michal-rojek/iStock via Getty Images

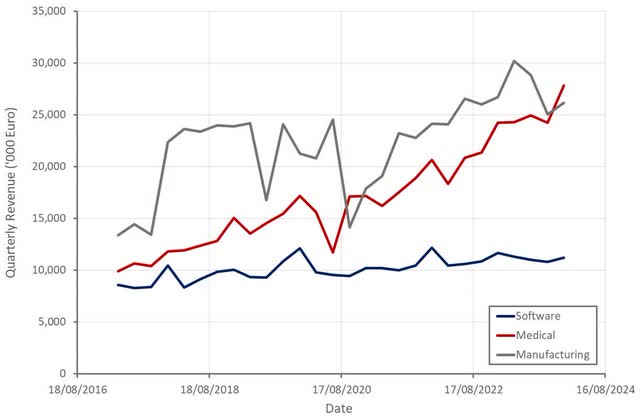

materialize (Nasdaq: MTLS) is coming to the end of a major investment period, and the company’s profit margins are expected to move higher over the next 1-2 years.Moderate valuation, coupled with solid growth and direction profitability, should see the stock perform well going forward. While Materialize is a quality company with a potentially bright future, there are risks. Competition in Materialize’s software division is intensifying, manufacturing demand remains weak, and continued adoption of robotics in joint replacement surgeries could hurt the medical business.

The last time I wrote about Materialize, I recommended holding the stock. While the manufacturing business remains risky in the near term, Materialize’s valuation is fairly stable despite the generally sharp move higher. Materialize’s relative valuation is now more attractive, with the company moving closer to a higher valuation Margins continue to improve as the cloud transformation matures and ACTech’s facility expansion nears completion.

market

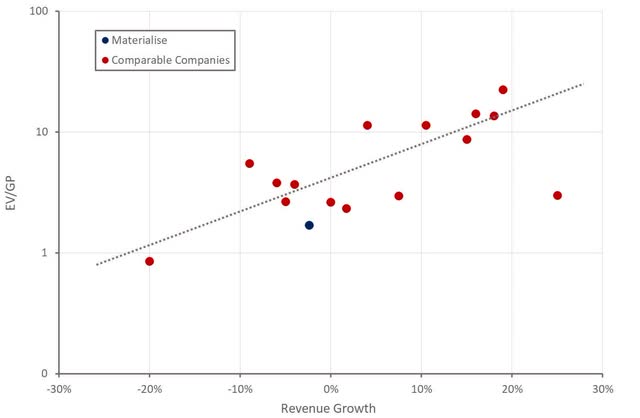

2023 is a challenging year for additive manufacturing, with rising interest rates, geopolitical tensions and economic uncertainty making customers hesitant to invest in new technologies. In particular, prototyping demand has taken a hit, although additive manufacturing remains the technology of choice in this sector. Printer sales were also weak, which weighed on Materialize’s software sales. Additionally, the macro environment dampened healthcare R&D spending, which impacted Materialize’s medical software sales. While conditions are likely to remain soft in 2024, absent a recession, the worst may be behind us.

Figure 1: European Manufacturing PMI (Source: The author created it using Materialize data)

The shift from prototyping to end-use products continues, especially for use cases that require customized parts, such as medical applications. Materialize also sees additive manufacturing being increasingly adopted to produce series end-use parts, such as in the aerospace industry.

Software is an important enabler in areas such as scheduling, monitoring and quality assurance. But more is needed. Software already allows automation of various stages of the 3D printing process, but there is still a need to integrate the various processes to create workflow automation. This is exactly the goal of the Materialize CO-AM platform.

medical

Materialize’s healthcare segment remains the company’s strongest performer, both in terms of profitability and growth. Materialize hopes to drive further growth through product innovation and reduced delivery times.

Additive manufacturing has a wide range of applications in the medical field, including:

- role model

- Prosthetics and Orthotics

- medical equipment

- surgical guide

- Implants

Although Materialize is working to diversify its medical revenue, it still relies heavily on knee replacement surgical guides. 3D printed surgical guides compete with robotic and navigation solutions that are rapidly taking market share in joint replacement surgeries.

I’ve written before about Zimmer Biomet (ZBH) and Stryker (SYK), leaders in the space. Stryker has a particularly strong robotic surgery business and has become increasingly vertically integrated in additive manufacturing in recent years.

Materialize is developing solutions for submarkets outside of orthopedics and CMF, such as planning tools for the short-term cardiovascular market and the long-term respiratory market.

Materialize’s U.S. manufacturing facility is now open, helping to shorten lead times and open up new markets, such as products for trauma patients.

