Olga Kaya/E+ via Getty Images

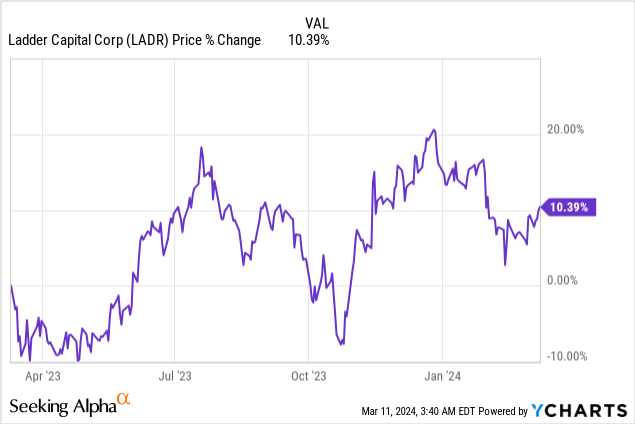

Ladder Capital (NYSE:LADR) is a mortgage lender that focuses primarily on short-term, variable-rate balance sheet first mortgages.REITs’ loan book quality amid concerns Growing CECL reserves. While there are risks to the portfolio, particularly when it comes to office building investments, I believe Ladder Capital currently provides good dividend support. As the REIT’s stock enters a new phase of its gains after filing fourth-quarter earnings and the discount to book value narrows again, I think a Hold rating makes the most sense.

Previous rating

In my most recent research on the CRE capital provider in December, I rated Ladder Capital a Hold because of the REIT’s focus on its variable-rate real estate loans. Core business segments. With the federal funds rate set to fall in 2024, adjustable-rate loan providers may see their distributable earnings decline. Although the P/BV ratio was slightly lower than in December, the REIT’s loan provisions increased.

CRE Loan Portfolio and Provision Trends

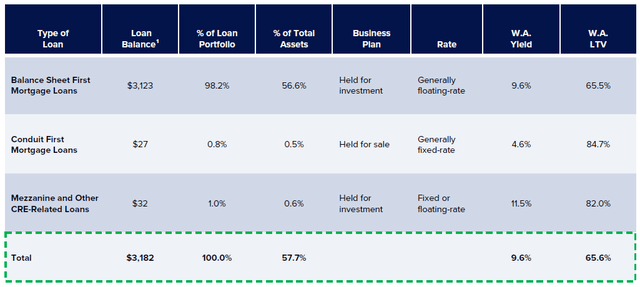

Ladder Capital provides capital to the commercial real estate market through off-balance sheet first mortgage loans. These mortgages are secured by commercial real estate and typically have variable interest rates that adjust based on the Federal Reserve’s changing interest rate trajectory. Having a large number of these loans was good for Ladder Capital during the last rise in the federal funds rate, but may not be a quality asset to hold on its balance sheet as the Fed pivots.

In the fourth quarter, the REIT held $3.1B of these balance sheet first mortgages, accounting for 98% of all loan investments. Additionally, Ladder Capital owns net lease commercial real estate investments and securities. However, by far the most important segment is the commercial real estate lending business, which includes first mortgages, mezzanine loans and other commercial real estate loans.

ladder capital

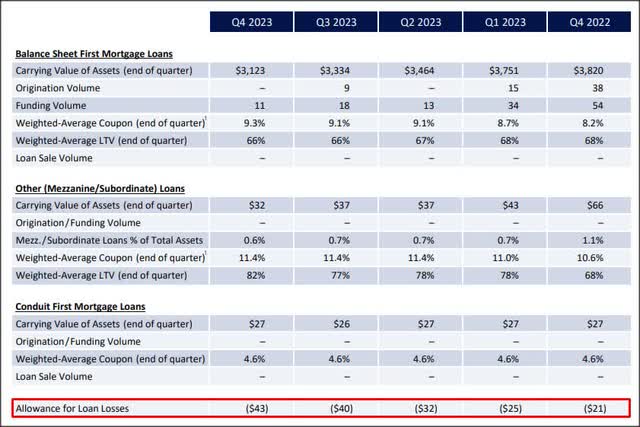

Questions have arisen recently about the quality of the REIT’s loans or the health of its portfolio, as the company has made multiple office building investments in the past that total about 16% of Ladder Capital’s asset base. To determine the quality of the loan portfolio, we can observe trends in credit reserves, which in the commercial real estate market are known as CECL reserves. CECL stands for current expected credit losses, and Ladder Capital continues to add to this reserve account through fiscal 2023.

