Ralph Hahn

Currently, there is stiff competition for your money when it comes to yield. Not so long ago, if you had some cash, if it was sitting in or sitting in your bank account, you would basically make change. in the currency market. However, that has all changed, with most money market funds now yielding over 5%, and banks even offering substantial yields on CDs and savings accounts. But just as we shouldn’t take zero interest rate policy, or “ZIRP,” for granted, we should also realize that the days of parking cash in money market funds that yield more than 5% (currently) are numbered.Many investors appear to have become complacent with their use of money market funds, as there are now approximately $6 trillion in cash sit in these funds.

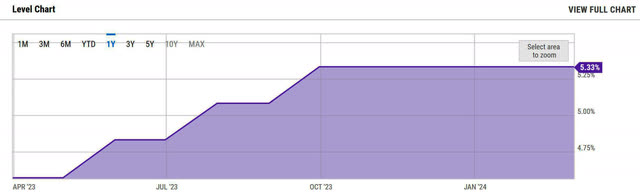

When interest rates fall, the yields on these money market funds can plummet, triggering massive flows into other income-producing assets. As recently as 2022, money market funds returned less than 0.5%. This is a stark reminder of how far and how quickly rates are climbing, and it should also be noted that money market fund yields will likely be cut in half from current levels but will still be many times their 2022 yields. This just goes to point out that there’s a lot of room for interest rates to come down without going back to the extremely low rates we’ve seen during the pandemic. The chart below shows how interest rates went from almost zero to now over 5%:

ycharts.com

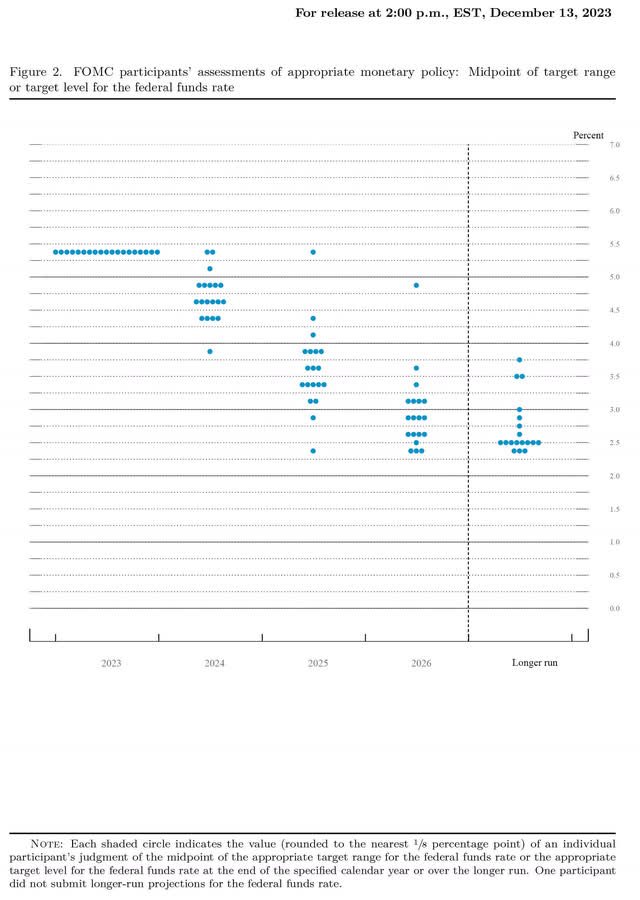

We’re not there yet, but at some point in the near future we may see a significant exodus from money market funds. Looking at the FOMC’s “dot plot” forecast for the federal funds rate, it shows that interest rates may fall from the current level of more than 5% to a low level of around 2.25% by 2026.

fed.gov

This shows what interest rates are likely to look like in the near future, so it makes sense for investors to start making some strategic moves before the potential yield on money market funds is only 2.5% or lower. We all know what happens when a company cuts its dividend: many investors sell off, and we’ll likely see money market funds cut their “dividends” by 50% between now and 2026. When money market fund rates drop to levels like 2.5%, or even lower, many investors will be dissatisfied with receiving so little income and may be tempted to cash out of money market funds and pay more for dividend stocks than they did when interest rates were higher. Be willing to pay more like today.

