Ziren

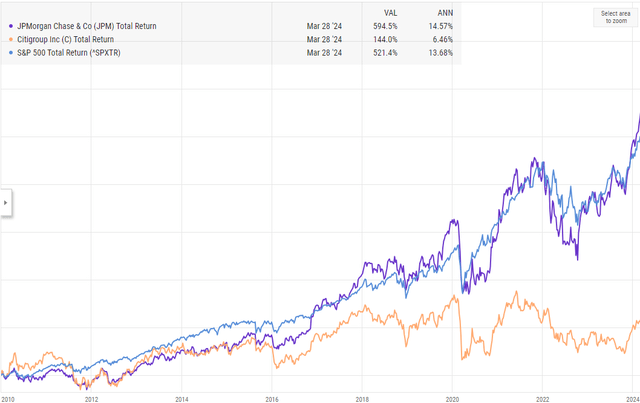

Last night, Citigroup (C) released a earnings preview and compared Citi to JPMorgan Chase (New York Stock Exchange: JPMorgan Chase), it’s interesting to see the differences between the two banking giants in the same industry: Citi has little to offer Earnings are not growing, and valuations depend entirely on book value and a discount to tangible book value. Citi’s historical ROE is mid-single digits, well below its peers. The stock has been in the doldrums for years, lagging the S&P 500 by a wide margin. The index was affected over a long period of time, especially after 2008.

JPMorgan, on the other hand, has always been a sign of organizational stability. The top CEO of the bank over the past 10-15 years has been (undisputedly) Jamie Dimon. Since 2010, JPMorgan’s per share Earnings have grown an average of 18% annually and consistently generate tangible common equity returns in the high teens or higher.

Still, when it comes to investing, you can make a strong case that Citi is the better stock (based on its valuation and upside potential), even though JPMorgan is by far the better bank.

The risk for JPMorgan right now is execution: As of today, the sell-side consensus expects flat EPS in 2024 and 2025, and the stock trades at 13x and 12x earnings, respectively, when it releases its earnings report on Friday, April 12, 2024 .

JPM’s book value (BV) and tangible book value (TBV) valuations of 1.9x and 2.32x, respectively (with shares trading at about $200), are the highest BV and TBV valuations among the large banks.

JPMorgan recently raised its dividend and looks to be buying back shares again, which could help in 1Q24.

A big plus for 2023 (in my opinion) is JPMorgan’s acquisition of First Republic (OTC: FRCB) via a special auction in May ’23, which is huge for JPMorgan and is expected to Added $500 million to JPMorgan Chase’s profits.

(Based on shares outstanding as of 12/31/23, if my calculations are correct, this equates to an additional $0.17 per share in JPMorgan earnings per share, just from First Republic.)

Performance:

As of March 31, 2024, benchmarking JPMorgan Chase against the S&P 500 over the past 13 years, JPMorgan’s stock has outperformed the S&P 500 by nearly 100 basis points each year over the past 13 years.

JPMorgan has been among clients’ top 10 holdings for much of the past decade and the current decade. (Minimum cost basis is $35 per share.)

Summary/Conclusion: In the Q1’24 earnings release on Friday morning, keep an eye on Corporate and Investment Banking (CIB), which accounted for 27% of total net revenue and operating income as of 12/31/23.

Corporate bond issuance set a record in 1Q24 given how tight corporate high-yield and corporate high-grade credit spreads have been over the past few years.

CIB’s growth within JPMorgan has slowed after strong growth in 2021 due to the coronavirus pandemic, but investors may see some upside in the bank’s business with potential returns from the bond issuance and IPO markets.

Credit quality is expected to remain stable (co-written with Citi last night). Jamie is quite conservative on loan loss provisions and has actually been increasing banks’ provisions throughout 2022 and 2023, so it’s likely to taper off this year.

Jamie did say in 2022 that if the national unemployment rate reaches 6%, JPMorgan may need to add $4-6 billion in LLR (loan loss reserves) for such economies. If nothing else, the pace of LLR is likely to slow given the strength of the U.S. economy.

JPMorgan Chase expects NII (net interest income) to be US$88 billion in 2024. Given the stability of interest rates, you might think this would be easy to achieve in 1Q24.

Business lending has been growing by mid-single digits: Again, given the strength of the U.S. economy, there’s no reason to think that number won’t be reached.

The problem is this:

- Actual 2023 EPS: $15.84 (32% annual increase)

- 2024 EPS Forecast: $15.91 (expected annual growth of 0%)

- 2025 EPS Forecast: $16.31 (EPS expected to grow 3% annually)

2024 is a tough comparison, but if investment banking improves, the rest of the business maintains service, and there don’t appear to be any credit issues (given U.S. employment), $15.91 could be a conservative EPS estimate for this year.

Ultimately, I think JPMorgan can reach $20 per share in the next few years, but the stock rarely performs well by traditional bank valuation metrics.

Dr. David Kelly, chief global strategist at J.P. Morgan, probably gave the best summary of the U.S. economy earlier this year when he said — based on his research work from J.P. Morgan — that there was no likelihood of a recession. Structural imbalances or excesses. disrupting the U.S. economy at this time. Presumably he was talking about the tech and broad market growth bubble of the late 1990s, or the mortgage/housing crisis of 2008. Everyone is focused on commercial real estate and CMBS issues, but so far it doesn’t look “systemic.”

JPMorgan’s technical picture is already stretched thin: the stock has risen from $100 in mid-2022 to nearly $200 in early April 2024. This is quite a rebound in 21 months.

None of this is advice or advice. Past performance is no guarantee of future results. Even short-term investments can result in a loss of principal. The market is highly volatile and changes rapidly. All EPS and revenue figures come from London Stock Exchange Group (LSEG).

thanks for reading.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.