BlackJack3D/E+ via Getty Images

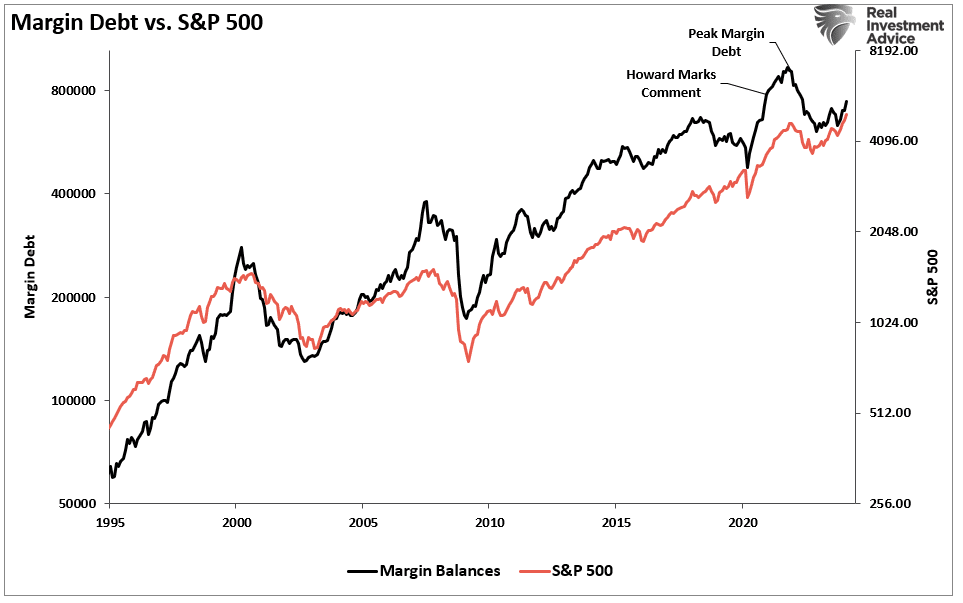

In the latest report from the Financial Industry Regulatory Authority (FINRA), margin debt levels are soaring as bullish investors take advantage of bets on the stock market.An increase in leverage is not surprising as it represents an increase in risk taking by investors stock market.

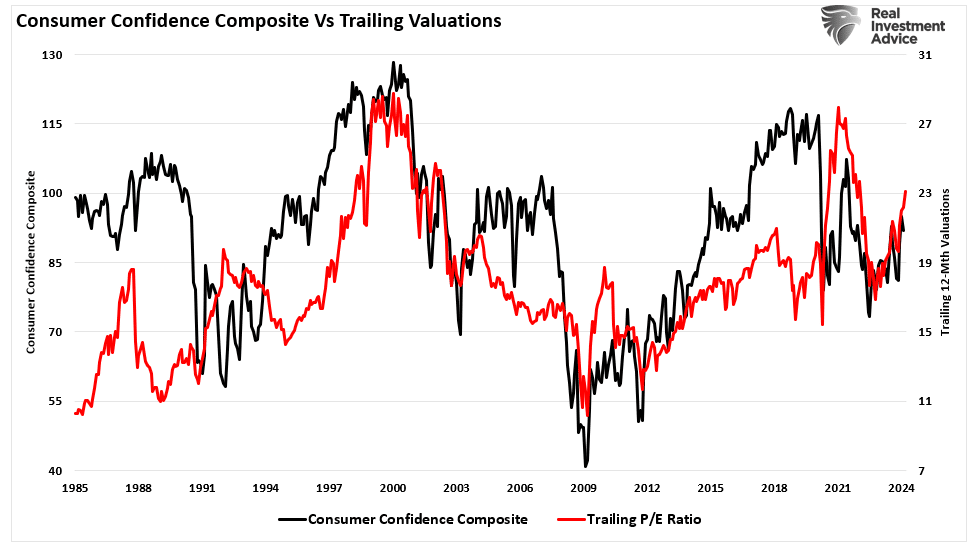

us Valuation was discussed beforeIn the short term, it reflects investor optimism. In other words, as prices rise, investors rationalize why paying more for current earnings is justified.

