Aerial view of automotive company Magna’s powertrain production and engineering facilities

Photofex/iStock Editorial via Getty Images

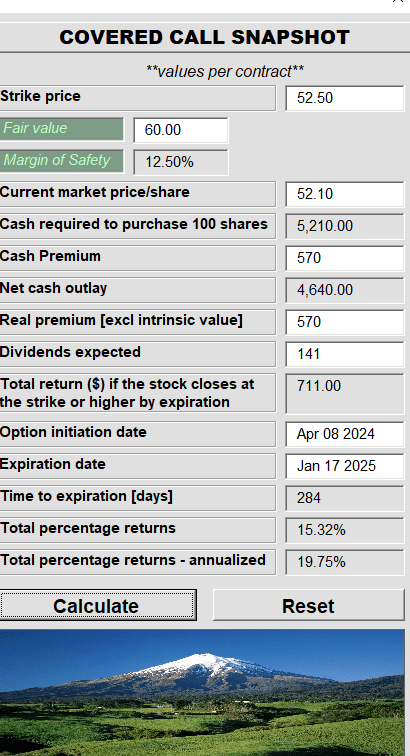

In our last coverage of Magna International (NYSE:MGA), (TSX:MG:CA) We are optimistic about the outlook. The risks facing the company weaken this outlook, and we suggest the best approach is through defensive covered calls.

this The main risks come from a prolonged UAW strike and a severe recession, with auto inventories remaining low and not building at all. A depressed valuation would provide some cushion, but in this scenario, MGA could trade as low as $40. As before, we maintain a Buy rating on Magna International, with the caveat that options continue to deliver superior risk-adjusted returns to date.

Source: You Still Have Some Advantages

It’s a “half-full” success story, as the stock has significantly underperformed the broader indexes, but the longer-dated covered calls will offset any losses.

Seeking Alpha

During this time, you’ve earned an average annualized return of 15% from the long-term calls, and they will completely eliminate the downside. Let’s take a look at why this stock has been such a disappointment and what the future looks like for this stock.

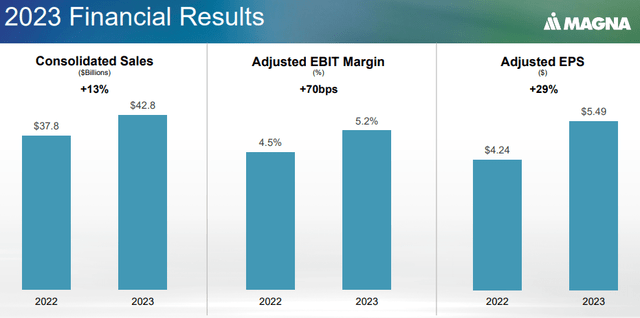

Miss Q4 2023

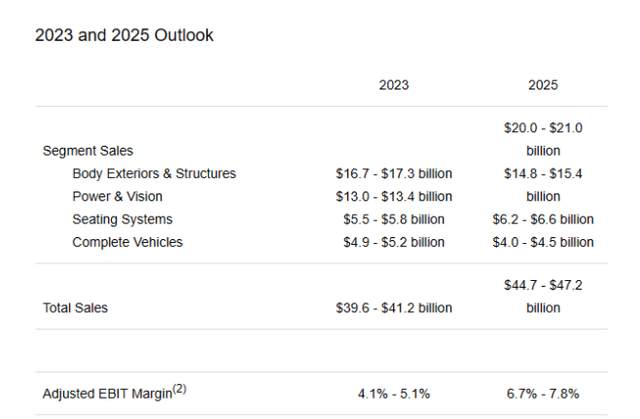

Magna continued a string of weak results in the fourth quarter of 2023. Adjusted EBITDA was $930 million, significantly below the consensus of nearly $965 million. While you can always blame analysts for being overly optimistic, that’s where Magna leads them. Even the change in earnings for 2023 isn’t impressive. Back in early 2023, the company projected full-year sales of up to $41.2 billion.

MGA 2023 Guide (from Q4 2022)

Final sales and adjusted EBITDA margin figures were higher.

MGA Q4 2023 Presentation

We saw improvements in all segments except complete vehicles.

