Abnormal factory

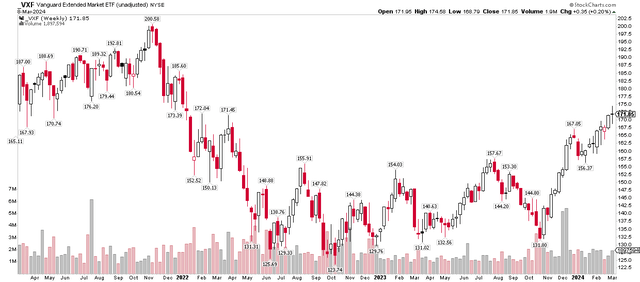

Investors often focus on the S&P 500, but there are many stocks beyond domestic large-cap stocks. One ETF that’s been overlooked is the Vanguard Expanded Markets ETF (VXF).This is an all-inclusive SMID capped fund – it Contains all U.S. stocks that are not technically classified as large-cap stocks. These include many big-name companies such as CrowdStrike (Add, delete, modify and check), snowflake (Snow), ultramicrocomputer (SMCI) and KKR (NYSE:KKR). VXF has broken out to new highs since early 2022 as the stock market rally extended.

My focus today is KKR.I reiterate A buy rating for the stock. I think underlying earnings will rise going forward, and there’s a good chance this $87 billion company will be added to the S&P 500 later this year.

U.S. Extended Markets ETF hits two-year high

Stockcharts.com

According to the bank America Global Research, KKR is a leading global investment firm that manages capital across multiple alternative asset classes, including private equity, credit and real assets. KKR has a differentiated business model, a large balance sheet and a sizable capital markets business.

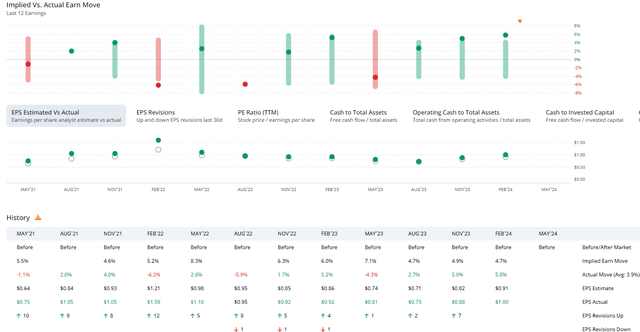

KKR has beaten earnings estimates in each of the past 12 quarters.its latest quarterly report Exceptionally bullish. Earnings per share handily topped Wall Street consensus estimates, sending the stock up more than 5% immediately following the February release, adding to a string of strong reactions.

Data from Option Research & Technology Services (ORATS) shows that the average actual move after the report was 3.9%, and while we have not yet determined pricing for the May 10, Q1, 2024 straddle, given the solid profit-making operation. Seeking Alpha reports that KKR’s EPS has been upgraded a dozen times in the past three months.

With its fundraising accelerating, strong earnings trends, and potential inclusion in the S&P 500 in the coming months, there are plenty of fundamental drivers. A normalizing bond market and rising share prices also help boost KKR’s profit potential. KKR’s total assets under management now stood at $553 billion as of the latest quarter’s end.

Key risks include continued bearish risks from hot markets in 2020 and 2021 and capital-intensive patterns. In addition, KKR’s voting structure may make SPX less attractive for inclusion in S&P’s governing body.

KKR: Series of earnings per share growth, share price surge after last 3 reports

pray

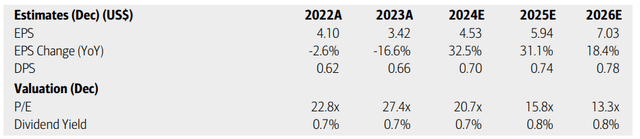

exist ValuationBank of America analysts, like many others on the street, up Their EPS forecasts since last fall. Operating earnings per share are currently expected to be over $4.50 this year, close to $6 in 2025, and over $7 in 2026. That’s very strong growth.

Seeking Alpha consensus numbers show a similar profit trajectory. At the same time, revenue growth is also strong, growing 44% this year, 17% next year, and 30% in 2026. While the yield will likely remain modest, investors should consider owning KKR due to its high-yielding growth profile.

KKR: Earnings, Valuations, Dividend Yield Forecasts

Bank of America Global Research

If we assume normalized EPS of $5.20 and apply a market multiple of 21, the share price should be closer to $109. I raised the stock’s base price-to-earnings ratio because earnings growth forecasts have improved significantly since October. The profit growth was combined with strong sales trends.