“Valuation indicators are indicators of current valuation. More importantly, when valuation indicators are too high, it is a better measure of “investor psychology” and a manifestation of the “fool theory.” As shown, there is a strong correlation between our composite consumer sentiment index and the S&P 500’s valuation over the past year. “

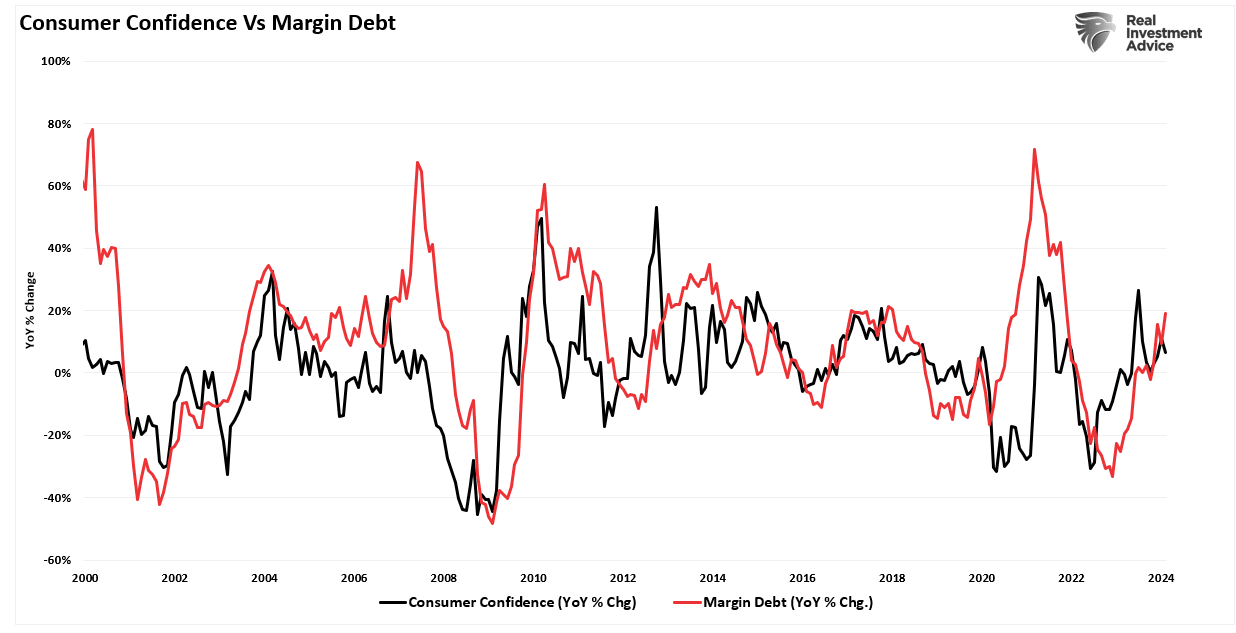

The same goes for margin debt. Not surprisingly, as consumer confidence grows, so does speculative demand for financial products. stock. As the stock market improves, the fear of missing out becomes more prevalent. This boosts demand for stocks, and as prices rise, investors take on more risk by adding leverage.

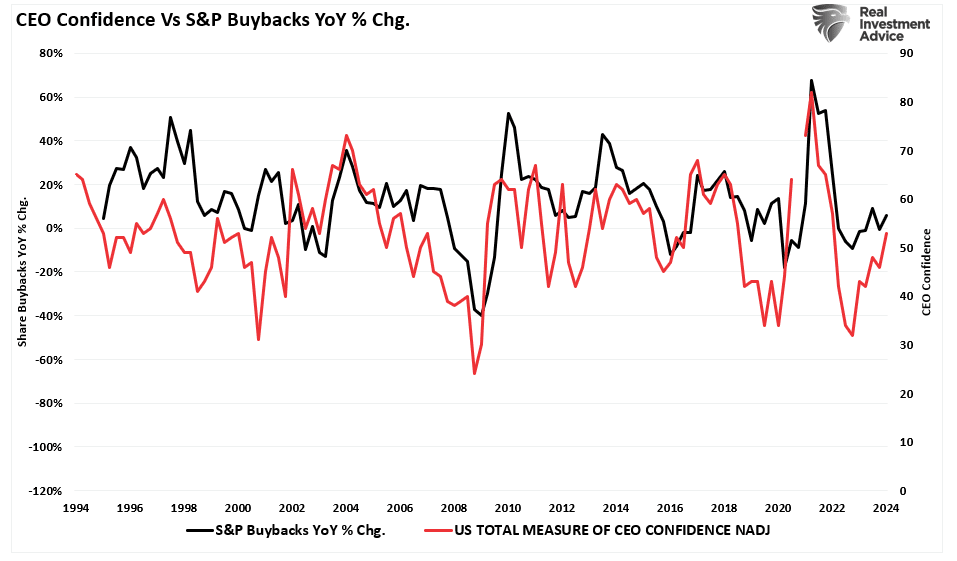

This boom has been fueled by increased demand for share buybacks, which have been a major source of share buybacks. “Buy” Since 2000. As CEO confidence improves (a byproduct of rising consumer confidence), they increase their demand for share buybacks. As buybacks push asset prices higher, investors increase leverage and increase risk exposure as a virtual spiral develops.

