summer

Invesco KBW Bank ETF (Nasdaq ticker: KBWB) is a passively managed exchange-traded fund modeled after the KBW Nasdaq Bank Index.The fund invests primarily in large and mid-capitalization companies engaged in banking activities in the United States USA. These companies include large diversified banks, regional banks, investment banks and brokerage providers, asset management and custodian banks, and consumer finance companies. It is weighted using a modified market capitalization method.

Overall, we believe the outlook for the banking sector will worsen in 2024 and do not see much advantage in investing directly in the sector or in this fund as the Fed is likely to raise interest rates, which will reduce net interest margins and in line with the broader market Poor performance in comparison.

Bank market analysis

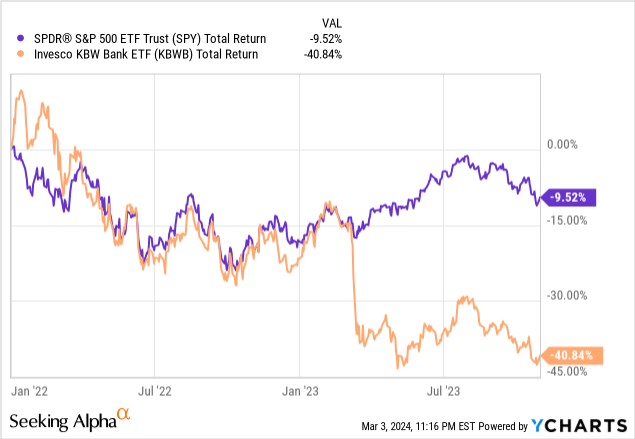

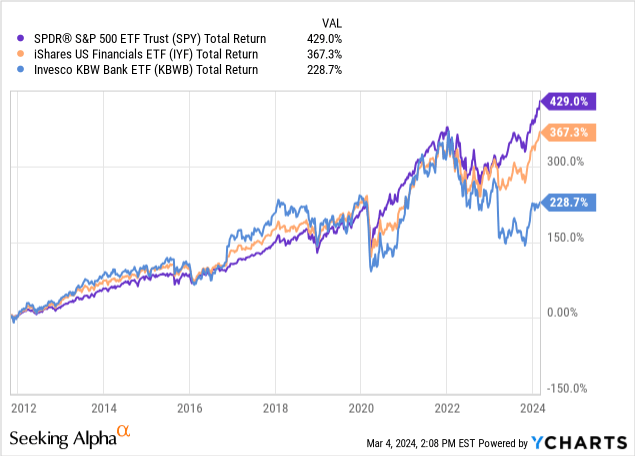

The Federal Reserve will raise interest rates 11 times in 2022 and 2023.This allows The bank has significantly increased its net interest margin, which is its largest source of profit, creating some Hailed as the best environment in global banking since 2007. However, this did not result in bank stocks outperforming the market, and they plummeted in early 2023 after a number of regional banks failed.

Considering that it is impossible for an industry to outperform the market in a general environment, and the risk that a bank failure may bring down the entire industry, it is difficult for us to see the advantages of directly investing in the banking industry through industrial ETFs, especially since the prospects of the banking industry are not very promising. optimism. The benefits banks have gained from rising interest rate margins over the past two years are waning as the Fed is widely believed to have finished raising interest rates and will keep rates steady in the coming months. Another headwind facing banks is the implementation of new regulations through the so-called Basel III Endgame (B3E). The Basel Committee on Banking Supervision is the most important standard setter for international bank supervision, followed closely by the Bank of America. B3E described as a ‘sea change’ for U.S. banking industry Ernst & Young It will cost banks a lot of money to comply by July 2025. As banks implement these changes over the next 16 months, we believe rising costs will act as a headwind to profitability.