That means now is the time to start locking in some high yields by buying dividend stocks. The idea is that not only can we lock in a generous yield, but we can also realize potentially significant capital gains through 2026, as these stocks are likely to rise and be worth more in a much lower interest rate environment. I think we all need to consider the fact that money market funds are an extremely crowded trade right now and we should start exiting before the crowd does.

Since investing in individual stocks carries significant risks that can devastate your portfolio, I think it makes sense to use ETFs for diversification. If I want to put a lot of money into a certain asset class, especially for the long term, I use ETFs. I typically purchase shares of a company when I see a potentially very attractive opportunity that would provide me with additional upside to compensate for the additional risk of purchasing a single stock.

Schwab U.S. Dividend Stocks ETF (NYSE: SCHD) is an ideal way to buy a basket of dividend-paying stocks. The fund pays a dividend of $2.66 per share and yields about 3.4%. Some of the fund’s top holdings include: Texas Instruments (TXN), Chevron (CVX), Verizon (VZ), Cisco Systems (CSCO), Coca-Cola (KO), Broadcom (AVGO) and more. The ETF launched in 2011 and has returned about 13% annually since its inception. It’s a very good record.

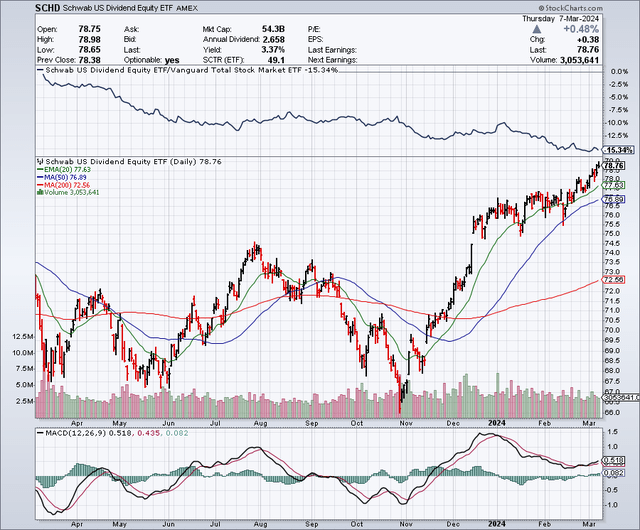

The ETF’s value had been rising over the past few months, but in late 2023, the stock market sold off sharply, causing the ETF to fall to about $66. After the recent rally, the ETF now looks a little overextended. Therefore, I would wait for a pullback before initiating new positions or adding to existing positions.

As shown in the chart below, the ETF bottomed in October 2023 and has been rising steadily since then. With the ETF currently trading at over $78 per share, I think it makes sense to wait for some pullback before committing any large sums of money to this investment. The 50-day moving average is $77.67, so we could easily see a pullback to that level. The 200-day moving average is around $72.50, which would be a more ideal level to buy the stock, and if the market experiences even a minor correction of 5%, we could reach this key support level.

StockCharts.com

While the Charles Schwab U.S. Dividend Stocks ETF may not seem like an exciting opportunity, it certainly is when you consider its track record of providing shareholders with annual returns of nearly 13%. I think it could potentially provide these types of returns in the coming years, as dividend stocks may be re-rated to higher levels when interest rates fall. For example, if money market fund rates fell to 2.5%, it would not be unrealistic for the ETF’s yield to fall to 3% or less. The decline in the ETF’s yield from 3.4% to 3% represents a roughly 15% rise in the stock price. This example may be too conservative, as the fund’s yield could even be as high as 2.5%, which would mean a larger share price increase. But even if it only grows 15% over the next 2 years, that could result in a total shareholder return of about 22% (15% capital gains, plus dividends totaling 3.4% per year for 2 years, which equates to almost 7%). However, as I said before, I would wait for a pullback, which could increase the upside in capital gains and dividend yields.

