Aniline paint

MFA Financial Corporation (NYSE:MFA) is a type of mREIT that leverages investments in loans and mortgages to earn income. The company is challenged by the Federal Reserve’s restrictive interest rate policies.Last year, I wrote an article about MFA Convertible Notes This provides high yield returns. Since then, The company has issued New Baby Bond (NYSE: MFAN) offers an 8.875% coupon and matures in 2029, making it the best income investment among its common, preferred and debt securities in my opinion.

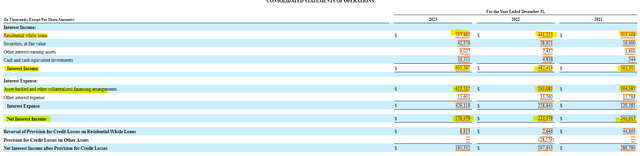

MFA Financial’s profitability has eroded over the past few years as interest rates have risen. While interest income increased from $362 million in 2021 to $605 million in 2023, interest expenses surged 3.5 times during the same period, from $120 million to $429 million.The net result was an increase in net interest income from $242 million to $176 million From 2021 to 2023.

SEC 10-K

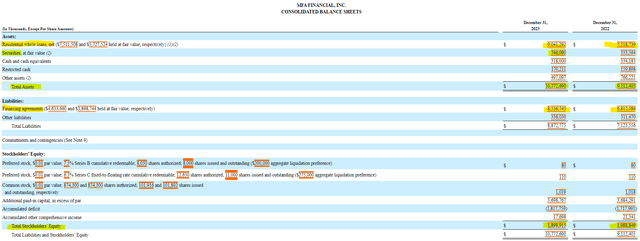

MFA Financial’s balance sheet shows significant asset growth in 2023. The company has increased its investments in residential whole loans and securities. The $1.6 billion increase in assets was primarily driven by an increase in loans, which account for more than 80% of the company’s investments. MFA is funding all of its asset growth in 2023 through debt (financing agreements), an increase of $1.7 billion. The decline in overall residential loan values reduced shareholders’ equity by $100 million to nearly $1.9 billion.

SEC 10-K

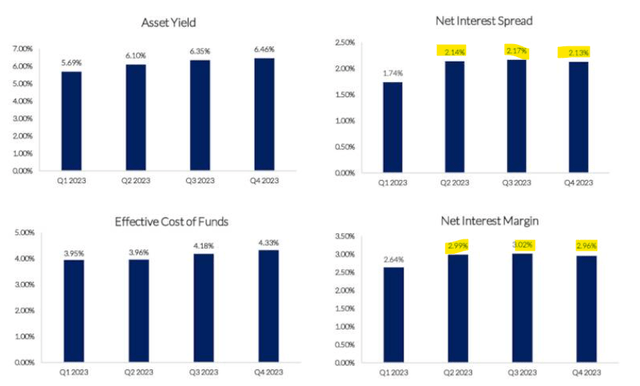

Adding leverage to invest in more assets in a high-rate environment appears to be paying off for MFA Financial. The company’s return on assets increased from 5.69% in the first quarter to 6.46% in the fourth quarter. The company’s cost of capital increased less than that. In practice, this resulted in increases in net interest margins and net interest margins.

profit report

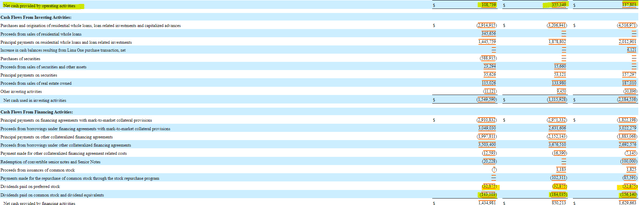

From a cash flow perspective, I generally like to combine free cash flow with the ability to fund dividends. For MFA Financial, which has no capital expenditures, the task is difficult. The company’s investment activities include the purchase and origination of loans as part of its day-to-day operations. It is important to understand the dividend obligations on preferred stock and common stock.

SEC 10-K

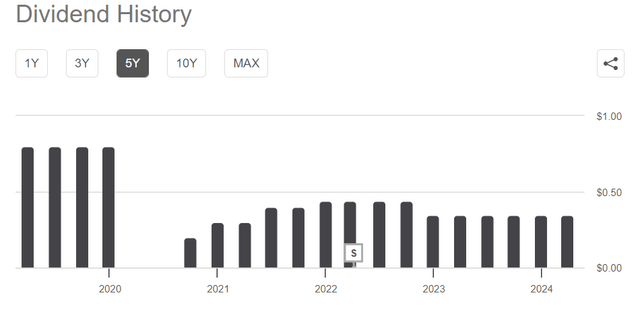

To achieve dividend sustainability, MFA provides distributable earnings to compare whether a company is generating the earnings needed to pay its dividend. Although distributable earnings are growing, they were still below the dividend threshold three quarters ago. This tightrope, combined with MFA’s history of multiple dividend cuts over the past five years, makes me uneasy about investing in common stocks.

profit report Seeking Alpha

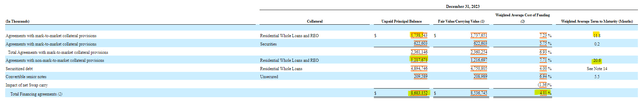

The level of interest rates is a major risk to MFA Financial’s financial performance. The company appears to be betting big that we have reached the peak of the rate hike cycle. If we fail to do this and loan rates are to rise, MFA will have to write down the value of its assets, which will push its leverage ratio higher. It’s also important to note that while lower interest rates will help MFA Financial, falling interest expenses may not benefit the company as quickly as its peers. The two highest-interest loans on the liability side of the business have interest rates in excess of 7% and average maturity times of 12 to 21 months.

SEC 10-K

While I’m not opposed to MFA Financial’s preferred stock (MFA.PR.B) (MFA.PR.C), the Series B preferred stock trades at a yield comparable to that of a baby bond, while the Series C preferred stock trades at a yield that’s more than lower 100 basis points.Although the floating interest rate on Series C preferred stock is Three-month LIBOR (or SOFR) plus 5.345%, that float won’t happen until the end of March next year. By then, interest rates may be low enough that floating rates are comparable to current baby bond rates. The baby bonds offer an attractive 8.875% coupon, which will provide the same yield as the preferred stock but with a bit more safety.

MFA Financial is making a big bet that interest rates may stabilize or fall soon. The company increased leverage to invest in additional loans, raising capital in part by issuing new baby bonds. Based on the level of safety of each security, I believe the 8.875% coupon baby bonds are a good investment for both debt and income investors.