lucgerma/iStock via Getty Images

In our last coverage of LTC, we looked at fundamentals beyond the third quarter of 2023 and admitted that we were a little too bearish on the REIT.It has survived, if not thrived, and there are reasons to believe it is on the way On the other hand, there is the stress caused by the pandemic. That is, we postponed (Pediatrics) as our choice in the field and make no secret of it.

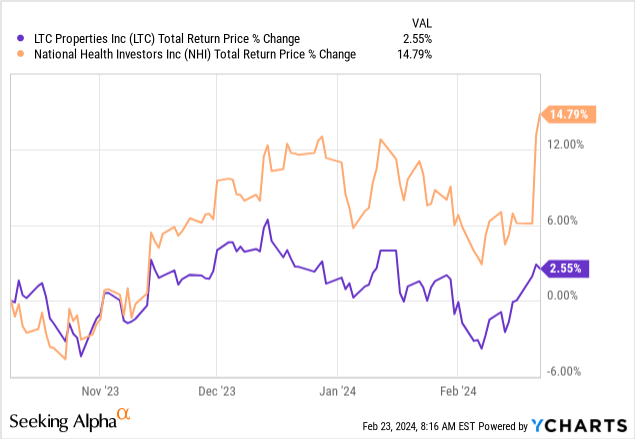

NHI has the same multiple as LTC, and we prefer it for several reasons. First, it is a larger company with an investment-grade credit rating. Fixed charge coverage and EBITDA net debt are also much better than EBITDA. So if we have to choose one here, it would be NHI. LTC is still a HOLD, but we have to admit the company is doing much better Better than we expected.

Source: Seeking Alpha

Now it turns out this was our better choice as NHI has beaten LTC since then.

We check out LTC’s setup following its Q4 2023 results and tell you where we’ll be looking for this laggard.

Q4 2023

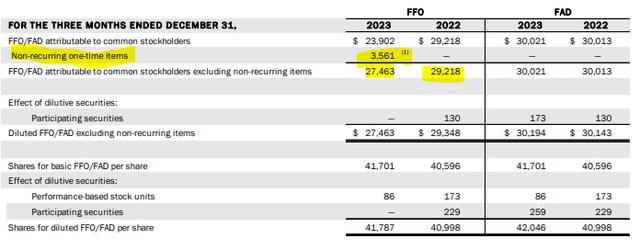

The fourth quarter of 2023 was one of the most active quarters for LTC in years. These include asset sales, new lease agreements and the transfer of property to a new operator. The net result is that funds from operations (FFO) were significantly lower than in the fourth quarter of 2022. Even excluding a sizeable $3.561 million write-off, this number is still low.

LTC Q4 2023 Demo

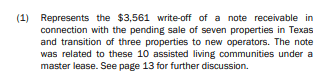

This relates to 10 properties that LTC had to move away from operators they deemed unworthy.

LTC Q4 2023 Demo

Full details of the capital transactions that occurred during the fourth quarter of 2023 can be seen in the 10-K, but the snapshot below shows just how busy things were.

LTC Q4 2023 Demo

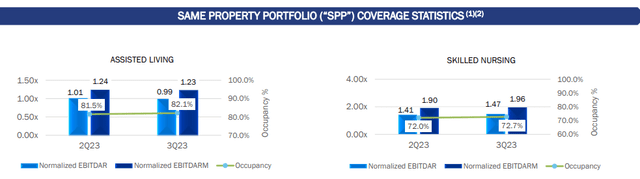

Through it all, LTC has made some progress on the key metric of rental coverage. Rent coverage here refers to the ability of tenants in the skilled nursing sector to pay rent.

LTC Q4 2023 Demo

Assisted living still looks poor, but since this is a trailing 12-month indicator, we expect improvement in the coming quarters as occupancy rates rise.