Materialize also has a limited launch of Mimics Flow, a case management solution that helps hospitals manage their 3D printing operations. Materialize believes the adoption of additive manufacturing in point-of-care will be a driver of this solution. Materialize expects to use 2024 as a learning opportunity before launching Mimics Flow in other areas in 2025.

software

Materialize is moving its software business to the cloud and hopes to capture end-use parts opportunities through Magics, construction processors and CO-AM. Materialize has released new capabilities for Magics specifically targeted at metal production, a growth area for production use cases. The company continues to recruit partners and add capabilities to CO-AM, including recently announced partnerships with HP and Ansys. Materialize also recently announced its next-generation build processor designed to improve printer performance and reduce part costs, which are key determinants of success for production use cases.

Revenue growth will be weak in 2023 due to market conditions and Materialize’s transition to subscription software.

Although software is Materialize’s traditional strength, competition has intensified in recent years, and the success of Materialize’s transformation to the cloud is not guaranteed. Competitions include:

- Open source software applications

- 3D printer maker bundles software with device

- CAD software supplier that has expanded into the field of additive manufacturing

manufacturing

Materialize’s prototyping services are performing well despite the challenging macro environment. Materialize also positions its manufacturing operations to help customers start producing end-use parts for areas such as aerospace, medical devices and wearable devices. To support this, Materialize has established a certified manufacturing service to provide customers with documented and verified part production.

Materialize also continues to invest in its sports and eyewear businesses. However, the company has said little about these businesses in recent quarters, and their performance appears to be poor. As the recent impairment of the Materialize Motion asset shows.

The expanded ACTech factory will be launched at the end of this year and is expected to stimulate manufacturing growth. However, near-term success may depend on the demand environment.

financial analysis

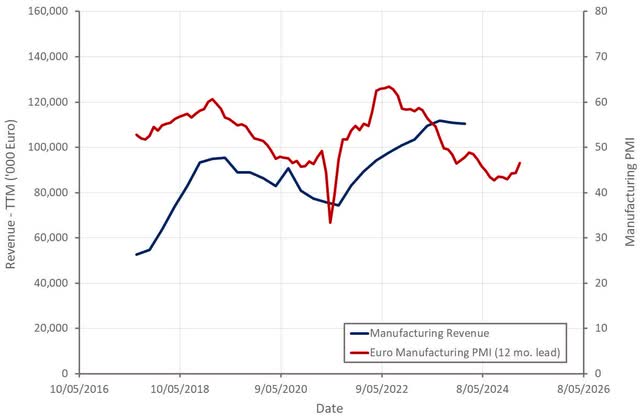

Materialize’s fourth-quarter revenue was 65.3 million euros, a decrease of 2.4% from the same period last year. Strong growth in the medical sector was offset by weakness in software and manufacturing.

Materialize now expects 2024 revenue of €265-275 million, guidance assuming continued macroeconomic uncertainty and heightened geopolitical tensions. While the transition to subscription models will continue to put pressure on the software business, all three segments are expected to grow.

Figure 2: Realizing revenue (Source: The author created it using Materialize data)

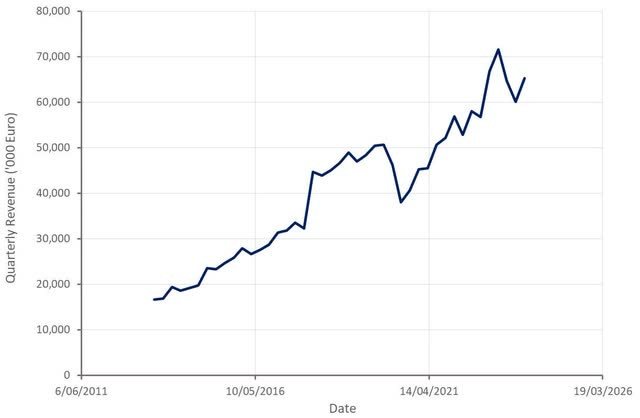

Materialize’s medical business continued to expand steadily, while its manufacturing and software businesses experienced subdued growth due to weak demand and segment-specific issues.

In the fourth quarter, software accounted for 17% of Materialize’s revenue, with manufacturing accounting for 40% and medical accounting for 43%. Software accounts for approximately 31% of the healthcare segment’s revenue.

