BankRX

introduce

Seeking Alpha is full of experienced investors who are very savvy when it comes to investing. But for the same number of experienced investors, I’m sure there are plenty of less experienced people looking for stocks with attractive yields.Especially when they trade Prices are cheap at the moment.

But what your lack of experience might not tell you is that it’s probably cheap for a reason. One dividend king that comes to mind is Leggett & Platt (NYSE:LEG). I’ve followed LEG for years and was always attracted to their dividend record and growth. But randomly searching for the stock the other day, my eyes couldn’t help but notice the price.In this article, I’ll discuss why, although the yield remains attractive, Leggett & Platt is a stock I would at least avoid as cash flow is expected to decline, pushing its FCF payout ratio above 100% at present.

Stock price plummets

It’s been a while since I covered Leggett & Platt, but if I remember correctly the last time I did, the stock was trading close to $40 per share. So, when I looked at it recently and saw that it was trading close to $20, the first thing that came to my mind was, Maybe they cut the dividend?

But no, the dividends and their track record remain intact, At least until now! For new investors looking for high yields, they will likely consider LEG for several reasons.

- This stock is a Dividend King.

- The company has a long history, having been around since the 1800s.

- Their dividend growth and yield are currently attractive.

- Their business model is solid. As a bedding company, LEG improves lives around the world by designing and manufacturing innovative, unique products and components that are used not only in bedding but also in automotive and other fields.

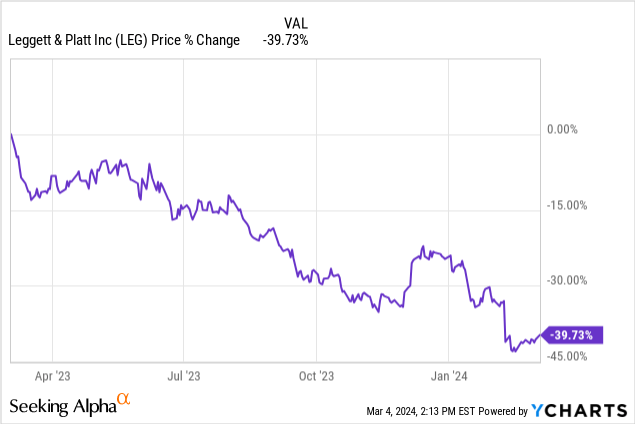

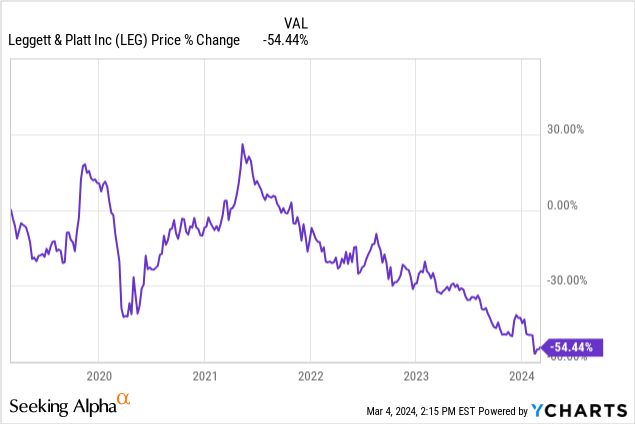

As a result, one might think that a company like Leggett & Platt is safe when it pays its dividend. But looking at the share price performance over the past 1 and 5 years, this may be coming to an end. As the chart below shows, LEG’s stock price has underperformed over the past year, falling nearly 40%.

Of course, interest rates have caused dividend stocks to fall out of favor, as investors can earn yields approaching 6% through certificates of deposit or Treasury bonds. But if you look at the past 5 years, the stock is down almost 55%. So even with dividends invested, you’ll still lose money if you hold the stock.

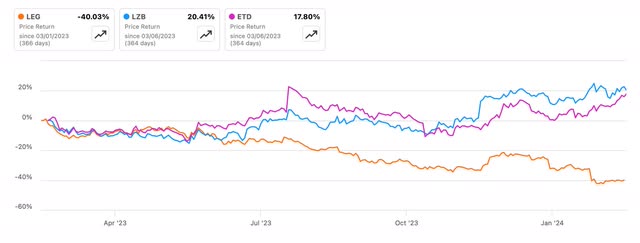

Sometimes your portfolio holdings have periods of underperformance, namely REITs since 2022, but with a brick-and-mortar company like Leggett & Platt, you’d expect more. Especially when you compare them to peers La-Z-Boy (LZB) and Ethan Allen Interiors (ETD).