Ladder Capital’s loan loss provisions stood at $43 million at the end of the fourth quarter, meaning the REIT’s reserves for the year totaled $22 million. While provisions appear high, they only represent about 1.4% of total loan investments in Ladder Capital’s core division, suggesting that the quality of the portfolio has not been seriously compromised. However, the increase in CECL’s reserves was recognized as an impairment in the REIT’s income statement, which lowered Ladder Capital’s net profit for fiscal 2023.

ladder capital

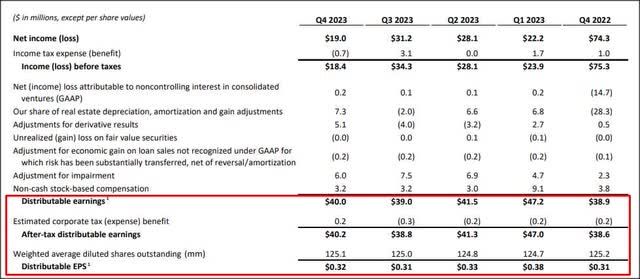

Therefore, net income is not an important number to use in determining the safety of a dividend. Ladder Capital’s loan impairment charges are added back into a number called “distributable earnings,” which is better used to quantify a REIT’s dividend coverage. The increase in CECL’s reserves is non-cash and therefore will not impact Ladder Capital’s distributable earnings, although this will occur regularly in fiscal 2023.

Ladder Capital’s distributable earnings are sufficient to support the REIT’s quarterly distribution rate of $0.23 per share in the fourth quarter and throughout fiscal 2023. Based on reported distributable earnings, Ladder Capital achieved distribution coverage of 1.39x in Q4’23 and 1.46x in FY23. So the distribution is well supported, but I don’t think Ladder Capital will raise the dividend in FY24 given the trend of its CECL reserves.

ladder capital

Valuation of Tianti Capital

Providers of commercial real estate capital have faced increased scrutiny recently due to concerns about their exposure to the office market and the performance of commercial real estate loans. So far, Ladder Capital hasn’t had any problems supporting its dividend, which may explain why Ladder Capital’s stock price entered a new uptrend after the REIT filed its fourth-quarter earnings scorecard.

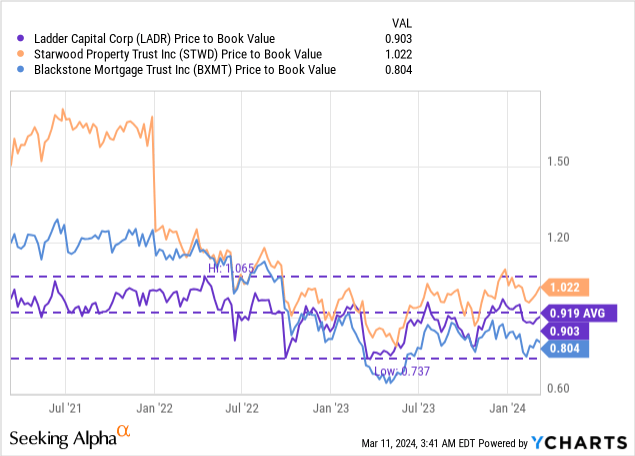

Ladder Capital stock currently trades at a P/E ratio of 0.90x, which is slightly below its 3-year average P/E ratio of 0.92x. Rivals in the CRE industry – Starwood Real Estate Trust (STWD) and Blackstone Mortgage Trust (BXMT) – have price-to-earnings ratios of 1.02x and 0.80x, respectively. Blackstone Mortgage’s CECL reserves have increased dramatically, which is why I recently downgraded the REIT. I believe Starwood Properties operates a diversified commercial real estate business with complementary revenue streams that reduce investor risk.

risk Track your metrics with Ladder Capital

Ladder Capital’s terms are worth tracking. The deterioration in commercial real estate loan quality will be immediately reflected in higher net additions to CECL reserves in the coming quarters, so dividend investors should be able to see changes in distribution coverage in advance. If CECL reserve trends worsen or improve throughout the year, my view on Ladder Capital will change.

final thoughts

Do investors need to worry about Ladder Capital’s 8% dividend and FY2024 yield? Probably not when you realize how low CECL reserves are as a percentage of the CRE sector’s outstanding loan amount. Ladder Capital’s distributable earnings also easily supported the full-year dividend, but as long as the CECL reserve account continues to grow, I don’t expect the REIT to increase the dividend by any amount in fiscal 2024. I think a book value rerating will be a catalyst if the REIT doesn’t have to add to its CECL reserves in the coming quarters, but I’m sticking with a Hold rating on Ladder Capital for now.