Buda Mendes/Getty Images Entertainment

Live Nation Entertainment (NYSE:LIE) is arguably the largest event organizer in the world. Between music, sports and other live events, Live Nation has a huge foothold in the world of experiences.

I am a large live events client and the business is doing very well Very attractive to me. Unfortunately, this strength hasn’t translated into strong financials, as Live Nation struggles to generate meaningful profits and continues to dilute its shareholder equity.

I encourage investors to make sure they understand what they are buying and how much they are actually paying, as Live Nation’s financials are more complex than the average company.

Live Nation Entertainment Introduction

I’ve been covering Live Nation on Seeking Alpha since last June. Throughout my coverage, I maintain a Hold rating.

On the surface, Live Nation’s business is pretty simple.The company produces live events in various categories (music, sports, festivals, etc.) and operates a ticketing platform Providing services to the company’s concert division as well as to third parties.

While the business itself is simple, the business model and finances are quite complex. I’ve discussed this extensively in previous articles, explaining the huge difference between free cash flow and net income, as well as the loopholes in the inter-segment subsidy strategy.

This complexity results in a lack of focus on shareholder interests, which is the primary reason I rate the stock a Hold, despite what appears to be strong performance.

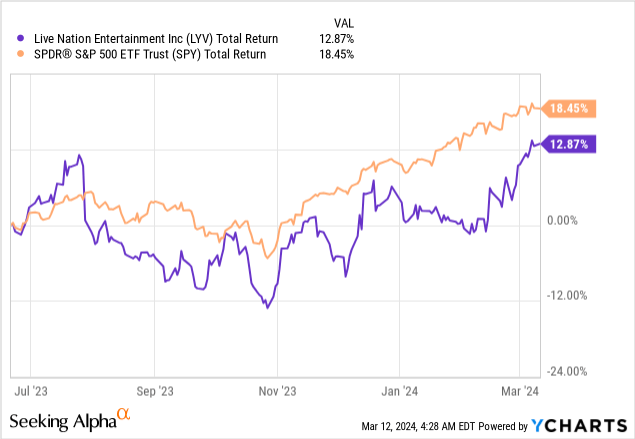

Our analysis has been spot on so far, as the company has underperformed the market since we started reporting on Live Nation:

Importantly, I don’t think Live Nation doesn’t have a high-quality business. Just considering the flaws I listed above, I find the stock to be overvalued.

So, let’s see if there’s room for repricing going into 2024.

Amazing 2023 on paper

2023 was a record year for live events, driven by hits from Taylor Swift and Beyonce, which was reflected in Live Nation’s revenue and operating metrics.

Revenue was US$22.8 billion, an annual increase of 36.4%, attention and ticket sales increased by more than 30%, and sponsorship increased by double digits.

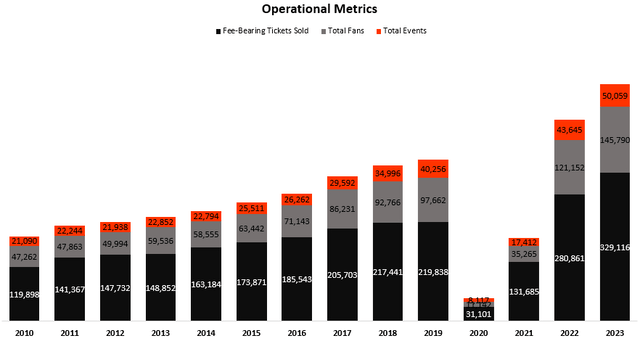

The company hosted 50,059 events, a 15% increase from the previous year, approximately 67% of which were held in North America. The total number of fans attending the show reached a record of nearly 146 million, an increase of 20% year-on-year. Paid ticket sales increased 17% to more than 329 million, and total ticket sales were 620 million, an increase of 13%.

Created by author using information from Live Nation Entertainment’s financial report (10-K); figures other than total number of events (in thousands).

Gross profit was $5.5 billion, with a profit margin of 24%, a decrease of 205 basis points, mainly due to an increase in headcount and direct operating expenses growing faster than revenue.

