Afternoon pictures

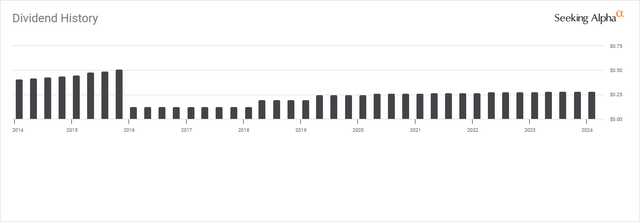

Since early 2021, Kinder Morgan (NYSE:KMI) shares have been trading sideways between $15 and $20. Share prices have still not recovered to pre-pandemic levels, and we are about to enter a decade of relatively flat returns.Long-term investors who hold shares of the company Teenagers may be unhappy with KMI as it went from a company with strong value growth and dividend payments to a dividend The dividend paid was 59.07% of the dividend paid before the 2016 cut. It’s not about where the company comes from, it’s about where the company is today and what its future prospects are. KMI continues to achieve its strategic objectives of financial discipline while demonstrating the ability to generate sustained profitability and rebuild its capital allocation program.Although the long and short term charts do not look enticing, I am bullish on KMI because As I speculated, the energy transition looks more like a hybrid approach than eliminating fossil fuels. If you’re looking for income with capital appreciation potential, I think KMI is a strong candidate, as we could see the share price top $20 in 2024.

Seeking Alpha

Following my previous article on Kinder Morgan

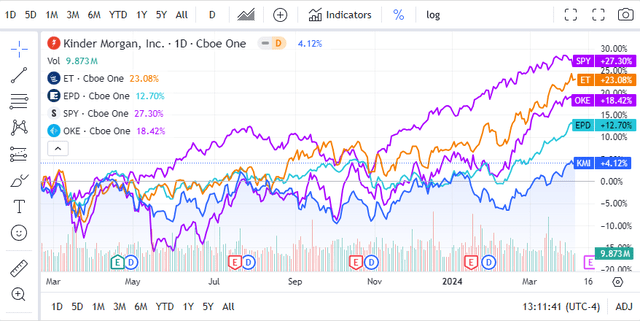

KMI is one of my favorite energy infrastructure companies.Since my last post last December 5, In 2023 (which can be read here), shares have gained 3.42% compared to the S&P 500, which has gained 14.2%. If dividends are taken into account, KMI’s total return since December 5 is 5.13%. Over the past year, KMI shares have gained 4.23%, while the S&P 500 has gained 27.23%. Unlike other energy infrastructure companies, KMI has not participated in this rally. In my last article, I discussed KMI’s latest dividend increase and the strong guidance it issued for 2024. Now that fiscal 2023 results have been released, I wanted to provide an update on my investment thesis and discuss why I remain bullish on KMI despite the stock price remaining in a multi-year range.

Seeking Alpha

Seeking Alpha

Risks to My Investment Thesis

There are many risks associated with my investment thesis on KMI. The first risk to consider is opportunity cost, as investing in KMI over the past decade has not provided much upside at any time. Over the past five years, if you had invested in the SPDR S&P 500 Trust (SPY) in April 2019, the share price had rebounded from the pandemic crash and was still up 79.65%, while the KMI was still -7.93% below where it was at that time That was five years ago. KMI’s growing dividends don’t even make up the difference between investing in an S&P 500 index fund and KMI, because the gap between the two is so great. Even if you’re an income-focused investor, you need to consider the opportunity cost, and the impact of KMI stock lagging the market by so much. Arguments may form that KMI is dead money, and negative investor sentiment will be difficult to eradicate. KMI is also at risk from the agenda of environmental groups and elected officials. Heading into the 2020 election cycle and with a major push to eliminate fossil fuels in the coming decades, KMI faces significant threats from future policy changes. While attacks on the oil and gas industry appear to have subsided, a future push for green energy could gain traction and disrupt KMI’s business model.

