Andrii Dodonov/iStock via Getty Images

Let’s take a look today Mesomorph Ltd (NASDAQ: MESOMEOBF, ASX:MSB). The market has been on a roller-coaster ride since the overseas development company took the stake. full response letter, or CRL, from the FDA’s marketing application surrounding its cell therapy candidate “remestemcel-L,” also known as Ryoncil, for the treatment of a type of steroid-refractory acute graft-versus-host disease, or sr-aGVHD, in children. The rejection triggered a massive sell-off in the stock. However, recent bullish news has triggered a 180-degree turn in the stock market. Where do stocks go from here? Analysis below.

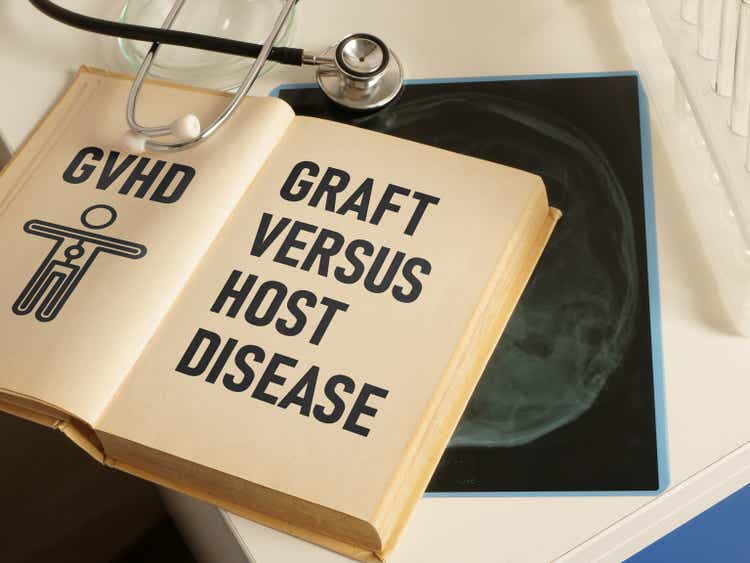

Seeking Alpha

Company Profile:

Company introduction meeting in February 2024

Mesoblast Limited is headquartered in Melbourne, Australia.This clinical-stage biotechnology company focuses on developing regenerative medicine products through its regenerative medicine technology platform Based on specialized cells called mesenchymal lineage cells. These cells are extremely rare and are found in the bone marrow. They respond to tissue damage by secreting mediators that promote tissue repair and modulate immune responses. Mesoblast’s manufacturing process is based on this approach to produce industrial-scale, cryopreserved, off-the-shelf cellular medicines.

February 2023 Company Introduction Meeting

The stock currently trades at just over $5.50 per share, giving it a market capitalization of approximately $660 million.

February 2023 Company Introduction Meeting

Management held a meeting with the FDA in September. The goal of the meeting was to come up with a way to:

“Demonstrate that the product used in the Phase 3 trial is similar to the product intended for commercial release, as measured by standardized potency assays”.

The data from this study is part of a marketing application that triggers CRL.

These discussions finally came to fruition, and in late March, government agencies if “Mesomorph”The company is positive about its plans to win U.S. approval for its cell therapy candidate remestemcel-L. “ The stock has more than doubled since the news broke. It should also be noted that remestemcel-L acquired Designated as a rare pediatric disease and orphan drug in mid-January status As a potential treatment for children with hypoplastic left heart syndrome in mid-February.

Company introduction meeting in February 2024

Another treatment called Rexlemestrocel-L or Revascor has received Regenerative Medicine Advanced Therapy (RMAT) designation for the treatment of chronic low back pain, or CLBP. The primary endpoint of the pivotal study will be 12-month data showing pain reduction compared with placebo. Pivotal Phase 3 trials have now begun. The company plans to screen and recruit patients into the study throughout the year.

Company introduction meeting in February 2024

Revascor also received RMAT designation for the treatment of heart failure in patients with left ventricular assist devices (LVADs).Management reported in February that telephone conference Just recently”A very encouraging meeting with the FDA on regulatory pathways to approval” in this regard.

Analyst Comments and Balance Sheet:

Surprisingly, given recent news developments, there has been very little commentary from analyst firms on the company’s 2024 outlook. On March 12, two weeks before the stock began its recent rally on FDA developments, Piper Sandler reiterated a Hold rating and $4 price target on MESO. This is the only analyst rating I can find so far this year.

The company has taken a number of measures to reduce Burn money After CRL last summer. These include cutting management salaries by 30% and reducing all personnel costs by 40%.As a result, the company has approx. six quarters of cash based on its most recent quarterly burn.

Company introduction meeting in February 2024

The company also received approximately $8 million in royalties from sales TEMCELL Notably, it is conducted annually in Japan by its licensees.

judgment:

Mesoblast Limited is located outside the United States, which presents some challenges for U.S. investors. Wall Street coverage is sparse, making it difficult to determine whether insiders are selling or buying shares, and the company’s ADRs have little daily trading volume.

It’s certainly good news that Mesoblast can now submit a Biologics License Application {BLA} surrounding Rexlemestrocel-L to treat children with SR-aGVHD using existing late-stage trial data without the need for another expensive and time-consuming test. Notably, the BLA should be submitted sometime this quarter. If all goes well, the application could be approved in the first half of 2025. Additionally, a pivotal trial in adults with aGVHD, a larger potential target population, should also begin this quarter.

February 2024 company introduction meeting

A Seeking Alpha follower asked me to take a look at Mesoblast because of all the latest news about the name in a recent comment article. After analyzing this gene therapy issue, I have concluded that Mesoblast Limited stock is certainly not for the faint of heart.

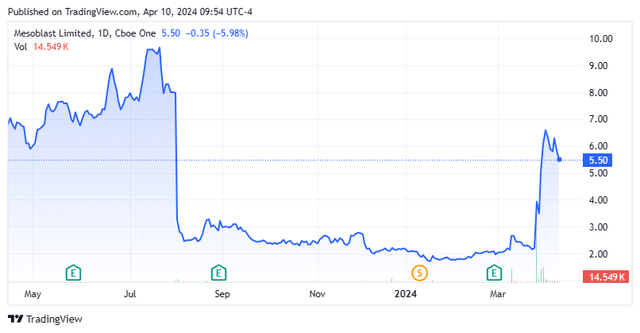

Seeking Alpha

For me, there are too many unknowns to recommend Mesoblast Limited stock. Furthermore, the company has been a public company for nearly two decades but has consistently disappointed long-term shareholders (see chart above). Management is still pursuing the first FDA approval of a gene therapy candidate. Therefore, caution appears to be the best part of MESO Courage for all but the most aggressive and risk-tolerant investors. I would mark Mesoblast Limited stock as “avoid” Awaiting further development.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.