Bhim

Martin Marietta Materials Inc.’s stock (New York Stock Exchange: MLM) is just 1.7% below the all-time high set on March 7th2024.

Martin Marietta has been on a roll lately, with the stock up more than 21% year to date and nearly 80% higher than last year Twelve months.

The company’s most recent earnings results showed strong revenue growth and earnings per share that beat analysts’ expectations. That, coupled with recent acquisitions and other potential catalysts, has pushed the stock to new highs. Martin Marietta also has a solid dividend growth record, but are these factors enough to justify the valuation?

Company background and recent profit results

Martin Marietta is a construction materials company that supplies materials used in construction and infrastructure products. Some of the company’s leading products include aggregate, asphalt, cement, concrete and paving materials.In total, Martin Marietta has nearly 350 quarries and distribution sites 28 different states in the United States. The company also operates in Canada and the Bahamas.

Martin Marietta report Announcement of fourth quarter and full-year profit results for 2023 on February 12th, 2024. Revenue rose nearly 9% to $1.61 billion, although that was slightly below market expectations. On the other hand, earnings per share soared to $4.63 from $3.01 the year before. This was also $0.61 ahead of expectations.

Growth was also seen throughout the year, with revenue rising 10% to $6.2 billion in 2023 and earnings per share of $19.32, which compared favorably with 2022’s $13.70.

Fourth-quarter sales did decline 2% annually, but that was offset by pricing actions implemented early and mid-year last year. As a result, most businesses within the company were helped by mid- to double-digit price increases. For example, the increase in the price of aggregates, which is the largest component of the company’s business, increased performance by 15%. The second largest business, cement, pricing behavior contributed nearly 17%.

As you might expect, pricing has a huge impact on Martin Marietta’s bottom line. Total gross profit increased by 36.8% this quarter, and gross profit margin expanded by 650 basis points to 32.2%. Cement gross profit increased by 46%, and gross profit margin surged 1,450 basis points to 52.8%.

Affected by this, the company’s gross profit margin increased significantly. Gross profit margins in the fourth quarter and full year were 30.1% and 29.8% respectively, compared with 24% and 23.1% in the same period last year.

Reasons for continued optimism

Martin Marietta’s results are particularly impressive given the slowdown in home sales caused by rising interest rates. The company mentioned on the conference call that the housing market slowed this quarter, resulting in reduced demand for its products.

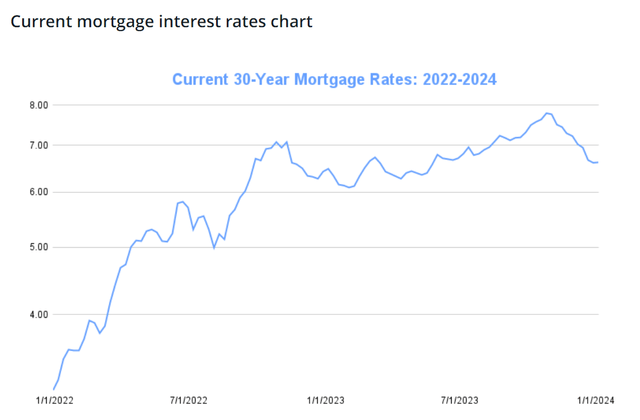

That’s not surprising, as mortgage rates have climbed steadily over the past two years, which coincides with the Federal Reserve raising interest rates.

mortgage report

However, the chart above shows that mortgage rates have fallen from their recent peak of nearly 8% as the Federal Reserve paused interest rate increases. If the Fed begins cutting interest rates at some point this year, as expected, mortgage rates could fall further, which could make housing more affordable.

It’s clear from Martin Marietta’s fourth-quarter profit results that customers are willing to endure higher costs for materials like aggregate and cement, even as housing becomes more expensive. Lower mortgage rates could trigger higher demand for homes, which in turn could drive up demand for building materials. Falling mortgage rates will be a real catalyst for Martin Marietta’s business.

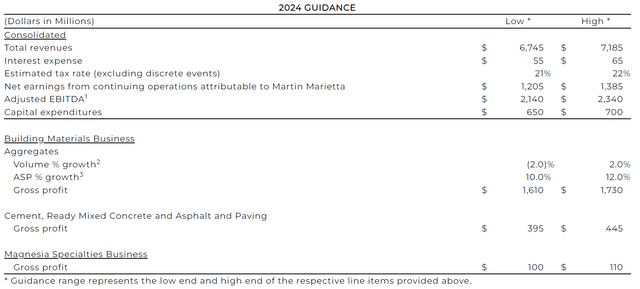

This expectation appears to be baked into Martin Marietta’s 2024 guidance.

Martin Marietta’s Q4 Earnings Report

Revenue this year is expected to grow by 9% to 16%, and gross profit is expected to grow by 4% to 13%. The market also believes that last year’s momentum will continue into 2024. Analysts expect the company’s earnings this year to reach $21.25, a 10% increase from last year.

Much of this growth is expected to come from price increases, as they did last year. For example, the overall average selling price is expected to increase by 10% to 12%, and sales volume may decrease by 2% to increase by 2%.

