59 yuan

paper

We last mentioned this name in an article six months ago, where we assigned a “Buy” rating to this high-yield fixed-income CEF. CEF has surged since we highlighted this opportunity:

Original Rating (Seeking Alpha)

in our In the first article, we highlighted CEFs’ discount to net asset value, their classic high-yield structure and conservative leverage, as well as the wide range of credit spreads. The combination of various conditions creates an ideal entry point to participate in this CEF, which is an opportunity to obtain huge rewards.

Fast forward to today and things have changed dramatically. In this article, we take a fresh look at the PGIM High Yield Bond Fund (NYSE:ISD) and its performance, and shed light on why today’s price points no longer represent an attractive entry point, thus keeping the name alive.

Credit spreads surge

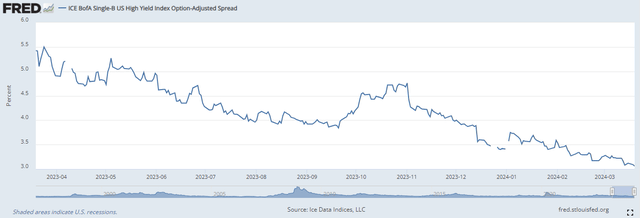

Single B credit spread U.S. high-yield bonds have fallen to a staggering low of 3.06%:

Credit Spreads (Fed)

Spreads tightened very sharply last year, starting at 5.5%, experiencing a sharp move higher in October 2023, and then resumed their decline.

These are historically low levels not experienced since 2014-2019.Markets are clearly pricing in a soft landing, and Powell’s speech The news on March 20 reinforced the view that the Federal Reserve will cut interest rates this year regardless of the inflationary environment.

One could describe today’s credit environment as “Goldilocks,” with risk appetite prevailing and credit spreads at historically low levels. While total yields are not low, credit spreads are low considering the federal funds rate is above 5%. Retail investors should always focus on credit spreads when considering high yield, as this is where you are compensated for taking on default risk. Simply investing short-term treasury funds can earn you a 5% interest rate, but the question is whether 3% is the right compensation for the credit risk you take.

We believe the market is too complacent and any deviation from the current soft landing path could result in credit spreads repricing significantly higher. In the best-case scenario, a soft landing will materialize and investors will continue to shave 3% off credit spreads without any real further upside. At these levels, cutting yields is a best-case scenario. However, the downside is much more serious, and if credit spreads return to early 2023 levels, credit spreads could almost double from current levels.

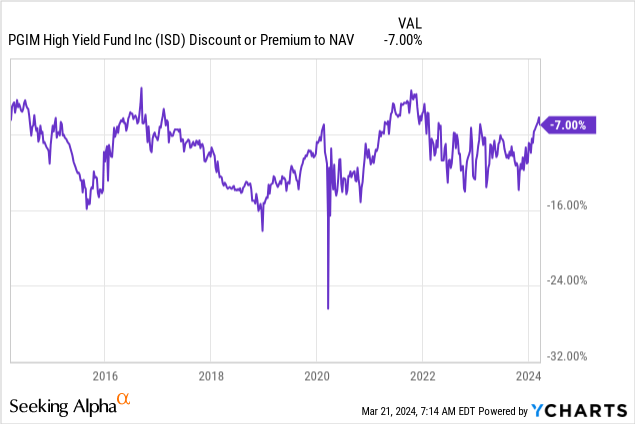

Discount to net asset value reaches record high

CEF’s discount to NAV has narrowed and is now close to a decade high of -5%:

Most high-yield CEFs exhibit this beta under market conditions, where gains in high-yield fixed income are closely correlated with narrowing discounts to NAV. In the CEF space, historically tight range levels should be sold and very wide range levels should be bought, all else equal to infrastructure and credit risk assumed.

ISD is simply repricing higher as expected, but given the CEF pricing of the manager’s platform, we expect the name to trade at the current discount going forward.

The z-score for NAV Discount currently stands at 1.9, illustrating the stretch in the indicator here, with a standard deviation of 1.9 compared to the mean of observable historical levels.

analyze

- Assets under management: $420 million.

- Sharpe ratio: 0.07 (3 years).

- standard. Deviation: 10 (3Y).

- Yield: 10%.

- Premium/discount to NAV: -7%

- Z-stat: 1.9.

