McKeven

Main Street Capital (NYSE: Main) appears to be one of Wall Street’s most coveted BDCs as the company has delivered consistent growth in net asset value per share over the life of the company.Even though Main Street has been raising dividends To shareholders, BDC appears overpriced, at a 58% premium to NAV… which I believe is an unattractive risk profile for dividend investors. BDC’s equity yields 8%, while Main Street’s core LMM portfolio generates a much higher weighted average debt yield of 13% in 2023. I believe the premium is still high, but the dividend is at least well protected!

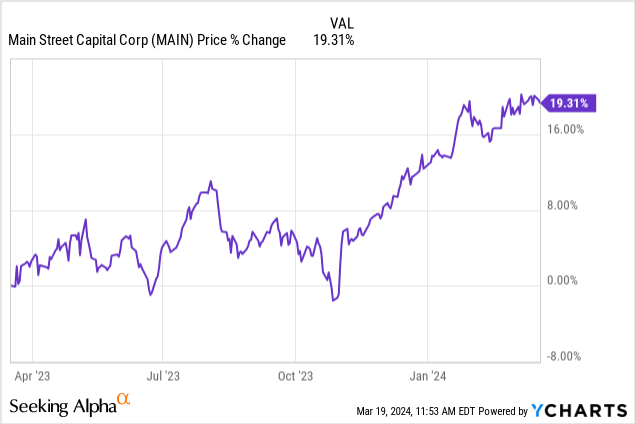

Previous rating

In May 2021, when I was working on Main Street, I had a Sell rating on BDC. However, Main Street shares have certainly performed well since then, with the price rising 19%.considering Main Street NAV has grown faster than other BDCs over the past three years, and I think an upgrade to Hold is justified.

Main Street’s fiscal 2023 revenue hits record high

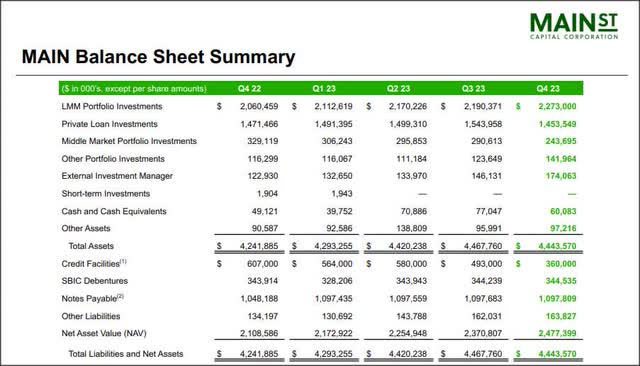

Main Street is a BDC with significant investments in (lower) mid-market lending. These loans, primarily made to companies with proven business models and predictable cash flows, have a total value of $2.27B as of the end of fiscal 2023, with investments worth $1.45B in complementary investments (private loans) and mid-market loans worth an additional An increase of $243.7 million. In fiscal 2023, BDC’s total fair value investments were calculated at $3.97B. Within its loan portfolio, Main Street has achieved weighted average debt yields ranging from 12.5% (private loans) to 13.0% in the lower middle market loan group.

Main Street Capital

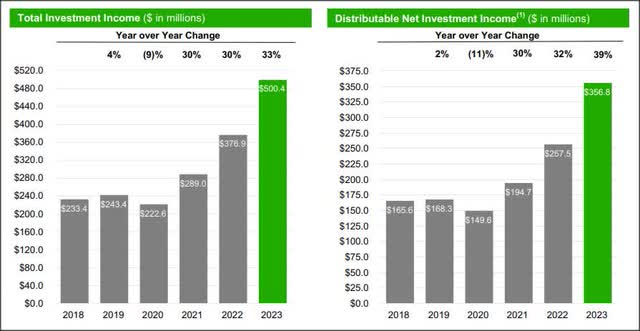

Main Street hit an all-time high in fiscal 2023, and BDC entered fiscal 2024 with considerable net investment income momentum. Last year, Main Street achieved record total investment income of $500.4 million, an annual increase of 33%. Main Street’s distributable net investment income also hit an all-time high of $356.8 million, an increase of 39% year over year, and this was the second consecutive year that distributable NII growth accelerated due to the strong recovery from the epidemic.

Main Street Capital

Distribution coverage analysis

Main Street has earned its reputation primarily for two things: 1) its ability to grow its monthly dividends, and 2) providing a safe dividend that can be paid in good and bad markets.

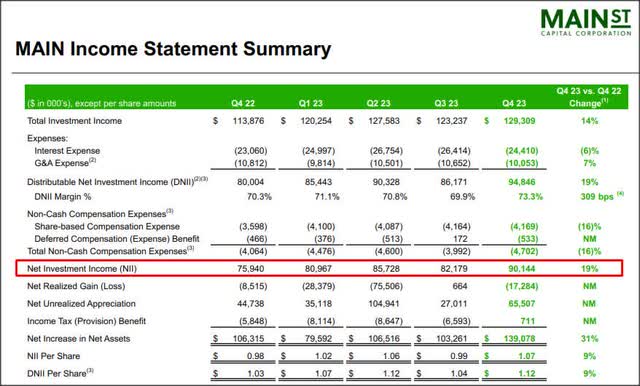

Main Street’s net investment income soared in fiscal 2023, in part due to a boost from the Federal Reserve’s tightening policy. Main Street’s NII earnings in Q4 2023 were $90.1 million (up 19% year over year) and earnings per share were $1.12 (up 9% year over year).

