Afternoon pictures

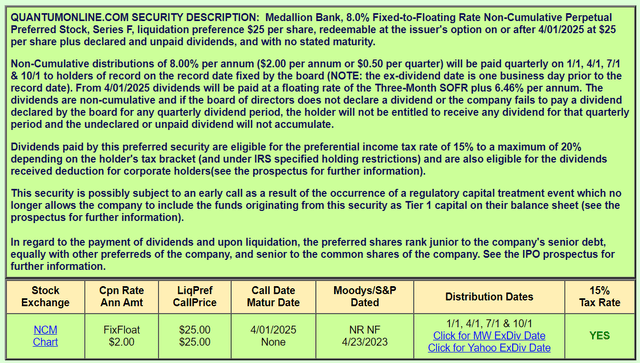

Medallion Financial (NASDAQ:MFIN) is a niche bank that has successfully pivoted away from lending to taxi drivers. Today, the bank manages deposits and lends them to entertainment and home improvement loans.Recently, I saw a bank’s 8% fixed interest rate floating preferred stock (NASDAQ:MBNKP). After reviewing the financials, I believe the fixed-to-floating preferred shares offer investors a great income opportunity, with the potential for income growth when the shares go public next April.

Quantum Online

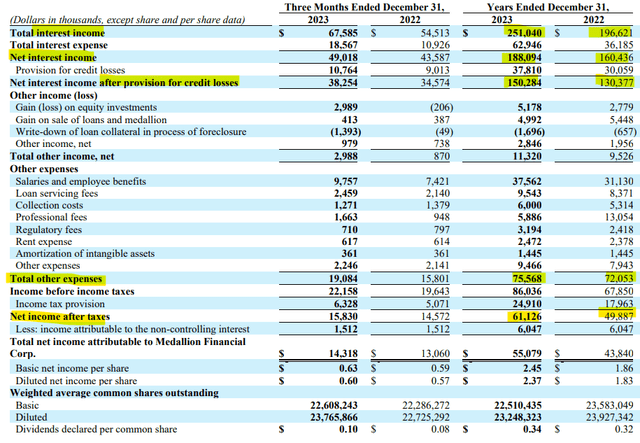

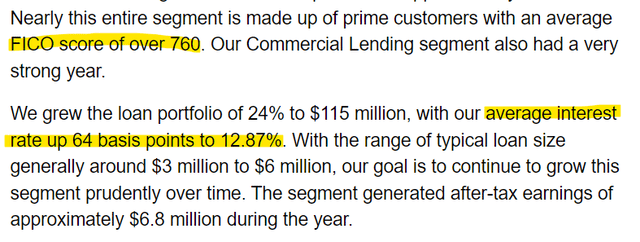

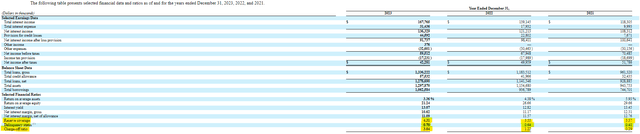

Medallion Financial has a strong 2023. Fortunately, facing a tougher financial backdrop, Medallion’s net interest income (interest income minus interest expense) was able to grow nearly 20% to $188 million.The bank was also able to control expenses, resulting in healthy growth with net income after tax of $61 million $50 million in 2022.

SEC 10-Q

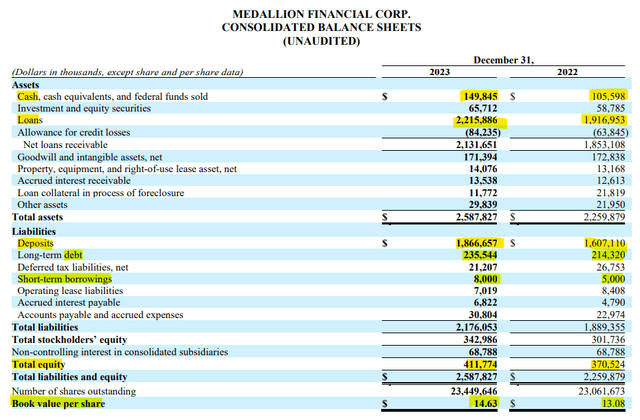

Medallion Financial’s balance sheet shows the bank’s impressive growth in 2023. The growth is quite impressive as the industry struggles to maintain deposits and cope with low-single-digit loan growth. The bank did take on some external borrowing to bridge the gap between deposit growth and loan demand, but shareholders’ equity increased by more than $40 million to $412 million, and book value per share grew by more than 10%.