Appearance

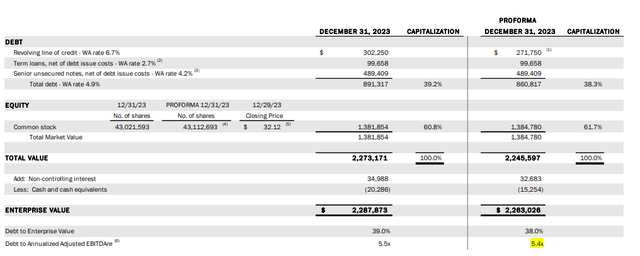

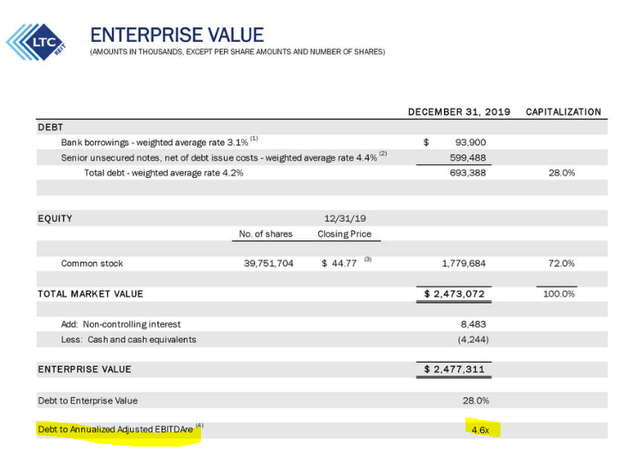

If you remember, in our last job, we were a little uncomfortable with the leverage of LTC. LTC seems to have read this and made an effort to write it down. There are a lot of shares being issued this quarter.

- Pursuant to the equity distribution agreement, 1,609,900 shares of LTC common stock were sold, resulting in net proceeds of US$52 million.

Source: Q4 2023 LTC Earnings Press Release

There’s also something beyond this season.

- Pursuant to the equity distribution agreement, 91,100 shares of common stock were sold, resulting in net proceeds of $2.9 million.

Source: Q4 2023 LTC Earnings Press Release

With asset sales completed in Q4 2023, LTC dropped to 5.4x.

LTC Q4 2023 Demo

This puts LTC in a better position to handle further stress in its portfolio.

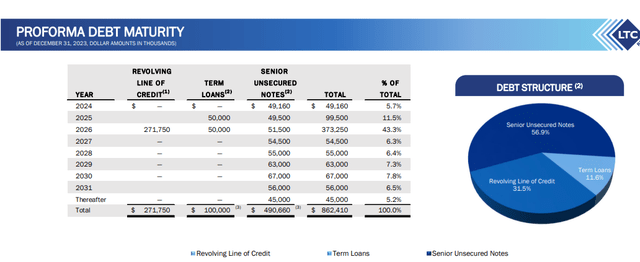

LTC Q4 2023 Demo

And the pressure is always there because most tenants have extremely low rent coverage. When these properties convert, rents fall and are difficult to recover to previous levels. Below we can see a brief discussion on the conference call about a property that has a rental price of $14 million and is expected to rise to $8 million. Rents will increase, but probably not back to levels close to $14 million.

Michael Carroll

So, how are these assets performing? I know they took over these, is it early 2023 when they take over? I guess how are they recovering since the surgery?

Clint Marin

That was 21 years after they took over. Occupancy rates have been fairly flat, but improving. Labor agency utilization declined. So cash flow has improved, but occupancy has been somewhat flat. So that’s really where the potential for growth is where we see it, growth in occupancy.

Michael Carroll

OK I know I mean, I guess the SEC contract rents are much higher. I mean, when you set a new rate, is it going to be closer to a $14 million, $15 million run rate? Or will it be closer to the $8 million run rate?

Clint Marin

Somewhere in the middle. I don’t think you go all the way back to 14 and 8.

Source: LTC Q4 2023 Press Release

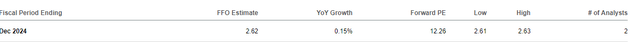

You can see this in the first-quarter 2024 guidance and analyst forecasts for 2024.

Seeking Alpha

In 2019, LTC’s annual growth rate was over $3.00. So 5 years later, despite having the lease escalator built in and net debt to EBITDA being higher, we’re still below that level.

LTC Q4 2023 Demo

Yes, the interest rates were higher, but LTC had many opportunities to go to fixed rates but didn’t. Therefore, you must be careful when assuming that you have a growing secure FFO stream. Currently, monthly dividends appear to be fully paid. 17 cents per month was still well below forecast FFO. Leverage has also been reduced and most of the risk transition has passed. Nursing home occupancy rates are rising. The construction drought coupled with an aging population should be a tailwind here. We think the dividend looks safe for at least 12 months and possibly longer. Stocks are still not very cheap. At about 12x FFO, you’re paying about the same as you would for Omega Healthcare Investors, Inc. (OHI) or NHI. Both indicators run lower leverage indicators and give you an investment grade indicator so you can take advantage of the credit markets when needed. We think you could pay up to about 10x FFO for this, and if we saw $27.00 per share, we’d consider buying it.

Please note that this is not financial advice. It looks like it, sounds like it, but surprisingly, it’s not. Investors should conduct their own due diligence and consult with professionals who understand their objectives and limitations.