Gary Yeowell

Main thesis/background

The purpose of this article is to evaluate the iShares U.S. Real Estate ETF (NYSEARCA:NYSE:IYR) as an investment option at current market prices.This is a passive industry fund that invests in REIT objective “Tracks the investment results of a real estate industry index comprised of U.S. stocks.”

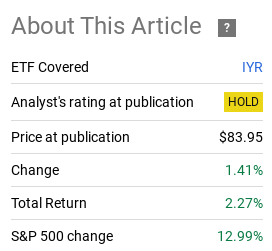

Five months have passed since I wrote a cautious article about the International Year of Rice, and in hindsight, that caution was justified. While the broader market moved sharply higher during this period, IYR’s returns were very modest in comparison:

return on capital (Seeking Alpha)

With the stock market being tested over the past week, I think it’s time to take another look at the real estate sector, as perhaps its recent underperformance can serve as an argument for future downside protection If the broader market becomes disrupted. The industry is sometimes seen as a more defensive and stable space, although the pandemic and its aftermath have challenged that argument.

So I looked at the International Year of Rice again with an open mind because I didn’t want to miss out on some of the value here. But after thinking about it carefully, I still don’t see a case for purchase. The headwinds facing the industry have some long-term legitimacy, I just see better places to put my money. I’ll explain my concerns and reasons for maintaining a “Hold” rating in more detail below.

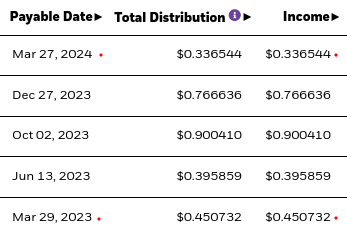

Falling dividends illustrate challenges facing industry

I immediately have concerns about the International Year of Rice, which I think reinforces the merits of not being bullish. If we look at the fund’s first-quarter distribution, we see a significant year-over-year decline. This is rarely a sign I view positively:

Allocations for the International Year of Rice (Anshuo)

This is understandable given the macro context.I’m not suggesting that I expected See strong dividend growth. But the fact is, it reinforces why investors need to be cautious. The underlying companies in IYR’s portfolio don’t see an environment in which to grow their dividends. While I applaud management’s caution in a difficult environment, that doesn’t mean I want to be an investor in this environment.

The IYR yield (around 3%) is already a number I’m not too excited about. When I combine that with the year-over-year spending decline, I’m very hesitant to buy.

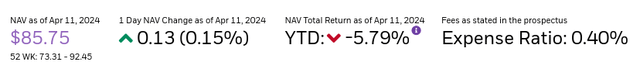

Owning a fund is not cheap

Another issue I have with the IYR has nothing to do with the current climate, but is a general red flag for me. Here’s the expense ratio – at 0.40%, which doesn’t seem “high” compared to actively managed funds, we should remember this is a passive sector ETF:

Quick facts (Anshuo)

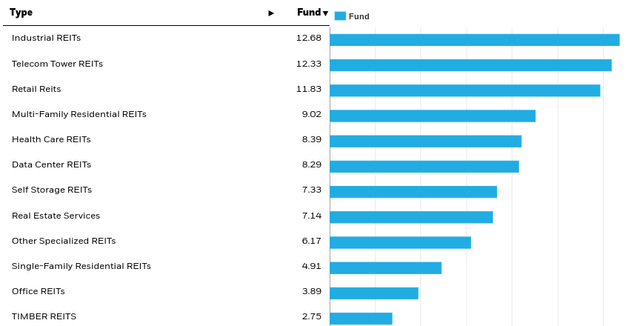

This is a very simple property, so I won’t spend too much time discussing it. But IYR holds many of the largest and most popular REITs on the market. In terms of diversity, this is a good thing and provides investors with a one-stop-shop for funds across various sub-sectors within the real estate hierarchy:

Sub-industry segmentation (Anshuo)

My thesis is based on the premise that investors would be better served by taking a more tactical approach, given all the headwinds facing the real estate industry. I’m focusing on the best-in-class residential, self-storage, and data center REITs and limiting investments to retail and office space (I’ll explain why later in my review). From this perspective, it doesn’t make sense to buy a fully staffed REIT and pay a high expense ratio when I believe a tactical strategy will outperform.