Figure 3: Specific revenue by market segment (Source: The author created it using Materialize data)

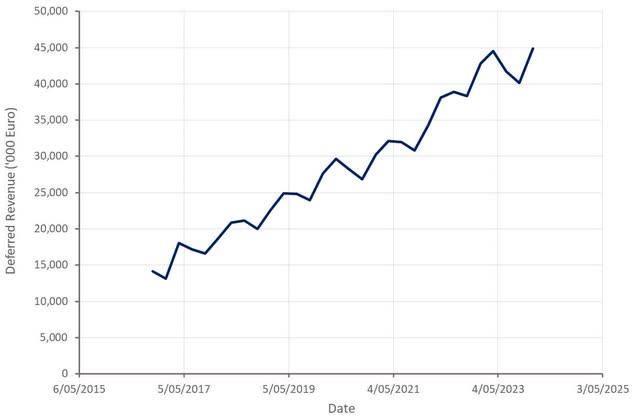

Materialize’s software growth has been sluggish in recent years, but that’s partly due to a shift toward a subscription business model. Recurring revenue increased by 5% year-on-year in the fourth quarter, while non-recurring revenue decreased by 16% year-on-year. However, Materialize’s deferred revenue continued to increase, reaching €44.9 million by the end of 2023. Software sales were also affected by lower demand for OEM machine sales.

Figure 4: Realizing deferred revenue (Source: The author created it using Materialize data)

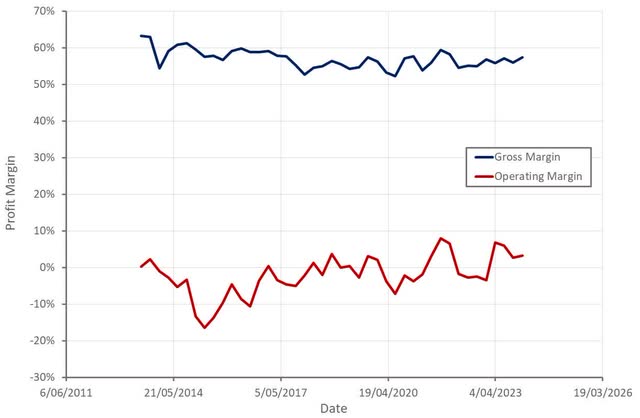

In 2022, Materialize’s margins were impacted by inflationary pressures (labor, energy, materials and freight), partially offset by higher prices. However, the company is now beginning to overcome some of these headwinds. Materialize’s gross margin continues to rise, likely driven in large part by revenue mix. This will be aided by improved fixed cost utilization once the demand environment improves.

Materialize’s fourth-quarter operating expenses fell 6.5% compared with the same period last year. A net loss was recorded in the fourth quarter due to an impairment of goodwill, tangible and intangible assets of €4.2 million. Approximately 3.6 million euros of this amount was attributed to Materialize Motion.

Figure 5: Achieving profit margins (Source: The author created it using Materialize data)

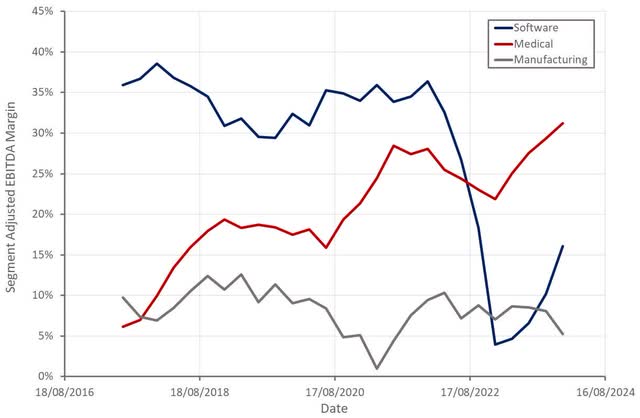

Software margins continue to rebound as Materialize’s transition to a subscription business model matures. This, coupled with further expansion of medical margins, should support profitability going forward. Manufacturing margins continue to deteriorate, although ACTech’s factory expansion and rebounding demand have the potential to change that.

Figure 6: Adjusted EBITDA margin by market segment (Source: The author created it using Materialize data)

Investments in the first half of 2024 are expected to reduce free cash flow. Cash flow is expected to improve in the second half of the year as investments ease and the expanded ACTech facility comes online. Materialize generated slightly positive free cash flow in 2023, with cash and equivalents on the balance sheet at the end of the year of €127 million.

in conclusion

Materialize’s business continues to face demand headwinds, exacerbated by the company’s transition to a subscription software business model. The past few years have also been a period of heavy investment, which has put pressure on both profits and cash flow. These investments should start to pay off over the next few years, especially if the macro environment improves. Given Materialize’s current valuation, this scenario could create strong returns in the future. But there are risks, including the rise of robotic surgery reducing demand for Materialize surgical guides.

Figure 7: Achieving relative valuation (Source: Author created using information from Seeking Alpha)