Yagi Studio

Quality is a word that gets thrown around a lot when picking stocks, but it doesn’t mean much unless you can quantify what quality means.Quality is indeed important, but in my opinion, it needs to be rule-based to truly have it Confidence in a portfolio that claims this as a primary factor.that’s why J.P. Morgan U.S. Quality Factors ETF (NYSE: JQUA) is interesting to me.

JQUA is a passively managed investment vehicle that tracks the J.P. Morgan U.S. Quality Factor Index. The index represents a basket of Russell 1000 Index stocks recognized for their strong indicators of quality, profitability and balance sheet health. JQUA was established in November 2017 and has since demonstrated its potential to perform solidly in the ETF market and is focused on providing investors with high-quality investment opportunities.

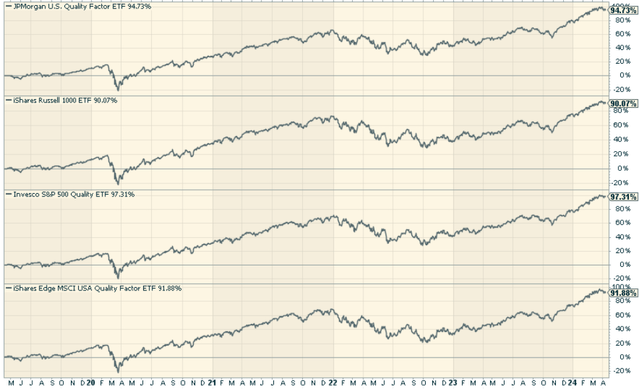

when you look Taking the price ratio of JQLA to the iShares Russell 1000 ETF (Internal whiteboard), it’s clear that this fund is a winner, especially during the difficult times of 2021 and 2022.

StockCharts.com

The fund has shown continued growth since its inception. The fund’s expense ratio of 0.12% is low among the competition, making JQUA a cost-effective investment option.

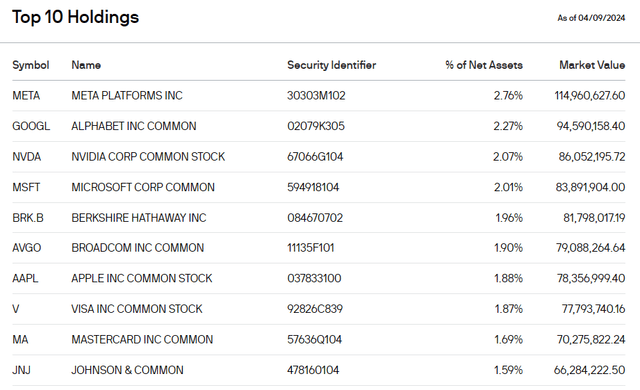

Top holdings: A closer look

The JQUA portfolio includes high-quality stocks across a variety of industries. These are all names you should be familiar with, but what’s most impressive is that not a single stock makes up more than 2.76% of the portfolio. This was actually a very diversified correction that looked different than the S&P 500 (SP500), but performed just as well overall.

JPMorgan Chase website

Notably, the fund holds about 246 stocks, compared with 993 for the Russell 1000 Index. It’s selectivity in what you filter, which is exactly what you want to see, especially when choosing profitable companies. This is important in an environment of higher long-term interest rates and reduces the risk that a company’s overall debt management will be stressed by higher interest payments.

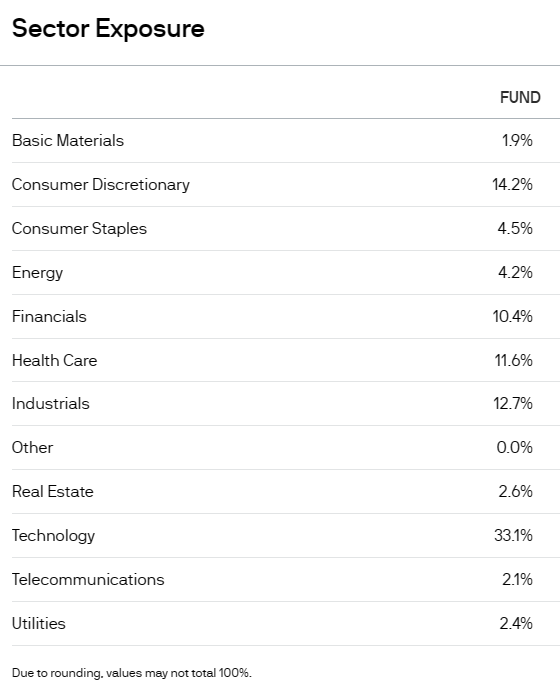

The only real downside, in my opinion, is that 33% of the fund is invested in the technology sector. I completely understand that many tech stocks could be classified as quality stocks, but I still think it’s a risk given how massive the sector’s performance has been. So, on the one hand, we have a well-diversified portfolio of individual stocks with controlled safety weightings, but the technology sector remains overly concentrated.

JPMorgan Chase website

Peer Comparison: JQUA vs. Competitors

Key competitors include iShares Russell 1000 ETF (IWB), Invesco S&P 500 Quality ETF (SPHQ) and iShares MSCI USA Quality Factor ETF (QUAL). Overall, the funds performed well, with JQUA performing worse than SPHQ but better than the other funds.

StockCharts.com

Advantages and Disadvantages of Investing in JQUA

advantage

-

diversification: JQUA’s approach ensures a balanced investment in a variety of stocks, reducing idiosyncratic risks from other market proxy firms that make up a significant portion of the overall portfolio.

-

Quality focus: This fund focuses on high-quality, profitable companies, enhancing the potential for stable returns.

-

Low expense ratio: JQUA has an expense ratio of 0.12%, making it a cost-effective investment option.

shortcoming

-

market fluctuations: Like all ETFs, JQUA is subject to market fluctuations, which in turn affects investment returns.

-

potential overestimation: Given its focus on quality stocks, there is a risk of overvaluation, which could impact future returns. At a price-to-earnings ratio of 21.75, it’s not cheap.

Conclusion: Is JQUA worth investing in?

Investing in the J.P. Morgan U.S. Quality Factors ETF provides an opportunity to gain exposure to high-quality companies with strong profitability and solid balance sheet health. JQUA is a strong core equity pick due to its diversified stock portfolio, focus on quality, and low expense ratio. However, potential investors must consider market volatility and possible overvaluation risks. The overall funding is strong and I think quality will become more and more important in the coming years. At least the fund has a process for defining this correctly.