big country

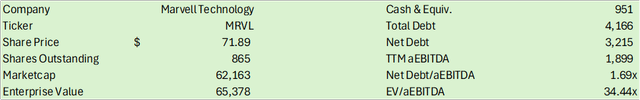

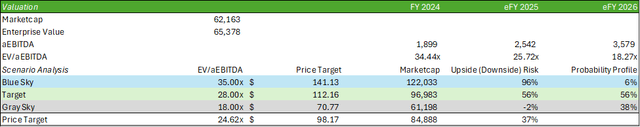

Marvell Technologies (NASDAQ: MRVL) experienced a tale of two cities in its Q4 ’24 earnings report, with the ship starting to grow as enterprise networks, carrier infrastructure, consumer and automotive/industrial took a hit.As AI infrastructure is further adopted at the enterprise data center and hyperscale enterprise levels, we It is believed that Marvell will achieve sustained advantages in its data center field and experience the opportunity to develop market share in the hyperscale field through the launch of 3nm chips in eFY26. With enterprise networks expected to resume growth in the second half of fiscal 2025, I expect revenue to grow significantly in fiscal 2025, margins to expand slightly, and growth to continue throughout fiscal 2026 as the company expands production scale. . I have a Buy recommendation on MRVL stock with a price target of $98.17 per share and a probability-weighted multiple of 24.62x eFY26 aEBITDA.

operations

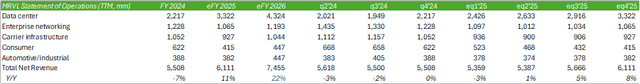

Marvell Technology posted a disagreement Results for 4Q24 showed mixed revenue results and strong margins. These factors are not necessarily unique to Marvell, as the industry appears to be divided into data center-oriented growth, with telecom, networking, industrial and consumer significantly behind the curve. The difference for Marvell was quite significant, with data center growth of 54%, enterprise network and carrier declines of -28% and -38% respectively. Consumers are lagging -20%, and this downward trend is expected to continue as consoles continue to end their cycles.

Management does see the automotive industry showing strength in double-digit growth (not breaking out) and multiple Ethernet design wins in EVs, hybrids, and high-volume ICE vehicles among automotive OEMs. Management expects the Automotive/Industrial segment to be flat throughout fiscal 2025, indicating more challenges on the Industrial side compared to the forecast strength of the Automotive segment.

On the carrier and enterprise networking side, management expects further declines in eQ1’25 and forecasts a recovery in e2H25, anticipating that these end markets will re-contribute $1 billion in revenue on a long-term basis as demand normalizes. Seek guidance from carriers on capital investments, AT&T (T) Fiscal 2024 guidance is $21-22b, up from $18bn in fiscal 2023. T move (TMUS) guided for capital investment of $860-940 million, down from $980 million in fiscal 2023 capital expenditures. Verizon (VZ) also lowered its fiscal 2024 eFY capital investment guidance to $1.7-1.75 billion, down from $1.88 billion in fiscal 2023. Translating this into Marvell’s results, there could be some continued pressure cycles ahead of some recovery in fiscal 2025. In the last fiscal year, the carrier’s market share was as high as 22%, but due to seasonal factors, the market share in the fourth quarter of 2024 has dropped to 12%. I expect average segment concentration to decrease by about 3-6% on a SAAR basis throughout fiscal 2025.

The guidelines for enterprise networking run counter to Broadcom’s (AVGO) guidelines for growth in its equivalent segment. Given Broadcom’s hyperconverged approach to IT infrastructure across compute, storage and networking, I believe the company may be able to capture more market share at the enterprise level as more companies seek to reduce overall IT spending. Although Broadcom’s network infrastructure only spans two hyperscalers, I believe the company will make great strides in attracting new customers, both at the enterprise data center and hyperscaler levels. This could pose a challenge to the future of Marvell’s enterprise networking division. For reference, Broadcom’s networking segment was up 46% year over year in its most recent Q1’24 results, while Marvell’s enterprise networking segment was down -28% in its most recent Q4’24 results. Remember, fiscal quarters are adjusted on a calendar basis.

In reference Gartner 2024 IT Spending Forecast, the research firm expects communications to experience low growth of 3.3%, while data centers are at the high end of the growth range, at 9.5%. My expectation for Marvell is that Marvell’s data center will continue to be strong as more companies look to enhance their AI/ML capabilities. I believe that as Marvell’s 5nm chip designs further penetrate the market, GPU accelerators will significantly drive growth. I also expect their 3nm designs to significantly accelerate data center growth over current trajectories and carve out some market share at the hyperscale tier. The data center revenue mix grew from a low of 33% in the first quarter of 2024 to 54% at the end of this fiscal year, with the segment accounting for an average of 40% of total fiscal 2024 revenue. As management mentioned in its Q4 2024 earnings call, Marvell is working to transform into a more data center-centric semiconductor designer. I expect this segment to expand further beyond the current mix as I expect growth to accelerate after fiscal 2024 and fiscal 2025 as the company brings 3nm wafers into production.

