Fin Tap

Not surprisingly, the FOMC left its target rate range unchanged at 5.25-5.5% and continued to let its securities bleed to maturity.

In support of the decision, the committee’s statement cited data showing: Job growth remains strong, the economy is expanding steadily, and inflation has slowed but remains above target.

At the press conference, Chairman Powell announced at the beginning of his prepared statement that the Committee remains committed to the twin goals of price stability and maximum employment and is firmly committed to its goal of reducing inflation to 2 percent.

Subsequent questions focused on what would make the committee more confident that inflation would reach 2%. Powell did not provide the specific details the questioner was seeking.

However, he said at a previous press conference The road to 2% can be bumpy, as the inflation data from the past two months have been. Therefore, more data and more time are needed.

What was a little surprising about this meeting was the new SEPs and how the forecasts changed in several ways. Real GDP growth is revised upward in all four forecast years, with real GDP growth in 2024 revised upward significantly from 1.4% in 2024 to 0.1 or 0.2 percentage points in 2025 and 2026.

The unemployment rates in both 2024 and 2026 are revised down by 0.1 percentage points. Finally, the personal consumption expenditure inflation rate is stable at 2.4% by the end of 2024, but the inflation rate for 2025 is raised and remains unchanged at 2% in 2026.

Finally, the median federal funds rate is stable at 4.6% in 2024, but will increase in both 2025 and 2026. Although the SEP still includes three rate cuts in 2024.

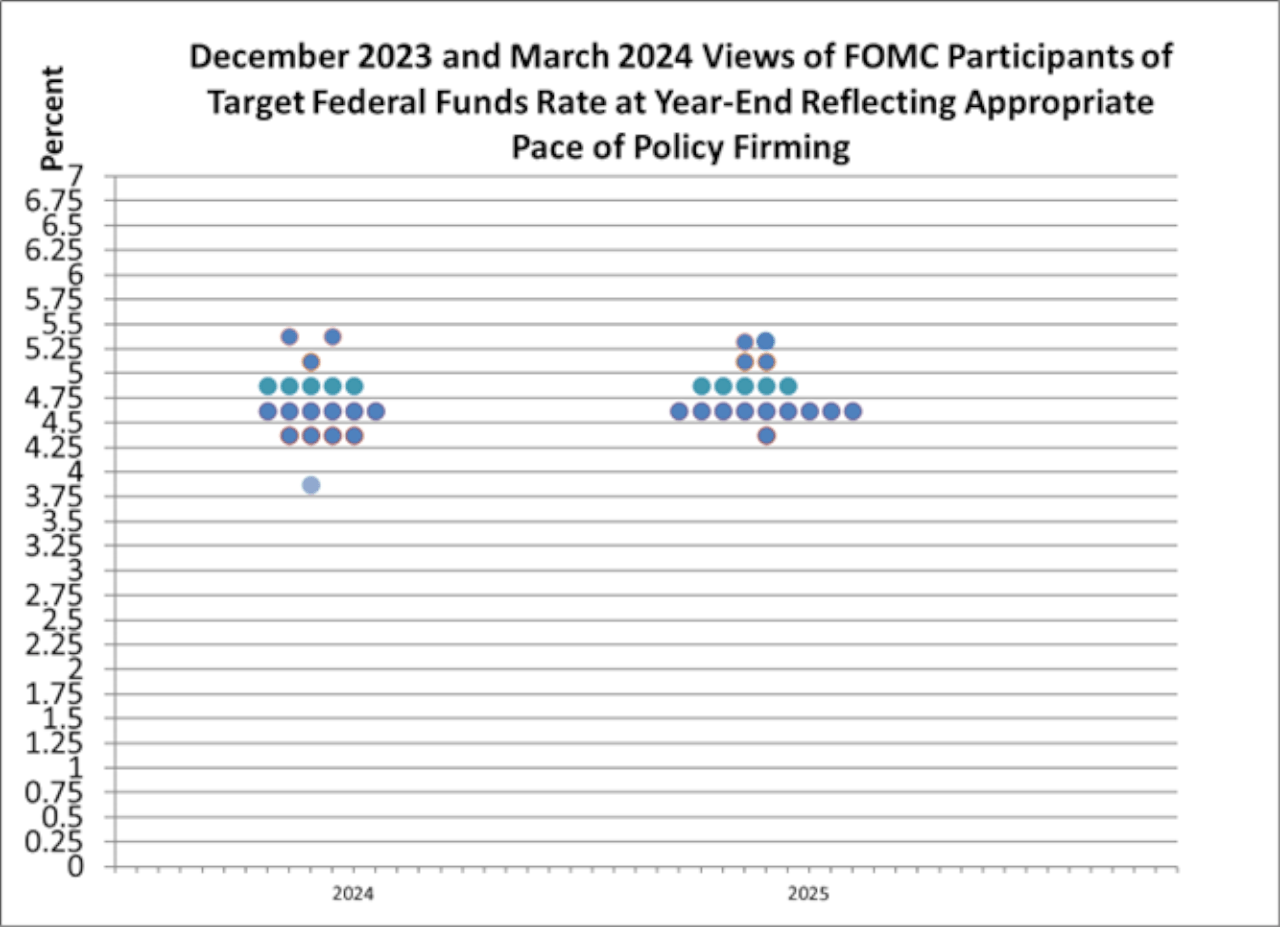

In addition, more participants agreed with this policy perspective. The dot plot below compares participants’ views on the appropriate policy rate in 2024 in the December and March SEP.

Six participants thought three cuts were appropriate, while this number increased to nine participants in March. In addition, four of the five participants who believed that the number of rate cuts should be more than three times changed their views and moved to three rate cuts in 2024.

So there appears to be a growing consensus on what interest rates should be at the end of December, but Chairman Powell made it clear that the path remains uncertain.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.