Mr. Market has no respect for KMI’s business

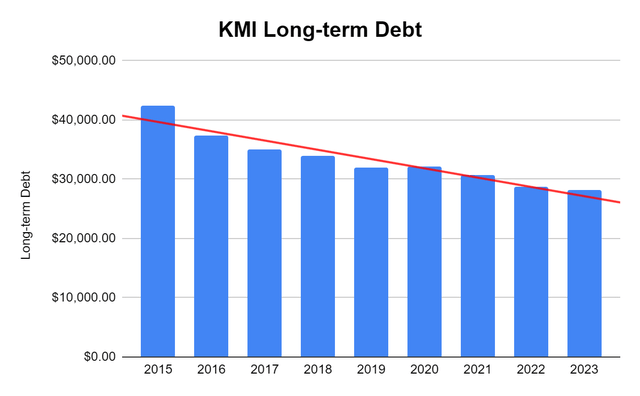

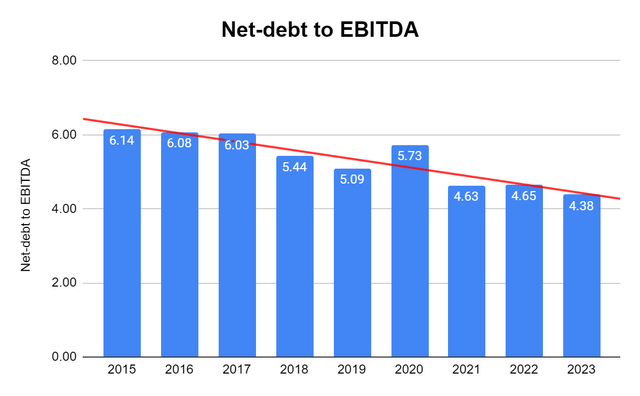

KMI’s share price has fallen one way since April 15, The price in 2015 was $44.34.In less than a year, KMI’s stock price had fallen to $13 by January 11, 2016. Since then, shares have struggled to stay above $20, and every time shares looked like they were going to breakout, they fell back into the $15-20 range, excluding the pandemic crash. The KMI that ended fiscal 2015 and the KMI that it is today are two completely different companies. KMI’s long-term debt in fiscal 2015 was US$42.47 billion, and the net debt to EBITDA ratio was 6.14 times (US$42.96 billion/US$6.22 billion). KMI has eliminated $14.24 billion of long-term debt from its balance sheet, a reduction of 33.54% over the past eight years. KMI’s net debt to EBITDA ratio also fell by 28.67%, from 6.14 times to 4.38 times. KMI’s management team remains committed to financial discipline, and eight years later, it has been reducing debt and leverage. Despite cleaning up its balance sheet and rebuilding its capital allocation plan, KMI’s stock price remains stagnant.

Steven Fiorillo, “Searching Alpha”

Steven Fiorillo, “Searching Alpha”

Since fiscal year 2016, Comey Generated $41 billion in cash flow and returned 64% to its equity and debt holders. Over the past eight years, KMI has returned $16.4 billion through its dividend program and repurchased $1.4 billion worth of stock. KMI has doubled the amount of capital allocated to annualized dividends and has increased its dividend six times since 2018. The quarterly dividend is still 55.88% from Q4 2015, but I’m concerned about where the company is today compared to where it was originally. KMI has established a 6-year track record of dividend growth while eliminating 33.54% of long-term debt and currently has an annualized dividend yield of 6.12% on $1.13.

Seeking Alpha

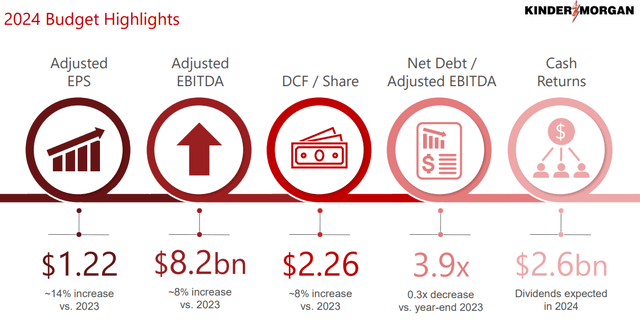

By the end of 2023, KMI has invested $3 billion in funding for its growth projects. The companies are self-funded through cash flow as KMI looks to expand its network by adding capacity in natural gas, refined products and gathering and processing. On an adjusted basis, KMI expects adjusted earnings per share to increase 14% annually to $1.22, and adjusted EBITDA to increase 8% annually to $8.2 billion. This would bring its distributable cash flow (DCF) to $2.26 per share, double the current dividend. On an adjusted basis, KMI’s net debt to adjusted EBITDA ratio is expected to decline to 3.9x by the end of the fiscal year. I think Mr. Market is wrong in valuing KMI the same company he valued in 2016, and as we progress through 2024 and 2025, I think there’s a good chance KMI shares will break through the $20 level.

Kinder Morgan 2024 Investor Presentation

Why I’m still bullish on KMI’s future

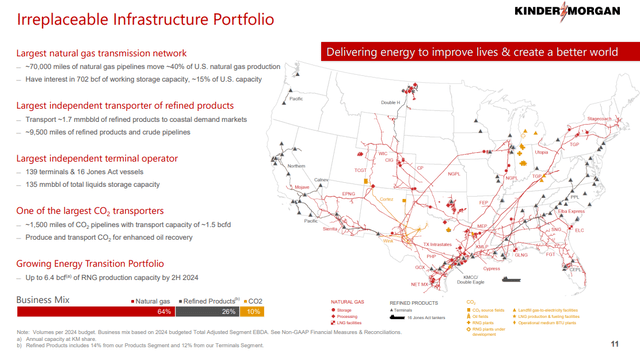

KMI operates one of the largest energy infrastructure companies in the United States, with an asset base that is arguably impossible to replicate. New competitors can’t just enter the energy infrastructure space because everything is regulated by the Federal Energy Regulatory Commission (FERC). The amount of resources required to create new pipeline and storage infrastructure is huge, which is why we are seeing more consolidation rather than new competitors across the industry. KMI owns and operates interests in 82,000 miles of pipelines and transports 40% of the natural gas produced throughout the United States. KMI’s cash flow is protected by the types of contracts it enters into, as 68% is tied to take-or-pay contracts. This enables KMI to enter into agreements where quantities and prices are contractually fixed and they are paid in full regardless of the quantity moved through the KMI pipeline. If the upstream producer only ships 90% of their contracted volume, KMI will be paid 100% because they have reserved space on the KMI system. 27% of KMI’s capacity is delivered through toll contracts, in which prices are fixed but volumes fluctuate. The remaining 5% is based on commodity prices, and when we are in a high oil price environment, like we are today, KMI benefits. This is a favorable structure for KMI, allowing them to build infrastructure while reducing debt and increasing dividends since 2016.