Seeking Alpha

Looking at the chart above, you can see that both peers posted double-digit green growth compared to LEG. Therefore, one has to wonder why the former performs poorly compared to the other two. Well, let’s see why.

Bland 2023

It’s no secret that businesses, even high-profile ones, will be in trouble in 2023 due to a challenging economic backdrop. The main reason is interest rates. Now in 2024, some people are still feeling the effects. Borrowing and product costs soared. Operating expenses have also increased dramatically, which has cut into corporate finances or profits.

For all of 2023, LEG’s earnings payout ratio has risen to over 100%, which is the first red flag that this is not a situation any business wants to see, let alone a company in its portfolio. However, these problems can occur, although sometimes unexpectedly, but as an investor, this is only what I hope to see for the time being. Maybe a quarter or two? I became skeptical of anything after that.

In its fourth-quarter earnings report released on February 9, the company reported earnings per share of $0.26, $0.01 lower than expected, and revenue of $1.12 billion, exceeding expectations. Earnings per share decreased 33% year-on-year from $0.39 in 4Q22 and 1Q23.

As you can see in the chart below, earnings per share declined steadily quarter-over-quarter, from $0.39 to $0.26, which is something you don’t want to see from Dividend King. Of course, the economic backdrop creates disruption and financial instability for consumers, but the continued decline in financial conditions is concerning. Earnings per share in 2022 will be $2.27.

Author’s creation

A challenging economic backdrop and market dynamics, particularly within LEG’s residential end-market, have changed consumer habits, resulting in a long-term decline in its profits. In short, consumers are spending less. In addition, the macro environment caused disruptions to LEG’s customers, ultimately leading to lower demand for certain products, particularly in the bedding segment. Additionally, the cost of goods and services increases as interest rates rise.

Full-year sales fell 8% to $4.7 billion, primarily due to weak market demand and raw material-related issues. Adjusted EBITDA also fell 5.9% from 7.6% in the same period last year.

Of these 3 market segments, 2 experienced declines, with bedding falling by 14% quarterly and 17% for the full year. Sales of furniture, flooring and textiles were also down 11% for the full year, while sales of LEG professional products were up 5% from Q4’22 and 14% for the full year.

To add insult to injury, management’s guidance for 2024 isn’t doing the company any favors either. Full-year EPS is expected to range from US$0.95 to US$1.25, with the impact of restructuring costs ranging from US$0.20 to US$0.25. Sales volumes were lower in the bedding and furniture segments.

Although interest rates are expected to fall, I expect management to take a conservative approach to managing shareholder expectations as consumers may continue to face financial instability, leading to lower demand and sales for the company.

In addition, global steel cost and metal profit compression are also expected to impact future business. Even if the aerospace business expects strong demand and a record backlog of orders, it won’t be enough to offset the expected decline. However, as management gets more visibility and data on rates, they may increase guidance in the coming quarters.

Dividend safety

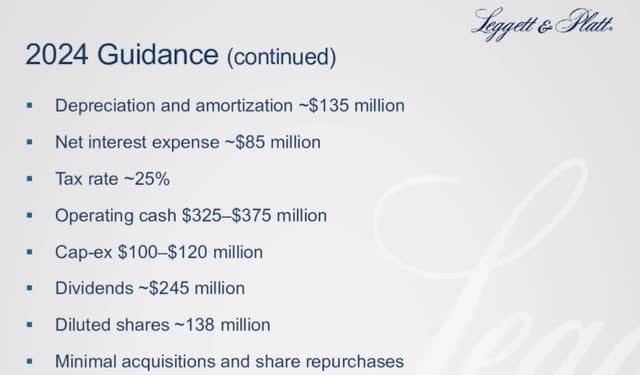

In addition to weak profit guidance, cash flow is also expected to be significantly lower than 2023’s $497 million. While this figure does increase from $441 million the year before, excluding capital expenditures, it is expected to reach $240 million in 2024.

