Andy_Oxley/iStock Editorial via Getty Images

record backlog

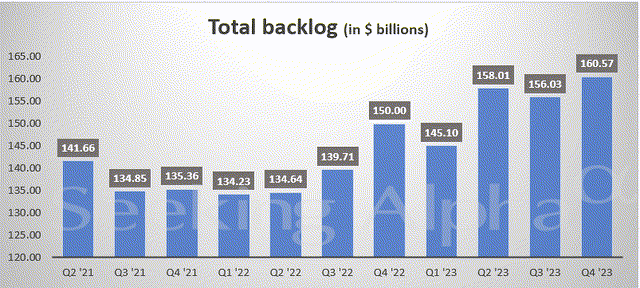

My purpose in writing this article is to demonstrate a buying argument Lockheed Martin (NYSE:LMT).I think the stock offers a solid buying opportunity given the demand Its products face all the ongoing geopolitical conflicts, a record backlog of reports for Q4 2023, and an attractive price-to-earnings multiple. Many geopolitical tensions around the world may lead to increased defense spending, directly benefiting LMT.This is reflected in the record backlog Q4 2023 report (see chart below). The current backlog is as high as $160.57B.As its president and CEO said Jim Tacklet,

Our solid finish to 2023 and full-year results reflects continued strong demand for our full portfolio of advanced defense technology solutions. The order backlog reached a record $160.6 billion, and sales increased 2% annually to $67.6 billion…

I agree with the CEO’s optimism about continued demand for LMT products. To name a few notable examples, the aerospace sector’s backlog exceeds $60 billion. The demand from the United States and its allies is very favorable, especially for F-35 and F-16 fighter jets. The missile and fire control segment is a business worth more than $32 billion. The U.S. Army and European militaries are keen to modernize their precision strike and interception systems. Rotary and Mission Systems’ backlog is nearly $38 billion. At the same time, international demand (from a long list of allies including Spain, Norway, India, Greece, South Korea and Singapore) plans to enhance its air capabilities, most likely through LMT systems. All in all, I believe record backlog and future demand will translate into continued profit growth for LMT in the coming years.

However, the stock is still very reasonably valued and therefore offers good return potential, as discussed in the next section.

Seeking Alpha

Valuation and projected returns

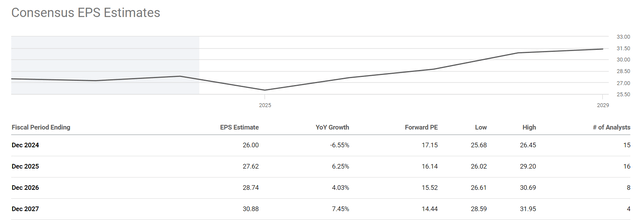

The chart below shows consensus estimates for Lockheed Martin’s earnings per share over the next four years. It can be seen that analysts expect LMT’s earnings per share in fiscal 2024 to decline slightly to $26.0 (i.e., an annual decrease of 6.55%). After this, however, earnings per share are expected to rebound and grow steadily over the next four years. Analysts expect earnings per share to reach $30.88 by fiscal 2027, with a compound annual growth rate of about 6% from 2024 to 2027.

Seeking Alpha

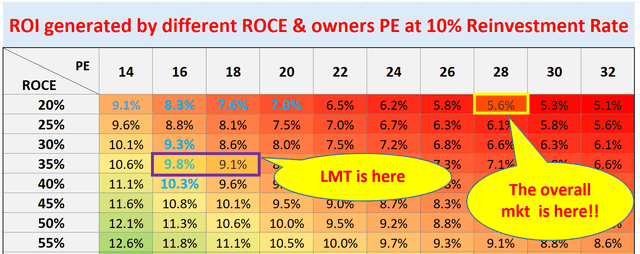

Considering the growth catalysts mentioned above, I think such a CAGR over the next few years is very feasible. As a stand-alone approach, I also estimate LMT’s long-term growth rate based on ROCE (return on capital employed) and the reinvestment rate (“RR”). In recent years, LMT has maintained a ROCE of about 35% and a RR of about 10%. Therefore, the actual growth rate is expected to be 3.5% (from ROCE * RR = 35% * 10% = 3.5%). Coupled with an inflation rate of 2% to 3%, the project growth rate will reach approximately 5.5% to 6.5%.

If we can agree on the long-term growth rates mentioned above, then forecasting future long-term returns is fairly straightforward. This free blog post details our approach, the key points of which are summarized below:

- A business owner’s long-term return on investment is determined by only two things: A) the price paid to purchase the business; and B) the growth rate of the business (reflecting its quality and moat).

- More specifically, Part A is determined by the owner’s yield (“OEY”) when we purchase the business. Part B is determined by long-term ROCE and RR.

- That is, long-term investment return = OEY + growth rate = OEY + ROCE* reinvestment rate

The table below summarizes the application of the above methods in LMT. Here, I use a conservative yield to approximate its OEY (owners’ return). Based on the current FY1 price-to-earnings ratio of 17.15 times, LMT’s OEY is approximately 5.8%. As mentioned earlier, assuming it can sustain a ROCE of 35% and an RR of 10%, its actual annual growth rate will be closer to 3.5%. Therefore, total expected returns (real returns before inflation) will be in the range above 9%. Adding the inflation escalator could push returns above 10%. This is well above what I would have expected for the overall market, which currently has higher valuations (and lower ROCE), as shown in the chart below.

author

Other risks and final thoughts

In addition to the positive factors mentioned above, it is worth noting that there are other risks, some of which are common to LMT and its peers, but some of which are unique to LMT. Defense spending is highly dependent on global tensions, which are ultimately unpredictable. If the conflict eases or defense budgets tighten, it could also have a negative impact on sales to LMT and other defense contractors. Defense contractors also compete with each other. For LMT, contract bidding wars and competition from other major players such as Boeing and Northrop Grumman could squeeze margins.

In terms of the more specific risks facing the LMT, I think its heavy reliance on the F-35 program tops the list. The F-35 project is LMT’s main source of revenue. Delays or issues with the program could disproportionately impact LMT compared to peers with more diversified product portfolios. LMT also relies on a complex network of parts and materials suppliers. Supply chain disruptions, especially those caused by geopolitical events, can severely impact LMT production. As of now, there are indeed some software and hardware supply problems, which may lead to delayed delivery of F-35 upgraded models in the next 1 to 2 years, thereby affecting its overall sales growth.

All in all, I think the above issues are mostly temporary. The only exception is competition – competition has always existed and always will, but LMT has a wide and stable moat based on its technology and customer relationships. Looking at these recent issues, I see great businesses selling at reasonable prices. In particular, the company’s current order backlog is at a record high, fully demonstrating strong demand for its products and providing strong support for continued growth in the coming years.