HSBC

introduce

KONE (OTCPK:KNYJF) (OTCPK:KNYJY) is one of the world’s largest manufacturers and installers of elevators and escalators. As such, its financial performance is closely linked to the well-being of the global construction industry and construction-related activities. A slowdown in new construction will result in fewer orders for the oligopoly of elevator manufacturers (Schindler and Otis are the other members of the oligopoly).as it has been about It’s been a while since I last discussed KONEI think it’s time for an update.

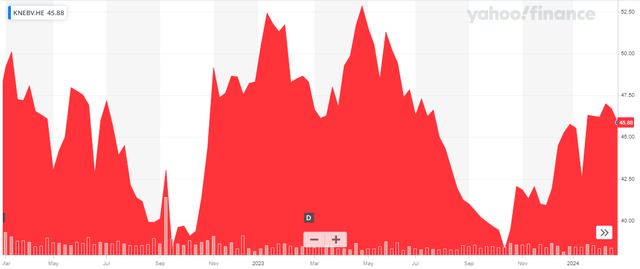

Yahoo Finance

KONE’s primary listing place is Helsinki and trades under the symbol KNEBV.The average daily trading volume in Finland is About 600,000 shares per day.The net value of outstanding shares is approximately 517 million shares (weighted average number of shares in 2023), and Kone’s current market capitalization is slightly less than €24B. I will use the Euro as the base currency in this article.

a robust set of results

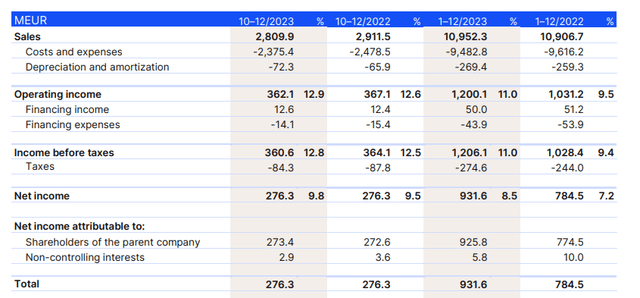

Kone reported Total revenue €2.81B In the fourth quarter of 2023, operating expenses also declined, although they were down nearly 4% from the same period last year. If not for slightly higher depreciation and amortization charges, operating income would have been unchanged.

Total net profit in the fourth quarter was 276 million euros, of which slightly more than 273 million euros were attributed to KONE ordinary shareholders, equivalent to 0.53 euros per share.

KONE Investor Relations

For a large company like KONE, just one quarter’s results don’t mean much, and looking at the full-year results might be just as interesting, if not more interesting. We saw total revenue increase by almost half a percentage point while operating expenses declined. This resulted in operating income growing 16%, jumping to €1.2B. It ultimately generated pre-tax income of €1.21B (thanks to net financial income for the financial year), attributable net profit after tax of €926 million, and earnings per share of €1.79. This is nearly 20% higher than the €1.50 per share reported in 2022.

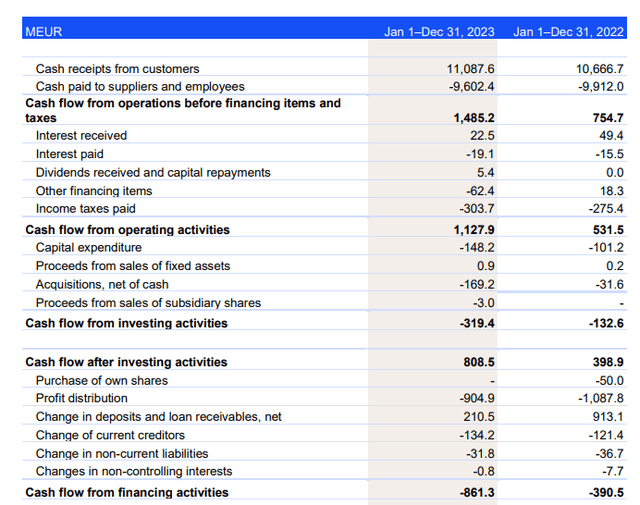

The full-year cash flow profile is also encouraging. As shown below, the company reported operating cash flow of approximately €1.13B, but this included €304m in taxes, although only €275m was due according to the FY2023 income statement. In addition, changes in working capital resulted in a net contribution of €16 million. This implies underlying operating cash flow of approximately €1.14B.

KONE Investor Relations

Total capital expenditure was only €148 million, which resulted in net free cash flow of just under €1 billion. We should also deduct lease liabilities – this is not clearly shown in the cash flow statement. According to the company’s balance sheet, Recent lease payments amounted to €110 million required, which suggests an underlying free cash flow result of approximately €870 million or €1.68 per share. This suggests that the company’s current free cash flow yield is below 4% based on fiscal 2023 results.

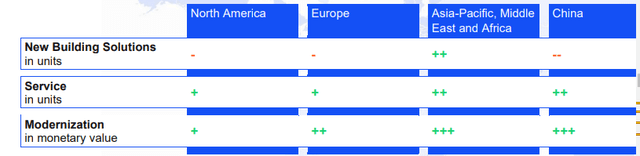

For 2024, Kone appears cautiously optimistic as it has a positive outlook for nine of its 12 end markets, with the Modernization business expected to grow across all business areas, with strong growth in Asia Pacific, the Middle East, Africa and China. . Three plus signs in the chart below indicate expected growth rates exceeding 10%.

KONE Investor Relations

On the revenue side, KONE expects its total revenue to remain stable or grow very slightly compared to 2023, while it expects EBIT margins to continue to improve, albeit at a slower pace.this Analyst consensus estimate It is expected that EBITDA will grow to 1.63B euros this year, and EBIT will grow by 10% to 1.37B euros. The level of EBITDA will continue to grow by approximately 100 million euros per year. This should also deliver high-single-digit earnings per share CAGR over the next three years.

investment thesis

KONE has a very substantial net cash position of ~€1B, and we will likely continue to see significant interest income in 2024. As a leader in the industry, KONE deserves to trade at a premium valuation, but I’m also not keen on paying 20 times expected 2026 net earnings. I’m currently on the fence, but will be keeping a close eye on Kone and its results.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.