Cobbs Law

Mortgage debt doesn’t get much attention in the media, but it’s worth considering in an investment portfolio. what are these? A floating-rate mortgage obligation (CLO) is a complex financial instrument composed of a pool of loans.These loans are typically senior, secured, non-investment grade loans Issued by the company. Pooled loans are securitized and divided into tranches with varying degrees of risk and reward. “Floating interest rate” means that the interest rate on these loans is not fixed, but adjusts according to market interest rates, usually linked to benchmarks such as the London Interbank Offered Rate (LIBOR) or its subsequent interest rates. This feature helps protect investors from interest rate fluctuations.

Investors in a CLO receive payments resulting from interest and principal repayments on the underlying loan, with payments allocated according to a tranche hierarchy, starting with From least risky to most risky. As such, CLOs provide a way to invest in corporate debt with mechanisms to reduce interest rate risk, although their complex structures come with their own set of risks.

One way to obtain a CLO is through Janus Henderson B-BBB CLO ETF (Bat: JBBB). JBBB is an exchange-traded fund (ETF) that offers floating-rate mortgage bonds with a general rating between B and BBB, making the fund a unique investment opportunity for individuals and institutions. ETF structures provide transparency, liquidity and lower costs that have historically been available only to institutional investors.

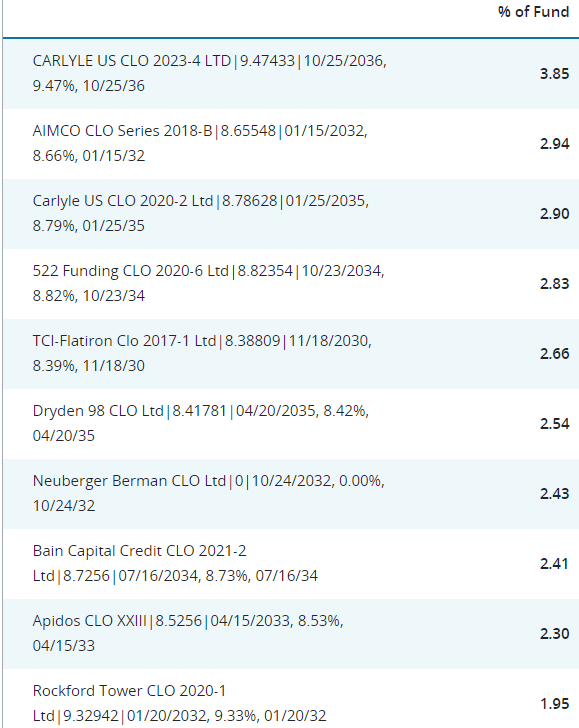

Analyzing fund holdings

When we look at holdings, no holdings account for more than 3.85% of the fund. The total number of debt issuances is 88, and the effective period is -0.09. This means that the fund is not actually interest rate sensitive, which is ultimately more to do with credit from a risk perspective.

janushenderson.com

With a net expense ratio of 0.51%, this isn’t a very expensive fund for the money you get. After all, as a retail investor, you can’t easily acquire a CLO, so it’s a great packaged product to get you exposure. Considering this is debt, the yield is actually quite important. The current 30-day SEC yield is 8.55%, and distributions are made monthly. Very positive, there is some credit risk with debt issues, but not a lot, and duration is not an issue for those worried about the negative impact of rising interest rates on prices.

Keep in mind that the Janus Henderson B-BBB CLO ETF’s industry composition and weightings are spread across multiple industries, with the majority investing in the Financials sector.

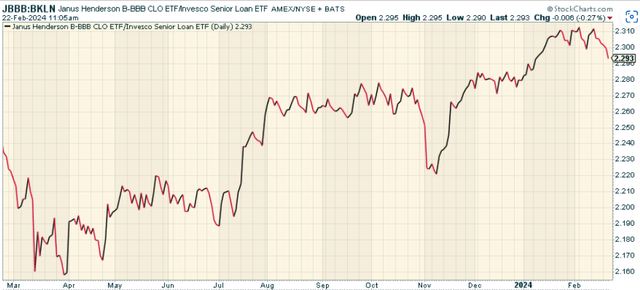

Compare to peer ETFs

When evaluating the performance of the Janus Henderson B-BBB CLO ETF, it is important to consider its position among similar ETFs. JBBB’s performance is very competitive compared to similar ETFs on the market, such as the Invesco Senior Loan ETF (BKLN). On a relative basis, JBBB has outperformed given that BBB securities have slightly negative total returns and duration, while BKLN has positive duration, meaning it has been relatively hurt by rising interest rates.

stockcharts.com

Weigh the pros and cons

Investing in the Janus Henderson B-BBB CLO ETF has its own advantages and disadvantages. The fund offers diversification potential and floating rate exposure, which are attractive features for many investors. It is important to note, however, that the fund’s focus on CLOs rated B to BBB may expose investors to higher credit risk compared to investment-grade securities. Additionally, if you think the next step is a rate cut, you might want fixed income with duration to benefit from that cycle, given the potential for price appreciation independent of yields driving total returns.

Conclusion: To invest or not to invest?

For those seeking adjustable-rate mortgage debt, investing in the Janus Henderson B-BBB CLO ETF could be a strategic move. This is a good fund that has received some attention from investors since its inception, offers different styles of debt investments, and offers high yields. It’s worth considering bonds in your portfolio.