While the company managed to cover its 2023 dividend at a safe free cash flow payout ratio, next year’s dividend is expected to be over 100% based on management guidance.

Of course, that could change if the company can beat expectations. A lot can happen between now and the end of the year. Interest rates are expected to fall, which will have a positive impact on consumer spending habits. This may also result in reduced operating expenses.

The company paid $239 million in dividends in 2023, safely covering $383 million in free cash flow for a free cash flow payout ratio of 62.4%. But as mentioned earlier, their cash flow is expected to decline significantly this year.

LEG investor introduction

The company also expects to make minimal acquisitions and buybacks, so using a projected share count of 138 million shares, this means they would need a minimum free cash flow of approximately $254 million to cover the dividend if the dividend remains unchanged. Leggett & Platt raised its dividend 4.5% to $0.46 in May, and given their reputation as a dividend king, they’ll try to keep that momentum going.

But how long that lasts remains to be seen. If I were in management, I would hold the dividend here while the company learns more about the economic future. Cutting the dividend to free up cash flow is also a real possibility. Quant currently rates the stock a Sell and an F for Dividend Safety. Until the company shows more promise financially in the foreseeable future, I think this will continue in the short term.

underestimated

Leggett & Platt’s current price-to-earnings ratio is about 15 times, which is slightly higher than the industry median of 14.74 times. They are also trading 8% below their 5-year average, further suggesting that the stock is currently undervalued.

However, this figure is currently higher than peers Ethan Allen’s 10.63 times and La-Z-Boy’s 12.66 times. Although analysts expect LEG’s profits to decline this year, it is expected to resume growth in 2025, with an average growth rate of approximately 6.5% over the next four years. But, of course, it all depends on how the company performs in 2024. Analysts have a $19.67 price target on the stock, with about $1 of downside at the time of writing.

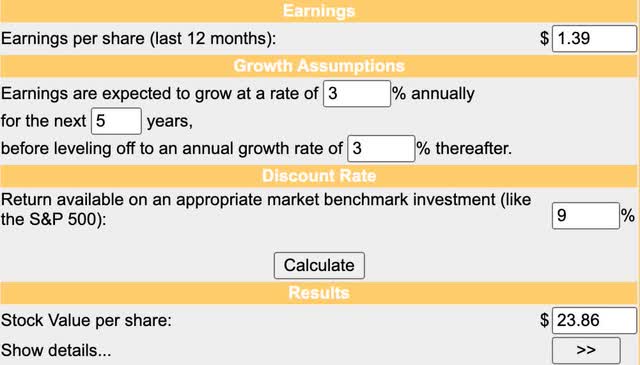

Expectations are managed using a discounted cash flow model and an expected growth rate of 3%. I also use an expected return of 9% because the S&P’s historical average return is 7% – 10%. This works out to LEG’s fair value of $23.86, which is about $3 higher than the current price.

money chimpanzee

risk

The biggest risk facing Leggett right now is the company’s prestigious record as a dividend king. They’ve been operating for a long time, and while the 2023 dividend was safely paid, the 2024 dividend remains volatile. Unless the economic backdrop eases and cash flow is higher than expected, I think the stock price will continue to face downward pressure. short term.

If the company does cut its dividend, then I do see some slight downside, albeit minimal, as I think the risk of a cut is already priced into the price. Investors who currently own LEG should pay close attention in the coming months, as the stock could see further volatility due to uncertainty about its king status.

bottom line

LEG may look attractive here due to its long track record and current yield of nearly 9%. Especially when you factor in the bargain valuation and annual payout. However, shareholders must realize that although they are Dividend Kings, past performance is no predictor of the future. Unless cash flows are higher than expected, LEG’s free cash flow payout ratio is expected to be above 100%.

I expect the company to hold on as long as possible and may even continue to raise its dividend in the coming months, but unless management makes or anticipates making significant changes to optimize its free cash flow, the dividend is at high risk of being cut. 2023 isn’t impressive, to say the least, but they still managed to safely cover the dividend with free cash flow. But with expected dividend payouts above 100% and the risk of a dividend cut, I rate the stock a Hold.