D. Lentz/iStock via Getty Images

Martin Midstream Partners (NASDAQ:MMLP) is currently expecting 2024 results Adjusted EBITDA is fairly similar to 2023 results. 2023 results slightly better than expected, Adjusted EBITDA Several million ahead of full-year guidance.

Overall, I think Martin’s results and 2024 guidance are largely in line with my previous expectations. Martin expects 2024 to be more of an investment year, with approximately $17 million in growth capital expenditures related to its Electronic Grade Sulfuric Acid (ELSA) facility Joint ventureand the benefits of the joint venture will be largely realized starting in 2025.

Martin Issuance of Form K-1 and may maintain limited quarterly distributions of $0.005 per unit during 2024.However, it is likely to increase allocations in 2025, which could Becoming a catalyst for a significant increase in its unit price. I believe Martin will be worth about $4.35 per unit by the end of 2025 (slightly lower than my previous estimate due to recent spending). At that time, Martin should be able to increase its quarterly distribution to $0.125 to $0.15 per unit.

Although Martin has been reducing debt and recently received an issuer credit rating upgrade from S&P, Martin’s units remain risky due to high leverage (3.75x at end-2023). There may also be limited investor interest in its units before quarterly distributions are increased, and I don’t expect that to happen until the second half of 2025.

Fourth Quarter 2023 Results

Martin’s performance in 2023 was relatively strong, with adjusted EBITDA of $29.2 million in the fourth quarter of 2023. This puts it approximately $2.5 million above full-year adjusted EBITDA guidance. Martin achieved its adjusted leverage target of 3.75x at the end of 2023, a significant improvement from the 4.53x adjusted leverage at the end of 2022.

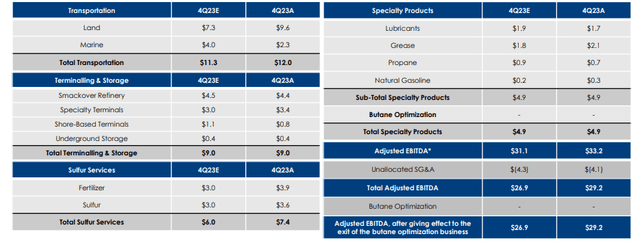

Martin’s land transportation business performed better than expected as it cited a recovery in its long-haul loads. However, Martin’s shipping business was hit by an additional $1.1 million in insurance costs due to overall shipping industry issues. Martin’s sulfur services business also performed relatively well, with adjusted EBITDA expectations for the quarter exceeding $1.4 million.

Martin’s fourth quarter 2023 results (mmlp.com (Fourth Quarter 2023 Financial Report))

Martin also has net debt of $442 million at the end of 2023, slightly better than my estimate of $445 million to $450 million in net debt at the end of 2023.

Outlook 2024

Martin provided 2024 guidance of $116.1 million in adjusted EBITDA. This is roughly the same as 2023 Adjusted EBITDA after exiting the butane optimization business (-1% lower).

Martin also plans to spend $32 million in maintenance capital expenditures and $17.4 million in growth capital expenditures. Martin’s 2024 interest costs are likely to be about $50 million, and 2024 free cash flow is expected to be a little over $13 million. Martin’s quarterly distributions are expected to remain at $0.005 per unit, with annual distributions totaling less than $1 million.

As a result, Martin expects net debt to reach approximately $430 million by the end of 2024, with a leverage ratio of 3.7x.

I had expected Martin to generate over $20 million in free cash flow in 2024, so its 2024 free cash flow guidance was slightly lower than expected. This is due to an increase in the capex budget, as Martin’s adjusted 2024 EBITDA guidance is in line with my expectations.

Martin’s maintenance capital expenditures are budgeted at $32 million in 2024, up from $24 million in maintenance capital expenditures in 2023. Martin said the Smackover refinery turnaround, budgeted at $4.8 million, occurs every two years and is scheduled for 2024. Martin’s ship equipment will also have a higher than typical proportion of dry dock inspections in 2024 due to timing reasons.

Potential outlook for 2025

Martin’s free cash flow results in 2025 should be significantly better than in 2024 due to a number of factors. The ELSA plant joint venture is expected to start contributing to Martin’s results in the fourth quarter of 2024, with full-year contributions expected to benefit in 2025.

Additionally, there should not be any growth capex associated with the project in 2025, while maintenance capex in 2025 should fall back to around $20 million. Therefore, I could see Martin generating around $40 million to $45 million in free cash flow before distributions in 2025, allowing it to provide a more substantial distribution. That’s assuming there are no major growth projects in Martin’s 2025 capital expenditure budget.

Estimate Valuation

I previously noted that Martin is valued at approximately $4.50 per unit based on an EV of 5.0x 2025 adjusted EBITDA multiple and $425 million in end-2024 net debt.

My forecast for Martin’s 2025 Adjusted EBITDA remains unchanged. However, Martin’s net debt is currently expected to be $430 million by the end of 2024 (due to an increase in the capex budget), so I trimmed its estimate by that multiple to $4.35 per unit.

In order for Martin’s unit price to truly reach this level, it will likely need to increase its distribution. By February 2025, Martin should have paid off the credit line debt in full. I could then envision it paying quarterly distributions of around $0.125 to $0.15 per unit, which would result in a yield of 11.5% to 13.8% at $4.35 per unit. Martin currently yields less than 1%, and its minimal distribution means its unit price remains relatively low.

risk

Martin Midstream’s main risk is debt. For years, Martin has struggled with high leverage, which resulted in an 11.5% interest rate on its second-lien notes. However, Martin has made progress in reducing debt, and its adjusted leverage at 3.75x at the end of 2023 appears to be its lowest year-end leverage in more than a decade.Martin’s improved debt profile also led S&P to upgrade its issuer credit rating from B to B Its 11.5% second lien notes due 2028 trade above face value 1 dollar to 106 cents recent.

However, while Martin’s current financial position has improved, it still has significant net debt and is vulnerable to a significant slowdown in business conditions. A 10% decline in adjusted EBITDA would put its adjusted leverage above 4.0x again, and its free cash flow would be minimal in a year like 2024, when both maintenance and growth capex are higher than typical amounts. S&P noted that fee-based contracts now account for about 70% of Martin’s EBITDA, so its results should be less volatile now than when it was still involved in the butane optimization business.

Another major risk for Martin is that investors will have little appetite for MLPs that currently yield less than 1%. martin is paying The quarterly distribution was $0.50 in early 2019, then cut to $0.25, then again to $0.0625 per unit in 2020, and finally to $0.005 per unit in the second half of 2020.

It’s uncertain when Martin will increase its distribution, and it’s unlikely that Martin will come close to realizing the potential upside I forecast for it until it significantly increases distribution. As mentioned, I think Martin will likely pay quarterly distributions of $0.125 to $0.15 per unit starting in late 2025, but the timeline for increasing distributions may be later than that.

in conclusion

Martin Midstream’s 2023 results ended up being solid and it hit its adjusted leverage target of 3.75x. Martin’s investment in growth projects at its ELSA facility and higher than typical maintenance capex in 2024 means its deleveraging will likely slow in 2024.

As a result, Martin is unlikely to increase its distributions in 2024, but the outlook for 2025 should be much better and looks capable of generating over $1 per unit in distributable cash flow in 2025.

I now expect that distribution volumes may increase in the second half of 2025, which may be able to support a value of around $4.35 per unit. However, Martin is unlikely to reach that price unless it significantly increases its quarterly distribution from the current $0.005 per unit.