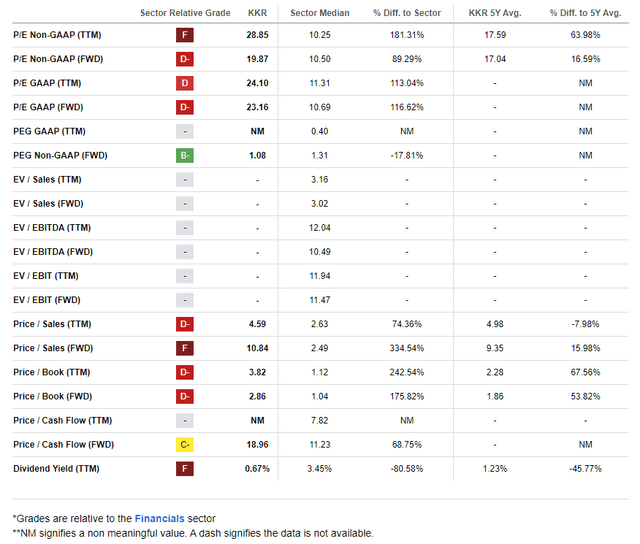

Very attractive PEG ratio

Seeking Alpha

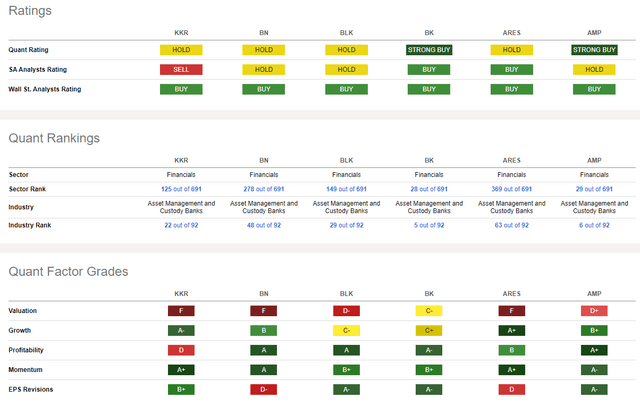

Compared with peers, KKR’s growth is very high, but its valuation grade is weak, although I’ve shown that the valuation is actually quite attractive when looking forward.although profit trend Recent results have been modest, but a range of EPS growth is bullish for future profit potential.the best of them Momentum readings Across the market, sell-side analysts have become more bullish on the stock with a B+ Earnings per share revision grade.

competitor analysis

Seeking Alpha

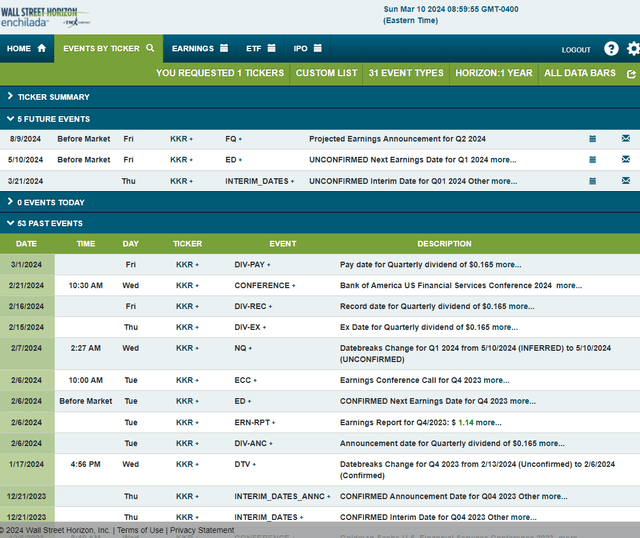

Looking ahead, corporate activity data provided by Wall Street Horizon shows an unconfirmed first-quarter 2024 earnings date of Friday, May 10. The firm also provides interim AUM data on Thursday, March 21.

Corporate Events Risk Calendar

wall street skyline

Technical points

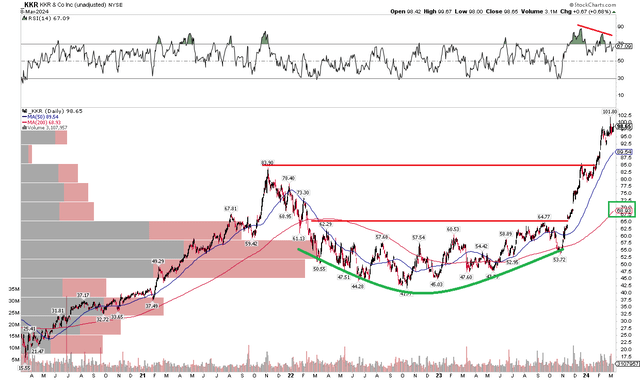

KKR’s chart is impressive thanks to high EPS growth and a still-good valuation. Note in the chart below that the stock price broke out of its major base late last year, shortly after my October analysis. The stock has nearly doubled after hitting its long-term 200-day moving average in the low to mid-$50s in the fourth quarter of 2023. It has been one of the major momentum companies that continues to attract investors. KKR has surpassed its all-time high of $84 set in 2021, only to retreat slightly at the start of the year. With no indirect supply from the stock, the sky is clear going forward, with support at the old $84 level.

However, the RSI momentum indicator at the top of the chart is showing a warning sign. With the stock hovering at all-time highs, its highs are heading lower. I would like to see an improvement in the relative strength index (RSI) to confirm upward price momentum. Another issue that bulls should be concerned about is the price gap of approximately $89 compared to a month ago. Therefore, a pullback to the 50-day EMA and this gap could easily occur without breaking the broader trend.

Overall, KKR’s chart remains strong from a bulls’ perspective, despite two recent signs of caution.

KKR: Bullish upside breakout, RSI cautious

Stockcharts.com

bottom line

I reiterate my Buy rating on KKR. Valuations have improved significantly compared to my assessment last October, and share price momentum is very strong.