Generating record revenue and gross profit isn’t easy, but Martin Marietta expects 2024 to be even better for the company. This will be achieved through the company’s various catalysts.

First, the company’s bullish case is limited competition in key markets, such as the overall market. Only a few companies have greater market capitalization or annual revenue than Martin Marietta. This makes the number of potential partners small for customers, which allows the company to increase product pricing but slightly reduce sales. It’s also a good illustration of Martin Marietta’s ability to see revenue and profits grow at a higher rate if demand for its products picks up.

The company is keen on making acquisitions that make sense for the business. For example, Martin Marietta’s $2.7 billion acquisition of Texas Industries in 2014 was the company’s first major entry point into the state.Most recently, Martin Marietta report The company has agreed to partner with Blue Water Industries for just over $2 billion. The deal will significantly increase the company’s total reserves. At current extraction rates, Martin Marietta has more than 70 years of reserves, which will provide the company with a long runway for growth.

Finally, Martin Marietta should benefit from a higher Department of Transportation budget. The $1.2 trillion infrastructure investment and jobs bill and state and local investments will be a major source of revenue and profits for Martin Marietta and his group of peers. Department of Transportation budgets in the company’s top 10 states will grow an average of 10% through 2023. Among them, Minnesota grew by 38%, Texas grew by 24%, and North Carolina grew by 11%. Martin Marietta will benefit from the amount of capital available to infrastructure-related companies as more projects are approved and funded, which will further enhance the company’s ability to grow.

In short, Martin Marietta has several possible catalysts that could help the company build on its record-setting 2023 for another year of strong growth.

Dividend and Valuation Analysis

Martin Marietta has a strong track record of raising dividends. Following the acquisition of Texas Industrial, the dividend increased at a moderate pace after several years of stagnant growth.

The company’s dividends have grown for nine consecutive years, with a compound annual dividend growth rate of nearly 7% during this period. Last year, the company’s dividend grew by more than 12%, bucking a long-term trend of mid-single-digit growth. Dividends have remained constant or increased for nearly three decades.

The stock currently has a low yield of 0.5%, but its expected dividend payout rate in 2024 is only 14%. That would be the lowest payout ratio in more than a decade, meaning the dividend is not only safe but expected to grow over the next few years.

There is no doubt in my mind that the company’s profile and potential upside are impressive. Income investors can appreciate dividend safety even if they can’t see the yield. If there’s a problem with Martin Marietta, it’s the stock’s valuation, as the market seems very aware of the positives in favor of the company.

I prefer to use a range when determining a target valuation for a stock because this helps incorporate a variety of potential outcomes, both positive and negative.

Currently, the stock’s expected 2024 price-to-earnings ratio is 28.5 times, which is higher than the five-year average price-to-earnings ratio of 28.3. Over the past decade, Martin Marietta stock has had an average price-to-earnings ratio of 30.3. The difference between the two averages is relatively close.

Another factor to consider is competitor valuations. Martin Marietta’s peer group has a median P/E of just 16.4 times. Clearly, the market prefers the stock to those of the company’s competitors.

I do find Martin Marietta’s tailwinds worthy of the premium valuation. That said, I think a target valuation using an average mid- to long-term multiple is appropriate to help establish a range.

My target P/E range for Martin Marietta is 26 to 30, taking into account recent performance, positive factors for the company, and historical valuation. According to estimates, the target price range is $553 to $638. At current prices, the potential return is just 5.4%. The dividend yield will keep total returns below 6%.

While I’m bullish on the company’s prospects, I believe a greater margin of safety would make for a better investment in Martin Marietta and would like to add the company’s name closer to the lower end of my valuation target range.

Investment Thesis Risks

In addition to higher valuations, there are some risks investors should be aware of before buying the stock.

I think the biggest risk to my investment thesis is interest rates. Despite market sentiment to the contrary, there is no guarantee that the Fed will lower interest rates. From January to February, the consumer price index rose 0.4% from the previous month and 3.2% from the previous year. Although the month-on-month growth was expected, the annual growth rate was slightly higher than the market consensus of 3.1%.

This higher-than-expected inflation reading could mean an even longer pause in interest rates than expected. If inflation figures are higher in the coming months, a rate hike could be on the agenda again. That could mean higher mortgage rates, further slowing housing demand and eliminating one of the pillars of the stock’s overall investment thesis.

final thoughts

There were several positives that made me interested in Martin Marietta. The company posted record quarterly and full-year results despite a slowdown in the real estate market that led to lower sales across most product categories. Higher prices have led to impressive profit growth, and the company expects another record high in 2024.

Martin Marietta has several tailwinds that could lead to growth in the coming years, including a strong presence in a growing market, acquisitions, potentially lower interest rates driving demand for housing and higher federal, state and local governments infrastructure spending.

That said, the company’s shares appear to be fully valued relative to its own history and very expensive relative to its peers. Dividend growth is strong, but the low yield doesn’t make up for the valuation. Therefore, I am waiting for a better entry point before purchasing Martin Marietta.