Top 10 holdings

|

Name |

weight(%) |

|

FuGuo bank |

8.739 |

|

JPMorgan Chase & Co. |

8.36 |

|

Goldman Sachs Group Inc/ |

7.985 |

|

Bank of America |

7.94 |

|

Morgan Stanley |

7.603 |

|

capital one financial corp. |

4.317 |

|

Citigroup |

4.216 |

|

fifth third bank |

4.156 |

|

Bank of New York Mellon/ |

4.066 |

|

U.S. Bank |

3.856 |

Wells Fargo (WFC) and JPMorgan Chase & Co (JPM) are part of the “Big Four” banks in the United States. Wells Fargo is the fourth-largest U.S. bank by total assets and the second-largest mortgage originator. JPMorgan is the largest asset-based bank in the United States, and its current situation is the product of numerous mergers in the financial industry over the past 30 years, including the acquisition of prominent companies Bear Stearns and Washington Mutual during the 2008 financial crisis. Both companies have Buy ratings from Seeking Alpha analysts and Wall Street, according to Seeking Alpha’s Ratings Summary Tool.

Bank ETFs Comparison

|

symbol |

FTXO |

KBE |

KB |

|

Name |

First Trust Nasdaq Bank ETF |

SPDR S&P Bank ETF |

Invesco KBW Bank ETF |

|

Date of establishment |

September 20, 2016 |

November 8, 2005 |

11/1/2011 |

|

Total assets under management |

$115,519,272 USD |

$1,604,714,708 USD |

$1,416,453,760 USD |

|

Quantity held |

35 |

92 |

26 |

|

Weighted average market capitalization |

$37,484 |

$9,645 |

$62,490 |

|

weighted average price to earnings ratio |

9.1 |

9.6 |

11.7 |

|

weighted average debt to capital ratio |

42 |

35 |

48 |

|

Estimated profit growth in 5 years |

15.30% |

10.00% |

9.60% |

|

Forecast price to earnings ratio |

10 |

9.7 |

10.7 |

|

Forecast dividend rate |

3.40% |

3.30% |

3.80% |

|

dividend frequency |

quarterly |

quarterly |

quarterly |

|

net expense ratio |

0.60% |

0.35% |

0.35% |

There are a few things to note when comparing KBWB to the First Trust Nasdaq Bank ETF (FTXO) and the SPDR S&P Bank ETF (KBE). First, KBWB has the highest concentration, especially compared to KBE. This is a positive for us because it makes it easier to understand what assets we may own and ensures that each holding will have a significant impact on the fund’s returns.

On average, the fund invests more in high-cap stocks, with just 5.2% of assets invested in small-cap stocks.We are somewhat negative about this trait because across the board Industry analysis review shows Economies of scale are not particularly important in the banking industry, and increased scale does not always lead to greater efficiency or growth, but it does benefit bank employees. We see expected multiple contraction and lower expected 5-year earnings growth compared to other funds. The fund does perform well in terms of dividends and fees, but not enough to overshadow the negatives we’ve outlined.

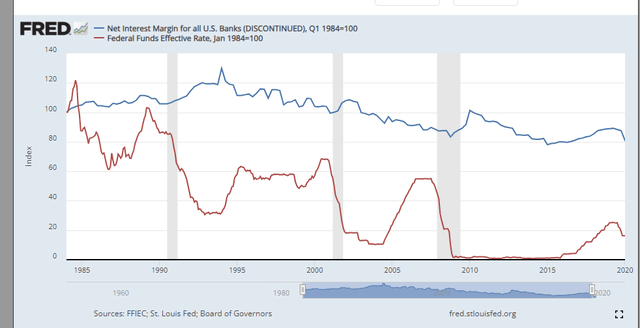

Investment Banking Risks

There are some significant risks when investing in the banking industry. First, banks are cyclical and will be adversely affected by economic downturns. Because banks make money by making loans, when a recession hits, consumers will be more worried about their finances and fewer people will want to take out new loans, especially for big purchases like homes. . A recession can also negatively impact banks by causing people to lose income, making it more difficult to repay existing loans, leading to higher default rates. Regulatory risk is also an issue, as banks are one of the most highly regulated industries and must spend significant amounts of money to comply with regulations. Finally, banks are highly sensitive to falling interest rates, which causes their net interest income profits to fall (i.e.: the difference between what they pay on deposits and the interest they receive on loans). Net interest income is typically a bank’s largest source of profit. The chart below shows how net interest margins decline as interest rates fall.

fred

in conclusion

We assign a Sell rating to KBWB due to the banking sector’s significant underperformance even under some of the most favorable circumstances, the deteriorating industry outlook, and KBWB’s shortcomings relative to its competitors.