MGA Q4 2023 Presentation

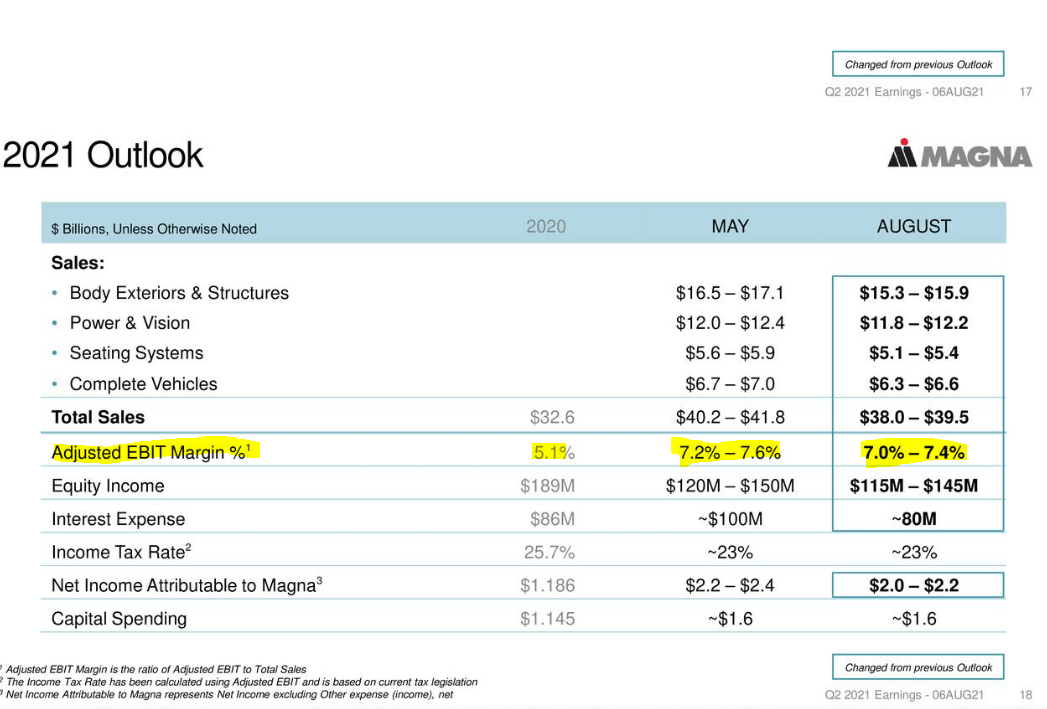

But those margins are still well below what the company needs. Back in 2021, MGA had sales of $40 billion and EBIT margins in the 7%-7.4% range.

MGA 2021 Q2 Presentation

So despite exceeding initial 2023 guidance, it’s frustrating that EBIT margins remain subdued.

The profit situation is not optimistic

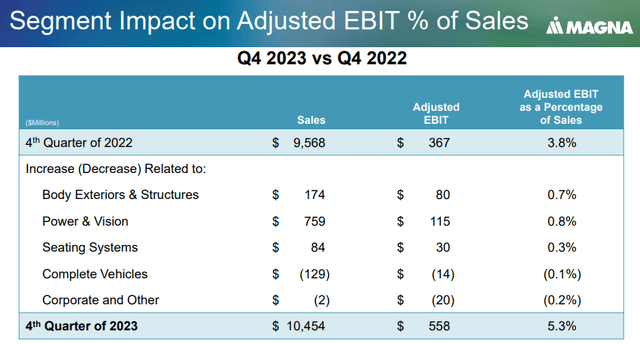

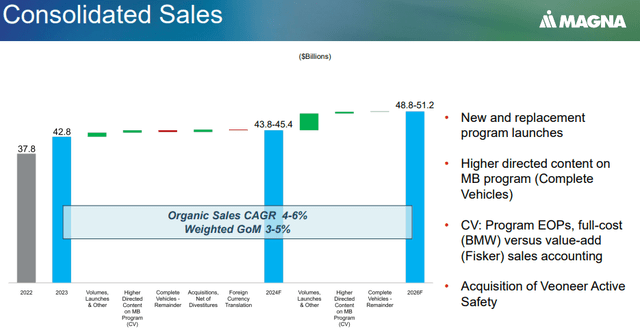

Well, that’s a thing of the past. So where does Magna go next? As usual, MGA’s guidance covers the year ahead and forecasts the next three years.

