Luis Alvarez/DigitalVision via Getty Images

investment thesis

Maxeon Solar Technology (NASDAQ: MAXN) released preliminary results showing that its revenue growth rate is slowing rapidly.

Not only is its revenue expected to drop by 37% annually, but more importantly, its The net debt position increased significantly. What’s more, the company’s underlying cash burn is increasing rapidly.

I believe investors would be wise to avoid buying the dip.

Maxeon Solar Technologies Near-term Outlook

Maxeon Solar Technologies is engaged in the solar energy industry. They focus on two main areas: utility-scale solar projects and decentralized generation (“DG”), which includes residential and commercial solar installations. In utility-scale projects, they manufacture solar cells and panels for large solar power plants, primarily in the United States. They are also working to build a new manufacturing facility in New Mexico to increase production capacity.

for DG, they sell solar panels directly to installers who then install them on the roofs of homes and businesses. They also introduced a new, more efficient solar panel technology called Maxeon 7.

In the near term, Maxeon’s distributed generation business faces challenges. While the U.S. utility-scale industry is showing steady growth, Maxeon’s DG business has hit a snag.

In fact, as Maxeon CEO Bill Mulligan pointed out in the press release, Maxeon’s DG demand continues to slow. These factors have resulted in lower demand for DG and have posed an obstacle to Maxeon’s revenue stream and profitability.

Most importantly, Maxeon must continue to defend its intellectual property rights through patent infringement litigation, which increases the complexity of Maxeon’s operations.

Given this background, let’s now take a deeper look at its financials.

Revenue growth rates are disappearing

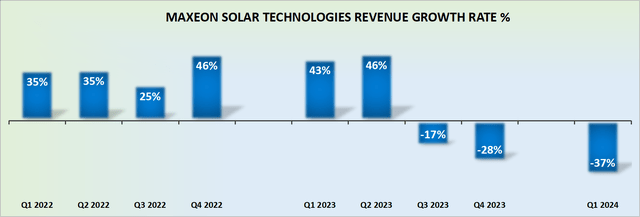

MAXN revenue growth rate

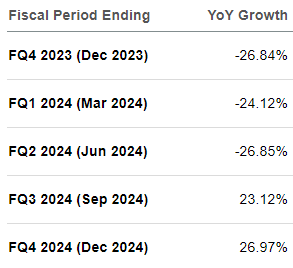

The chart above shows a business that has previously delivered solid revenue growth. However, its latest guidance shows that the business has encountered obstacles, with guidance for the first quarter of 2024 showing a revenue decline of approximately 37% year-over-year.

For reference, analysts tracking Maxeon had expected its first-quarter 2024 revenue to compress about 24% from the same period last year. But revenue fell 37% from the same period last year.

AT Premium

But I believe that’s not the whole story. The next section of this analysis will provide a more complete look at the bear market scenario.

MAXN Stock Valuation – Valuation is Too Difficult

That’s the problem. We didn’t get Maxeon’s latest balance sheet or preliminary earnings.But we do know that Maxeon has approx. $432 million in debt As of October 1, 2023 (page 14), as early as the third quarter of 2023.

At the same time, we know that Maxeon’s cash position decreased by approximately $70 million in the fourth quarter of 2023, from approximately $270 million in the third quarter of 2023 to just under $200 million in the fourth quarter of 2023, but we don’t Know how much of the cash reduction is used to pay down debt versus cash burn in operations.

However, we do know that approximately $25 million of debt is carried as current liabilities; so I think probably $25 million of the $70 million of cash used in the quarter was used to pay down current debt.

All told, I estimate Maxeon’s net debt position is probably around $200 million.

This means that more than 100% of its market capitalization is made up of net debt. Next, let’s discuss its potential profitability.

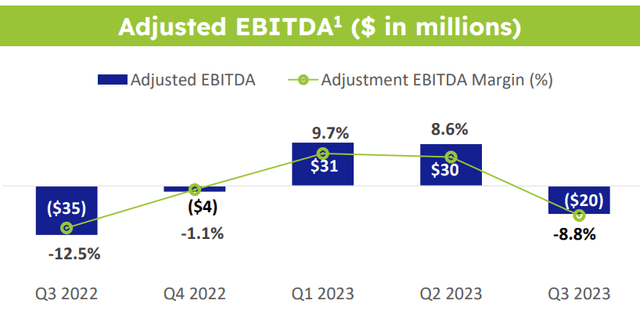

MAXN Investor Introduction

Back in the third quarter of 2023, Maxeon’s adjusted EBITDA margin was negative 9%. Its preliminary results indicate that its EBITDA margin will be approximately negative 15% in the fourth quarter of 2023.

Given that its Q1 2024 guidance implies that its revenue will be down approximately 37% year over year, I believe this will cause its underlying EBITDA margin to compress to around negative 18%.

That means the business is not only shrinking, but its losses are mounting, and its equity represents an ever-smaller proportion of the total value of the business.

bottom line

Given Maxeon Solar Technologies’ poor guidance, I have to advise investors not to buy the dip.

The company’s near-term prospects appear to be in jeopardy due to a sharp decline in revenue growth, which is expected to drop approximately 37% annually, and a significant increase in its net debt position.

The company’s situation is further exacerbated by the continued slowdown in demand for distributed generation.

Additionally, with negative adjusted EBITDA margins expected to worsen as revenue shrinks, it’s clear that the business is not only shrinking, but is also facing expanding cash losses. Avoid this stock for now.