SEC 10-K

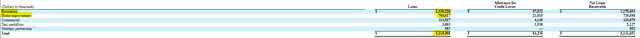

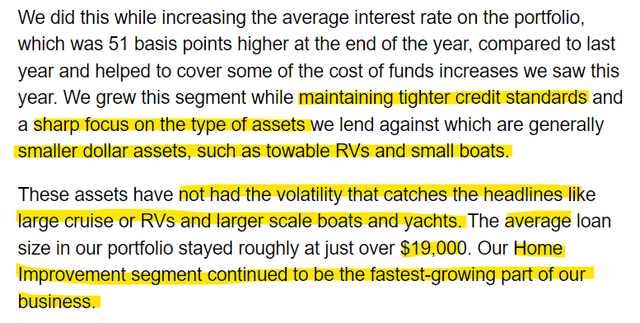

Because of Medallion’s professional status in the banking industry, investors should gain a deeper understanding of Medallion’s loan makeup and its customers. Medallion loans fall into two main categories: leisure loans and home improvement loans. While both areas are sensitive to changes in their customers, Medallion is quick to point out that they lend against less volatile assets and have seen their loan growth come despite tightening lending standards.

SEC 10-K Earnings Call Transcript

Medallion Financial’s customers in the bank’s fast-growing home improvement segment also helped drive profits. Even though the interest rates incurred are high, Medallion still offers loans to average consumers with credit ratings above 760.

Earnings Call Transcript

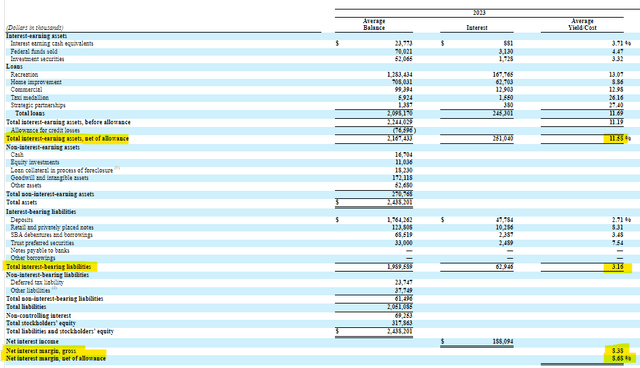

When looking at the overall performance of Medallion Financial’s loans, investors should remain optimistic. The bank’s average return on interest-earning assets is 11.6%, which is much higher than traditional commercial banks. Medallion’s average liability interest rate is 3.16%, slightly lower than some commercial banks because of their ability to increase deposits and not relying on external debt.

SEC 10-K

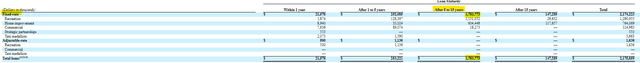

Additionally, Medallion’s interest rate structure and loan portfolio tenors are favorable to investors. As of the end of last year, $1.75 billion of the bank’s $2.18 billion loan portfolio were fixed-rate loans with maturities of five to 15 years. This differs from other lenders that focus on short-term or variable-rate lines of credit or short-term consumer debt. Medallion Bank’s loan interest income should be more stable and predictable in the coming quarters.

SEC 10-K

As briefly mentioned, investors should pay attention to changes in consumers, such as rising unemployment or falling wages. These sources of volatility could cause Medallion Financial’s delinquency rates to increase and reduce loan demand. It’s worth noting that the bank did see a small increase in delinquency rates last year and a larger increase in charge-off rates. Despite these changes, Medallion Financial’s profits remain strong.

SEC 10-K

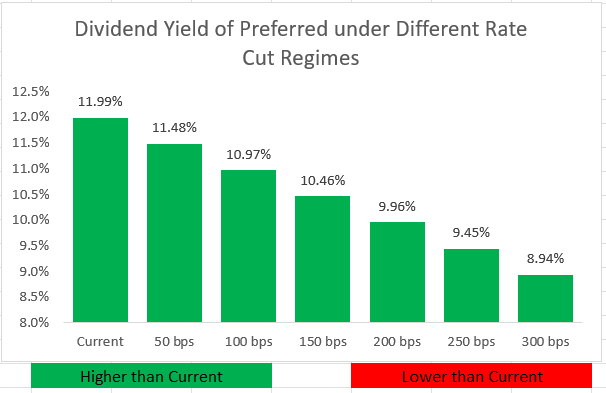

Income investors also face the possibility of dividend growth when investing in Medallion Financial’s preferred stocks. The dividend is scheduled to float in April next year at an interest rate of 646 basis points plus the three-month SOFR rate. At the current interest rate structure, this means a dividend yield of 12%. While it is certainly feasible for Medallion to redeem these shares, investors are not exposed to redemption risk since the shares are currently priced below par. Dividends are unlikely to fall below the current level of 8%, as this would require the Fed to cut interest rates by more than 400 basis points.

Quantum Online

Medallion’s strong financial performance highlights the low risk level of its preferred stock investments. The bank does not have the problem of holding on to depositors and has successfully increased its loans by catering to key customers through its fastest lending arm. Risks to consumers are noteworthy, but could have a larger impact on common stocks. Meanwhile, preferred stocks represent a great income investment with higher dividend opportunities.