Office vacancy rates illustrate industry woes

I will now look at what is happening across the economy and discuss how this supports my neutral view on the real estate industry. The first area is commercial office space. This is an area where the IYR has had limited direct contact – and that’s a good thing. I say this because my followers are certainly aware of my negative views on this space – and most readers have probably seen the series of headwinds associated with this space over the past few years.

In short, the challenges of COVID-19 have not gone away. In fact, as the United States adapts to a more remote and hybrid world of work, some problems have accelerated. As many white-collar workers leave urban centers, office vacancy rates continue to climb and hit new records (and that’s not a good thing):

Office vacancy rate (United States) (Moody’s)

This really highlights the problems facing the industry and explains why commercial real estate valuations have plummeted. That’s not good news for investors or the stock price.

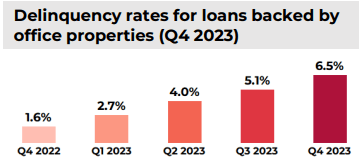

The broader point I’m making here is that this is not a sudden reversal. Contrarian investors may view bearish and negative indicators for the sector as an opportunity to hit a bottom. As someone who considers myself a bit of a contrarian thinker, I certainly appreciate this sentiment. But contrarians need an argument to explain why things look so bad—and I don’t have that argument here. Similar to vacancy rates, delinquency rates are rising – which is bad news for the loan holders backing these properties (think Regional Banks):

Delinquency Rate (Office Building Properties – United States) (National Association of Realtors)

My conclusion here is that there are fundamental problems with the industry and no immediate catalyst to correct them. Until I see one of these come to fruition – or at least the potential for it to come true – I can’t be a buyer here.

Headwinds for retail as consumers face pressure

My next concern is that International Year does have more exposure to industries. This is a retail environment, which refers to locations such as malls, regional malls, malls, etc. It’s another hard-hit area during the pandemic, but it’s rebounding better than office space as consumers are out shopping again.

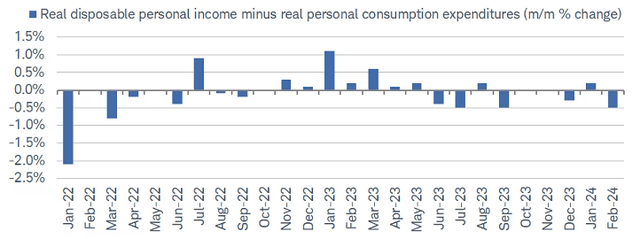

However, we’re not back to “normal” either, as online purchases continue to grow as a share of total retail spending. While the retail industry has been adapting to this changing consumer behavior, one area it may not be prepared for is the softening of the consumer spending cycle. I bring this up because inflation continues to erode wages, and while consumers have done well so far over the past few years, that’s not always a given.

To make it easier to understand, let’s look at the revenue metric. As inflation continues to rise, real incomes bear the brunt. In fact, real spending has been outpacing real disposable personal income growth for much of the past year, with a noticeable change at the end of the first quarter:

Changes in spending levels (United States) (Charles Schwab)

That means Americans continue to use savings or borrowing to support their purchasing power. Again – this is not a negative in the short term as it helps support the wider economy. But it can’t last forever. If spending does ease, non-essential retail will be the first to be affected. This also supports my limited outlook for the International Year of Rice.

bottom line

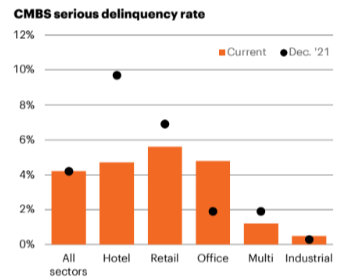

The International Year of Rice performed poorly as the real estate sector faced huge clouds. While I’ve pointed out a few areas that I think are particularly vulnerable to continued weakness, readers should note that there’s nothing to get excited about across the range right now:

Delinquency Rates by Industry (United States) (set of facts)

To be fair, buying for value often means buying the unpopular. But there are good reasons why some things are disliked many times over. This is the reality I see in real estate today. Ultimately, my outlook for the sector has not changed since late last year, which means I will reiterate my “Hold” rating on IYR. I advise my followers to approach this sector with great caution and take a more tactical approach than multi-sector, passive ETFs.