Another ETF that might make sense is the Vanguard Real Estate Index Fund (VNQ). The fund, which focuses on real estate investment trusts, yields just over 4% and is also expected to benefit from lower interest rates. However, I want to focus on SCHD because it offers more diversification in terms of investing in a broad range of industries, so I think it deserves a larger portfolio allocation. While it makes sense to use highly liquid ETFs for larger portfolio allocations, I think it’s also wise to add some higher-yielding stocks into the mix to improve the overall yield of the portfolio. Here’s an example:

British American Tobacco (BTI) is a leading global tobacco company. famous brand For example, Kent, Dunhill, Lucky Strike, Rothmans, Pall Mall. It also owns unique American brands such as Camel, Natural American Spirit and Newport. It also sells non-combustible products.

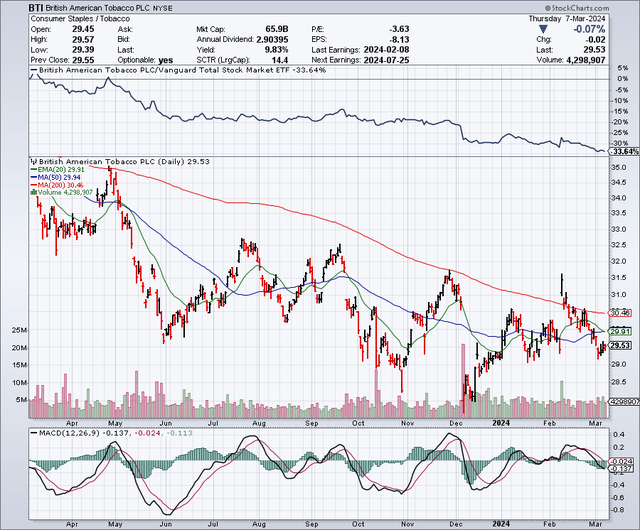

As the chart below shows, the stock dropped to around $28 in December and is currently trading slightly above that level. The 50-day moving average is $29.92 and the 200-day moving average is $30.47. If there’s a bit of good news, the stock could bounce back into the $30 range fairly easily and form a bullish golden cross on the chart.

StockCharts.com

The company pays a quarterly dividend of approximately 74 cents per share, which equates to nearly $3 per share annually. Tobacco companies face very high regulatory risks, and fewer and fewer people smoke every year, but they have faced these challenges for years and still rewarded shareholders with handsome dividends. These companies have pricing power so they can raise prices to keep profits growing despite lower sales volumes. I think major tobacco companies will enter the cannabis industry once the U.S. government legalizes it, which could lead to revenue growth. If revenue grows, the P/E ratio could expand significantly from current levels.

While I do have some concerns about the industry and regulatory risks, a lot of it seems to be priced in, I would say even overpriced. This industry is more durable than current P/E ratios and dividend yields suggest. Some analysts appear to agree. JPMorgan Chase (JPM) recently released a list of European stocks they believe can offer sustainable dividends, and British American Tobacco was on the list.

Despite the pessimistic scenario, if you look at profit forecasts, this doesn’t appear to be a business that’s going away anytime soon. Analysts expect the company to earn $4.64 in 2024, $4.97 in 2025, and $5.23 in 2026. This means a P/E ratio of only around 6. Furthermore, earnings at this level indicate very high dividend coverage, meaning it looks safe and there is room to grow the dividend.

When I invest in high-yield stocks, I always think of the “Rule of 72.” Investors use it to calculate how long it will take for your money to double. It is calculated by dividing production by 72. British American Tobacco currently yields around 10%, and if we divide 72 by 10, this shows it would take approximately 7 years to double your dividend. However, when interest rates fall, the stock’s valuation may be higher, which may create capital gains for shareholders.

Final thoughts:

In addition to these dividend ideas, I also like Whirlpool (WHR), which I wrote about recently, because I think it’s severely undervalued, with its 6.5% yield and single-digit P/E ratio. I think Whirlpool will be a big beneficiary of low interest rates, as this will likely thaw the housing market and lead to a surge in major appliance upgrades.

It’s clear that money market fund trading may be near its peak and very crowded. Now is the time to accumulate dividend payer pullbacks through ETFs like SCHD, as well as individual stocks. My strategy is to continue to increase my exposure to dividend stocks as there is a good opportunity to lock in some generous yields and possibly build a portfolio for capital gains as interest rates fall over the next few years.

No warranties or representations are made. Hawkinvest is not a registered investment adviser and does not provide specific investment advice. This information is for reference only. You should always consult a financial advisor.