However, should investors be worried about rising margin debt?

a by-product of prosperity

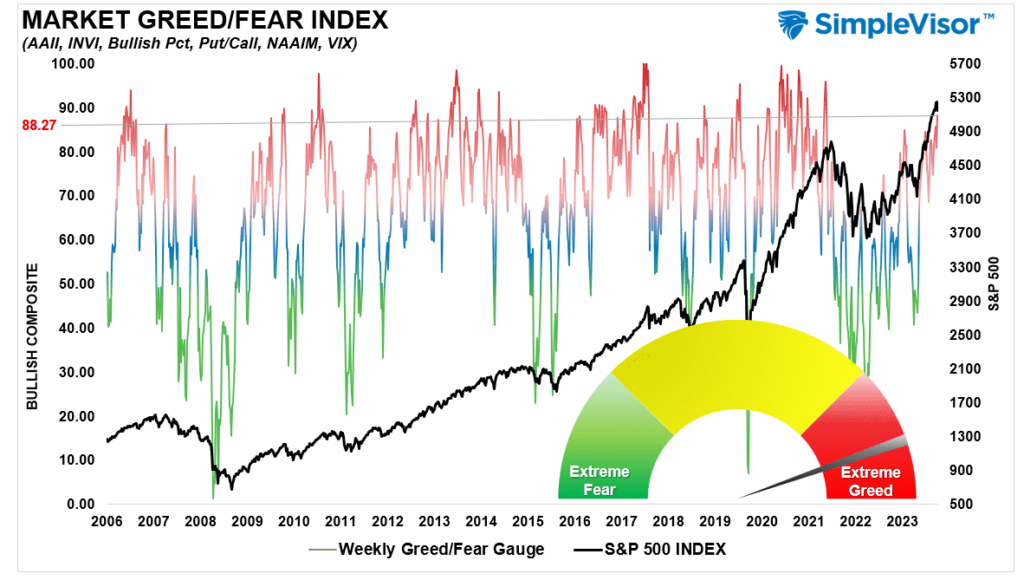

Before we dig any further into what margin debt tells us, let’s take a look at where we currently stand. There is clear evidence that investors are once again highly excited. The Fear Greed index below differs from CNN’s measure in that our model measures market positioning by the degree of stock risk faced by professional and retail investors.The exposure is currently at a level that is relevant to investors “All in” Equity “pool.”

As Howard Marks noted in a December 2020 report Bloomberg interview:

“The fear of missing out has replaced the fear of losing money. If people have risk tolerance and fear of being squeezed out of the market, They will actively buy, in which case you won’t find any bargains. This is where we are now.This is what the Fed is going to do by cutting interest rates to zero…We are back to where we were a year ago – uncertainty, expected returns are even lower than a year ago, and asset prices are higher than a year ago. People again have to take more risks to reap the rewards. At Oaktree, we are back to a cautious approach. This is not the kind of environment where you’re going to buy with your hands.

All have low expected returns. “

Of course, in 2021, the market continues to move higher with low volatility as investors increase margin debt levels in pursuit of higher stocks. However, this is a critical point with margin debt.

Margin debt is not a technical indicator of the trading market. It represents the amount of speculative activity taking place in the market.In other words, margin debt is “gasoline,” Because leverage provides additional purchasing power for an asset, it drives the market higher. However, leverage can also have the opposite effect, by providing an accelerator for a larger drawdown when lenders “force” assets to be sold to cover credit lines without regard to the borrower’s situation.

The last sentence is the most important. The problem with margin debt is that the release of leverage is not at the discretion of the investor. This process is at the discretion of the broker-dealer who initially extended the leverage. (In other words, if you don’t sell assets to cover it, the broker-dealer will do it for you.) When lenders worry they may not be able to collect on the line of credit, they force borrowers to put up more cash or sell assets to cover it. debt.The issue is “Margin Call” Often they occur simultaneously, as asset price declines affect all lenders at the same time.

Margin debt isn’t a problem—until it is.

As it turns out, Howard was right in the end. In 2022, the decline wiped out all of last year’s gains and then some.

So, where are we currently?