Kinder Morgan 2024 Investor Presentation

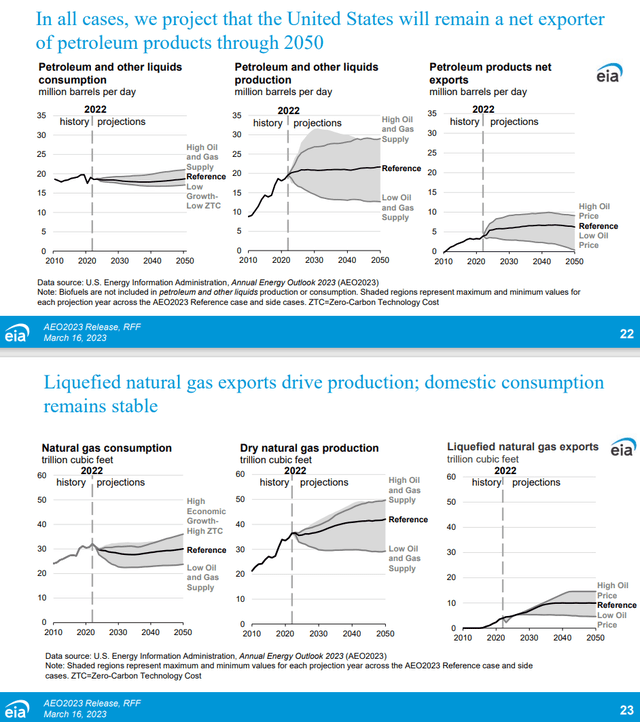

The real question is whether demand for traditional energy sources will expand or worsen. I support renewable energy and have invested in several companies focused on green energy. However, I make investment decisions based on data, not emotion. At the Energy Information Administration (EIA) annual energy outlook It clearly shows that in its reference case, production levels of oil and other liquids, as well as natural gas, will increase until 2050. The United States is expected to improve its position as a net exporter of oil and liquefied natural gas (LNG) over the next two decades. Given these projections, KMI’s infrastructure becomes increasingly important to global energy needs and to meeting future domestic energy needs. If energy demand does increase, it should be related to an increase in the amount of fuel passing through the KMI system, which should lead to more contracted volumes and the generation of more cash flow.

Environmental Impact Assessment

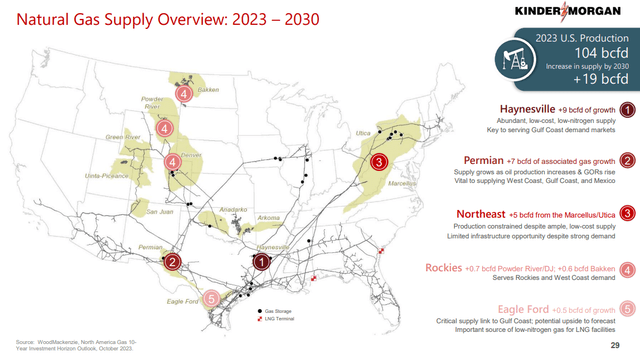

this U.S. population It is 341.39 million, and is expected to increase to 352.16 million in 2030, and to 366.62 million in 2040. global population It is 8.1 billion and is expected to increase to 8.55 billion by 2030 and 9.12 billion by 2040. The combination of population growth forecasts and what the EIA sees as domestic production from traditional fuel sources makes me extremely bullish on KMI. KMI’s infrastructure strategically connects all major U.S. basins with outbound capabilities to major hubs and refineries. If domestic and global energy demand continues to increase, the United States will likely remain the largest producer of oil and natural gas to help meet global energy needs. All traditional energy sources require transportation, and KMI’s network will be at the top of the list because of its connectivity options and delivery capabilities. This could drive KMI’s DCF and EBITDA even higher in the coming years, which is why I’m very bullish on KMI.

Kinder Morgan 2024 Investor Presentation

in conclusion

My focus is on KMI as a company now, not as a company in the past. Today, KMI’s financial position is much better, with a net debt to EBITDA ratio of 4.38x. While the stock has been trading sideways for too long, I think the stock price could break $20 in 2024. As more projects come online and conventional energy levels through its systems continue to improve, KMI is likely to be able to meet its 2024 forecast. Based on its dividend history, we may also be considering another dividend increase ahead of its second-quarter dividend announcement. As the Fed starts cutting interest rates, I think we’re going to see an expansion across the economy as the cost of capital comes down, which should push energy utilization up. I think many of the components of KMI are performing well, and eventually, the negative sentiment about where the company has been in the past will fade away and the market will realize there is an opportunity to unlock the true value of the company.