MGA Q4 2023 Presentation

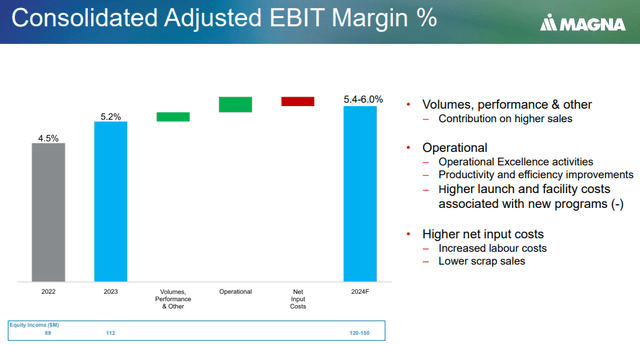

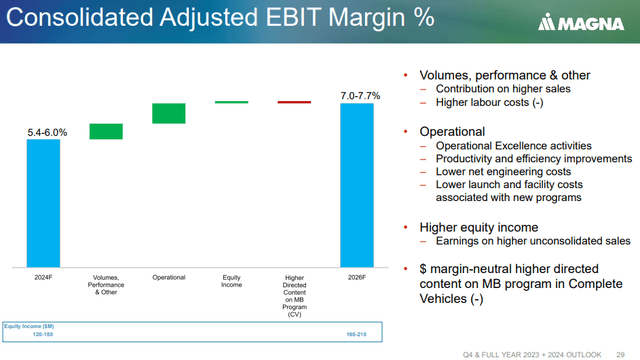

Sales growth is basically consistent with 2024, and there are no major surprises. Adjusted EBIT margins were the real reason the stock struggled on earnings day and thereafter. Improvement is there, and the 5.7% midpoint is heading in the right direction.

MGA Q4 2023 Presentation

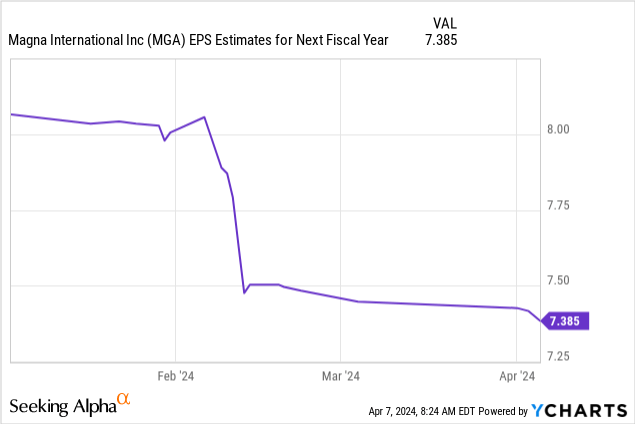

That’s still well below consensus. The analyst will usually take a ruler and draw as straight a line as possible. So if Magna sets their 2025 forecast at 7.2% (which they have done), then they are forecasting the mid-point number for 2024. That number is about 6.2%, with earnings per share expected to be $8.10. The midpoint of guidance was quickly lowered to $7.38.

Magna is still targeting EBIT margins above 7%. It’s just that that will happen later.

MGA Q4 2023 Presentation

Our outlook

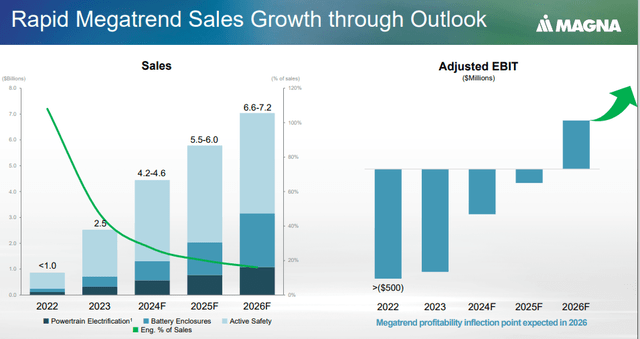

Magna’s disappointment comes primarily from the Megatrend sales area. While the segment is growing, it’s still well below expectations a year ago.