Operating margin improved 30 basis points to 4.7%, with lower gross margin offset by SG&A’s operating leverage. This resulted in operating profit of $1.1 billion, an increase of 46% year over year.

Net profit was US$563 million, an increase of 90% year-on-year, but the profit margin was still extremely low, only 2.5%.

Free cash flow, the metric used by many investors to justify the company’s valuation, fell 25% to $1.4 billion, and operating cash flow margins fell nearly 5 percentage points, largely due to an increase in working capital.

Despite having plenty of cash on the balance sheet, the company once again diluted shareholder equity by 1.7% and returned no cash to shareholders.

Looking to the future

The company provided several leading indicators that give us an idea of what to expect in 2024.

As of mid-February, concert ticket sales were up 6%, and event-related deferred revenue was up 8% at the end of the year.

Currently, the company’s venue portfolio is 65% booked this year, compared with 50% last year. Importantly, this speaks more to higher certainty at the start of the year than growth, as macro uncertainty hampers bookings at the start of 2023.

On the ticketing front, paid ticketing volumes increased by double digits. Again, this doesn’t exactly line up with ticket revenue, as sales are sensitive to ticket prices and the company’s fees aren’t always charged as a percentage of the price.

Sponsorship bookings reached 75%, a double-digit increase from the previous year, giving greater confidence in the company’s ability to maintain growth in its most profitable areas of the business.

Management said seasonality will be more important in the second and third quarters than in previous years. They expect capital expenditures to be $540 billion and no major changes to the share count.

Valuation

Based on current consensus estimates, analysts expect revenue to grow 7.7%, consistent with management’s comments, and earnings per share of $1.9, reflecting EPS growth of 39%.

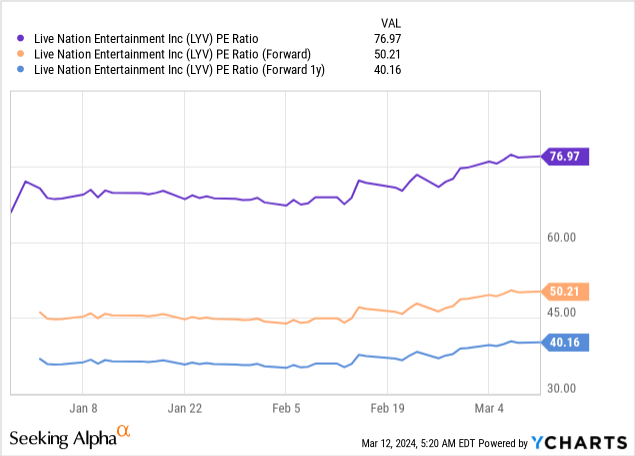

As we can see, Live Nation is expected to trade at 50.2x 2024 P/E and 40.2x 2025 P/E.

Based on expected growth rates, our PEGs for 2024 and 2025 are 1.3x and 1.8x respectively. Nothing too crazy, but nothing too appealing either.

I find it hard to believe that the company can achieve such high operating leverage, but that seems to be the consensus.

One important thing to note here is that the consensus estimate relates to net profit attributable to shareholders after the increase in non-controlling interests.

Normally, this wouldn’t be something worth mentioning, but in the case of Live Nation, it is.

In 2022, net profit was US$295 million, value added was US$146 million, and net profit was US$149.2 million (a difference of approximately 50%). In 2023, the net profit was US$563 million, but the value added was only US$247 million, equivalent to a bottom line of US$315.8 million (about 44% difference).

Likewise, complex financials make forecasting next year’s earnings per share difficult.

in conclusion

Live Nation is having a great year in 2023, with strong performance across all segments of the company.

Going into 2024, growth is expected to slow significantly and return to pre-pandemic normal levels.

Due to the company’s complex financials and inter-segment subsidies, I believe investors are focusing on the wrong metrics when evaluating the company.

Based on a simple valuation methodology, I still estimate Live Nation’s valuation to be unattractive and rate the stock a Hold.