We talk a lot here about leveraged buyouts (LBOs) and the complex, often bank-arranged financing packages that come with them, often in the context of deals involving millions or even billions of dollars.That’s no problem for a behemoth like Blackstone, which became the first private equity firm to achieve this goal Trillions of assets under management. But what about those of us with portfolios totaling just under thirteen figures and who may not have Goldman Sachs on speed dial for arranging large-scale leveraged loans or other customized debt financing?

I have four words for you: Small Business Administration (SBA) loans. The SBA is a U.S. government agency whose mission is to support small businesses, and part of that means helping ensure that investors looking to start, buy, or grow a small business can get the credit they need. The primary way the agency accomplishes this is through SBA loans. These small business loans are issued by private lenders (usually regional banks or credit unions, but larger institutions can also make them) but are partially guaranteed by the federal government. It may not be the first source of leverage that comes to mind when you think about private equity transactions, but independent sponsors can and often do use SBA 7(a) loans — a specific type of financing we’ll focus on in this article Next — —Buy acquisitions.

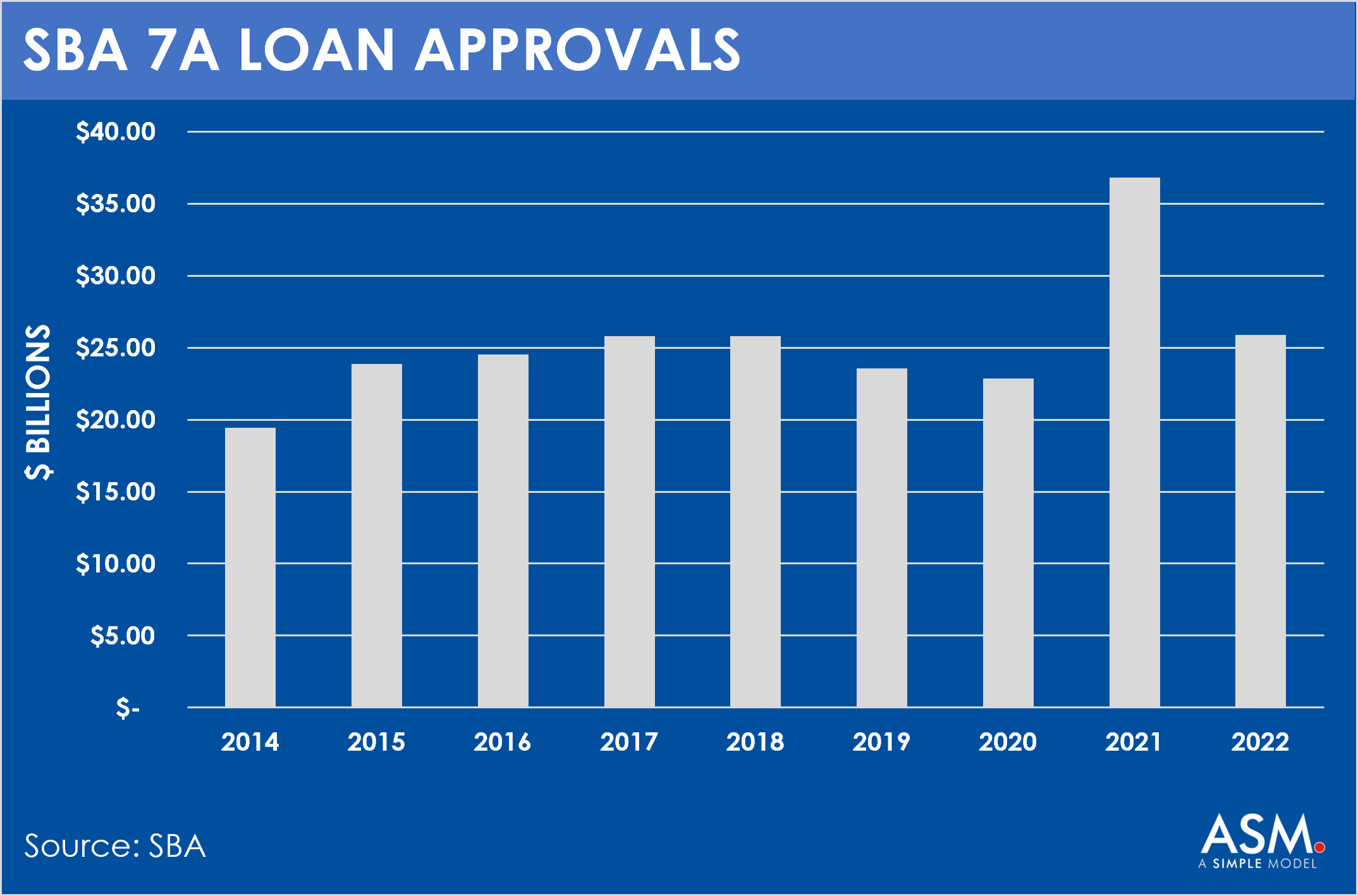

This is a popular source of financing. As shown in Figure 1, total annual approvals have been between $20 and $25 billion since 2017, with the exception of 2021, which was an outlier due to pandemic-related legislation but is worth noting. , not all or necessarily most of these funds are used to acquire businesses (as opposed to growing existing businesses).