MGA Q4 2023 Presentation

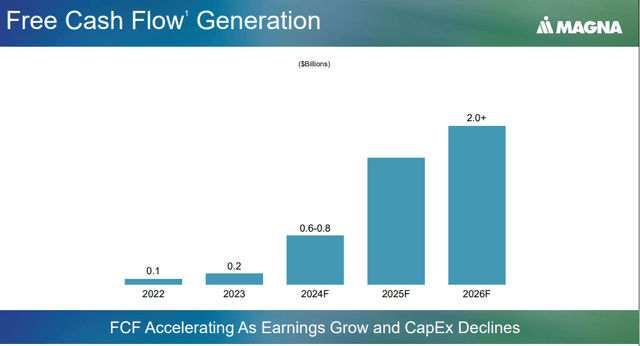

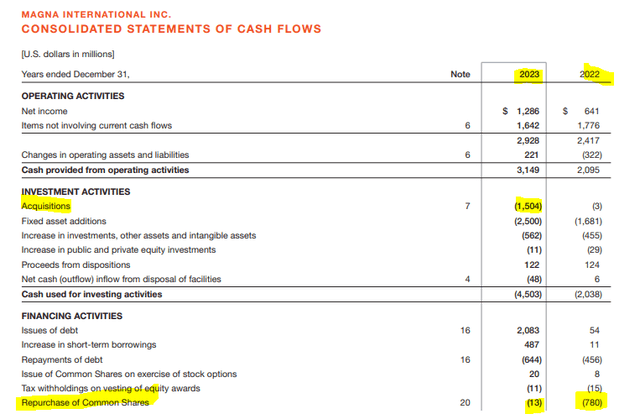

If you’ve been following electric vehicle news, you’re aware that there have been a lot of disappointments in the space as growth slowed. We also can’t ignore the fact that free cash flow generation has been pretty weak this cycle. From this perspective, 2022 and 2023 are terrible, with free cash flow not even enough to cover the dividend.

MGA Q4 2023 Presentation

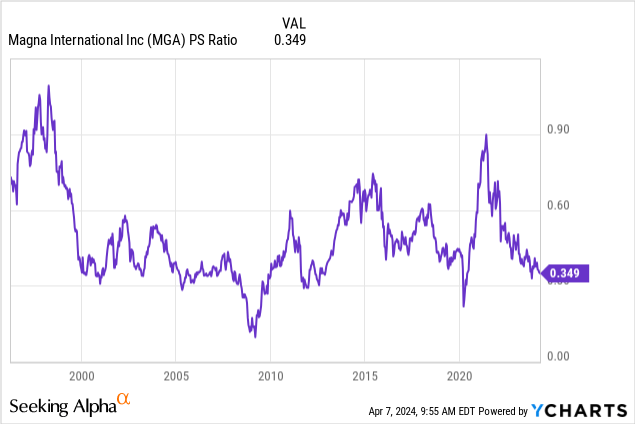

Even this free cash flow calculation doesn’t include areas where Magna has additionally splurged on acquisitions. Given the peak performance of the economic cycle, the stock price movement is not surprising. Still, the stock is fairly cheap and correctly reflects what’s happening. Our favorite Magna metric is the price-to-sales ratio. The beauty of this metric is that it won’t be fooled by low P/E ratios when margins are too high. This also leaves us in wait-and-see mode (see “Moving to wait-and-see time”), very close to peak. This ratio screams “buy” right now.

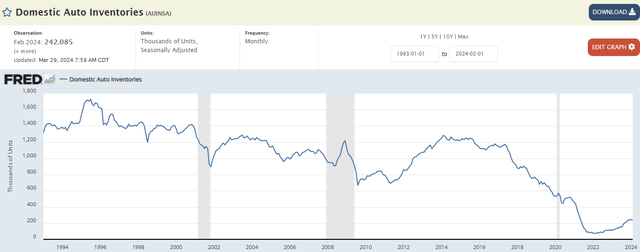

Yes, it could be lower, and in a recession, it could be even lower. But on the other hand, this is what our domestic auto inventory looks like.

fred

Again, these numbers could be lower, but on a population-adjusted basis, this is a very, very low number. If we built it at any time, Magna sales would really explode.

judgment

Magna’s Class A balance sheet is a key weapon in dealing with financial difficulties. To maintain this, it canceled the buyback after acquiring Veoneer AS.

MGA Finance

This disappointed investors. Earnings are also noticeably weaker, with modest improvement in 2024. It all also depends on a recession not happening in the near future. But this is when your long-term returns may be good. If you combine each entry with a longer-dated covered call, it seems you’d be hard-pressed not to make money in the long run. We will consider new job requirements issued in January 2025.

Author’s App

We rate the stock a Buy and would rate it a Strong Buy below $40.00.

Please note that this is not financial advice. It looks like it, sounds like it, but surprisingly, it’s not. Investors should conduct their own due diligence and consult with professionals who understand their objectives and limitations.