- Leverage: 22%.

- Composition: Fixed Income – U.S. High Yield Bonds

- Duration: 4.3 years.

- Expense ratio: 1.48%.

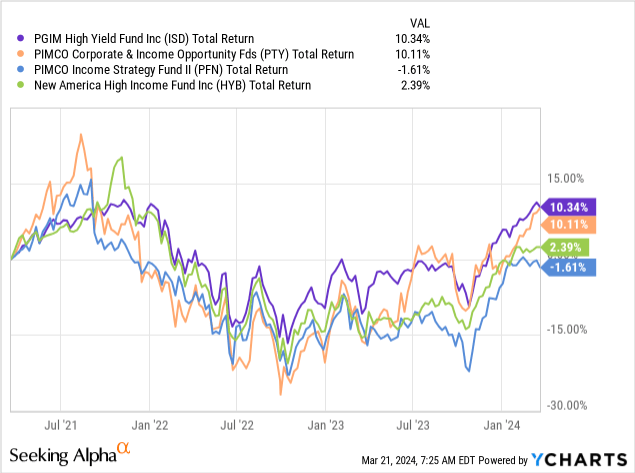

Strong performance enabled this CEF to be held

The fund has weathered this monetary tightening cycle compared to some of its peers at large asset management platforms:

When we compare CEF to similar funds like PIMCO Corporate & Income Opportunity Fund (PTY), PIMCO Income Strategy Fund II (PFN), or New America High Income Fund (HYB), we can see that ISD leads the pack. 3-year review of the cohort. These are very strong results for the fund and speak highly of the portfolio management team.

To sum up, ISD achieved returns of over 10% during one of the most rapid monetary tightening environments in recent history. This is no small feat and has had a positive impact on fund managers here.

While the current price point is no longer attractive for the name, CEF is a solid choice to hold given its high dividend distribution and its management team’s ability to successfully navigate economic cycles.

There is no change in fund composition

The composition of the fund has not changed significantly since we penned the name six months ago:

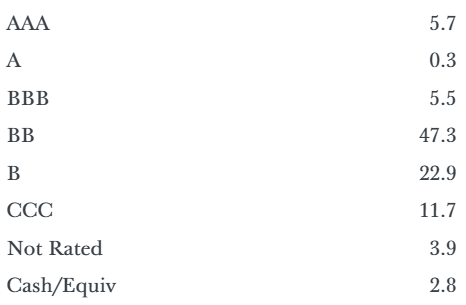

Rating (fund website)

The credit quality of the portfolio remains unchanged, with BB/B weightings and CCC categories accounting for approximately 11% of the underlying portfolio. This is a pretty classic build. The name is slightly conservative due to its low leverage and high concentration of BB names. We like this structure and think it’s an asset to own CEF in today’s Goldilocks environment.

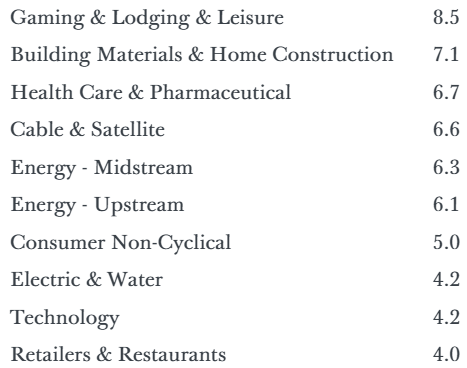

From an industry perspective, the fund is highly diversified, with all of its fund shares making up less than 10% of the fund’s portfolio:

Section (fund website)

Games and accommodation accounted for the largest proportion, accounting for 8.5%, followed by building materials and home construction, accounting for 7.1%. Funds with significant industry risk have exposures above 15% for any given industry group. That’s not the case here.

in conclusion

ISD is a U.S.-focused high-yield CEF. This fund, from Prudential Investment Management, represents strong long-term performance. We issued a “Buy” rating on this CEF six months ago, and the outstanding opportunity has proven to be extremely valuable, with the CEF having risen significantly since then. The factors that drove the original “Buy” rating have now ended, making today’s entry point no longer attractive. With credit spreads at 5-year lows and the fund’s discount to net asset value near record highs, ISD is no longer an attractive entry point, but its 10% yield is a solid hold.