Figure 1. Total SBA 7(a) approvals

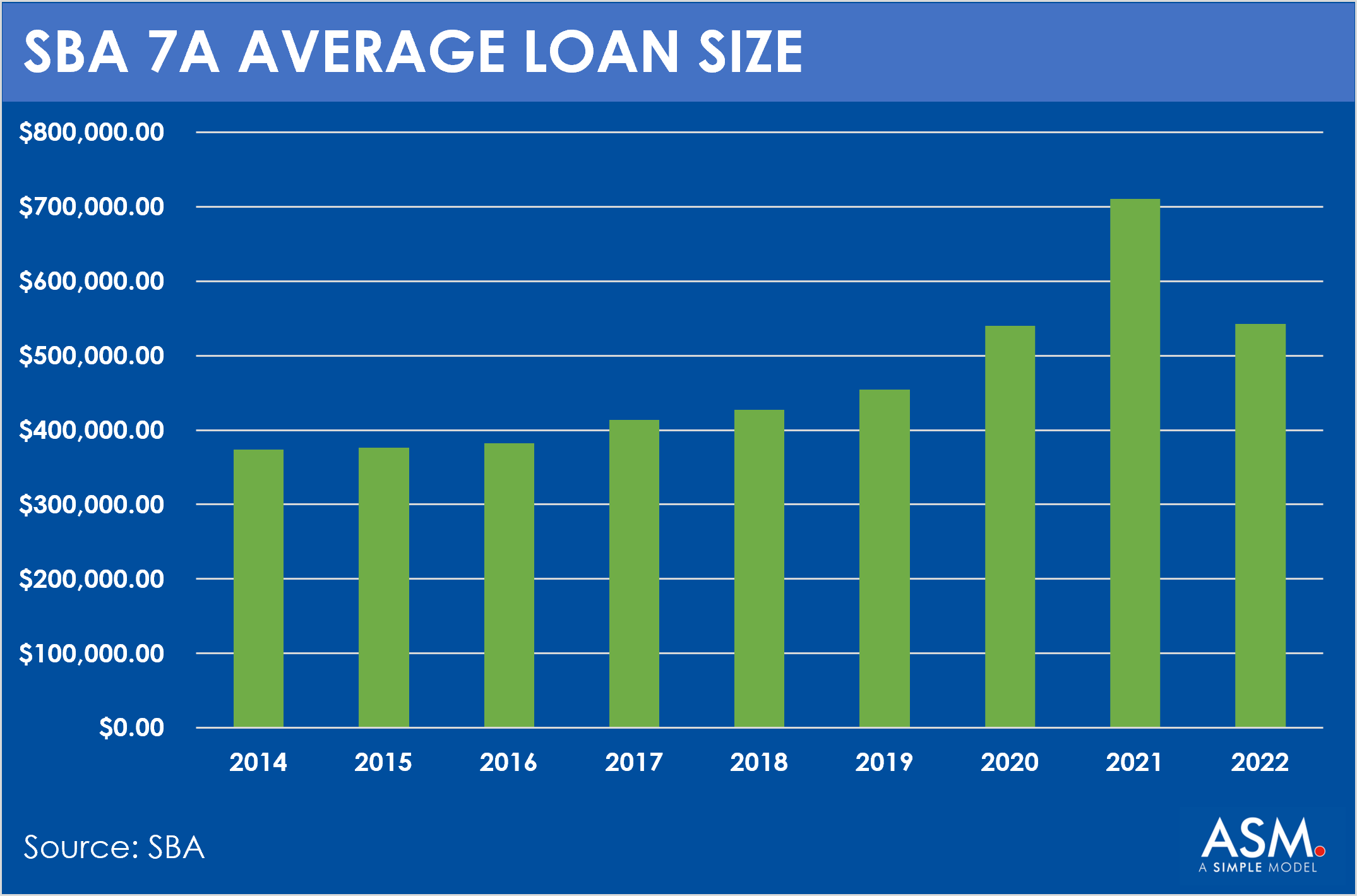

Remember, these are considered small business loans. As shown in Figure 2, the average personal loan size is approximately $500,000 (an outlier again in 2021), but amounts can be as high as $5 million.

Figure 2. Average size of SBA 7(a) loans

For those unfamiliar with SBA loans, the biggest question may be: Why use them? As we’ll outline below, SBA loans typically have lower interest, fees, and equity down payments because of the government guarantee. However, the application process is relatively complex and therefore involves some red tape. But the potential savings and other advantageous features of the loan can make the process well worth it. Although many SBA loan applications are denied, approval is much more likely for well-qualified applicants who understand how the process works.

Five Benefits of SBA 7(a) Loans

Availability: Depending on the circumstances, traditional bank loans are not always available to those purchasing a business, or may not provide the amount a sponsor needs to complete the deal. In these cases, the government’s guarantee of SBA loans (up to 75% of the loan amount for SBA 7(a) loans over $150,000 (and 85% for small loans)) promotes the lender’s perspective .

Low interest rates: SBA loans often, but not always, have lower interest rates than other financing options. This is because the SBA caps interest rates at a certain amount above the base loan rate. The interest rate is negotiated between the borrower and lender, but this maximum rate is always adhered to. The cap depends on the loan amount and term. As of this writing, the following link shows a breakdown of the maximum interest rates for SBA 7(a) loans by loan amount: Terms, Conditions & Eligibility | U.S. Small Business Administration (sba.gov).

Reasonable fees: Like other loans, SBA loans come with fees, some of which can be bundled into the repayment and others that must be paid up front. For example, currently (2023), lenders can pass on prepaid SBA guarantee fees to borrowers. For loans with a term of 12 months or less, the maximum fee is 0.25% of the guaranteed portion. For long-term