company report

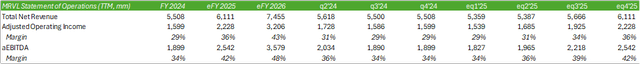

Factoring these assumptions into operating performance, I expect margins to decline slightly in eQ1’25, followed by a sharp recovery in e2H25 as the company scales operations as demand normalizes in the net data center segment. I expect the strength of their data center segment to also drive margin expansion through economies of scale as the company benefits from building out its AI infrastructure. Looking further into fiscal 2026, I expect this profit drive to continue, with its data center segment maintaining strength and enterprise networking, carrier infrastructure and automotive/industrial segments returning to growth. I expect the consumer segment to return to annual growth, but still below fiscal 2023 numbers.

company report

Management expects higher sales from its AI cloud optimization program, which will drive up margins due to scaled operations. Management expects these wafers to exit eQ4’25 at prices above 200mm, pushing annual run rates toward the 800mm target. An interesting factor that caught my attention during the Q4 2024 earnings call was that the transition from 400g to 800g in cloud computing should occur in some volume within a few years as their 800g offerings expand into AI infrastructure, And is likely to maintain a certain level of volume in the coming years. product. This can also be set for Marvell’s next generation Nova 1.6T PAM4 DSP for AI/ML.

Valuation and shareholder value

company report

MRVL’s share price is currently trading at 34.44 times FY24 EV/aEBITDA, which represents a high premium but is lower than historical highs, leaving some room for multiple expansion. I believe the bull case for MRVL supports a higher valuation as the company expands its data centers and potentially captures hyperscale market share. The pessimistic case would be for greater pressure from telcos, enterprise networks and automotive/industrial. Although the telco is guiding for lower capital investments in 2024, I believe Marvell’s operations have been impacted and should be able to absorb any further declines. My support for Marvell Enterprise Networks is 50/50 as it relates to my view of Broadcom’s market share growth. I do expect further declines across e1H25, with a slow recovery in e2H25 as noted in the table above. As for the consumer segment, I do expect this segment to decline further during fiscal 2025 and recover slightly during fiscal 2026. Overall, I believe data center strength will lead the way for the foreseeable future, followed by a recovery in enterprise networks and carrier infrastructure.

In terms of shareholder benefits, management increased its stock repurchase program by $3 billion, for a total expense of $330 million. The company also pays a small dividend, with an annualized dividend of $0.24 per share.

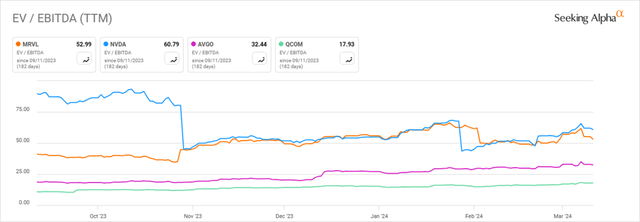

Seeking Alpha

MRVL stock does have a higher unadjusted EV/EBITDA size compared to its peers. I do believe MRVL’s growth trajectory positions the company for strong growth payouts, as revenue is likely to hit multiple positive turning points at different times over the next two fiscal years. I believe their high valuation is justified by the growth trajectory I predict, which leads me to believe MRVL stock presents a positive risk profile for shareholders.

company report

In terms of valuation, I believe the stock should be priced at 24.62x fiscal 2026 aEBITDA probability-weighted target of $97.17 per share. For the stock to reach a blue sky scenario, I believe network and carrier sales will need to recover faster and stronger than I forecast. The gray sky scenario would be the result of larger-than-expected declines in both segments and lower-than-expected data center growth. Given the broader optimism behind the infrastructure supporting artificial intelligence, I believe the stock will be priced with greater potential to achieve my goals.

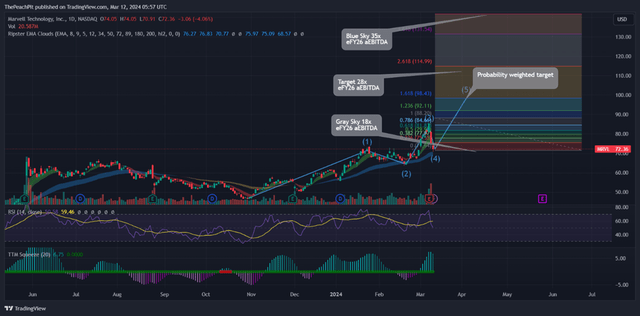

On the tactical front, the $98.17 per share price target is supported by expectations that MRVL stock is approaching the fifth wave of the cycle. Given the company’s strong operational growth capabilities, MRVL stock will likely continue to rise after reaching my fifth wave target, potentially reaching my target or even the blue sky scenario. While there are more risks involved in targeting these higher valuation scenarios, I wouldn’t rule them out entirely as the broader AI market shows strong support for the long-term adoption of more energy-efficient infrastructure.

trading view

Currently, I recommend buying MRVL stock with a price target of $98.17 per share. I will revisit earnings after 1Q25 for any revisions to the long-term price target.