Margin debt confirms boom

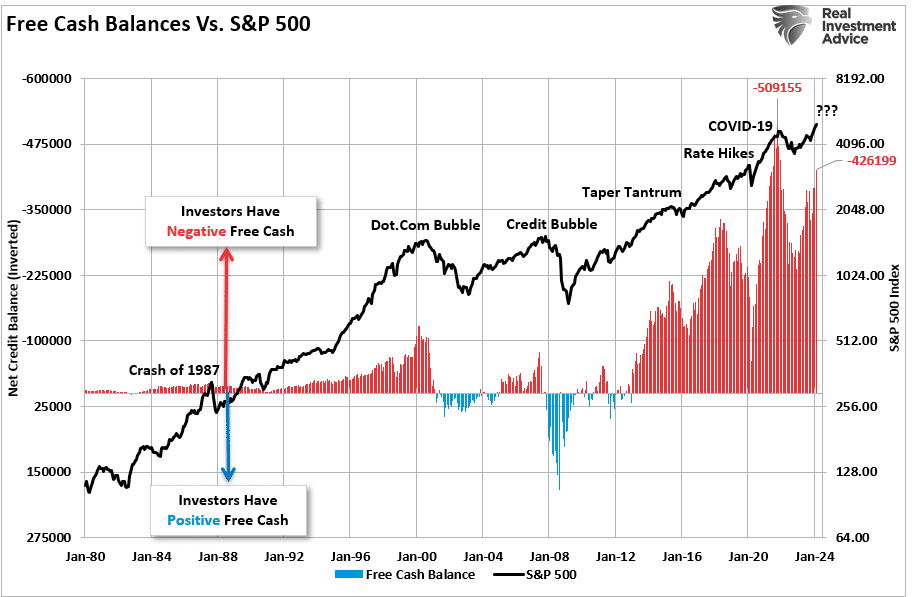

As mentioned earlier, when markets rise and investors use additional leverage to increase purchasing power, margin debt supports the rise. So it’s no surprise that margin debt has risen recently as investor enthusiasm rises. This graph shows the relationship between cash balances and the market. I invert the free cash balance so it better reflects the relationship between margin debt increases and the market. (Free cash balance is the margin balance minus the difference between the cash in the margin account and the credit balance.)

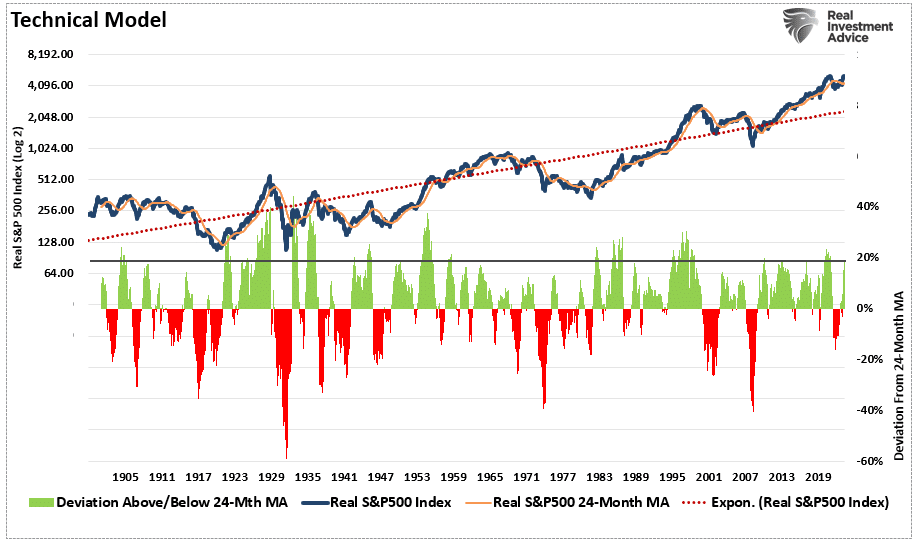

Please note that during the 1987 revision period, 2015-2016″Brexit/taper scare” 2018″Rate hike error” and”COVID-19 down,” The market never broke its uptrend and cash balances never turned positive. Uptrend breakouts and free cash balances were hallmarks of the 2000 and 2008 bear markets.With negative cash balances not yet at record highs, the next recession could be another one “correct.” However, if or when the long-term bullish trend is broken, unwinding of margin debt will increase “Add fuel to the fire.”

While the immediate reaction to this analysis is, “But Lance, the margin debt isn’t as high as it used to be,” There are many differences between today and 2021.Lack of stimulus payments, zero interest rates and $120 billion a month “Quantitative easing” Just a few of them. However, there are some clear similarities, including a surge in negative cash balances and extreme deviations in long-term means.

In the short term, prosperity is contagious. The more the market rebounds, the more risk investors are willing to take. The problem with margin debt is that when an event eventually occurs, it creates a rush to liquidate holdings.Since margin debt is a function of the value of the underlying asset “collateral”, A forced sale of an asset will reduce the value of the collateral. The drop in value then triggers further margin calls, triggering more selling, forcing more margin calls, and so on.

Margin debt levels, like valuations, cannot be used as a market timing tool. However, they are a valuable indicator of market prosperity.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.