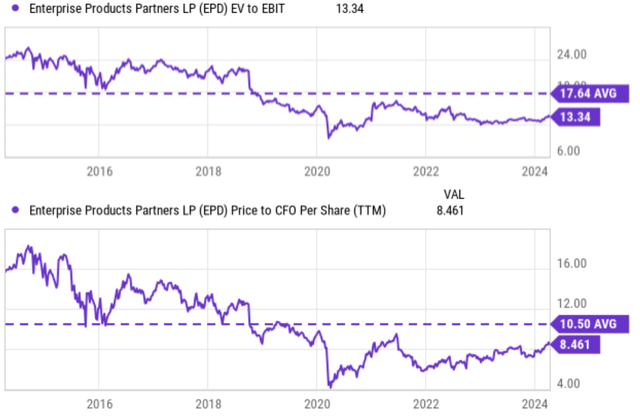

As mentioned above, its dividend yield either suggests fair valuation or a discount. In terms of price-to-earnings ratio, Environmental Development is currently trading at 10.8 times FWD EPS, which is very reasonable in both absolute and relative terms. Although it is a midstream stock, it uses a higher degree of leverage. Therefore, I think a leverage-adjusted cash-based metric is more appropriate here.

The chart below shows EPA’s EV/EBIT ratio and P/E and CFO ratios compared to their historical averages. As you can see, these indicators send the same signal. In terms of EV/EBIT, EPD’s current ratio is 13.34x, compared to the historical average EV/EBIT ratio of 17.64x over the past 10 years. The ratio is also near the low end of its historical range over the past decade. On a P/CFO basis, EPD’s current ratio is 8.46 times, again below the historical average of 10.5 times.

Despite the low valuation multiple, I think there are ample catalysts to drive earnings growth.

Seeking Alpha

growth catalyst

I think the most important catalyst is inflation. As mentioned earlier, energy costs are a major factor in the current inflation problem, and housing is another. Between energy and housing, I think energy is the more fundamental driver that can cause positive feedback – positive in the sense that feedback tends to drive up inflation. Our other needs (i.e. food production, transportation of goods, construction of housing, etc.) ultimately depend on the use of energy. One person’s problem is often another person’s opportunity. In this case, EPD is another one (along with other energy stocks like Exxon Mobil Corp. (XOM) , as detailed in my other article ).

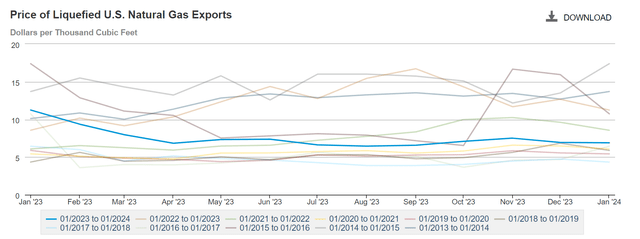

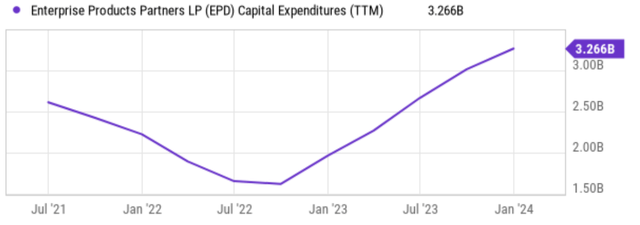

The second catalyst in my mind is its natural gas and liquefied natural gas (“LNG”) growth potential.Next chart The chart below shows U.S. LNG export prices (seasonally adjusted) over a 10-year period. The current price is $6.89 per thousand cubic feet. As the chart shows, prices are currently near the lower end of the historical price range and I expect LNG prices to rise. Meanwhile, the EPA is undertaking a major construction program to expand its LNG production capacity. As you can see from the second chart below, the EPA reduced capital spending in 2021 and 2022, but returned to more aggressive levels starting in 2023.

That said, capital spending slowed to a low of about $1.6 billion in 2021 and is now at a multi-year peak of $3.2 billion over the past 12 months. As the U.S. becomes the world’s most important exporter of LNG, I am very optimistic that the EPA can benefit from a more favorable pricing environment and expanded export volumes.

Environmental Impact Assessment Seeking Alpha

Risks and final thoughts

In terms of risks, I will not spend too much time discussing common risks in the midstream industry, such as commodity price fluctuations, regulatory risks, environmental issues, etc., but focus on some more special risks. .

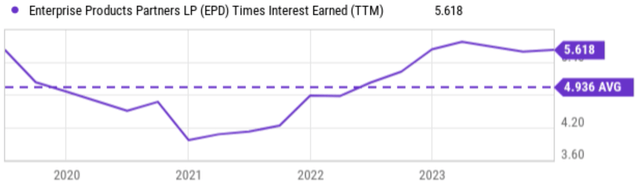

As mentioned earlier, the midstream industry relies more on debt financing than the economy as a whole. The Environmental Protection Agency is the more conservative and safer player in this area. As shown in the chart below, its current interest coverage ratio is approximately 5.6 times, which is much higher than the industry average and its historical average. However, the current interest coverage ratio is relatively low compared to the overall economic level (about 6.1 times), especially the long-term average. At the same time, midstream companies require significant upfront investments to build and maintain pipelines and storage facilities (as just mentioned, the EPA is no exception).

The combination of leverage and large capital expenditures could limit EPA’s financial flexibility and expand its balance sheet. A more distant risk—but one with consequential consequences—involves the EPA’s heavy reliance on specific pipelines. The EPA derives most of its revenue from a few key channels. If these pipelines are disrupted (due to catastrophic events such as weather, earthquakes, terrorist attacks, etc.), it could severely impact the EPA’s bottom line.

All in all, my conclusion is that EPD presents a compelling buying opportunity, especially for income-oriented investors in current conditions. This is a very well-rounded investment, combining growth potential, discounted valuation, and a generous and stable dividend. EPD has a strong midstream infrastructure and a proven track record of achieving continued growth in distribution. Current yields and their historical growth rates exceed inflation by a wide margin. Additionally, I think there are plenty of catalysts to support its earnings and dividend growth in the coming years. Finally, it also trades at an attractive valuation based on its yield and EV/EBIT ratio, which are either at or below historical averages.

Seeking Alpha