Bloomberg/Bloomberg via Getty Images

Clear stock outlook

Sober Group Corporation (NASDAQ: LCID) makes for a pretty stunning vehicle. Unfortunately, the company was unable to mass-produce and sell the Lucid Air profitably.Despite high hopes and high estimates, Lucid only sold 6,001 units Last year 8,428 vehicles were produced.

The car company recently reported earnings, and the results were shocking. Lucid delivered only 1,734 vehicles in the fourth quarter and generated revenue of only $157.51 million, $24.25 million lower than expected and a 39% year-over-year decrease.

Now, when Lucid first came out, I was bullish on it. The electric vehicle industry is a hot new frontier. Tesla, Inc. (TSLA) makes it look easy for other companies like Lucid and Rivian Automotive, Inc. (RIVN) to repeat their success.

Unfortunately for Lucid, creating significant demand while increasing efficiency and building out infrastructure has proven more challenging. Economies of scale, enhanced competitive advantage, and more.

Lucid’s average price per vehicle “ASP” appeared to be around $90,836 in Q4 (via 8-K Calculation).While it’s competitive with Tesla’s Model S Base cost $88,500Consumers can get Tesla’s Model S Plaid, starting at just around $108,500.To get similar performance, we need to use the sapphire version of Lucid, which will disappoint you Approximately US$250,000.

So while Lucid built a great car, it produced too few, lacked compelling infrastructure, and simply couldn’t make a profit selling the cars. In fact, Lucid lost $425,000 on every vehicle sold last quarter.

I’ve been bearish on Lucid stock for almost a year, and I’m happy to exit my latest holding after suffering a slight loss. Unless concrete material and operational improvements are made, I won’t touch this stock.

Additionally, I continue to rate Lucid a Sell because it may soon become a penny stock due to its insane cash burn and need to constantly raise capital to fund endlessly expensive manufacturing operations. Lucid may even undergo a “reorganization” if Saudi Arabia’s PIF throws in the towel.

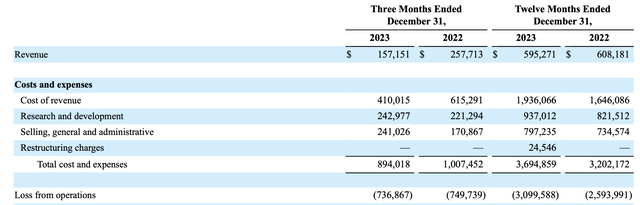

Have you seen these losses?

If you haven’t seen Lucid’s losses, their losses are staggering. Also, I want to stress that Lucid is not Tesla (in my book), and as a niche automaker, it’s questionable how long the company can sustain losses like this.

Lucid’s Operating Income Statement

Profit and Loss Statement (ir.lucidmotors.com)

Lucid’s revenue fell nearly 40% year over year, pointing to weak demand for its Lucid Air vehicles. The Lucid Gravity SUV is coming soon, but it might not make a huge impact. After all, the Gravity SUV might be as similar to the luxury electric SUV market as the AIR is to the luxury electric sedan market.

These are niche segments for Lucid, largely because of the fierce competition from the established players in the space, especially Tesla. Regardless, Lucid’s sales are declining while operating costs are rising.

Lucid’s selling, administrative and research and development costs were significantly higher than the same period last year. Furthermore, the only reason production costs fell was due to lower Lucid sales. Lucid’s operating losses were approximately $737 million in the fourth quarter and approximately $3.1 billion in 2023. Operating losses increased 19% year over year, which is a scary sign.

This dynamic suggests that Lucid isn’t becoming more efficient or profitable with time or scale. In fact, there’s really no scale to talk about given the ultra-soft demand for its cars.

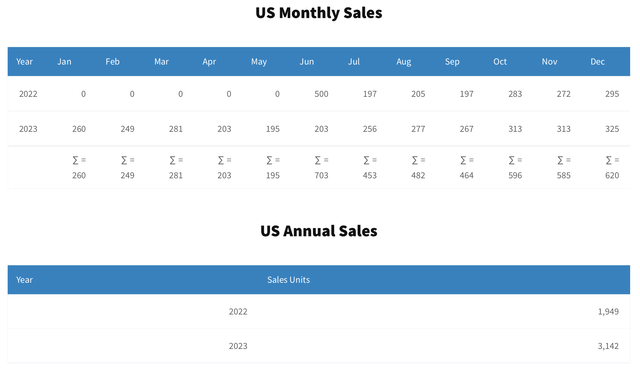

The Lucid Air is still a niche car

Sales in the United States (godcarbadcar.net)

The Lucid Air competes with the Tesla Model S and other 100% luxury electric sedans. However, when you can get such a huge performance upgrade (upgrading to the Model S Plaid) for $20,000, competing with Tesla is a challenge. It costs an extra $160,000 to upgrade to Lucid’s Sapphire add-on, which offers similar performance to the Plaid.

Tesla for sale thousands Monthly number of vehicles in the United States. Of course, Lucid will find it very challenging to compete with them. Tesla also has extensive supercharging, service and repair, and network programs. Lucid has a mobile service plan that brings a van to fix minor issues. However, I wonder how efficient and cost-effective this strategy would be for Lucid.

Don’t let Lucid’s annual sales growth fool you. Lucid Air deliveries will begin in June 2022. If we calculate sales in the last seven months of 2022 and 2023, Lucid’s sales fell 16.8% year-on-year to 1,949 and 1,641 units.

Gravity cannot save sanity

I’ve written before about why gravity may not save sobriety. It’s a handsome SUV, but it’s in the same position as the Air. Tesla’s Model X, Model Y and other premium full-size SUVs and crossovers dominate the market with high-quality electric vehicles. Lucid once again faces issues such as sufficient demand leading to increased production efficiency, economies of scale, and more.

Lucid has yet to prove it can make a profitable vehicle out of Air. In fact, Lucid’s operating losses appear to be as high as $425,000 per vehicle. What makes analysts believe Lucid’s Gravity SUV will do better? Instead, Lucid may encounter production bottlenecks, increased costs in ramping up capacity, and other factors that could exacerbate losses, further weakening Lucid’s already fragile financial position.

Bottom line: Why waste time and money on LCID?

I want to stay away from Lucid. There are better EV companies out there. My favorite is still Tesla (for many reasons). NIO has potential, but it faces some issues (similar to Lucid) and I’m losing patience with its stock. Still, NIO’s losses aren’t as severe as Lucid’s. Additionally, Nio continues to expand, selling more vehicles and increasing production. Sadly, I can’t say the same for Lucid. This stock is a very high risk investment here and is still a clear sell for me!