loans, the maximum interest rate ranges from 2% to 3.75%, depending on the loan amount. Now the good news. The SBA also prohibits many fees, such as separate origination fees, that private lenders might otherwise charge at whatever level a borrower is willing to accept (although lenders can still charge “package fees” if the fee is “reasonable and reasonable”) . “Customary” and consistent with fees charged on other loans of similar size).

Long Duration and Covenant Light: SBA real estate loan terms can be up to 25 years, and equipment and inventory loan terms can be up to 10 years. Loans covering different asset mixes (such as business acquisitions) can have mixed terms. In comparison, traditional small business loan terms typically don’t exceed 5 years. SBA loans typically have fewer covenants than traditional business loans. This is because government guarantees make lenders less likely to require businesses to maintain specific financial ratios throughout the life of the loan, which provides significant additional flexibility in the event of an economic downturn.

Low down payment: We’ll cover this in more detail in our next article, but SBA 7(a) loans allow buyers to put down as little as 5%, which is far less than the typical down payment requirements for conventional loans (which can be two to three times as much) this amount. Less of your own capital in a trade means greater leverage, which means the potential for greater returns.

bottom line

The SBA 7(a) loan is a widely used financing option for purchasing a small business. If approved, you’ll receive a good interest rate and reasonable fees, and may be required to put less of your own money into the deal. In other words, it’s the leverage Uncle Sam provides that lets you acquire a business when other sources of financing aren’t readily available or require onerous terms that would eat into your returns. But it’s worth noting that in order to take advantage of this funding source, you and your proposed acquisition must meet certain basic requirements (7(a) Loans | U.S. Small Business Administration (sba.gov)). We’ll cover the specifics of these loans in our next article: The Specifics of SBA 7(a) Loans.