BDC paid a total of $3.695 per share last year, including four supplemental cash dividends of $0.95 per share. Main Street’s distribution coverage ratios for fiscal 2023, fiscal 2022 and fiscal 2021 are 1.17x, 1.17x and 1.10x, respectively, meaning that despite paying special cash dividends, the margin of dividend safety has been particularly limited over the past two years. improve. From an income perspective, I think Main Street offers a very safe 8% dividend (and BDC’s monthly dividend is growing), but I still have issues with Main Street being overvalued, which I don’t think is justified.

Main Street Capital

Net asset value growth is better than average

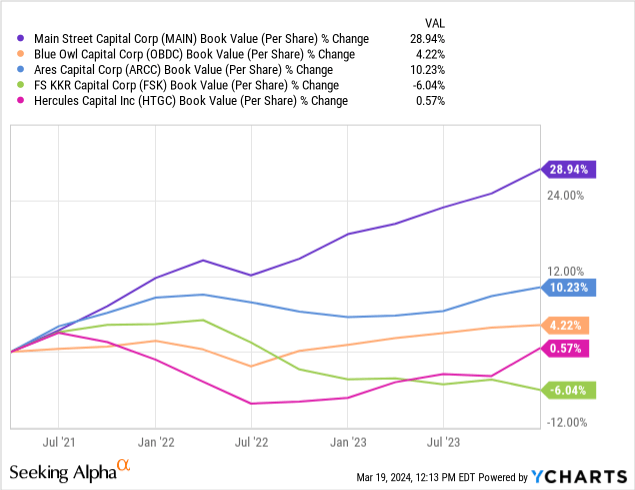

Main Street has the pricing for quality BDCs…and the NAV track record to support that pricing. While the dividend is fairly safe based on BDC’s net distributable investment income, I believe the company’s performance in terms of net asset value growth is respectable. In the past three years, Main Street’s net worth has grown the fastest, achieving a three-year net worth growth rate of 29%. Even Ares Capital (ARCC) and Hercules Capital (HTGC) have had much weaker net worth growth over this period…

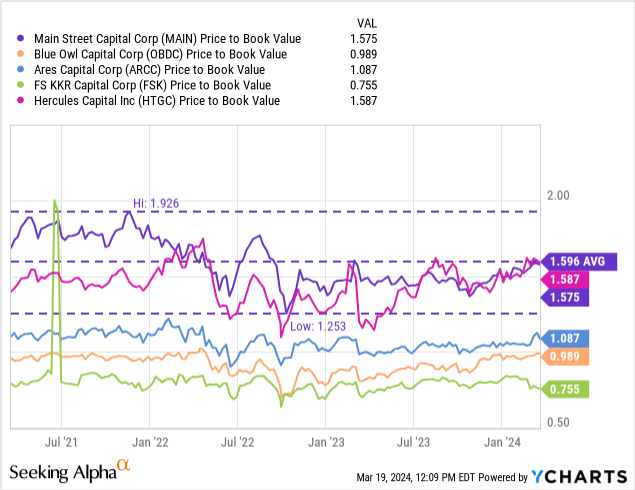

As a result of strong NAV growth, Main Street has one of the highest NAV premiums in the market: 58%. Only Hercules Capital is slightly more expensive than Main Street...I still have a favorable opinion of HTGC because management distributes a lot of cash to shareholders (quarterly standard + extraordinary), although the stock price is also expensive.

The result of the huge premium is that Main Street’s dividend yield is just 8%, while the loan portfolio yields 13%. I also think Main Street shares are fairly fairly valued given the 3-year average P/E/NAV ratio of 1.60x, and I think the upside for dividend investors is limited.

risk on the street

Main Street’s risk has less to do with BDC’s LMM loan portfolio and more to do with the company’s NAV premium. Dividend investors continue to pay a very high premium here, and Main Street may have a harder time defending its NAV premium once Main Street’s investment returns decline. However, the dividend is fairly safe, and as the distribution coverage analysis shows, BDC retains significant potential for increased distributions in the future.

final thoughts

Main Street generates durable dividend income from its lower-middle-market loan portfolio, but the premium to NAV is one of the highest in the market, suggesting dividend investors are fully pricing in BDC’s income potential. Yes, the dividend is well supported by distributable net investment income, and the company delivered record results in fiscal 2023, but the stock currently yields just 8%, while its portfolio of middle market investments yields Up to 13%. This yield difference can be explained by the premium investors place on BDC dividend streams. While Main Street is a solid revenue play, I’m still put off by BDC’s high valuation. However, I do recognize that over the past three years Main Street has generated stronger NAV growth than one of the largest BDCs in the market, so I upgrade Main Street to Hold!